The newest way to send your freight from China to Europe is not through ship , neither through Plane….. it is through train which involves spending 15 days and that doesn’t have a buffet car in sight.

On 3 January in Yiwu in eastern China, a bright orange locomotive pulling 44 containers cargo of small commodities including household items, clothes, fabrics, bags, and suitcases set off on a 7,500-mile (12,000km) journey to western Europe and arrived in London on 20th jan.

Yiwu Timex Industrial Investments, which is running this service with China’s state-run railways, says prices are half that of air cargo and cut two weeks off the journey time by sea. This London freight service makes London the 15th European city to have a direct rail link with China after the 2013 unveiling of the “One Belt, One Road” initiative by Chinese premier Xi Jinping.

Purely on economic basis , direct rail link between Beijing and Western Europe enables manufacturers to explore new means to lower transport costs. canny negotiators can leverage the new market entrant to lower prices of their established pathways by boat or plane.China is moving very fast on this initiative of ONE BELT ONE ROAD. Many analysts believe that an expanded Chinese economic role within central Asia will also enhance its political influence over an increasingly important global region

Category: Macro Posts

Newgate Absolute return fund…. Why we like commodity companies

The letter, which is available on company website outlines eight reasons for investment in resources

Newgate finds clear evidence of a synchronised recovery in the global economy at a time when there is genuine supply side restraint creating a perfect storm of rising prices

The current supply/demand environment is, a result of the commodity industry’s own mistakes. The resources boom, which took place between the early 2000s and 2014 was fuelled by China’s insatiable demand for commodities. However, commodity companies added new capacities at record high prices for industrial and bulk commodities pushing up input prices such as labor and materials to a point where capital costs of expansion were much greater than originally forecast. The world’s largest iron ore producer, Rio Tinto is a great example of this colossal value destruction. Newgate points out that between 2005 and 2015 Rio increased its asset base from $20 billion to $130 billion but over the same period return on equity collapsed from a high of 45% in 2005 to a low of -5% in 2012 and is currently around 0%.

“In very simple terms, one of the greatest resource booms in recorded economic history was squandered by the poor decisions made by the leadership of major global resource companies. They outlaid too much to expand supply, and when the increased production entered the market major price falls saw dreadful project economics.”

As commodity prices plunged and costs remain elevated, many small highly leveraged commodity companies were pushed into bankruptcy, and some of the world’s largest commodity trading houses such as Glencore and Noble were forced to issue new capital and deny accusations they were close to running out of cash.

To make our argument for an investment in resource companies we detail eight related justifications. 1. Economic outcome of the resources boom 2. Existential crisis of the resources industry 3. Psychological impact on leadership 4. Recovery period: value over volume 5. China capacity closures to protect the environment 6. Chinese fixed asset investment 7. Global growth is recovering strong 8. Animal spirit yet to emerge

Newgate points out that the commodity industry has now entered a new phase of capital preservation and risk aversion particularly in those companies which experienced a near death experience. It is the view of analysts at Newgate that resource company leadership are now a highly risk-averse group, and this will not change for the foreseeable future. They believe it could be up to a generation before resource companies embarked upon another round of value destroying capital expenditure, merger, and acquisitions.

“History will tell us that eventually resource companies will react to sustainably high prices by increasing supply. Nonetheless, because of the recent experience of resource company leadership we may be in a situation for many years where resource companies are content generating excessive cash flow and rewarding shareholders, rather than increasing supply.”

China is the wild card in resource markets. The country is a key producer of bulk commodities such as iron ore and coal, and many loss-making companies have been kept alive by cheap funding, allowing them to continue to produce even though traditional economics’ dictates they should collapse and take supply out the system. For the first time, China began to reform its commodity industry last year, closing excess supply to improve the overall health of the economy and reduce bad debts. Newgate expects this trend to continue over 2017 improving the supply-side picture. At the same time, the fund’s analysts believe the country’s consumption of bulk commodities will continue to grow at a steady rate for the foreseeable future.

Overall then, Newgate is highly optimistic about the outlook for commodity prices and commodity companies going forwards. Here is the concluding paragraph of Newgate’s January newsletter to sum up:

“Our conclusion is that the recent harsh lessons of the previous cycle means a supply response to high commodity prices may be very slow. This in turn may mean commodity prices remain elevated for longer than expected, allowing resource companies to enjoy heavy cashflows that can be paid out to shareholders over 2018 and 2019 and beyond.

Despite the excellent performance from resource companies over calendar year 2016, we still assess that it is a mildly contrarian investment. Many market participants are sceptical about current commodity pricing and are unwilling to invest in the sector, particularly after such strong performance over calendar year 2016.

We concede that some of our arguments may be wrong (in particularly Chinese demand and their fiscal position), and we will be tracking our thesis closely, but on the balance of probabilities, we believe it is time to be optimistic on global cyclical companies, particularly resources.”

I think if we add a mix of protectionism to Newgate’s arguments, it creates a potent mix of rising and volatile commodity prices which can have unintended consequence of rising inflation.

The Long Dollar Trade reverses

The WSJ on Monday night ran a story where Mr. Trump said he was not at all pleased with the “too strong Dollar

The Dollar has way too many brand-new bulls, is at a serious resistance area, and needs to sell off first, to be able to get thru that serious resistance area. The sentiment in the Dollar and the stock market has been, “what can possibly go wrong”. And the sentiment in bonds and gold has been, “what can possibly go right”. So this selloff in the Dollar is exactly what it needed to do.

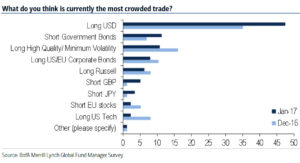

Bank of America Merrill Lynch released the results of its global fund manager survey for January which showed long US dollars was by far considered the most crowded trade. Almost half of the survey participants (47%) viewed long USD as crowded and the next most crowded trade was seen a short government bonds, see below:

I believe the trumflation will take breather for sometime and volatility will rise as this trade reverses.

Higher Govt Spending leads to lower P/E ratios

In the equation

C+I+G+(X-M)= GDP

where C is consumption I stands for Investment G for govt spending and (Exports-Imports) always negative for India and even US.

with (C) under pressure in India because of demonetization and in US because of household indebtedness ,private (I) not taking place because the future looks more uncertain , (X-M) perpetually negative,the only way GDP can bounce back is through higher govt spending. The narrative looks good and economist and corporates both are clamoring for govt to do more spending to bring back growth. But the above chart should debunk the theory that higher govt spending is good for economy. It might give near term impetus and excitement to the market but ,but if you believe like me that government is by nature less efficient than the private sector, then higher government spending will mean more capital misallocation, which is not good for stock valuations in medium term .

Mega Trend in Making

The global stock market capitalization has increased by $3 trillion recently, while the global bond market value declined by roughly the same amount.There are three macro trades over here. one.. bond to Equity second…. EM (bond & Equity) to DM Equity and third…. Rise in Dollar Index.This move since Trump win is what a trailor looks like in a long movie ,The markets are indeed forward-looking, but this latest leg of the risk rally has a certain speculative feel to it and I must admit this move ( strength in US Dollar) and sell off in Bonds are overextended in short term.

The Gathering Inflation storm

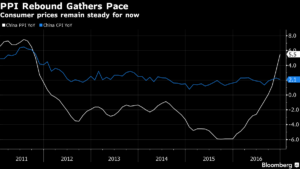

China quietly stopped being an exporter of deflation few months back when its factory gate price turned positive after a gap of five years. Portfolio managers who took this development seriously made a bounty in industrial metals stocks which outperformed the broader market since this news. Now we get one more jolt from china producer price index which also rose at the fastest pace in more than five years in December as the factory to the world swung to exporting inflation.

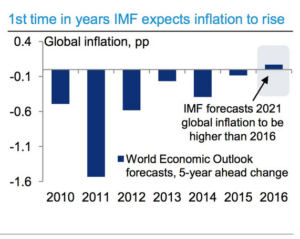

Now to be sure there are sceptics who point this as one off data but I think it is a start of a bigger trend. As Diana choleya writes China is more likely to be “exporting inflation” than “exporting price deflation” as it was in the period 2002-2006 because its economy and interaction with the world have changed .China used commodities and energy extremely inefficiently, but it also administered their domestic prices. Energy and commodity prices surged on world markets, but in China they hardly budged. Thus, global manufactured goods price deflation continued unabated until China reached its physical energy and transport supply limits. She further writes that gone are the days when Chinese exporters could rely on cheap and ample migrant labour to keep manufacturing prices low. Gone also are the days when China’s state-owned oil and gas producers could assume the burden of low administered energy tariffs, which also helped to hold down global prices of manufactured goods. Gone, too, are the days when public and overall debt were low enough for China not to care about shouldering the extra costs in order to achieve rapid industrialisation and to grab export market share and what you see is the risk in world today are hiding in plain sight in the form of unexpected higher inflation as the data highlights rise in both industrial metal and raw materials prices. All This adds to ongoing price pressures at Chinese factories, such as wage increases. They all raise input costs. With margins getting squeezed from the bottom up, producers will be trying to pass on these higher costs to the global supply chains via higher asking prices. And if they get those prices to stick, they’ll export inflation to the rest of the world. And that’ll be a sea change. Add a toxic mix of protectionism, the global markets will be surprised with health dose of inflation. Below is the chart where even IMF expects inflation to be in positive territory this year.

In my view mild return of inflation is already underway in India also as core inflation refuses to budge lower and input price inflation continues to march higher. The numbers are not alarming enough as is evident in bond market complacency and continued euphoria in equity markets to chase high P/E growth strategies even as bond yield refuse to go lower and value strategies have started outperforming. A major trend shift is underway ……Read the leaves the times they are changing

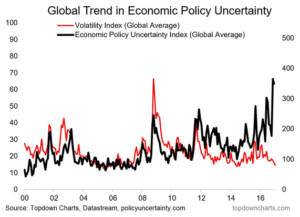

Global Trend in Economic Policy Uncertainty

If the global economic policy becomes uncertain, markets should compensate with increase in volatility. Trump win was the start of rally and compression of volatility. Will the Trump inauguration next week bring the volatility back and align these two charts?

The proposed “border adjusted plan” – a potential blow to India’s export story?

The ample availability of competent and cheap workforce has made India the global ‘outsourcing destination of choice’ in sectors such as IT, pharma, Gems and Jewellery, financial services etc. However, with right winged nationalist ideologies gaining prominence globally, this could come under some serious threat. The Republicans in the House of Representatives with the backing of President elect Donald Trump, have proposed changes to the US corporate tax code which could mark one of the most important shifts in US tax and international trade policy in a generation and an underappreciated threat to Indian exports. The so called “border adjusted” plan could radically change the structure of business taxation by imposing a 20 percent tax on all imports by US and providing a special exemption for all export-related income.

I will come to the potential impact but consider these facts:

Trump’s threat to protect the US interest in an inward-looking manner looks increasingly real now rather than just an election rhetoric as has been in the past. The way Ford announced the scrapping of its proposed Mexico plant shows that Trump means business when it comes to carrying out the threat of onerous border tax on US firms which ships jobs abroad. If enacted, the proposed bill would have a transformational impact on the US trade relationship with the rest of the world. The stakes are high for India and our exports.

If the border adjusted tax is enacted, US imports would become dearer as corporates would have to pay the new corporate tax rate (20-25% proposed) on the value of Imports. On the other hand, exports would become cheaper, because for every dollar of exports, corporate will no longer be required to pay tax on such earnings. Which roughly means that exports from US will be incentivised by upto 15% on tax adjusted basis and US imports will become 15% costly – post tax.

A border tax adjustment would be very positive for the US trade balance. As explained above, a border tax adjustment would be equivalent to an across the board import tariff of and an export subsidy of 10-20%. This could go a long way in reducing the US trade deficit.

The idea is to tax goods as they enter the United States from other countries, but to avoid taxing U.S. exports at all. For instance, a car imported into the U.S. from Mexico would be taxed, but the American-made steel sent to Mexico would not.

Proponents say the proposed “destination tax” would encourage more U.S. production of goods and create U.S. jobs. But opponents say it will send prices higher, unfairly cut profits for some sectors, particularly the retail industry, and could prompt retaliation. The idea is similar but not quite like a VAT, or value added tax, common in other countries.

Now these are only proposals and there are uncertainties related to all estimates above. As a signatory to WTO it can be debated whether the territorial corporate tax system would be allowable under WTO rules. The question is highly complex, but senior Trump advisers have stated they would be willing to take the issue to the WTO.

It is also not clear what types of goods and services the proposed tax would cover – however, one thing is for sure – the broader the coverage the bigger the impact and vice versa.

Still, it is hard to argue that such a fundamental shift in tax treatment of US exports and imports would not have a material impact on trade relations and flows with the rest of the world. More importantly, the second-order impact of “re-shoring” may be more material given that US corporate activity has been disadvantaged due to the current unfavorable tax treatment of offshore profits.

Taking all the above into account, I think dollar and dollar assets will be beneficiaries should the “border tax adjustment” be accepted and enacted. An appreciating dollar would be a natural response to an improving US trade balance and improved export competitiveness. I believe that the dollar Index could climb by 15-20% to fully offset the price shifts caused by the tax and more against countries running high current account deficits with the United States and have relatively higher dependence on dollar borrowings.

It is also important to understand that even if border tax proposal does not go through US is turning nationalist. In fact, of the two dozen US 2016 presidential candidates, only one advocated for a continuation of America’s role in maintaining the global security and trade order that the Americans installed and have maintained since 1945.

As Peter Zeihan writes in Accidental superpower “I see a long-overdue shift in the global order. New trends emerging. New possibilities unfolding. ”

The Americans who had created, nurtured, enabled, maintained and protected the post-WWII global order are losing interest and such shift will have monumental consequences. America’s energy needs at that time required that the US guard the world and in turn run current account deficits.

In 2006 total American oil production, had dropped to 8.3mbpd while demand was touching 20.7mpbd, forcing the United States to import 12.4mpbd, more than Japan and China and Germany combined. By 2016 U.S. oil output had breached 15mbpd. Factor in the Canadians and Mexicans, and total American imports of non-North American oil had plunged to about 2mbpd — and that in the teeth of an oil price war. And that’s just oil specifically. Take a more comprehensive view and include everything from bunker fuel to propane, and the continent is less than 0.8mbpd from being a net energy exporter.

The end of American dependence upon extra-continental energy sources does more than sever the largest of the remaining ties that bind America’s fate to the wider world; it sets into motion a veritable cavalcade of trends: the re-industrialization of the United States and the accelerated breakdown of the global order.

The world has had seven decades to become inured to a world in which the Americans do the heavy lifting to maintain a system that economically benefits everyone. The world has had three decades to become inured to a world in which the Americans do not expect anything of substance in return. As the Americans, back away, very few players have any inkling of how to operate in a world where markets are not open, transport is not safe, and energy cannot be secured easily.

The Disorder’s defining characteristic is, well, its lack of order. Remove the comfortable, smothering American presence in the world and the rest of humanity must look out for its own interests.

The chairman of one of India’s largest software companies recently expressed his concerns on recent political events that might “shape a world of exclusion, conflict and suspicion” ahead. It is high time that corporate India takes this monumental change in US strategy seriously.

Edited version of this article appeared in Economic Times on 14th Jan

Vulnerability of Asian Economies

As per credit suisse, Indian Economy is less vulnerable to trade protectionism than US Fed Rate hike. We allowed easy access to our capital Markets and never really developed ways to channelize this flow in real economy hence will hurt more where flows are more

Trump Index

This would mean buying sectors which benefit out of Protectionism and Inflation.