Probably the best article on Indian Budget.

Making sense out of Chaos

Probably the best article on Indian Budget.

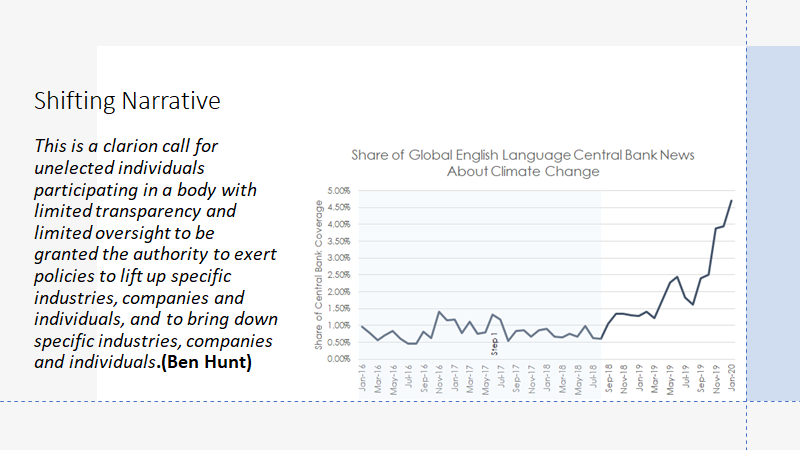

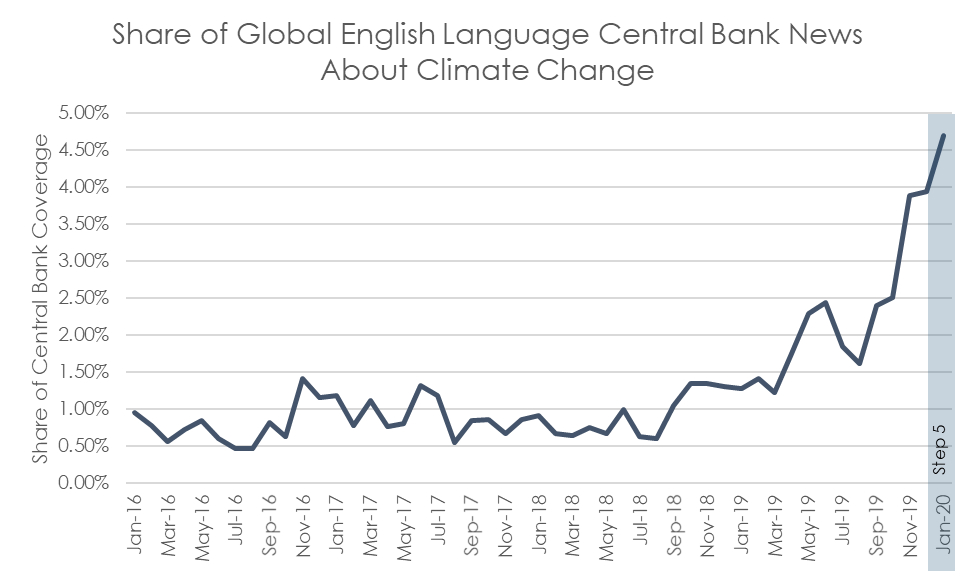

Ben hunt writes a brilliant post on shifting narrative which will have huge investment implications.A New Road to Serfdom

The best part was the following graph

This is a clarion call for unelected individuals participating in a body with limited transparency and limited oversight to be granted the authority to exert policies to lift up specific industries, companies and individuals, and to bring down specific industries, companies and individuals.

This is simply a brilliant interview of Russell Napier with Macrovoices.

Erik: Russell, you are best known as a financial historian, and I want to tap into that knowledge for my final question. Because some of the things that you’ve predicted in this interview, particularly the stage being set for the European Union in particular, but also other developed economies, to seriously consider capital controls because a lot of the macro drivers that you’re describing could potentially encourage large institutions to want to move a lot of their assets out of European markets into US markets. And that creates a self-reinforcing vicious cycle of dollar appreciation and so forth. So there’s good reason to think that capital controls might be in the future. Meanwhile, you just told us that you see that we’re now in the formative stages of a new cold war with China. Certainly in the last cold war, that resulted in the imposition of a lot of rules that would otherwise not have existed, that control who is allowed to invest where in the world. So how different might the financial landscape be in the future than what we’re used to as we get into this new regime where the European Union needs to be worried about these things and we have a cold war developing?

Russell: We do have a historical parallel which is 1945 to let’s say 1980 and probably up to 1989. Realistically, when we talk about the end of the cold war and also liberalization of capital controls in Europe. And kept them much longer than anywhere else. So I think we can all go back and look at that period in history as a sort of guide to what to do and how to invest and where to make money. Maybe I can just leave you with one idea of what some of the real winners of that period of history in equities, were companies with very large fixed assets. And those companies were beneficiaries of higher inflation when interest rates turned low. They were the beneficiaries of that as long as they didn’t have to reinvest a huge amount of the cash flow back into the fixed assets. Those weren’t sustainable fixed assets without high reinvestment. Those are asset-heavy companies. We’ve just had a 40-year bull market in asset-light companies. So it couldn’t be more profound, this turnaround. Not just in the reordering of the terms in financial asset prices. But even within the equity market. The winners and the losers are likely to be very different in this new world. And I think anybody listening to this will begin to realize that this raises many more questions than answers because it is such a profound change in what we’ve known, really, since the late 1970s. So, unfortunately for most of us, it’s back to the future.

full interview below

Welcome to Atlas Shrugged- Martin Armstrong writes in his blog

Australia has been perhaps the most aggressive tax authority in the world. They are certainly competing to be #1. Besides stalking children to see where they go to school, and then demanded the school reveal how the parents pay the tuition, now they are going after insurance companies demanding to know what assets people are insuring.

The Australian Taxation Office’s new scheme is hunting money and assets to seize and tax. They are demanding the last five years’ worth of insurance policy information from more than 30 insurance companies. They are searching for “lifestyle assets” of the rich who they clearly hate with a passion. They are demanding details on clients who own yachts, any boats, fine art, thoroughbred horses, high-value cars and aircraft. They have targeted around 350,000 taxpayers.

This is the world we live in — “1984” has just been late to arrive. It makes you really understand the entire principle behind Atlas Shrugged.

According to a report in Reuters

India is likely to fund roughly $28 billion of its expenditure outlay in its budget for fiscal 2020/21 via off-budget borrowings, three government sources said, as it seeks to revive a sagging economy while keeping its fiscal deficit in check.

Prime Minister Narendra Modi’s government is under pressure to increase spending on rural welfare schemes and infrastructure to boost growth that has fallen for six straight quarters.

Off-budget borrowings are a means by which the government keeps its fiscal deficit in check by making quasi-government entities borrow on its behalf, to partly fund its expenditure plan for the year.This would mark a roughly 13.8% increase in so-called off-budget borrowings from an estimated 1.75 trillion rupees ($24.6 billion) in the ongoing fiscal year, said the three sources, who have direct knowledge of the matter and asked not to be identified as the discussions are private.

“We’re facing a serious economic crisis,” said one of the sources, adding there was no alternative but to raise spending on infrastructure and welfare schemes to boost consumer demand and create jobs.

“You should not be surprised if the real deficit touches 4.5% of GDP,” he said, adding the “official” deficit could be kept between 3.5% and 4% of GDP.

He said the government had realised it needed to take all possible steps to support growth “after initial denial of the economic slowdown”.

A spokesman for the finance ministry declined to comment, citing the silent period ahead of the budget speech on Feb. 1.

The International Monetary Fund (IMF) this month cut India’s growth forecast to 4.8% for the ongoing fiscal year – its lowest level in 11 years.

Finance Minister Nirmala Sitharaman, who will deliver the budget speech, is widely expected to announce stimulus measures for small businesses and non-banking finance companies as a cut in corporate tax rates and rate cuts by the central bank have failed to revive growth.

The fiscal deficit for the current fiscal year was likely to touch 3.7% or 3.8% of GDP after the slowdown dented revenue collections, the second government official said.

In the 2020/21 budget, Sitharaman could announce plans to spend over 105 trillion rupees ($1.48 trillion) on infrastructure in the next five years and expand annual spending on railways, roads, renewable energy, water and health sector by up to 20%, said the first official.

“Inflation is not an issue for now,” he said, adding that India needed 5-6% inflation to improve agricultural and corporate earnings.

The government could increase the target of raising revenue through privatisation of state companies to 1.5 trillion rupees for next fiscal year, the second official said.

India’s committed spending, excluding capital spending, could be targeted at near 27 trillion rupees ($379.91 billion) for the next fiscal year, compared to the budgeted 24.5 trillion rupees in the current fiscal year, while about 4 trillion rupees could be allocated to capital spending, the first official said.

Modi’s party has also urged him to announce steps to revive real estate and other sectors.

“We are no more in a denial mode,” Gopal Krishan Agarwal, the head of BJP’s Economic Affairs Cell, told Reuters. “You will see measures in the budget to boost investments and growth.”

Indian Central Bank has also notified an increased limit of INR 150,000 for investment by Foreign Portfolio investors.

My two cents

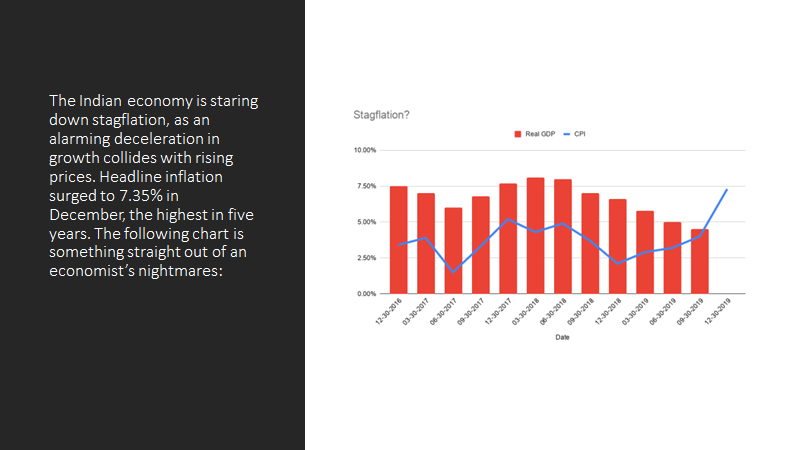

The Indian financial system does not have enough savings to fund Govt’s on and OFF balance sheet deficit without a spike in rates hence more limits are getting opened for Foreign money to fund wasteful expenditure. India is seeing some really worrying ‘MACROS” and this is not the right time to open financial system for short term carry money looking to reach out for the yield.

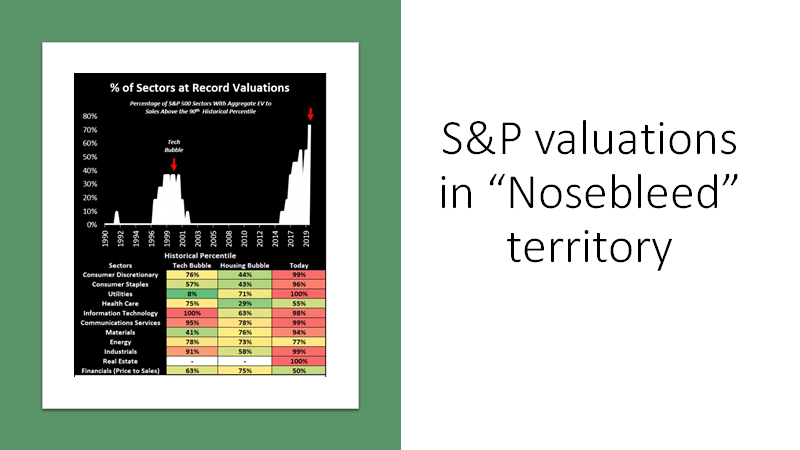

Paul Tudor Jones, founder of Tudor Investment Corp and the man who famously predicted the 1987 ‘Black Monday’ stock market crash, recently spoke with CNBC about the ‘crazy’ mix of monetary and fiscal stimulus that reminds him of “early 1999” and the height of the Dot-Com bubble.