There is never only one cockroach

Albert Edwards:”why the next recession might be only six months away”

Post Lehman, Foreigners Have Made More Money Out of Indian Stocks Than Indians

Vivek Kaul writes….As the stock prices have soared over the last few years, the FIIs have not bought much. A bulk of their buying in Indian stocks happened before and in 2014-2015. Between 2009-2010 and August 2018, the FIIs invested Rs 6,45,917 crore in Indian stocks. Of this, Rs 5,95,155 crore, came in before March 2015.

At the end of March 2014, the BSE Sensex was a little over 22,300 points. As of end August 2018, it was a little over 38,600 points. Basically, FIIs have gained quite a lot from the dramatic rise of Indian stocks, by investing early and holding on to their investment.

A bulk of their buying in Indian stocks happened when the price to earnings ratio of the BSE Sensex was lower than 19, a clear indication of the age-old stock market wisdom of buying low.

In comparison, the DIIs sold stocks worth Rs 1,03,603 crore between 2009-2010 and 2014-2015. This is when stocks were available at a good price. Between 2015-2016 and August 2018, they bought stocks worth Rs 2,67,752 crore. Hence, a bulk of the investment by DIIs in stocks has happened after the stock market has rallied quite a bit. Most of the buying by DIIs has happened at a time when the price to earnings ratio of the BSE Sensex was greater than 22.

In fact, DIIs invested Rs 1,14,600 crore in 2017-2018, the highest amount of money they have ever invested in the stock market, during a single year. At the beginning of April 2017, the BSE Sensex was already close to 30,000 levels. This is a clear case of buying high, something which goes against the most basic stock market wisdom.

Vivek concludes

All in all, foreigners have gained more out of the Indian stock market than the Indians, in the last decade. And that’s not good news.

Once the current stock market bubble deflates, a new generation of Indian investors will come to the conclusion that investing in the stock market is a gamble, which it clearly is not if one invests in an informed way and not just follow the herd.

How to spot next buying opportunity in Emerging Markets

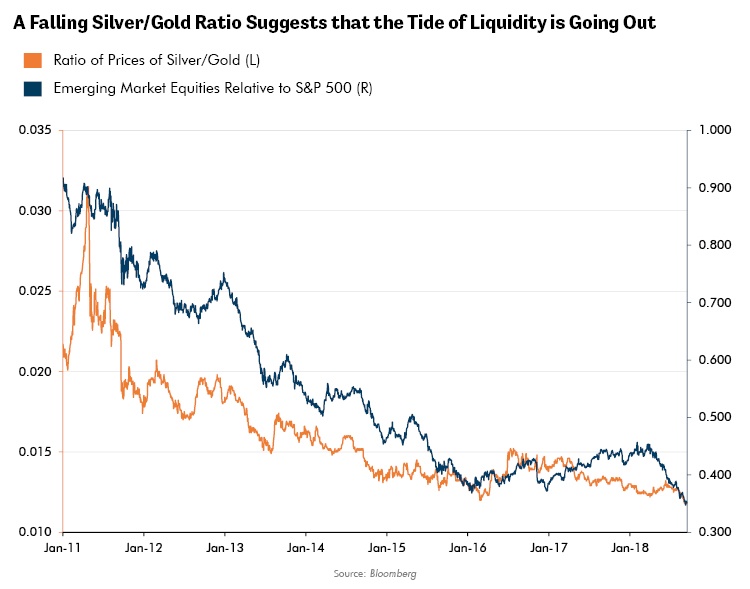

Lewis Johnson writes…Our experience has been the silver/gold ratio is one of the most sensitive leading indicators of liquidity. We believe that a fundamental reality lies behind this relationship. Both gold and silver are precious metals. The nature of the supply and demand for these metals, however, varies. Our experience is that silver is the more sensitive of the two to incremental changes in liquidity and/or inflationary expectations. My experience in real-time watching the silver/gold ratio move from its lows was helpful in both 2003 and again in 2008. In 2003, its rise indicated that the long bruising decline in emerging markets was finally over. Again in 2008, while the world was crashing, the silver/gold ratio demonstrated its insight by turning up in late 2008. I believe this ratio can be equally insightful when booms turn into busts, as this indicator amply displayed in mid-2008 and again in 2011.

Conclusion

We are now nearing historic lows in this ratio. This may suggest that we are in the zone during which we may reasonably expect that values in many emerging market investments will become compelling (I believe it will be commodities heavy markets like Brazil and South Africa). Our discipline, however, learned through many trading cycles, is to pair our valuation-driven insights with an informed view on liquidity. It is our expectation that a sustained turn in the silver/gold ratio may very well be the final link that turns us into more aggressive buyers of the select investments that our research team has identified among this challenged asset class.

Why Emerging Markets are a dead money trade

Alex at Macro-ops believe that China, and EM in general, is set to be a dead money trade and massive value trap for the remainder of this cycle.

He concludesEM’s structural growth limitations can be boiled down to the following:

– EMs are BoP constrained . Since they have soft currencies — meaning, they can’t finance current account deficits in their own money — they can’t grow faster than their exports for an extended period of time. Because, a current account deficit leads to a build up of hard currency debt, hot money outflows, and a BoP crisis.

– EMs have maxed out their market share of global exports. EMs now comprise over 50% of global non-commodity exports (see chart below) and further export share growth will likely be from one EM cannibalizing another. Globalization has peaked and with increasing trade tensions, we should even see a reversal of some of the outsourcing and offshoring that’s occurred over the past two decades.

– EMs are facing a significant debt burden amid tightening global liquidity. EMs are weighed down by a large amount of debt which they’ve accumulated in financing their current account deficits over the last decade, and much of this debt is dollar denominated. Rising US interest rates and a strengthening dollar will continue to put pressure on EMs going forward.

Read Full article

Macro-Economic Dashboard

BNP Paribas fortnightly Macro Economic Dashboard

Summary of main Points

Bank Non food credit growth rate remains strong.

(Believe will further accelerate for couple of months before it will slow. Quiet a few borrowers will get shut out of capital markets and will be forced to go back to banks, at least temporarily)

CP issuance growth slowing down…..though still very strong yoy growth.

10 years yields breach 8% and staying there. Rupee depreciation and current account deficit will need an RBI response, is an assumption.

Inflation number continues to be soft though rupee depreciation is expected to creep in with a lag.

A Chinese Wrench is Stopping Public Procurement From Supporting Modi’s ‘Make in India’

‘The price offered by Chinese vendors is usually 40-50% lower compared to what local suppliers offer, which renders irrelevant the 20% purchase preference advantage stipulated for the latter under the Make in India scheme.’

Noor Mohammad writes …..Suppliers, who have set up manufacturing facility under the Make in India programme, are entitled to 20% purchase preference in public procurement. That means they will be given contract provided the bid price differential is less than 20% and they are ready to match the offer of the lowest bidder, a foreign vendor.

But despite that, local suppliers are being outbid by Chinese vendors. The reason: price offered by Chinese vendors is usually 40-50% lower compared to what local suppliers offer, which renders irrelevant the 20% purchase preference advantage stipulated for the latter under the ‘Make in India’ scheme.

Plasser India, a manufacturer of track-laying and maintenance machines is operating in India since 1965. It already has one manufacturing unit in Haryana.

It decided to set up another manufacturing unit in Vadodara with investment of Rs 400 crore to benefit from sops available under the Make in India. The facility is expected to be operational by next March. However, it failed to match up to Chinese competition in two recent tenders.

Siegfried Fink, managing director of Plasser India, wants the government to introduce 50% mandatory localisation to level the playing field for companies that have set up manufacturing facilities here.

It was lure of this kind of demand that led companies like Plasser India into expanding their manufacturing capacity here. But now their optimism is fading fast as they see the reality.

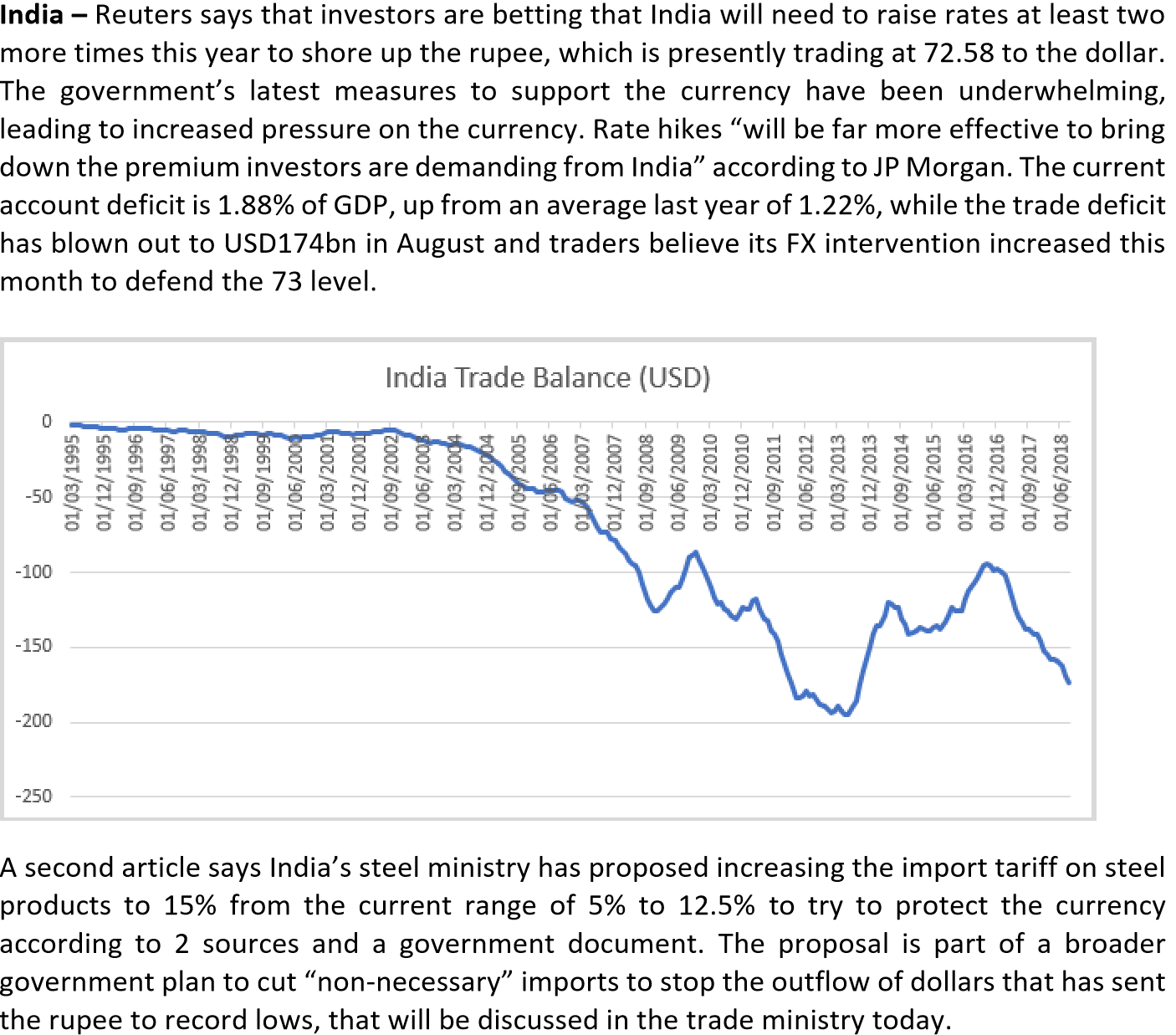

Investors betting on two more rate hikes by RBI this year