by Doug Noland

Pondering the shallowness of analyses being espoused by the vast majority of market pundits, I’m compelled to frame a thesis to help explain today’s most extraordinary backdrop. The coronavirus outbreak will eventually pass, though I have serious doubts contemporary finance will pass this test. Suggesting history’s greatest Bubble – that is today in serious jeopardy – is still considered crazy talk. Yet this is the reality so few are willing to contemplate. I expected the Russian Bubble to burst in 1998 with serious ramifications for the leveraged speculating community. Still, I was flabbergasted by the reckless leverage employed by Long Term Capital Management (that nearly brought down the global financial system). They were the smart guys (two Nobel laureates).

The Credit Bubble Bulletin was launched in 1999 when I was convinced finance had fundamentally changed – and that this ongoing transformation was appreciated neither by policymakers nor market participants. It was out with bank-dominated lending and in with market-based Credit – securitizations, the government-sponsored enterprises (GSEs), “Wall Street finance,” the “repo” market, derivatives and highly-levered hedge funds. Throughout history, Credit has proved inherently unstable. This new Credit was instability on steroids – spawning serial booms and busts at home and abroad.

I argued for an update to old banking “deposit multiplier” analysis – where one bank creates a deposit as it makes a new loan; with this new money then deposited in a second bank; where bank B then has funds for a new loan (the amount of their new deposit less reserve requirements); where this new money makes its way to Bank C to fund yet another loan (the newest deposit less reserve requirements). For centuries, post-Bubble post-mortem would invariably fault the instability of “fractional reserve banking.” The booms were magical, while the subsequent busts spawned panics and calamitous Bank Runs.

I argued back in 1999 of a dangerous new “infinite multiplier effect” – where contemporary “money” (electronic debits and Credits) moves around the system creating unfettered “money” and Credit expansion and associated Bubbles. This analysis, of course, was fiercely rebuked. It was not until Paul McCulley in 2007 coined the term “shadow banking” that people began taking notice. By then it was too late.

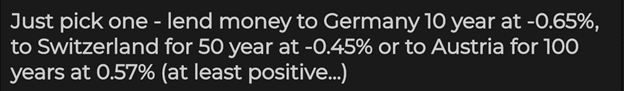

More than a decade ago, I began warning of the risks of an inflating “global government finance Bubble”. Policy makers had resorted to an unprecedented expansion of central bank Credit and sovereign debt to reflate global finance (and economies). And for years policymakers have administered near zero rates and egregious “money printing” operations to sustain history’s greatest Bubble, in the process extending a dangerous cycle. The unprecedented inflation of government finance has been alarming enough. Yet I worry most about this “infinite multiplier effect” and how leveraged speculation infiltrated all nooks and crannies – as well as the very foundation – of global finance.

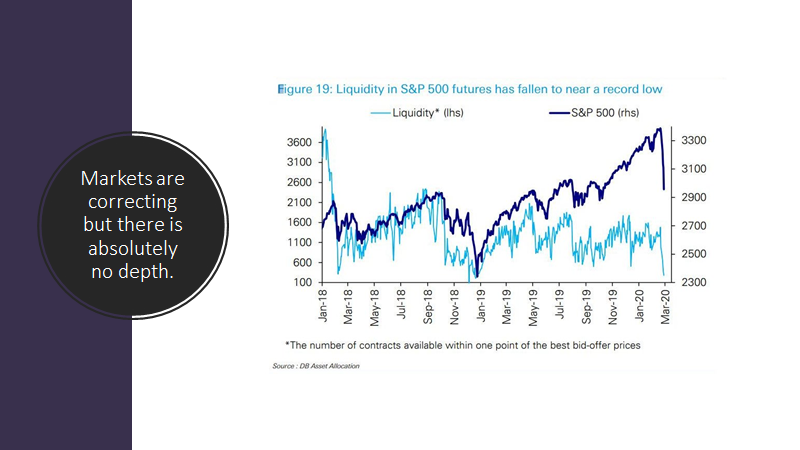

As I have stated repeatedly over the years, contemporary finance appears miraculous so long as it is expanding/flourishing – so long as new “money”/liquidity is created through the process of financing additional speculative holdings of financial assets. The new securities-related Credit fuels asset inflation, self-reinforcing speculation and more powerful Bubbles. Importantly, credit growth associated with global securities and derivatives speculation expanded to the point of becoming the marginal source of liquidity throughout international financial markets. After first ignoring its ascending role, central banks moved to accommodate, nurture and, finally, to assertively promote financial speculation. The risk today is that this unwieldy Bubble inflated beyond the capacity of central bank control.

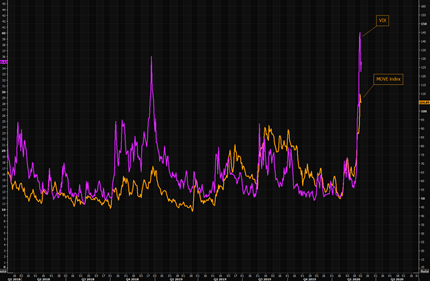

Bubbles and resulting manias take on lives of their own. They cannot, however, escape harsh realities: Fragilities only build up over time, and Bubbles don’t work in reverse. Collapse becomes unavoidable, with any serious de-risking/deleveraging dynamic leading to a contraction of marketplace liquidity, a spike in risk premiums, illiquidity, panic and dislocation. It’s the modern form of the old-fashioned Bank Run. That’s where we are today.

I was naive back in the nineties. I actually thought once policymakers understood the instability unleashed by unfettered “money,” Credit and leveraged speculation, they would take responsible steps to contain this new financial structure. They instead fully embraced market-based Credit and speculative finance as a powerful mechanism they could manipulate to stimulate markets and economies. What began with the Federal Reserve took the world by storm. Even as the years passed and the global economy boomed, rates were kept near zero.

In rough terms, balance sheets at the Fed, ECB, BOJ and PBOC each inflated from about one to $5 Trillion. Then came 2019, where aggressive monetary stimulus “insurance” was administered in the face of wildly speculative global securities and derivatives markets. The global Bubble inflated to unimaginable extremes, with fragilities turning only more acute. It is difficult to imagine a more inopportune circumstance for a global pandemic.

I point to the June 2007 collapse of two Bear Stearns structured Credit mutual funds as the beginning of the end for the “mortgage finance Bubble.” But it was the $1 Trillion of subprime CDOs (collateralized debt obligations) in 2006 that sealed the fate for historic financial and economic dislocation. I believe the Fed’s “emergency” 50 bps rate cut in September 2007 – and resulting record stock prices that November – exacerbated underlying fragilities and ensured a more devastating crash.

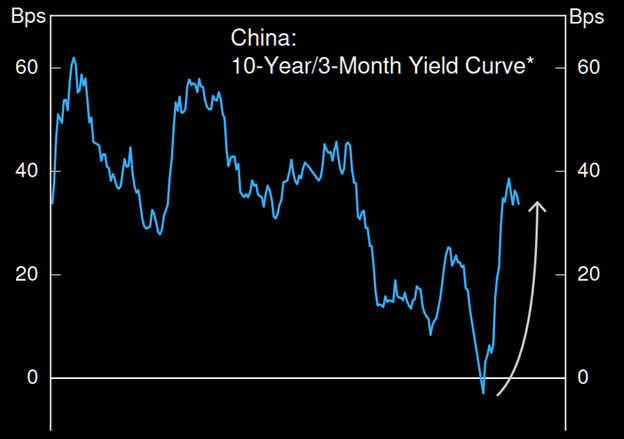

For the current global Bubble, 2018 was key. Fragilities were exposed, and policymakers attempted to sustain the unsustainable. China belatedly moved in 2018 to rein in egregious Credit excess, leading to faltering growth and heightened financial stress. The deteriorating backdrop hit U.S. markets in 2018’s fourth quarter – and Chairman Powell instigated his dramatic policy “U-turn” on January 4, 2019. Policymakers around the globe followed with aggressive stimulus measures.

Importantly, with its economy faltering, banking system and money market instability escalating, and U.S. trade negotiations struggling, Beijing reversed course and again promoted aggressive fiscal and monetary stimulus. Money market instability hit U.S. shores in September, whereby the Fed restarted QE and rapidly expanded its balance sheet $400 billion. In the end, it was a fateful year of record Chinese and global Credit expansion, record U.S. money supply growth, all-time high stock prices, all-time low sovereign yields, and the thinnest Credit market risk premiums since before the crisis. It was euphoria and near complete disregard for mounting risks.

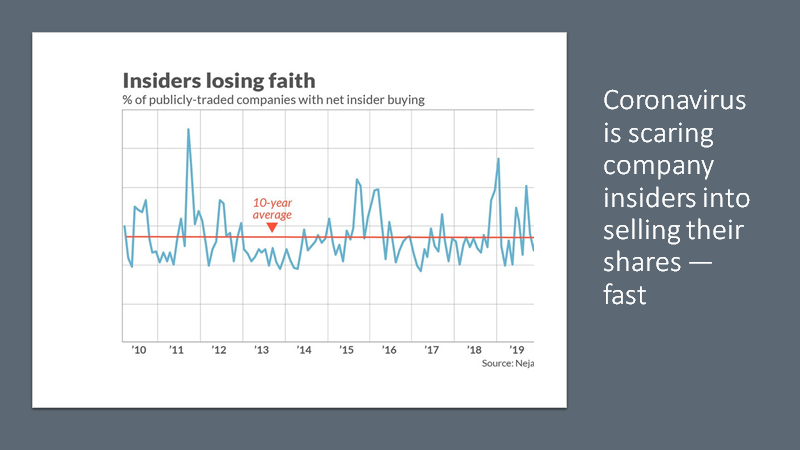

As far as I’m concerned, the evidence is indisputable: We have been witnesses to history’s greatest – and most precarious – globalized Bubble. If traders want to play for “oversold” bounces and the inevitability of more QE, it’s their money. But Bubbles invariably burst – and there is now a clear and present catalyst. The world is at the cusp of momentous change. Everyone has tried to remain convinced that risk can be ignored, with central bankers having everything under control. Yet the scope of global financial excess, myriad imbalances and structural impairment now dwarfs the capacity of central bankers to sustain market confidence, speculative excess and economic growth.

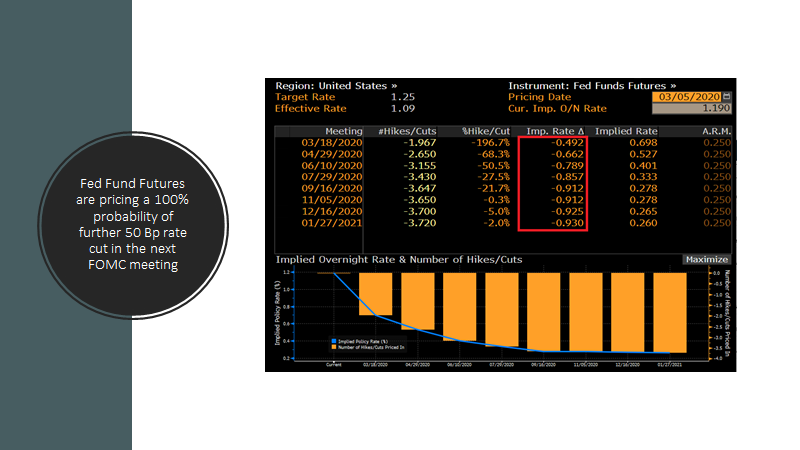

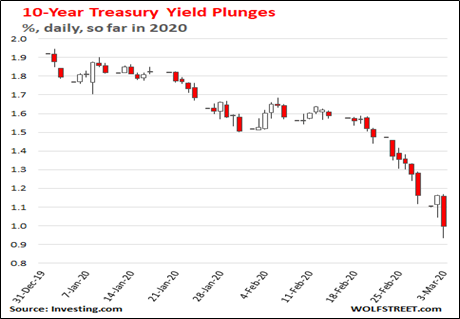

The Fed Tuesday orchestrated an emergency 50 bps rate cut and the S&P500 sank 2.8%. At this point, rate cuts are not going to cut it. The Fed’s current QE program calls for $60 billion monthly liquidity injections at least through the end of the first half. In the grand scheme of things, it’s a drop in the bucket. If not sooner, I expect the Fed to significantly increase the scope of liquidity operations. Expect more oversubscribed Federal Reserve overnight “repo” auctions, as deleveraging (paying down securities borrowings) destroys liquidity.

If the unfolding de-risking/deleveraging dynamic is as large and systemic as I anticipate, the Fed and global central bank balance sheets are about to commence another major expansion. Markets could very well rally on QE announcements. But akin to QE1 back during the crisis, the additional QE will not provide new marketplace liquidity as much as it will accommodate speculative de-leveraging (holdings shifting from the speculators to central bank balance sheets).

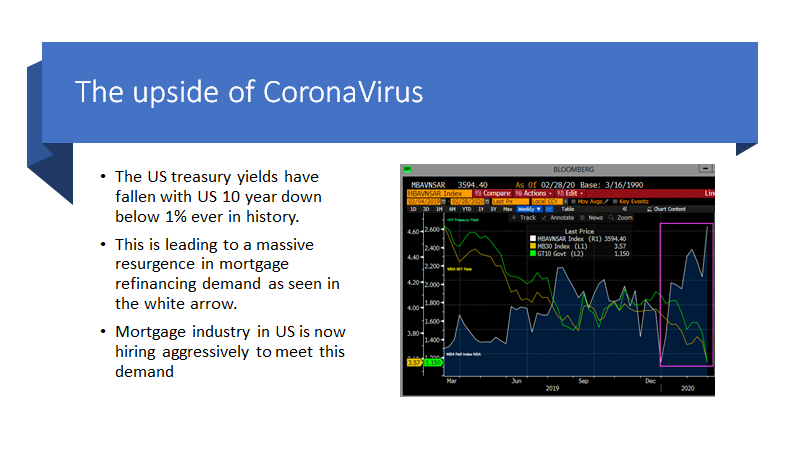

Ten-year Treasury yields collapsed 39 bps this week (15 bps on Friday!) to an unprecedented 0.76%, with a two-week drop of 71 bps. Two-year yields were down 40 bps this week (to 0.51%) and 85 bps over two weeks. This stunning move corroborates the analysis: A faltering historic Bubble will leave the Federal Reserve (and global central bankers) with no alternative other than employing massive and ongoing QE.

For those assuming this is equities bullish, I would offer some caveats. The Fed will be initially hesitant to open the flood gates, one reason being fear of spooking the markets. I could see the FOMC boosting their QE operations to $100 billion monthly at their meeting on the 18th. If, as I suspect, this operation has minimal impact on overall marketplace liquidity, markets will really begin to fret central bank impotence. And I’ll assume the Fed is pressed at some point to raise monthly QE operations to, say, $200 billion. Surly that’s equities positive, most would assume. But even such massive buying will before long be largely matched by ballooning fiscal deficits (and Treasury issuance).

Ominously, the dollar index dropped 2.2% this week, while gold surged 5.6% to $1,674. I recall how the late-nineties “king dollar” morphed into a faltering dollar Bubble. With such global instability, it has been rational for the leveraged speculating community to position for a stronger dollar. And all the speculative flows into U.S. securities markets easily outweighed never-ending U.S. fiscal and Current Account Deficits. Prospects are murky. Fiscal deficits at about 5% of GDP are about to balloon larger. Yield differentials are disappearing before our eyes. And the Fed is about to unleash QE it will have a difficult time controlling. Moreover, the interplay between the coronavirus and politics has the potential to make for remarkably unpredictable November elections.

March 6 – ABC7 News (Julian Glover): “A Santa Clara couple on the Grand Princess Cruise ship to Mexico with a coronavirus-positive man is ill and now getting tested for COVID-19. Leanne and Robert Cummins of Santa Clara were on board the Grand Princess Cruise ship to Mexico that departed on Feb. 11. A man on board that ship was infected with coronavirus and later died… After being notified of the man’s death by the cruise line, Mrs. Leanne Cummins said they started looking to be tested for the virus – especially since they are filling ill… Cummins said her husband has been very ill in recent days with no appetite, trouble breathing, and a fever at one point as high as 103 degrees. …They have been self-quarantining at their Santa Clara home. Mrs. Cummins also said at one point she felt weak and fainted. On Wednesday Cummins said she called the Sutter Health Urgent Care facility in Mountain View looking to be tested for the virus. She was told to go to the emergency room at her local hospital. She reached out to the emergency room at El Camino Hospital in Mountain View which then told her to call her doctor. She said her doctor then told her to go to Santa Clara Valley Medical Center to get tested. She said she called Valley Medical Center and was told that the hospital did not have any test kits and would not be conducting any testing… She was told to call the CDC. On Thursday, Mrs. Cummins said she did exactly that and a CDC representative told her to call the California Department of Public Health. She did and was told to call the Santa Clara County Health Department. She made that call and reached an answering machine. ABC7 News has also tried several times to speak to a public information officer at Santa Clara County Health Department in reference to where someone concerned about exposure to the virus should go for testing and was unsuccessful. After numerous calls a non-public health employee who was assigned to answer phones told ABC7 News that Mrs. Cummins should call her primary care physician back and have the doctor call the public health provider intake line. Again, still no answer as to where the couple should go to get tested.”

Almost 700 passengers and employees of the Diamond Princess were infected with the coronavirus. Now there’s the Grand Princess moored off the coast of San Francisco with 3,500 passengers (21 of 46 tested positive Friday). How many of last week’s departing passengers were infected (at least one death) – and where are they and where have they been? Having learned from the terrible experience in Japan, all passengers are to be tested. But don’t those passengers need to be removed from that ship as quickly as possible?

It’s stunning. Coronavirus cases are up to 6,800 in South Korea, 4,800 in Iran, 4,600 in Italy, 670 in Germany, 650 in France, 420 in Japan, 400 in Spain and 330 in the U.S. The pandemic is here. Now it is only a matter of the scope of the unfolding disaster.

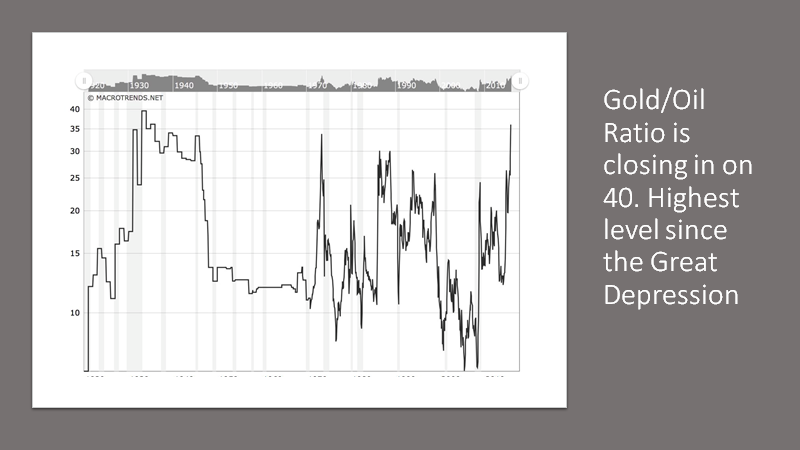

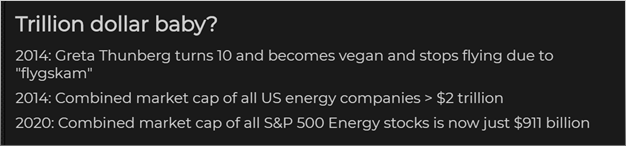

The outbreak appears to have somewhat stabilized in China, and the Chinese economy is trying to get back to work. I have serious doubts that China’s Bubble economy can be so easily reflated. As an indicator of global economic prospects, crude oil (WTI) sank 7.8% (“worst drop since 2008”) this week to $41.28.

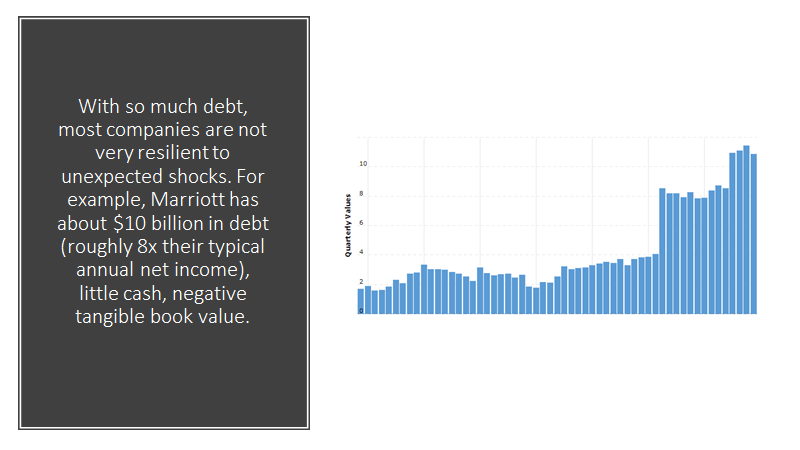

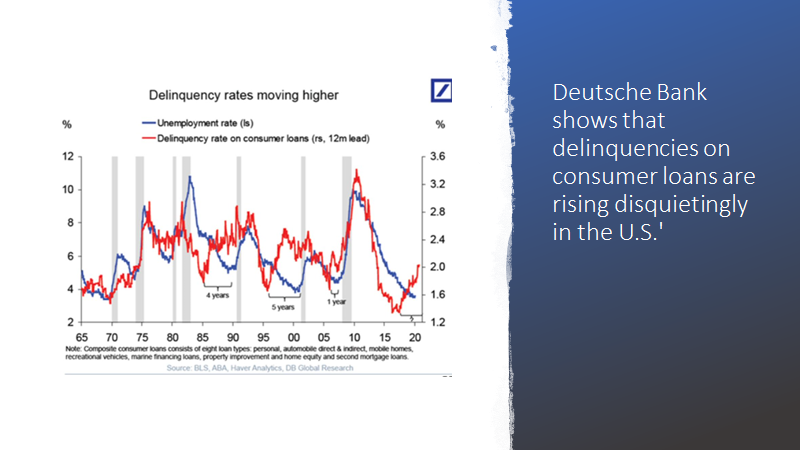

With the energy sector under pressure, U.S. high-yield Credit default swap prices surged 73 bps this week. After trading near multi-year lows at 280 bps on February 12th, high-yield CDS closed today at 443 bps – the high since (Powell U-turn) January 4th, 2019. Investment-grade CDS jumped 17 bps this week to a 14-month high 83 bps. The big financial institutions saw their CDS prices surge. Goldman Sachs CDS jumped 20 this week to 91 bps (14-month high). JPMorgan CDS rose seven to 60 bps (14-month high). Financial conditions are tightening dramatically.

The torrential rain has begun, and all those that have been making such easy money selling flood insurance have begun to panic. And I don’t think the prospect for zero rates and massive QE is about to instill calm and confidence. Indeed, the entire notion of open-ended QE and fiscal deficits creates acute market uncertainty. How does this melt-up in Treasury prices impact “carry trade” speculation in corporate Credit? Could dollar prospects (and currency market stability) be murkier in such a policy backdrop? How does such uncertainty play for global leveraged speculation? It is difficult to envisage a scenario where myriad global risks (i.e. coronavirus, financial, economic, policy, geopolitical) don’t incite a momentous de-risking/deleveraging dynamic. The odds of the dreadful global “seizing up” scenario are rising. The Modern-Day Bank Run.

http://creditbubblebulletin.blogspot.com/2020/03/market-commentary-modern-day-bank-run.html