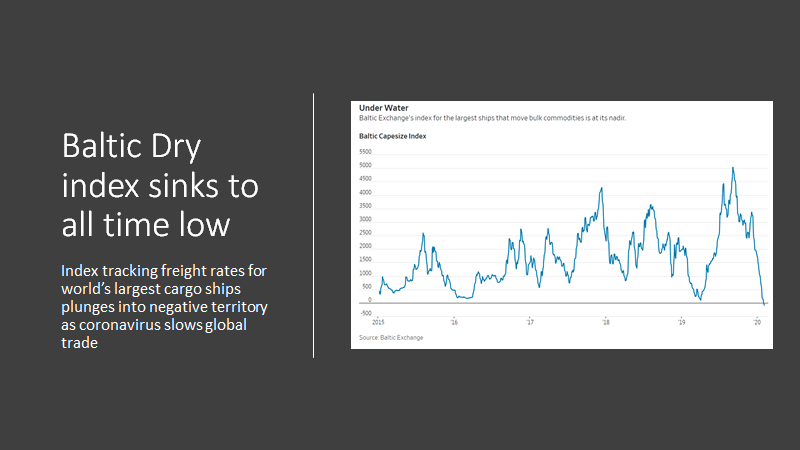

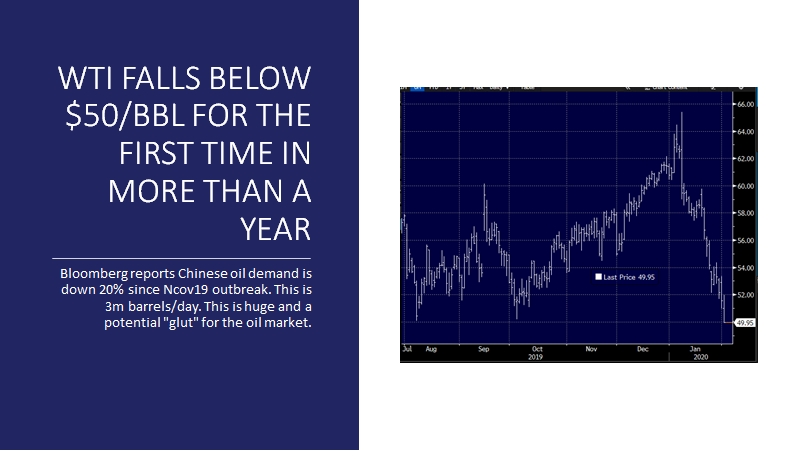

Japan’s economic performance plummeted at the end of 2019, and a recession seems inevitable. The downturn in the land of the rising sun is a bad omen for the global economy. Nevertheless, the entire coronavirus scare has resulted in a sharp collapse in many areas globally that depend on tourism. We are seeing sharp declines in South East Asia, Hong Kong, and even in Dubai. We should expect that the first quarter numbers for many areas around the world will show recessionary trends. This is only further pushing the dollar higher as capital continues to flee from Asia, in particular, as well as Europe and heads into the dollar.

Inside Incrementum: The 2020ies – The Decade of Crypto, Gold, Commodities and MMT?

by Ronald-Peter Stoeferle & Mark J. Valek

This quarter’s advisory board call was different than usual. Instead of having our usual advisory board members and one special guest, we invited all five partners from Incrementum to discuss their background, their investment style and best investment ideas for 2020 and the new decade.

During the call we talked about:

- Are markets finally losing faith in central banks?

- Is the gold bull market just about to start?

- Is 2020 the year of MMT?

- Which commodity markets are undervalued?

- What are the risks of inflation and stagflation in 2020?

- What are the biggest long-term (multi-decade) risks?

Read the PDF of the Advisory Board Transcript here.

Alternatively, you can also download the audio-file of our conversation.

what’s behind the breakout in GOLD

By Bryce Coward, CFA in Economy, Markets

This week’s breakout in gold is an epic expression of our times in which potential economic problems are quickly followed by massive actual and expected responses by central banks and governments. The problem de jour (for both markets and the public) is of course the real and scary health and economic consequences of a further spread COVID-19. So far, gold has been a beneficiary of the market’s response to the slowing growth prospects brought by the virus. We’ll explain why below.

But before we get to that, it may be useful to take a step back and examine how the gold price has evolved both in nominal terms and relative to stocks. As we can see in the chart below, it doesn’t take a master technical chartist to see that the price of gold stopped going down in 2015, went sideways from 2015-2019 and then “broke out” of two major resistance levels. The first such resistance level was $1300/oz, which was broken back in the middle of 2019. The second one was $1600/oz, which was broken this week.

In this second chart, we see that the S&P 500 has slowly started to underperform the barbaric relic beginning in late-2018 despite the S&P 500 having risen by 15% over that time frame.

read the entire post by clicking below

why are some of the greatest Entrepreneurs & Presidents school drop outs

Martin armstrong writes in his blog

It is absolute nonsense that degrees mean anything anymore. Schools cannot teach creativity. It takes imagination to become successful. That is not something schools can teach. Sidney Weinberg of Goldman Sachs, who indeed was known as Mr. Wall Street, started as an assistant to a janitor. He dropped out of school at 13. Richard Branson is now Sir Richard Branson and he dropped out at 16. Charles Culpeper also dropped out of high school and founded Coca Cola. Then there was Walt Disney who dropped out of high school at 16. The list of the top 20 will surprise many.

How about politicians? Did you know that President Abraham Lincoln who is on the $5 bill had only about a year of formal schooling of any kind! President Andrew Johnson never went to school at all. The list of people who became President of the United States and dropped out of college or never went to school includes:

- George Washington

- James Monroe

- Andrew Jackson

- Martin Van Buren

- William Henry Harrison

- Zachary Taylor

- Millard Fillmore

- Abraham Lincoln

- Andrew Johnson

- Grover Cleveland

- William McKinley

- Harry S. Truman

To a large extent, you either have the talent for your field or you do not. Elon Musk recently said he does not require employees to hold degrees. “There’s no need even to have a college degree at all or even high school,” Musk stated. The same is true with Google and Apple as well as 12 other top companies that no longer require college degrees. Neither does our firm. If you have the talent, you are hired. That reflects deeply upon student loans. Is the entire education system based upon fraudulent claims that you need a diploma to get a job?

The YEN decline is different

I have always considered DLR/YEN as the most important currency pair in the world because of its correlation with risk ON/risk OFF moves in asset markets. ALAS this correlation stopped working today.

Macro tourist explains the reason in his must read commentary about why it happened and what are the implications

https://www.themacrotourist.com/this-yen-decline-is-different/

Brave New World-15th Feb

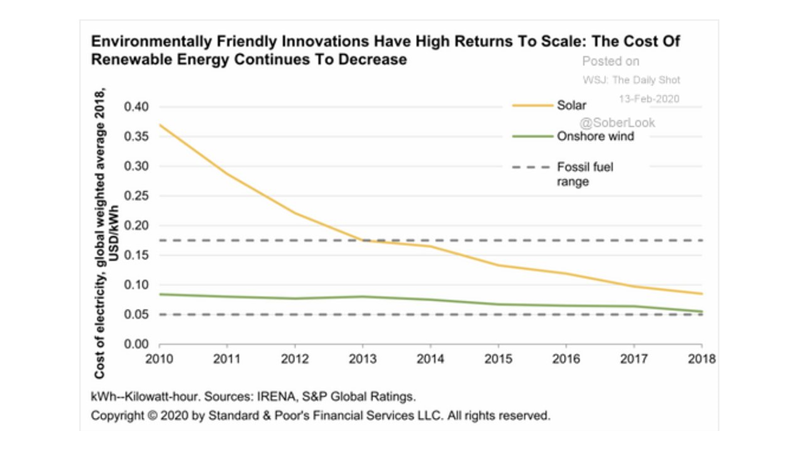

The coming Green Bubble

Macro Tourist write …

Although I was aware of the trend towards E.S.G investing, I didn’t understand the true magnitude of it until the recent action in Tesla. Lots of people tell me that Tesla went up on its own and that E.S.G. investing had nothing to do with the wonderful investment opportunity offered by this preeminent alternative energy/car company. Yeah, ok…

Read More

Brave New world- 9th Feb

Global Markets Commentary and Outlook

6th Feb 2020

“Everything which might cause doubt about the wisdom of the government or create discontent will be kept from the people. The basis of unfavorable comparisons with elsewhere, the knowledge of possible alternatives to the course actually taken, information which might suggest failure on the part of the government to live up to its promises or to take advantage of opportunities to improve conditions–all will be suppressed. There is consequently no field where the systematic control of information will not be practiced, and uniformity of views not enforced.”

Friedrich August von Hayek, The Road to Serfdom.

These words not only describe the state of society, but also our markets where everybody is playing a game of musical chairs.

Repo crisis, Coronavirus, Fake news, desperation in governments around the world, that’s why it is important to heed the advice of Martin Armstrong.

Just like me, I am sure, you would also get an uncomfortable feeling when you read these lines from his blog.

On the last day of the month of January, US 10 year treasuries closed at 1.5% and 30 year at a six months low of 2%.

Russell Napier has been massively bullish US treasuries for a long time and see’s a deflationary shock coming.

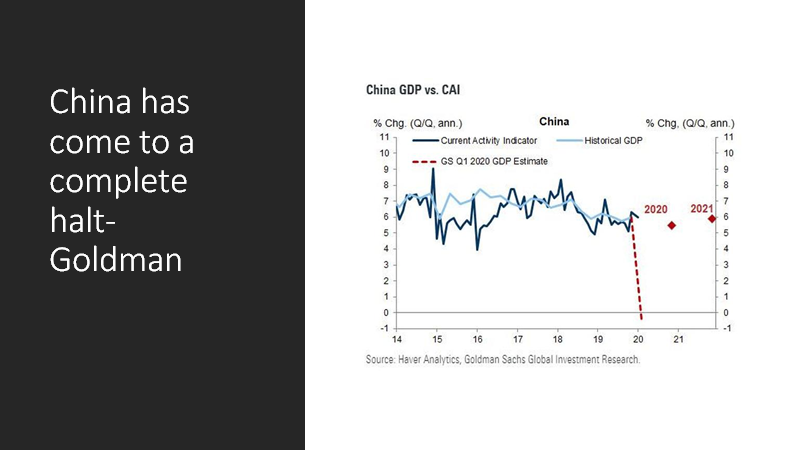

And speaking of China, I realize that the baby of 2003 is a WWF wrestler on Global stage.

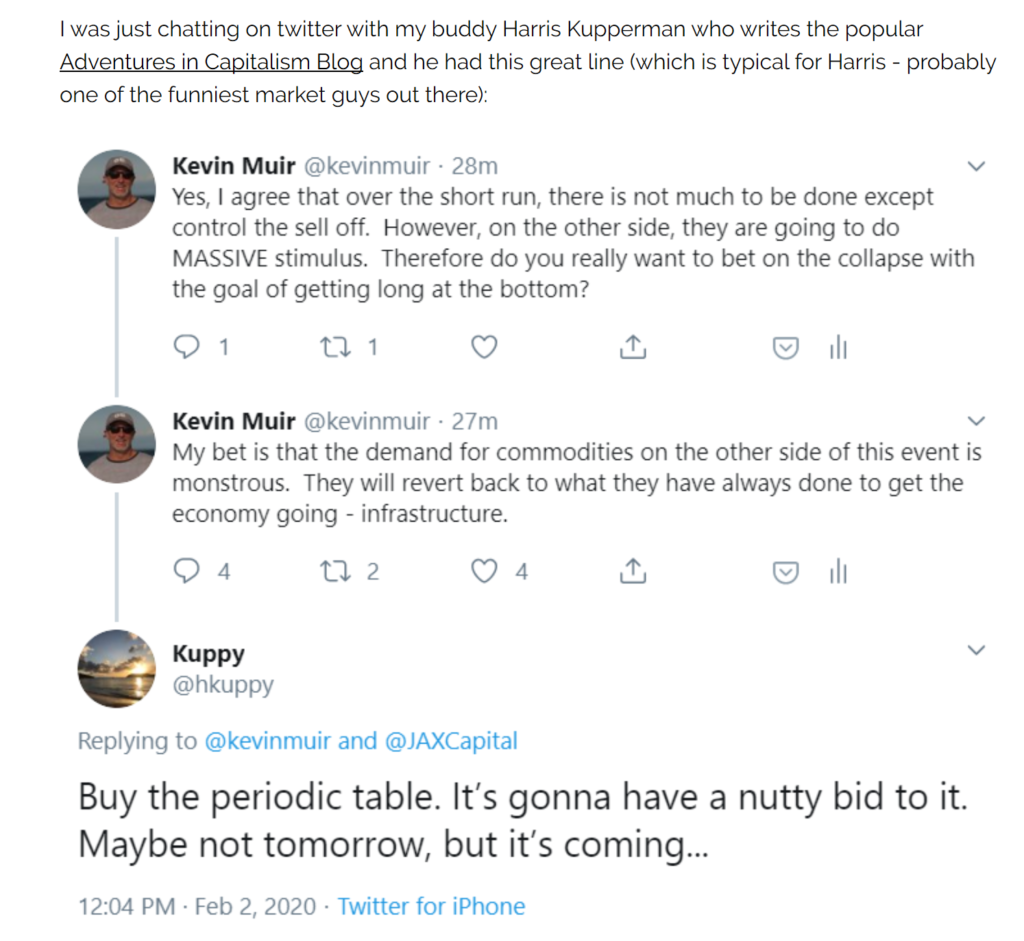

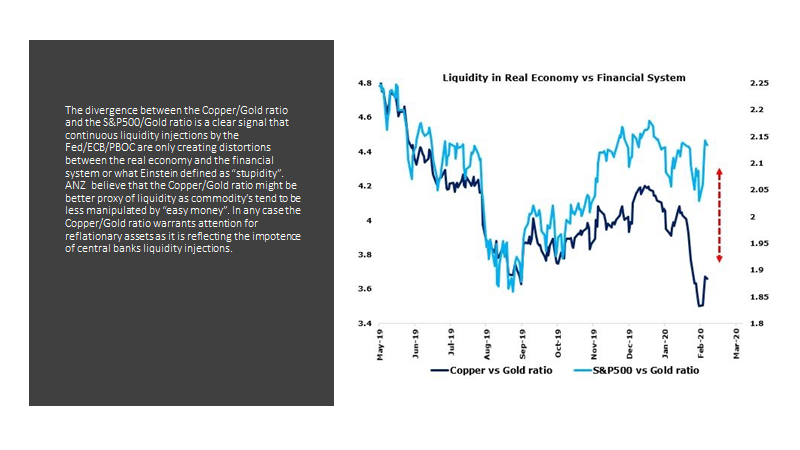

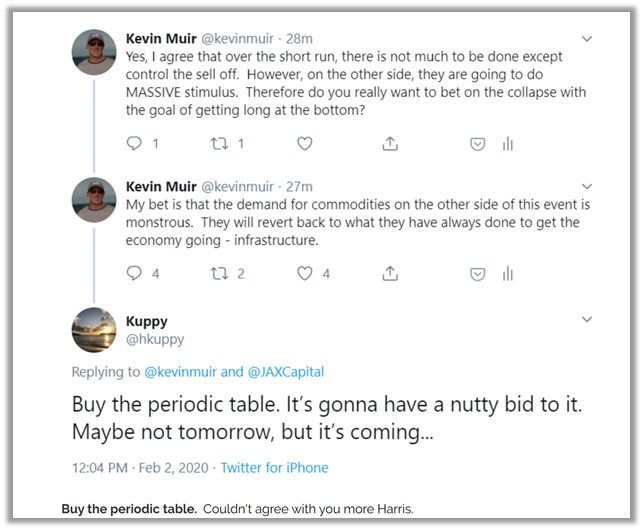

Kevin Muir believes that China will just throw kitchen sink in the aftermath of Coronavirus. That’s already evident with addition of more than 1 trillion Yuan in banking liquidity in first two days of February.

Coronavirus… Buy the periodic table

Macro Tourist further writes in his blog

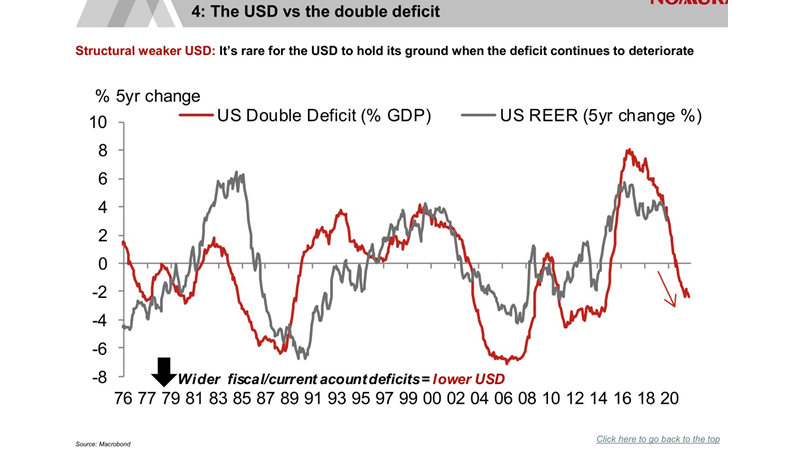

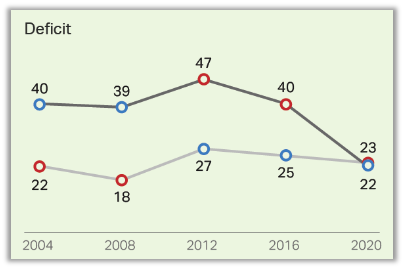

The best one comes from Luke Gromen who predicted the Repo crisis. He is used to connecting the dots and believes that US deficits are getting bigger and market is finding it difficult to absorb the supply. But who cares about the deficit?

As per a survey done by Gallup nobody ( Democrats or Republicans) gives a DAMN about deficits.

Foreign Central Bankers have already stopped buying US treasuries; hence Fed will have to step in to fund this deficit. This will also stop US dollar from rallying further. The result

Market outlook

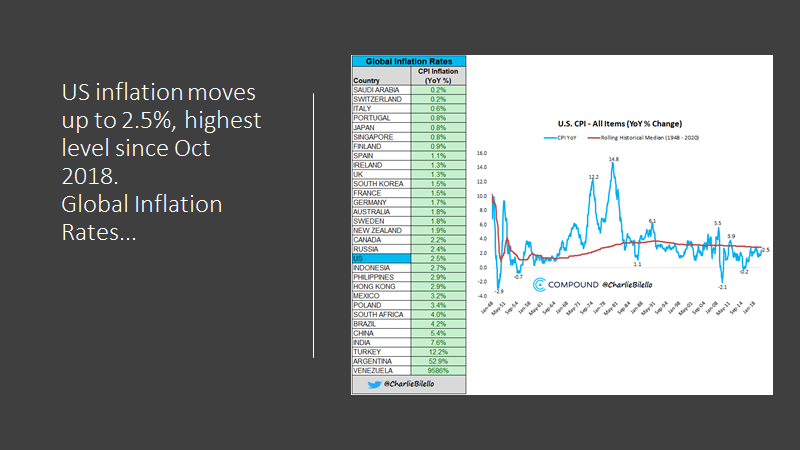

By now, you must be all confused. I have scared everybody with a deflationary collapse, a banking crisis in China and Europe, buying periodic table and if that were not enough then sharing a 50000 Dow call and $5000 Gold call. I think we will see a combination of all these events, maybe not to such an extent but close enough. When China can make its stock markets go up in the face of a deadly epidemic by pumping enormous amount of liquidity and by suspending short selling, President Trump tweeting every new US stock market high, Tesla getting a major stock price target of $15,000 by ARK valuation model, Indian Central Bank announcing $15 billion LTRO, Fed Vice Chairman talking about capping the bond yields in next recession, ECB talking about funding climate change through its balance sheet, Bob Prince Co-CEO of Bridgewater declaring that we have seen the end of Boom Bust Cycles…… Honestly anything is possible and no target is unachievable. Patience is virtue and flexibility in your views should be the approach.

Regards

Ritesh Jain

Worldoutofwhack.com