The rise of Zombie Firms

Key takeaways

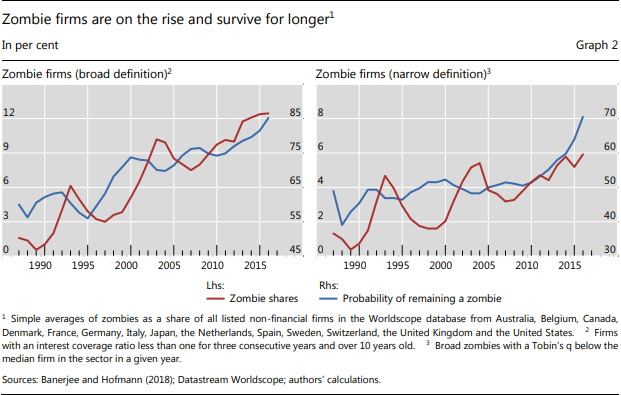

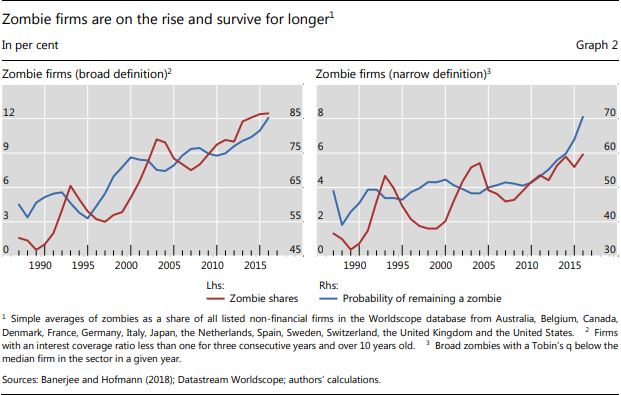

- The prevalence of zombie firms has ratcheted up since the late 1980s.

- This appears to be linked to reduced financial pressure, reflecting in part the effects of lower interest rates.

- Zombie firms are less productive and crowd out investment in and employment at more productive firms.

- When identifying zombie firms, it appears to be important to take into account expected future profitability in addition to weak past performance.

BIS writes in a paper….Zombie firms, meaning firms that are unable to cover debt servicing costs from current profits over an extended period, have recently attracted increasing attention in both academic and policy circles. Caballero et al (2008) coined the term in their analysis of the Japanese “lost decade” of the 1990s. More recently, Adalet McGowan et al (2017) have shown that the prevalence of such companies as a share of the total population of non-financial companies (the zombie share) has increased significantly in the wake of the Great Financial Crisis (GFC) across advanced economies more generally.

BIS analysis addresses three main questions:

First, are increases in the incidence of zombie firms just episodic, linked to major financial disruptions, or do they reflect a more general secular trend? Answering this question requires taking a sufficiently long perspective. Their database extends back to the 1980s and covers several business cycles. They find a ratcheting dynamic: the share of zombie companies has trended up over time through upward shifts in the wake of economic downturns that are not fully reversed in subsequent recoveries.

Second, what are the causes of the rise of zombie firms? Previous studies have focused on the role of weak banks that roll over loans to non-viable firms rather than writing them off (sounds familiar) . This keeps zombie companies on life support. A related but less explored factor is the drop in interest rates since the 1980s. The ratcheting-down in the level of interest rates after each cycle has potentially reduced the financial pressure on zombies to restructure or exit The results indeed suggest that lower rates tend to push up zombie shares, even after accounting for the impact of other factors.

Consequences of Rising Zombies

Previous studies have shown that zombies tend to be less productive. Therefore, the higher share of zombie companies could be weighing on aggregate productivity. BIS concludes….Moreover, the survival of zombie firms may crowd out investment in and employment at healthy firms .

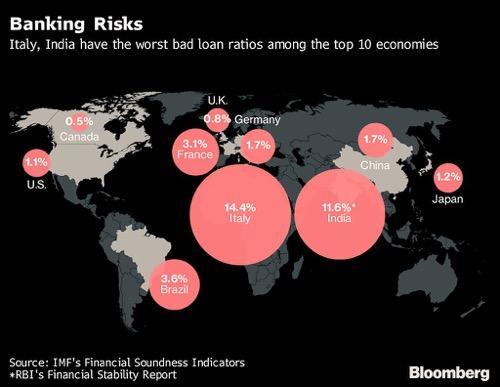

The above article by BIS is very relevant in Indian context where banks and system had an incentive of propping up Zombie firms. India is in urgent need of investment cycle which will also aid in employment generation and the cycle cannot kick start till the financial system is able to tackle this monster of zombie firms.

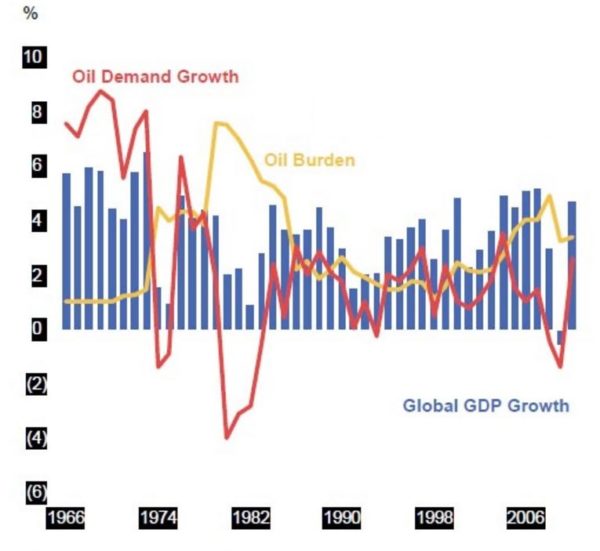

Is The Oil Burden A Rising Problem?

Danielle writes in “Escape from the Central Bank Trap”,the concept of the “Oil Burden”.It is the percentage of global GDP spent on buying oil. It is often said that when the oil burden reaches 5-6% of GDP it can be a cause of a global slowdown.

The global oil burden will rise to 3.1% of global GDP in 2018 from 2.4% in 2017 and -if Brent goes to $80 for an entire year- could soar to 4% of global GDP. This is where things start getting tricky for global economy

https://www.dlacalle.com/en/is-the-oil-burden-a-rising-concern/

LIC policy holders funding IDBI and ILFS mess…..

What’s around the corner- Bear Trap Report

Current Account Deficit: Short-Term Fixes For Structural Weakness?

EM credit risk faces repricing

India’s NPL Crisis Erupts: A Major Shadow Bank Defaults On Three Debt Payments

Weekend Charts

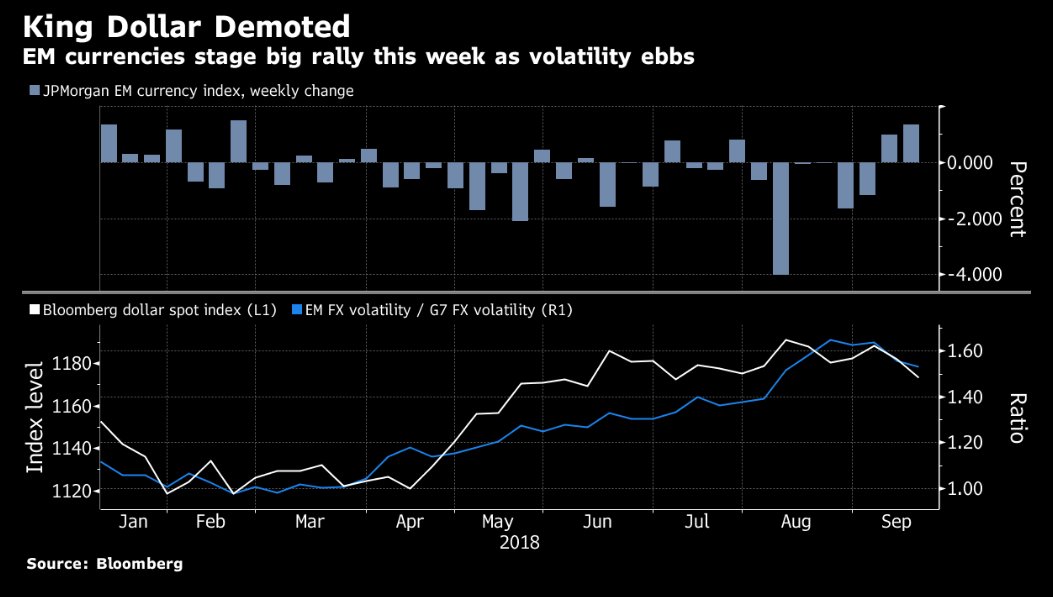

Emerging-markets currencies just had their biggest weekly gain since February.With China opting out of trade talks with US slated for next week, this gain might be short lived.

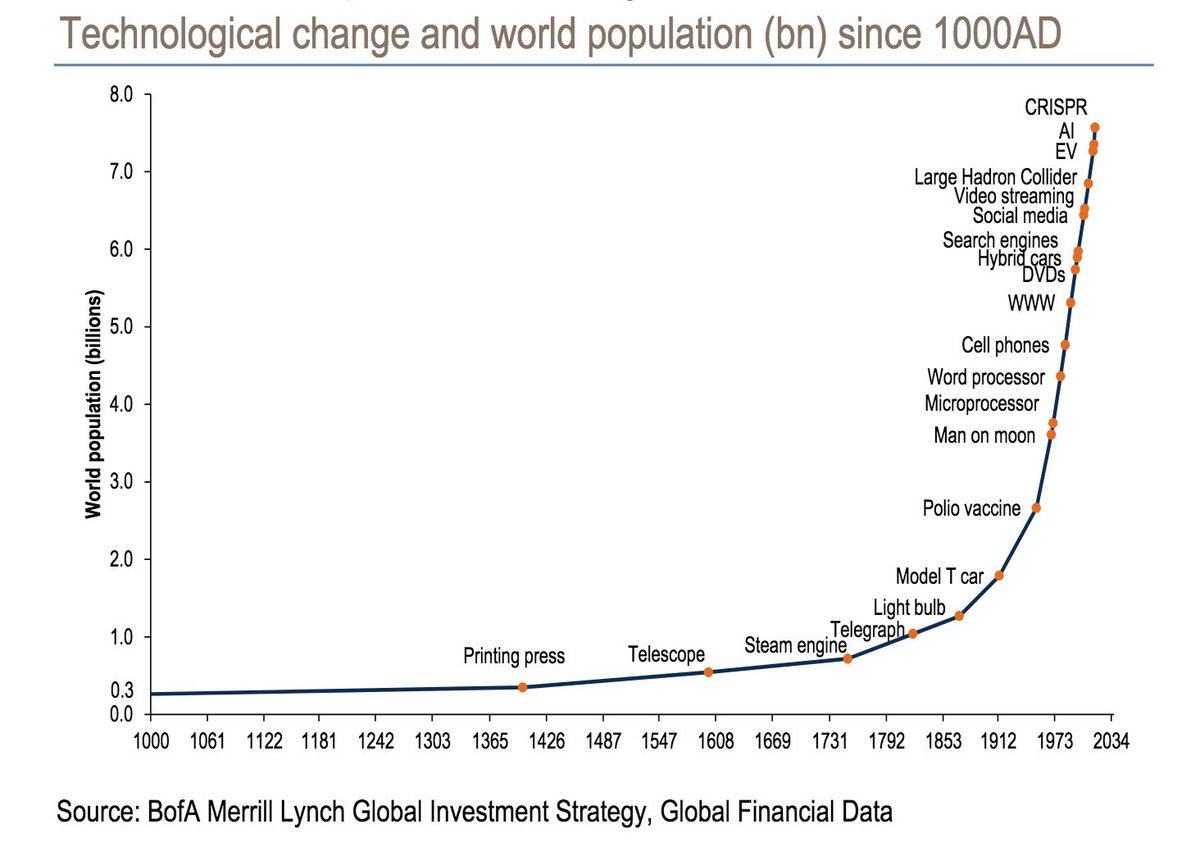

Tech disruption is deflationary, BofAML says. The supply of robots, artificial intelligence and big data putting downward pressure on the price of labor, goods, services & capital. Aging Demographics and Excess Debt adding to the deflationary pressure.

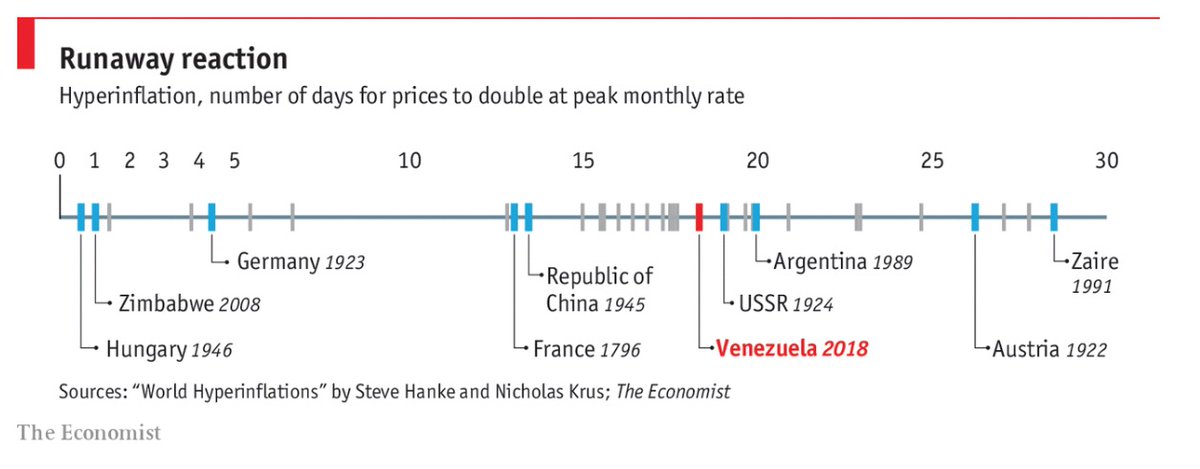

Venezuela’s hyperinflationary horror is far from unprecedented: In Venezuela it took less than 19 days in Aug for the currency to lose half its value. In worst month of Hungary’s hyperinflation, it took just 15 hours. Calculating half-life of a currency

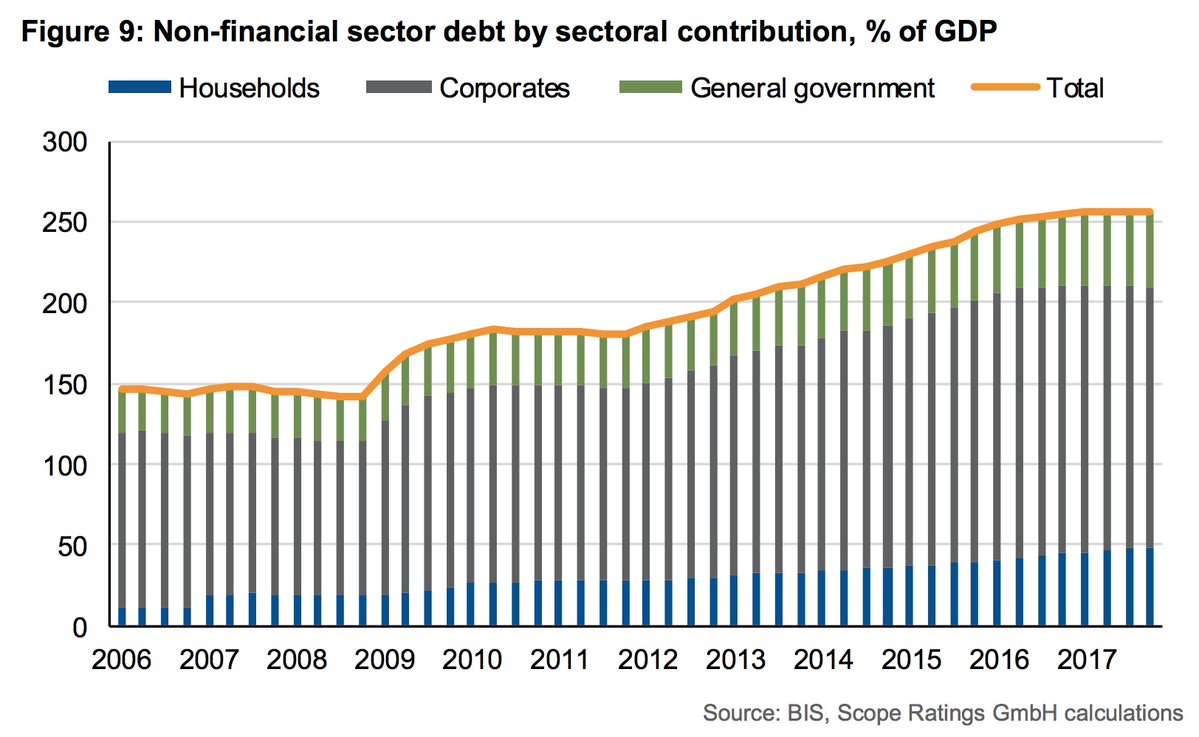

In case you missed it: Rating agency Scope has cut China credit outlook to negative citing significant public-sector deficits despite recent consolidation efforts and a growing public sector debt stock; and high levels of total non-financial sector debt.

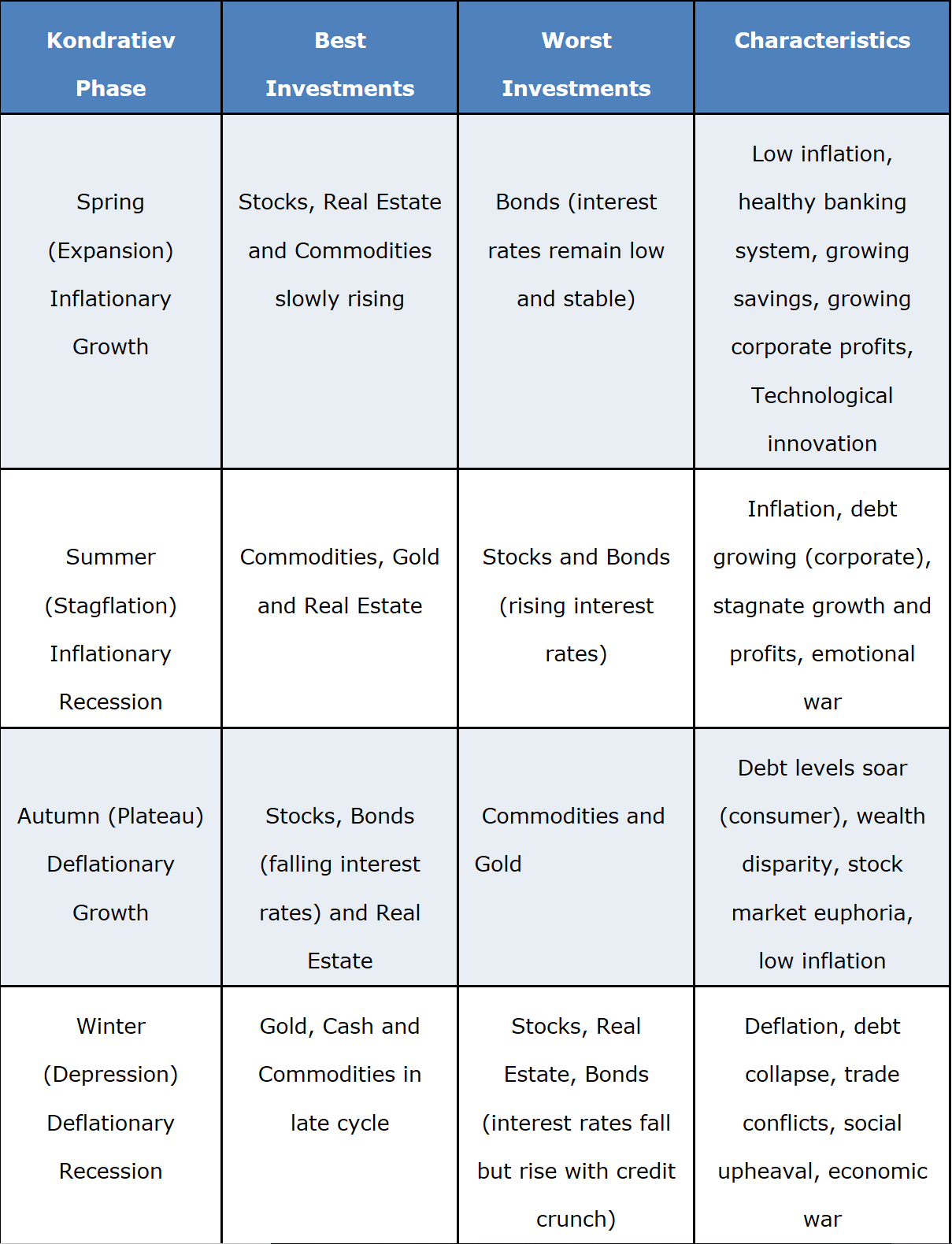

Indian economy moving from Autumn to Kondratiev Winter

Sociology …. I closely observe the society mood ,which is decidedly turning negative. Credit tightening which is gripping the Indian economy and years of mal investment not getting enough liquidity to be able to roll over the debt .

This is when I get the feeling that Indian Economy is moving from Autumn to Winter. The assets which do well in winter are different from assets which have done well in Autumn.

US is still finishing its autumn and that can be observed by looking at the following chart.