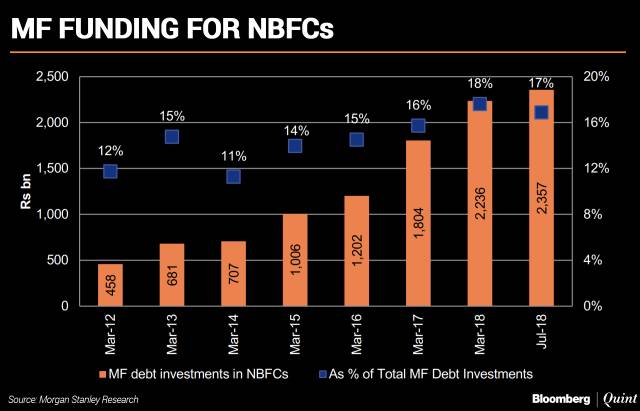

Telecom got its catalyst in the form of disruption from JIO. MF and NBFC have got their disruption in the form of current liquidity crisis which will affect their ability to attract investor and tap the market when in need of money .

“When it comes to India’s non-bank finance companies, the bigger they are, the faster they recover. That’s according to Andrew Holland, CEO of Avendus Capital Alternate Strategies who believes larger NBFCs will have a better chance of a comeback than their smaller peers.”(EXACTLY)

Only Large NBFC/HFC will now be able to tap the bond markets for sometime leaving smaller ones hanging dry. This in my view is a kind of disruption for Non Banking Finance Sector. if this funding disruption continues for long enough time, like reliance JIO smaller NBFC will have no choice but to selloff or merge with big guys

Institutional Investor will again tighten their norms to invest only with large AMC’s which are mostly a part of big conglomerates and the Mutual Fund industry which is already concentrated among few players will get more concentrated.

As I had written before, more and more industries in India are seeing increasing concentration of market share among very few companies (oligopoly) which is neither good for consumer or employment generation in long run.