Must watch interview with Ray Dalio https://youtu.be/7WXidoI9ppw

Download his latest book https://t.co/SBf4g90tc8

Making sense out of Chaos

Must watch interview with Ray Dalio https://youtu.be/7WXidoI9ppw

Download his latest book https://t.co/SBf4g90tc8

The Roman Emperor Augustus was believed to have been worth in current dollar terms nearly $5 trillion.

The only other person to have reached the trillion dollars net worth status was King Solomon of Judaea. After octavian/Augustus defeated Marc Antony and Cleopatra, he then possessed the entire wealth of Egypt. In this respect, the wealth really did belong to him. The Roman system was that a governor paid the tax to the state and he had the right to mine that province for taxes which were always in excess. So in this perspective, the wealth of Egypt truly did belong to Octavian/Augustus.

Some have attributed the entire wealth of nations conquered and argued that Genghis Khan was worth probably $100 trillion dollars. However, Genghis Khan may have been the ruler, but this was not exactly the same as the Roman system. All taxation was not the personal property of Genghis Khan as was the case for a governor of a province in the Roman Empire.

(armstrongeconomics blog)

Connecting the Dots

1 Donald Trump cut taxes ( he wants to make America great again)—- (which lead to)

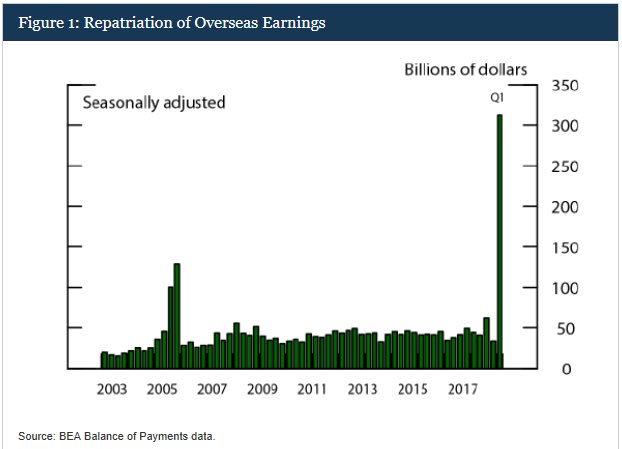

2.To take advantage of tax cuts, US corporations repatriate Dollar stashed/invested abroad ——–(which led to)

3.More Demand for dollar vs other currencies——-(which led to)

4. Fall in currencies (mainly EM) which had to supply dollar——(which led to)

5. Indiscriminate selling of local asset (read EM)to fulfill dollar demand —–(which led to)

6.Strengthening of Dollar vs these currencies

and finally this dollar which came back home had to be invested somewhere right?

The repatriated dollar went straight into stock buybacks leading to artificial demand for US stocks and that is why US market continues to be strong whereas all others are clearly struggling.

Now comes the 64 million (Dollar) question ……………………………..Is the pain over?

My view …no not at all…. this is the first time Americans don’t give a shit to what’s happening in rest of the world and happy to use Dollar as a weapon till it does not turn on them.

Dhananjay writes in a report ….The 71% yoy decline in net sales of equity mutual funds in Aug’18 epitomizes the cyclical nature of Equity MF flows, aligning with our year ago thesis. The sustenance of negative NAVs of equity MFs is a risk for the broader market. The broader market has seen a steep correction, but a capitulation is still some time away.

Considering also the RBI data on household savings, there is little evidence of a structural rise in financial savings of households.

Moderate increase in Household financial savings

Net financial savings of households, net of financial liabilities, increased only modestly in FY18 to 7.1% of disposable income, after declining to 6.7% in FY17 due to the demonetization shock. It was still much lower than 8.1% in FY16. Importantly, gross financial assets, excluding currency holdings, actually declined to 8.3% of disposable income, much lower than the pre demonetization average of 9.3%. Ironically, the holding of currency in financial assets of households jumped to 2.8% of disposable income in FY18, higher than the pre-demonetization level of 1.6% in FY16.

Broader market has seen a steep correction, but capitulation still some time away

The recent catch-up rally in the broader market with the benchmark indices after a decline of 17-20% earlier this year is possibly difficult to sustain. Even after the decline in mid-cap index trailing PE from 51x in Dec’17 to the current 39x in Aug’18, it is still trading at a 56% premium to the benchmark Sensex and Nifty indices. The risk is that it can go back to an average discount of 12-15%, instead of premium, as it existed prior to May’14.

Macro headwinds like higher risk-free rates, moderating global liquidity, INR depreciation, and uncertainty ahead of the general election in 2019 are likely to keep retail investor risk-taking appetite modest, thereby affecting valuation

multiples. This will possibly overpower the cyclical improvement in earnings growth due to currency depreciation and better consumption demand.

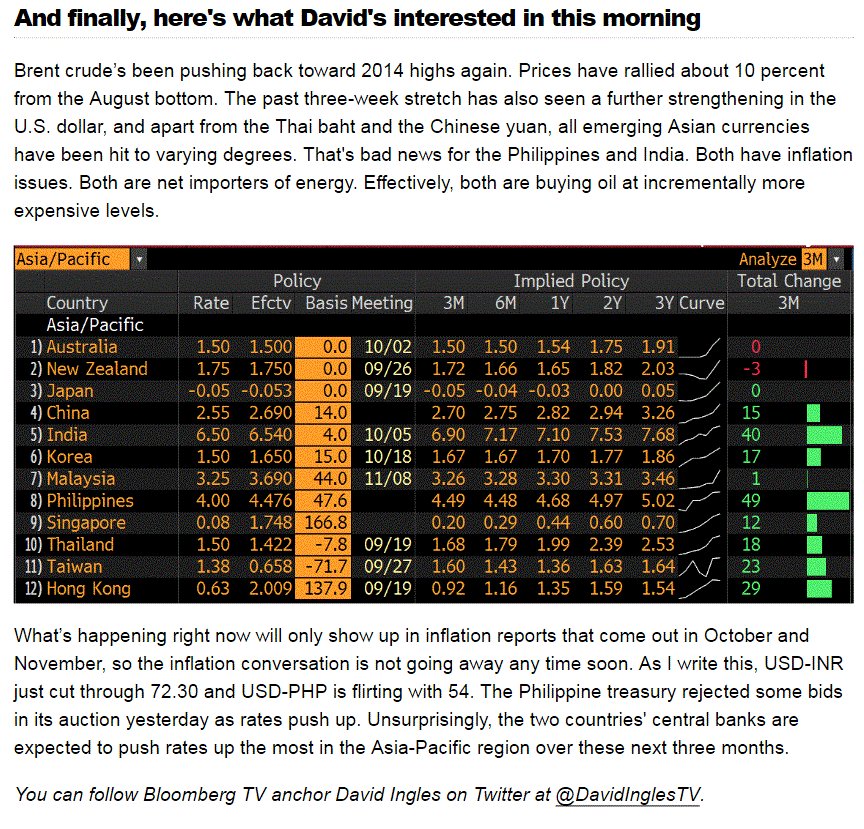

So this inflation issue looks like it’s not going away anytime soon, especially for the Philippines and India more so when valuations are 1 standard deviation above mean. Crude is the biggest bane for India and the current reduction in taxes by some state govt’s does not bode well for deficit.

The dollar allows the nation easily to finance its trade and budget deficits, other than protecting them against balance-of-payments crises.

Victor Shvets who, along with market consensus, is overweight Indian Equities writes…..

India might become the focus of investors’ concerns…… . If EM equities continue to come under pressure, it is quite possible that it would be India that would deliver the next sharp pain jolt to investors. MSCI India has actually outperformed by ~5.5%, and together with Thai & Taiwan, it has been one of the best markets. India is where investors are hiding from a storm (trade and liquidity. while there are reasons to stay long, environment is changing.

The positives

India is a much larger (approximating the entire ASEAN) and deeper market. Second, while still poorly governed, it is becoming better administered, and from a very low base, India thus has been delivering strong growth while inflation has been range-bound. Third, India does not like when commodities are too high or too low; it needs ‘goldilocks’ and this is what investors had experienced. Fourth, India cannot tolerate extreme USD volatilities, and until several months ago, it benefited from low FX volatilities. Fifth, it is largely a domestically oriented economy, and in a world of disruption, it is perceived as a safe haven. Sixth, India has considerable accumulated liquidity, and foreigners are not large in its bond market (~5% vs 30-40% for Mal or Indo).

However, the environment is changing. First, FX volatilities are rising, and INR is coming under strong pressure.

( yeah right it was accident waiting to happen when there is loose talks from Ministry officials)

Second, rapidly declining currency is usually not a recipe for improved competitiveness but rather higher inflation; and this is occurring at the time when inflation rates have already been picking up over the last twelve months.

( spot on! I don’t understand why Fund Managers don’t get that rates are gonna rise)

Third, India is running high twin-deficits (~9% of GDP). (get it guys, this kind of deficit is not sustainable for an Emerging economy. You cannot just spend by borrowing more)

Fourth, net FDIs are down from an annualized pace of $40bn to ~US$29-30bn. ( yes FDI is better than FPI flows, at least we get to keep those dollars)

Fifth, RBI is behind the curve, and is likely to further tighten, which, depending on volatilities, could be faster than market expects. (absolutely, growth will be sacrificed because demand needs to be curtailed)

Sixth, India is going into national electoral cycle, which is never good news for either tactical or secular reforms. (more tactical than secular)

Seventh, equity investors remain exceptionally bullish, with EPS growth estimates in a 15-20% range per annum for three years forward while valuation multiples are more than one standard deviation above the mean.( how will you achieve 15-20% EPS growth if RBI is going to curtail final demand… you simply cannot)

Conclusion

Finally Victor is nervous but he is still positive on India

(remember his KRA is to beat benchmark not deliver absolute returns inspite of market which is overvalued to the extent of 1 standard deviation from mean) .We are nervous and it is possible that India might be the next shoe to drop. However, what would replace India? Neither Indonesia nor china although he remains strong believers in China’s LT secular drivers. In the meantime, India’s external risks seem contained while its corporates are some of the best in the region ..

In addition, unlike other EMs, India retains the promise of sustained productivity gains.