by Ben Hunt

Louis Vincent Gave on Markets

Louis Gave of GAVEKAL gave a must read interview to the markets

https://themarket.ch/interview/gave-the-bond-market-is-the-biggest-bubble-of-our-lifetime-ld.945

The New Consumer-KKR

KKR released a new KKR Viewpoints publication authored by Paula Campbell Roberts . In The New Consumer , Roberts explores the recent emergence of the “Asset Light Consumer” – with respect to the consumer balance sheet and consumer purchases – and its impact on the broader investment landscape.

Paula concludes….The rentership and sharing economy proliferated post the financial crisis in the absence of traditionally secure jobs or strong income growth opportunities. However, despite the improvement in the employment and income picture, renting and sharing remain prevalent. For one, the absence of savings for many renters limits their ability to afford the down payment on a house or car. Second, structural constraints such as high levels of student debt or mortgage lending standards continue to pose challenges for ownership. Third, the flexibility and convenience offered by sharing economy models remain attractive to consumers. Consumers enjoy the benefits of access without the responsibilities of direct ownership. Consequently, while we expect ownership rates to improve, the sharing and rentership models that have penetrated many sectors including housing, autos and apparel, are likely to proliferate.

That said, the displacement of traditional secure jobs and the creation of more part-time work first catalyzed by the Financial Crisis, and later sustained and supported by the sharing economy, poses challenges to the business model. The advent of technology platforms that could efficiently match asset owners and service providers to users has made gig work viable. As more workers rely on multiple gigs for their long-term employment needs, the models of work and the relationship between labor, government and companies will need to continue to evolve. In the short term, gig economy workers and asset light consumers need to save more. In the long term, governments and companies may need to provide benefits and security that holding assets had traditionally offered.

Further, the decline in homeownership will likely translate into a loss of a wealth creation opportunity for a large segment of the population. Historically, homeownership has been an important determinant of the long-run well-being of families and individuals, enabling investments in education and businesses, providing economic security in times of lost jobs or poor health, and a means of wealth transfer to children.20

For investors, we suggest a focus on four primary areas:

- Lower rates of homeownership will likely lead to continued delays in asset purchases in the short term, followed by a slower rate of consumption growth in the medium to long term. As spending continues to outpace income growth, this renting and sharing consumer will continue to lack the savings to make asset purchases. Further, as Millennials enter their forties and healthcare burdens rise, savings will likely increase at the expense of consumption. In conjunction with the impact of demographics, this longer-term shift in consumption may lead to even slower growth in spending on goods, as well as some softness in discretionary services spending in favor of increased spending on healthcare as well as contributions to savings.

- Sharing and rentership models are likely here to stay, and will continue to disrupt traditional business models given the benefits they provide to consumers as well as workers.

- Be cautious about investing in sharing economy models that do not directly address the evolving needs of workers. We are in the middle of the Fourth Industrial Revolution, the digital revolution, which has resulted in a redefinition of work. The transition will likely continue to disrupt industries and investors should take heed.

- As the large consumer sector is diverse, be sure to disaggregate macro trends to understand how different cohorts behave. If business success relies upon demand fueled by renters, the business model may face more challenges than anticipated in a downturn.

- Finally, the impact of the new asset light consumer and the transition to a services economy may have contributed to slower growth in capex. New sharing economy business models for example rely less on traditional equipment. Instead, software and servers fuel the digital services economy. Increased sharing economy penetration creates less demand for the same quantity of assets e.g., autos, resulting in slowing growth in capex.

In GOLD we trust Chart book

Executive Summary of the In Gold We Trust Chart book

1. Eroding Trust in Monetary Policy and the International Monetary System • As we have forecasted, due to growing recession risks, central banks are about to conduct a big “monetary U-turn”: Expect more QE, lower rates and MMT-style policies like “QE for the people”.

• The erosion of trust in many areas plays into gold’s hands. An end to these crises of trust is not in sight.

• The steady buying of gold and the repatriation of central bank gold indicates rising mutual distrust among central banks.

2. Status Quo of Gold

• 2019 ytd, gold is up in every major currency.

• In many currencies (EUR, AUD, CAD) gold trades at or close to new all-time highs!

3. Gold Mining Stocks

• Mining stocks are in the beginning of a new bull market. Creative destruction has taken place, and leverage on a rising gold price is higher than ever.

• Gold & silver mining stocks are still one of the most hated asset classes these days. The capitulation selling of the last couple of years now offers investors a very skewed risk/reward-profile.

4. Quo Vadis, Aurum?

• Gold has entered a new bull market cycle and might become a core asset for generalists again!

full chartbook in the link below

In Gold We Trust Chartbook 2019 – “Gold Shining Through the Darkening Recession Clouds”

Brave New World

Changing Investment Paradigm

Prerequisite Capital writes…A traditional investment management paradigm is just not going to cut it in a world wrestling with the consequences of over indebtedness and hyper-active policy makers – disorientated & fearful capital will be the norm rather than the exception, this means vastly different market behaviour than what we’ve experienced the last 50 years. Click Here

Taking a step back and looking at things from a ‘bigger picture’… it is worth noting that:

a) Policy makers around the world are hyper-sensitive to holding back a wave of default, impairment and unemployment; both in private and public sectors.

b) The underperforming stock of resource allocation is progressively causing a declining return on capital, capital is being impeded from moving from less productive to more necessary uses – poor stewardship is being sustained at the expense of good stewardship, the stock & production of useful goods and services is progressively deteriorating.

c) Because less useful goods & services are being propped up longer, gradually the useful goods & services become more strained in their production… Question: what happens when supply becomes marginally constrained but demand slowly escalates in the face of insufficiency? Answer: Price rises in the stuff that matters. This is compounded by regulatory convolutions (like the US health system) and prices accelerate whilst the quantity & quality of useful goods/services deteriorates. This confuses many participants, as they see evidence of ‘inflation’ amidst useful goods/services, but overall in the system we see broader disinflationary trends due to the effects of maintaining under-productive structures – this is in totality not an inflation issue but a falling living standard issue.

d) With market mechanisms being impeded (by policy makers and regulations) from remedying the insufficiencies of the system, political mechanisms increasingly will be resorted to.

e) The incumbent political and governing classes (& even their new recruits) are inclined to selfpreservation & advancement first and foremost, with all other stakeholders in society (& their differing needs) subservient to this.

f) Political machinations within a socialist/fascist societal paradigm tend towards the erosion of liberty, property rights, good stewardship, the flexible & productive allocation of resources (that enhance the sustainable production of useful goods & services required to underpin rising living standards). a. Different countries are at different points in this progression – which cause ‘sequencing’ issues that drive both capital & people flows.

g) If civil political processes are not able to effect successful remedies to the insufficiencies & imbalances, then probabilities escalate towards violent upheaval.

h) The political/governing class, sensing or foreseeing potential societal violent upheaval either preposition to harness this uprising and/or seek to refocus it upon external threats or scapegoats of circumstances – misdirecting clear thinking & focus upon themselves.

i) History is ‘rhyming’ again…

I would like to add what Joe weisenthal of bloomberg wrote this morning.

I think it is important that investors understand this paradigm shift and prepare accordingly.

CRESCAT CAPITAL quarterly investor letter Q3 2019

October 17, 2019

Dear Investors:

Outlook for US Stocks and the Economy

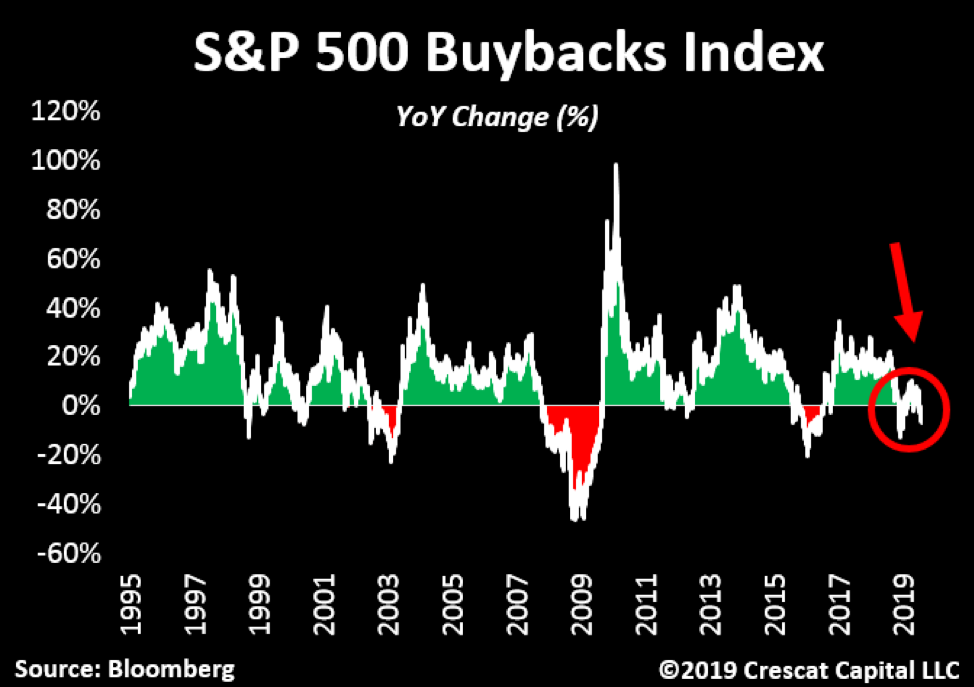

A breadth of deteriorating indicators is signaling an inflection point for the US stock market and economy. The percentage of inversions in the US yield curve surged to over 70% last month. This level of upside-down term premium has always led to severe bear markets and recessions in the past. Also, another major source of liquidity for stocks has just now started to fail. The S&P 500 Buybacks Index is now down on a year-over-year basis meaning that the companies with the most aggressive buybacks are no longer seeing an increase in their stock prices. Companies at large continue to repurchase shares, but the total level of buybacks is also off its record highs from a year ago.

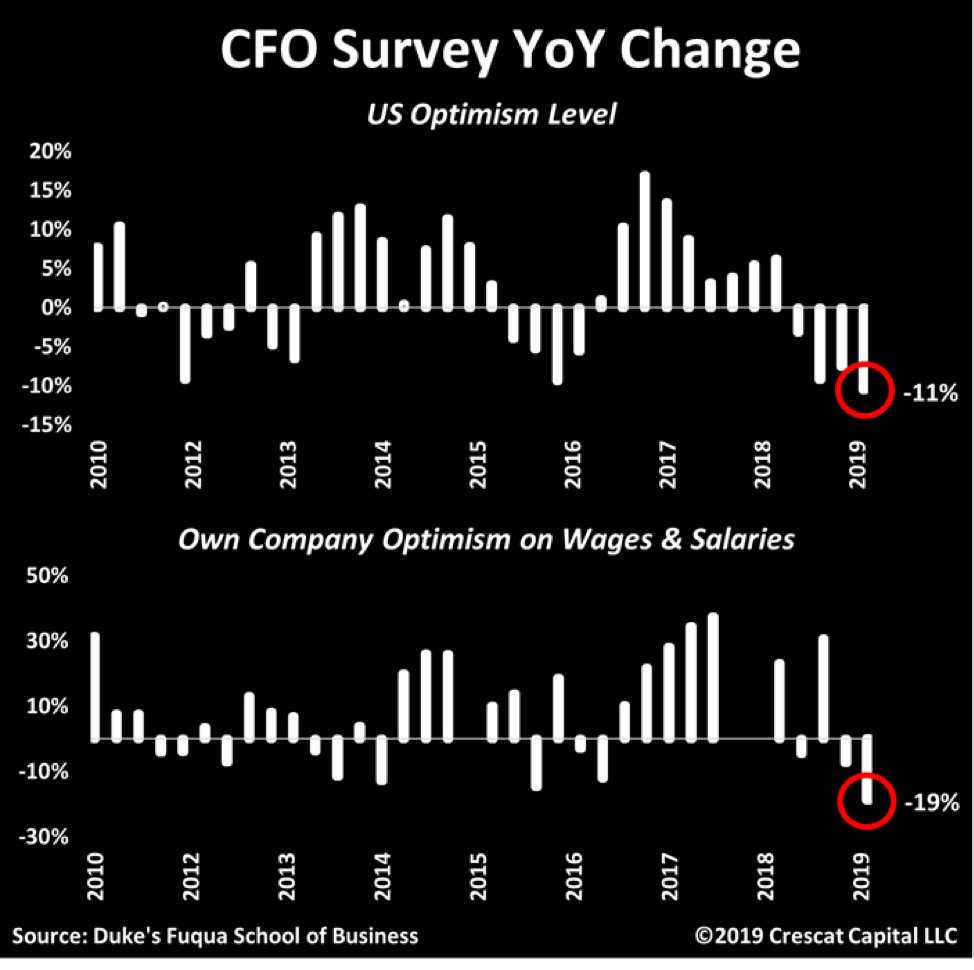

In the last several weeks, we have seen dismal economic indicators on multiple fronts: CEO confidence falling the most since the Global Financial Crisis, ISM figures plunging, and company insiders selling the most in two decades. Now the CFO survey is providing further evidence that the expansion is no longer alive and well. In the history of the survey, these sober-minded capital allocators have never shown a bigger decline in optimism. These are the men and women making corporate borrowing, spending, and hiring decisions.

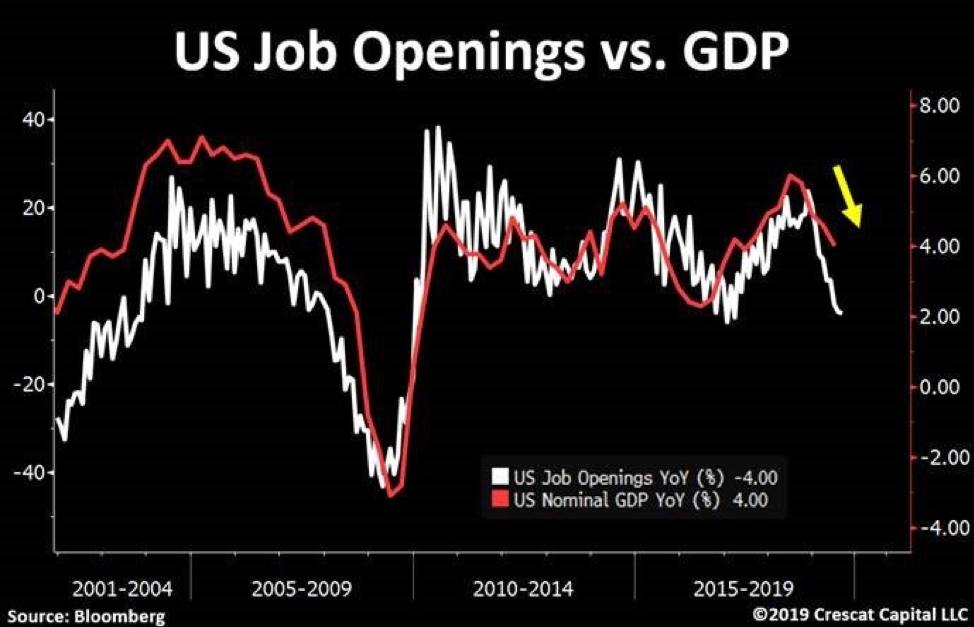

We have shown that US stocks have reached historic high levels across a composite of valuation measures. With earnings fundamentals and economic indicators faltering, a bear market and recession is almost certainly around the corner. Now, the labor market is also showing signs of weakness. Jobs openings just fell by 4% on a year over year basis. This leading indicator is strongly correlated with the overall business cycle and suggests a significant deceleration in nominal GDP in Q3 that would leave zero real growth for the quarter after inflation.

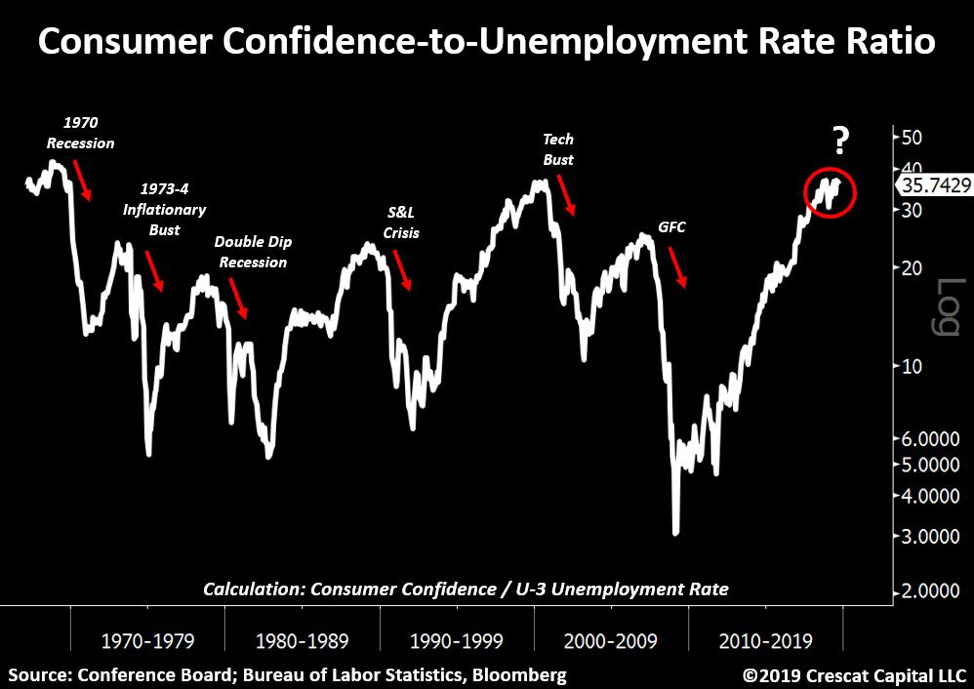

We continue to believe the economy is painted into a corner. A case in point is two reliable contrarian indicators that are now at an extreme. Consumer confidence is near all-time highs while unemployment rate is at a 50-year low. When you look at the ratio of these two measures, we are now re-testing the levels that preceded both the 1970 recession and the tech bust.

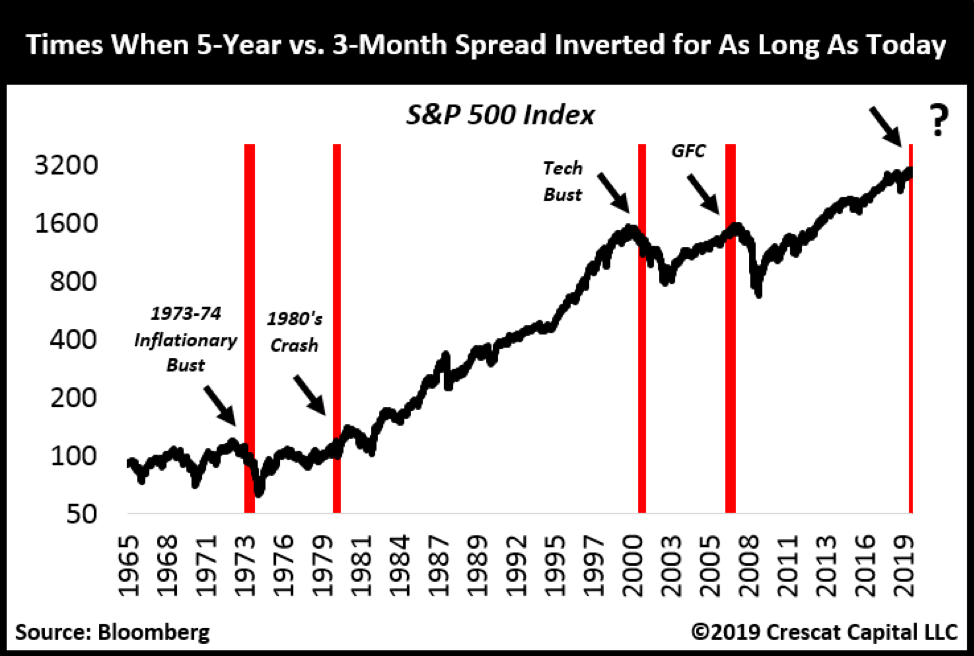

Yield curve inversions continue to be a major reason the recession clock is ticking faster. On that front, it’s important to note that 5-year vs. 3-month US Treasury spread has been inverted for 8 months. This only happened 4 other times in history: at the peak of the housing bubble, during the tech and 1973-4 inflationary bust, and 5 months prior to the 1980 recession.

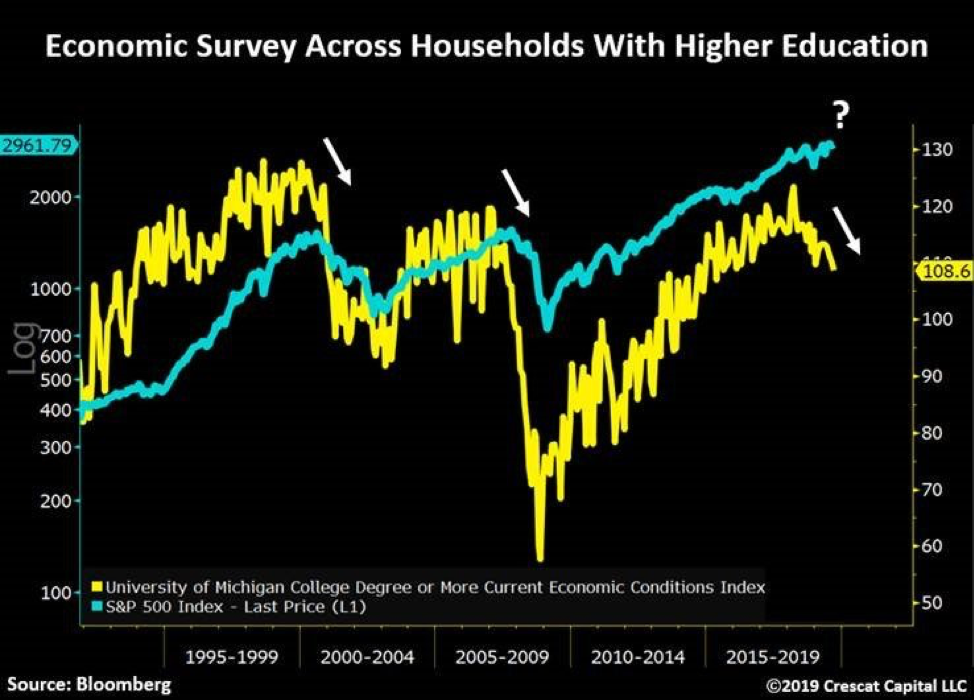

The University of Michigan performs a monthly survey across households with higher education in the US. This indicator just started to tip over, and it has also been highly correlated with the changes in the business cycle.

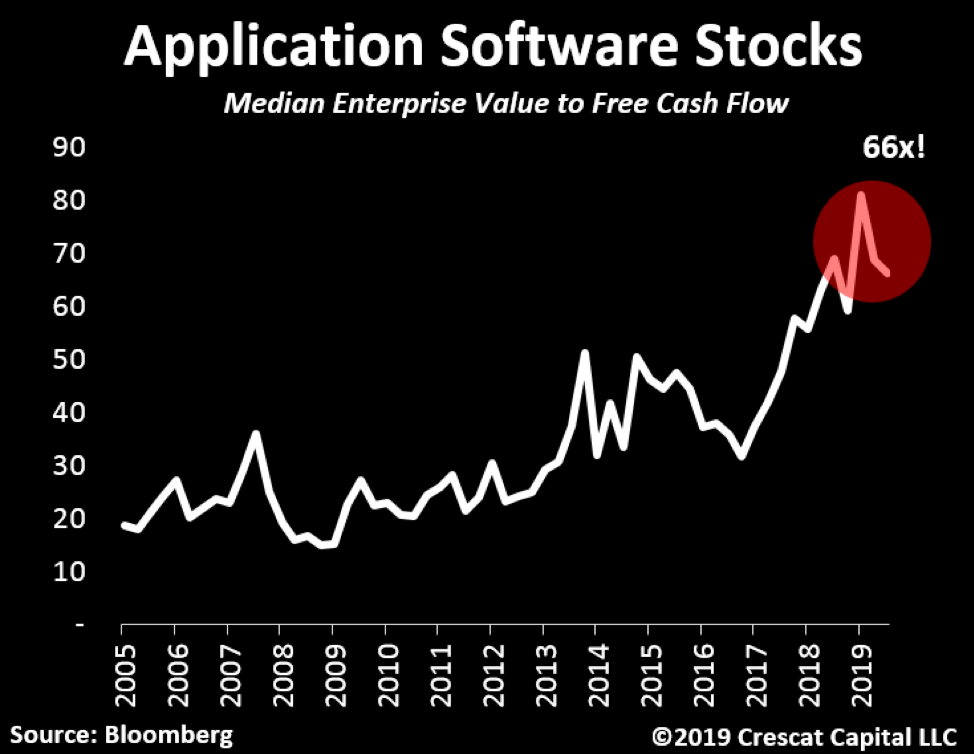

When searching for cracks in the market, look no further than its leaders. FANG stocks are the first ones to come to mind. Aside from Google, Netflix is down 30% from its previous highs, Facebook close to -15%, and Amazon about -13%. These are all staggering declines when compared to Nasdaq still 2 percentage points away record levels. Software stocks are showing a similar divergence. However, it’s the valuation of these businesses that continues to be a problem. Today, software stocks, thanks the popular and now ubiquitous software-as-a-service (SaaS) business model, trade at an absurd 66x median EV to free cash flow. It was 80x just three months ago! We have been short about a dozen of the highest of these high-flyers in our hedge funds since late June. The group seems to have peaked in late July and has continued to deliver gains for us even as the S&P 500 trended higher in the last month and a half.

Faltering leadership is also present on a sector level. Industrials, financials, health care, energy, and materials have all peaked a long time ago. These are all major parts of the economy and represent a major sign of stress in the market. Microcap stocks’ underperformance relative to the large cap market is yet another bearish divergence. These smaller companies are now down close to 20% since September of 2018. They tend to be domestic-oriented businesses that have correlated strongly with the overall market throughout history. The S&P 500 looks like it is poised to play catch-up.

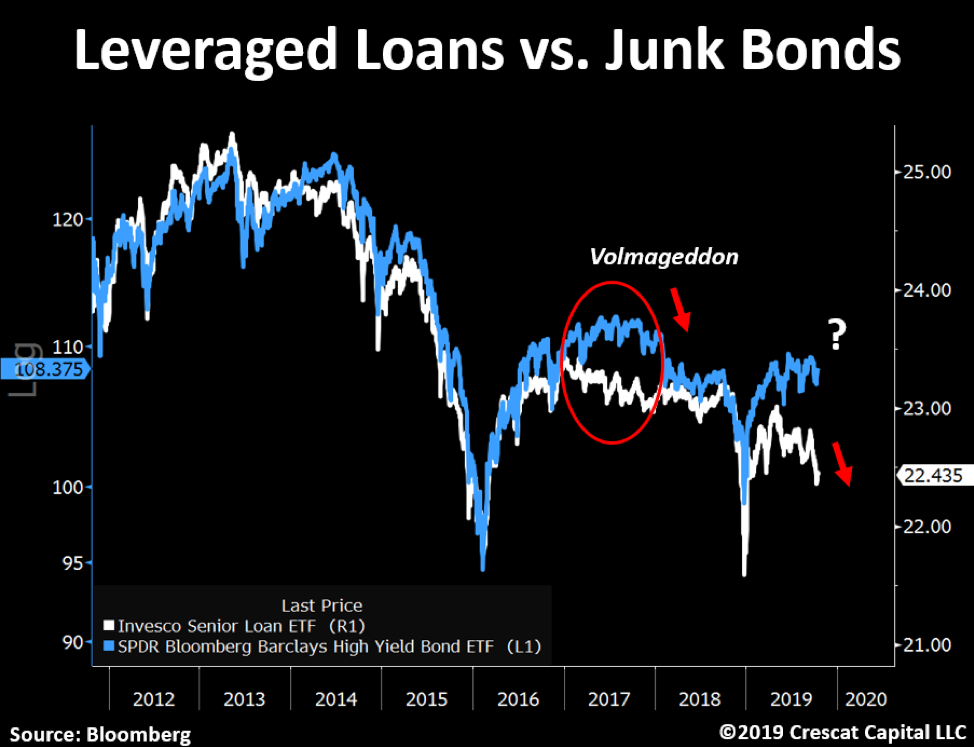

Leveraged loans also portend problems for equity markets. These murky corporate debt instruments are now revealing a key risk for the US economy. This $1.5 trillion market has more than doubled since the Global Financial Crisis. The price of leveraged loans is now significantly diverging from the S&P 500, another likely leading indicator for stocks.

Leveraged loans and high yield bonds are also diverging. Last time this happened it preceded Volmageddon in early 2018. In our view, given this record long economic expansion and historically elevated corporate debt levels, junk bonds look extremely vulnerable for the following months.

China and Hong Kong

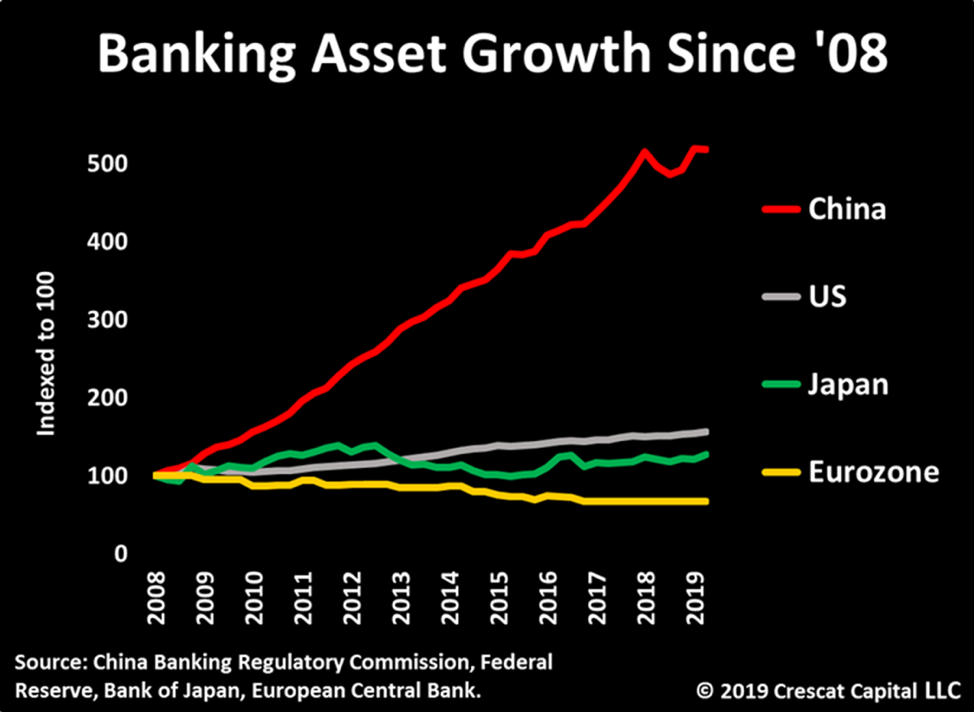

But leverage is not just problem in the US corporate market today. When we look globally, China today is arguably the biggest total-country credit bubble in world history. They have grown their entire banking system assets by over 400% since the GFC to about 40 trillion USD equivalent. That’s 2.3 times bigger than the US banking system for a GDP economy that is 36% smaller. ($21.3T vs. $13.6T). Add to that, that China is a totalitarian, communist emerging market with all its attendant corruption and mismanagement. In our view, China has an enormous hidden non-performing loan problem and is facing severe capital outflow pressure.

Credit bubbles build up when private sector debt growth rapidly outpaces GDP growth. Some of the world’s biggest financial crises have followed from this unsustainable pattern: Japan post 1989; S. Korea, Thailand, Indonesia gave us the Asian Currency Crisis in 1997; Housing bubbles in the US and Europe built up until 2007 leading to the Global Financial Crisis in 2008. Some of the larger countries facing financial risks today based on this pattern are China, Canada, and Australia. Canada and Australia have their own banking and housing bubbles related in no small part to at least a decade of illicit Chinese capital outflows that should soon be drying up completely.

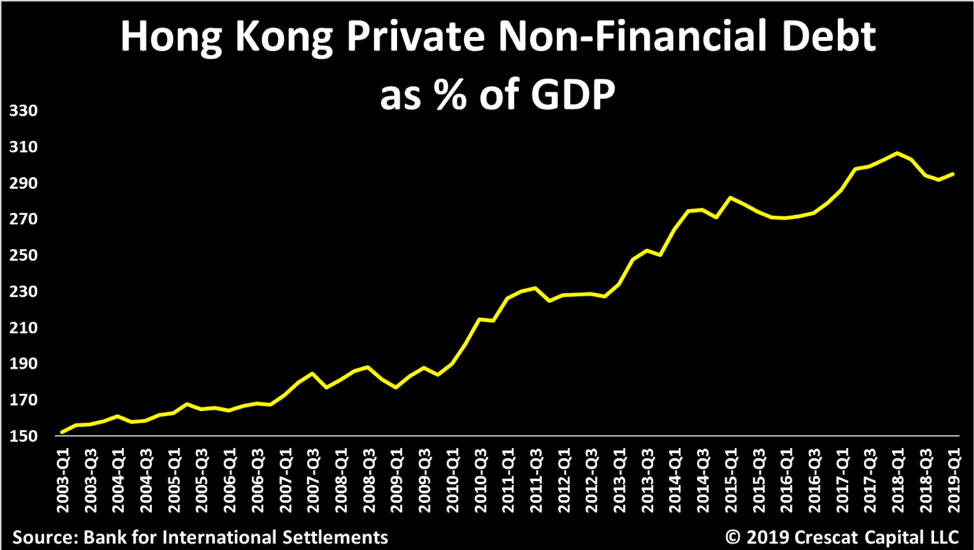

The build-up in Hong Kong’s debt to GDP is off the charts compared to those other credit bubbles at almost 300% for combined household and corporate non-financial debt.

Hong Kong is a Special Administration Region of China. Still, it retains its own currency, the Hong Kong dollar, a throwback to 156 years of British rule prior to the handover to China in 1997. As part of reunification with China, Hong Kong was supposed to retain its own democratic system of government and its own economic systems, but increasingly Hong Kong been coming under Beijing’s totalitarian control. The people of Hong Kong are rebelling. In the past several months, ongoing civil protests against the Chinese Communist Party have risen to a level comparable to 1989 Tiananmen Square democracy demonstrations. Hong Kong’s excessive debt growth relative to its underlying economy and its attendant record setting property bubble are warning signals of an impending financial crisis. We believe the Hong Kong dollar is likely to de-peg from the US dollar given capital flight from this former offshore banking haven.

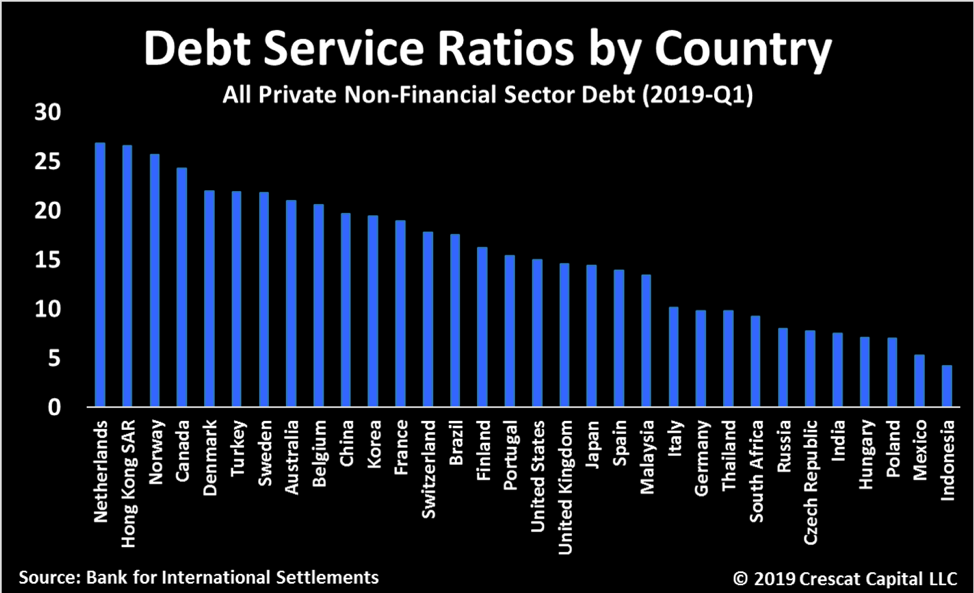

Hong Kong’s debt service ratio has been steadily rising and is now at 27%. The DSR is the percentage of annual income that Hong Kong’s citizens and businesses need to service their debts. Hong Kong has one of the highest DSRs among all the countries tracked by the tracked by the BIS, another financial crisis warning signal.

Outlook for Precious Metals

Aggressive monetary policies late in the business cycle are yet another warning sign of economic problems. It’s not just the Fed, global central banks are now hamstrung in the face of record financial asset bubbles and record low inflation expectations. Rate cuts, QE, other forms of liquidity injections should all result in a major shift in the macro landscape toward currency wars, rising inflation expectations, and bursting asset bubbles. Combine that with a grab for safe-haven assets that cannot be diluted by monetary debasement. Such a shifting macro landscape is one where gold can quickly become king.

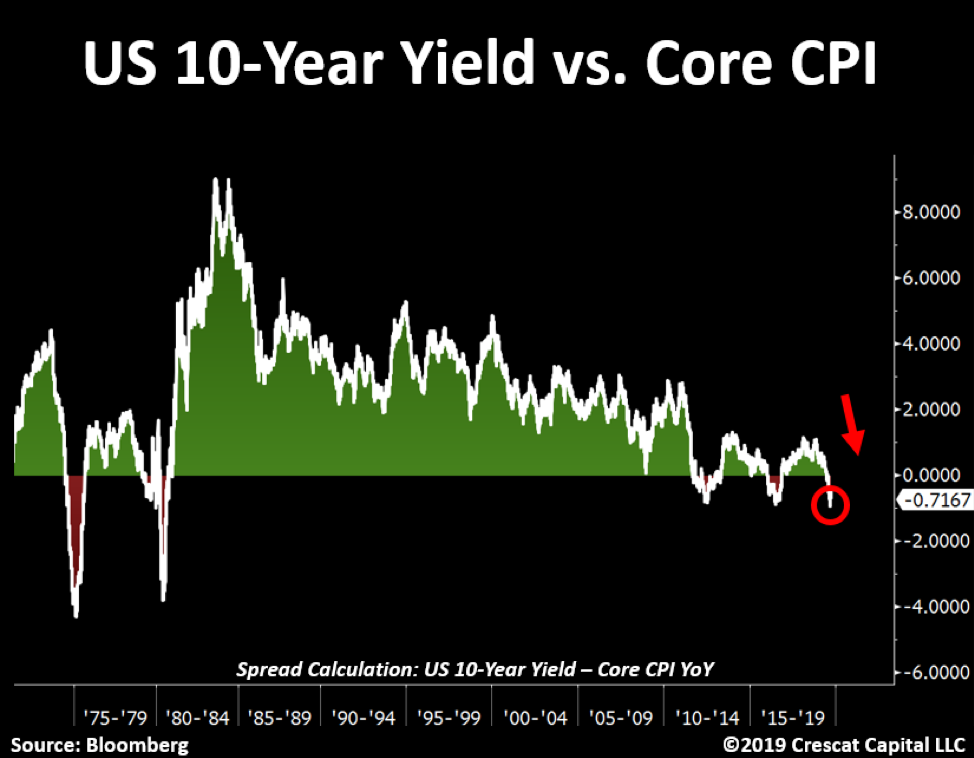

In a world of yields near record lows, we find it interesting that many are still oblivious to the fact that US core CPI just hit a decade high. Meanwhile, the US 10-year yield vs. core CPI is at a 40-year low.

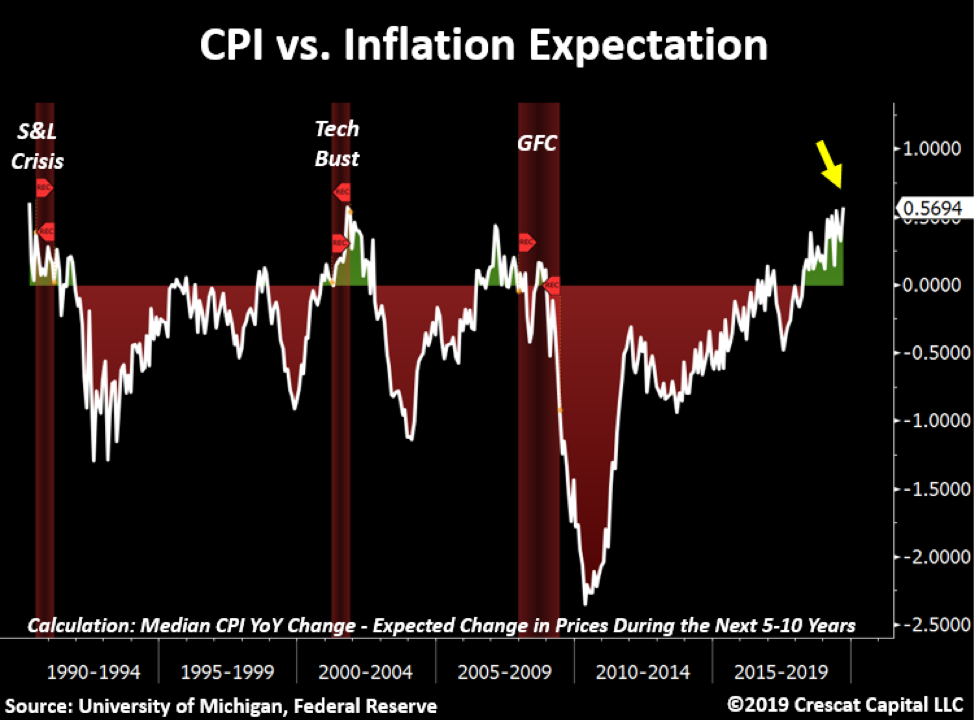

Inflation tends to surprise investors at the top of the business cycle. The outlook for rising prices is near 40-year lows while median & core CPI are at decade highs. While we are concerned about the deflationary impact of financial asset bubbles bursting including a credit bust in China, at the same time, we believe that inflation is one of the most underrated risks out there.

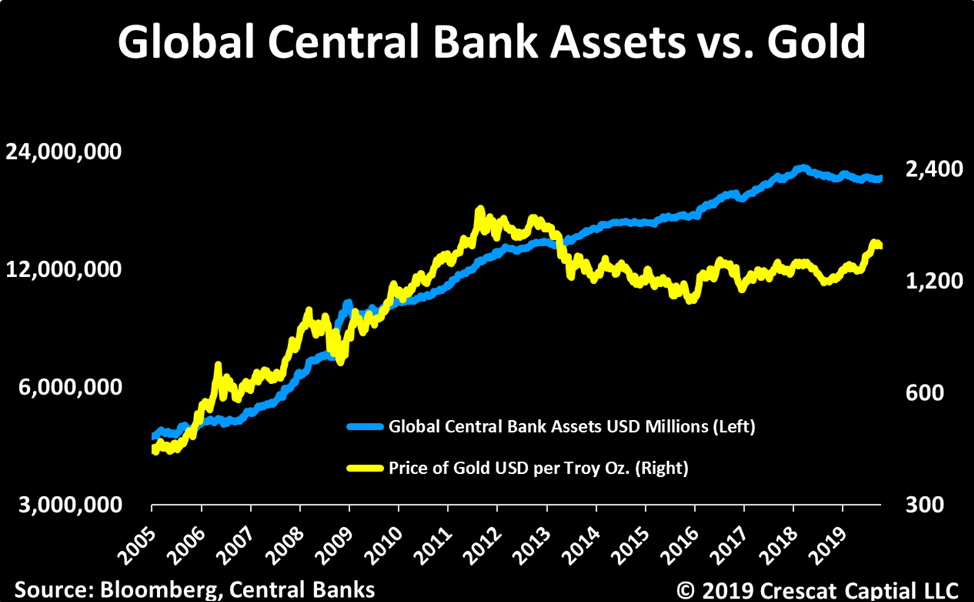

Ultimately, inflation is a monetary phenomenon. Since 2005, the global fiat central bank monetary base (M0) in USD terms has grown at a compound annual rate of 11.6% and is valued at $20.5 trillion today. Over time, we believe the price of gold tracks the amount of central bank money printing or global M0 growth converted to dollars. This relationship worked very well from 2005 until 2012 as we show in the chart below. But beginning in 2013, the price of gold started diverging from global printed money. As a result, we believe that gold is undervalued today.

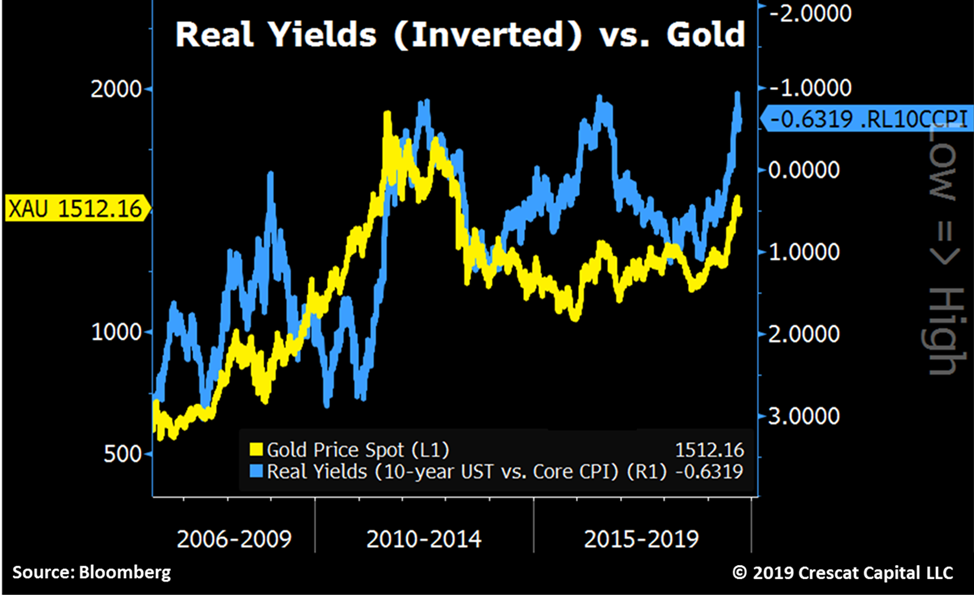

The reason for the divergence in the price of gold was that the money printing failed to materialize into the much-anticipated inflation spike in the aftermath of the GFC. In hindsight, the money printing largely went to re-inflating financial asset prices (debt and equity markets) rather than driving consumer price inflation. So, gold prices followed the path of declining inflation expectations. Said another way, the price of gold moved inversely to rising real interest rates. Below we can see the correlation between gold and inverted real interest rates based on the 5-year TIPS yield. Recently, real yields have started declining again, breaking out on the inverted chart from a 6-year downtrend. Real yields are not declining because inflation expectations are picking up, rather solely because nominal rates have come down. Just think how much gold could rise if inflation expectations also start to pick up. In this chart, we can clearly see that declining real yields have been a significant driver for gold’s recent move up!

If we use core CPI which actually is rising for real yields instead of expected inflation embedded in the TIPS yield, then we can see that gold may still have lot more catching up to do on the upside. This view jibes with our Central Bank Assets vs. Gold chart further above. Core CPI is more volatile than TIPS implied inflation but could be a good lead indicator in the current cycle.

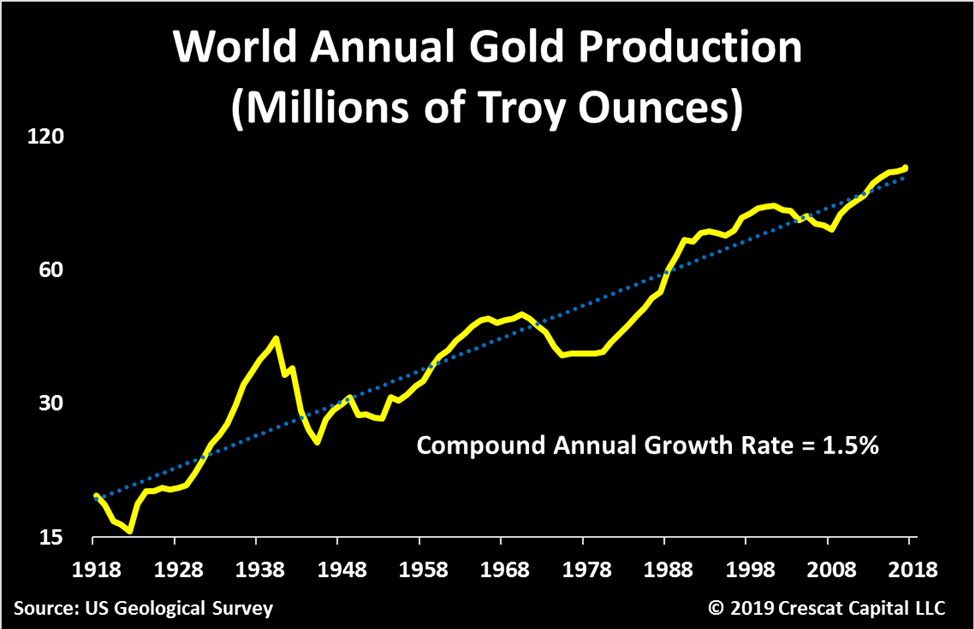

In contrast to fiat money’s 11.6% growth rate over the last decade and a half, the global supply of gold grows at a much more constrained long-term rate of about 1.5% annually. For this reason, gold has served as a sovereign and central bank reserve currency for thousands of years. The characteristics that have made gold the ultimate monetary asset are durability, portability, divisibility, uniformity, limited supply, and acceptability.

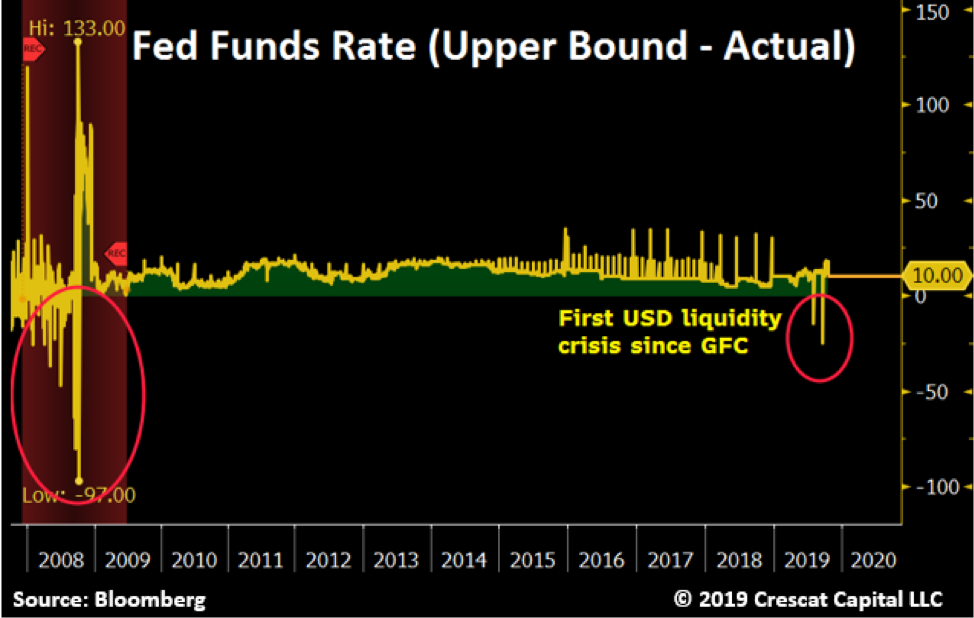

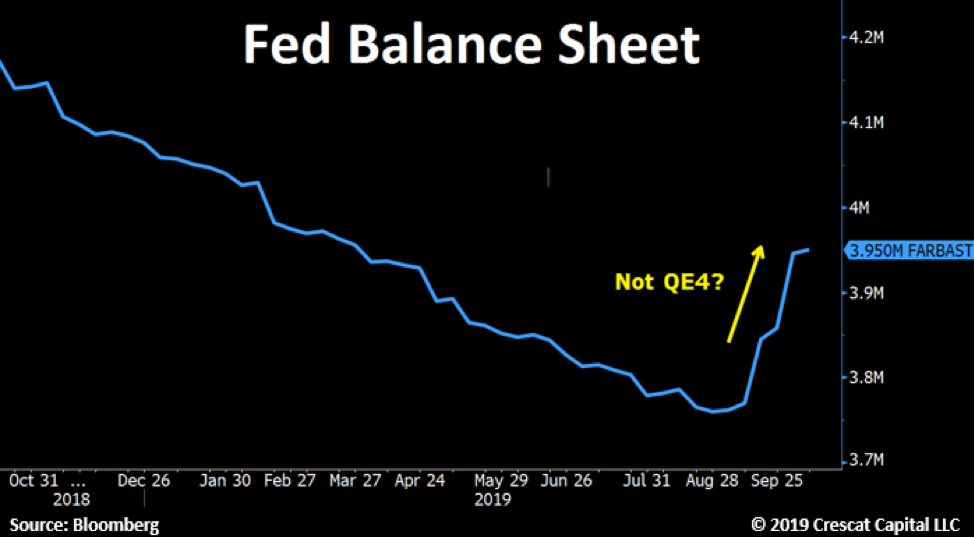

So, you have probably heard about the recent money market liquidity crisis where overnight repo rates rose as high as 10% in September. This dysfunction bled through to the fed funds market where the Fed’s benchmark rate breached the upper bound for the second time in the last three months. Such a breach is an important signal since it has not happened since the global financial crisis.

The breach was indeed a liquidity crunch as the Fed has now admitted that it took its quantitative tightening too far. Tight cash supplies in September were diverted to fill US government coffers through new Treasury issuance and corporate taxes. Banks failed to step up and fill the liquidity gap, so Fed was forced to step in with emergency cash, aka money printing, but don’t call it QE. The Fed has added $180 billion to its balance sheet in just one month since the repo liquidity crisis started. Chairman Jay Powell says, “In no sense is this QE!” Whatever you call it, it sure looks like money printing to us.

Fed intervention is clearly needed to stem the liquidity crisis and help prevent collapsing financial asset prices. However, the question is, will investors respond to new central bank easing by bidding up risk-on assets again? Or could ongoing new monetary stimulus also serve to create real-world inflation as in other macro cycles such as in the 1970s? Investor and consumer psychology and behavior need to be monitored as they will play a key role. The fact is, rising inflation expectations are a self-fulfilling driver of inflation. The post GFC world had the benefit of declining such expectations. That could happen again, but we seem to have the opposite setup today. This is particularly troublesome for stock and bond bulls because rising inflation would almost certainly be a killer of today’s financial asset price bubbles. The crowded risk parity trade (long stocks + leveraged long bonds) can handle deflation very well but not inflation. If one is going to buy stocks at all in this environment, one area that looks extremely attractive with low valuations and improving fundamentals is gold and silver mining stocks.

How to Play coming SOVEREIGN DEBT CRISIS

I hope by now you would have realised that we are moving from crisis to crisis and authorities are fighting hard to extend the cycle. The massive injection of liquidity by central banks has dramatically increased the government’s role in the economy and significantly decreased expected returns on bonds and equities. Martin Armstrong writes how to prepare for the coming debt crisis.

The little guy has NEVER materially benefited from the decline in interest rates because the banks never lowered the rates they charge consumers in proportion to the decline in official rates.

The consumer-level actually sets the tone for the big boys. Governments are hopelessly caught in a crisis drowning in debt and there is no possible way we can climb out of this without major problems and structural reforms.

Understanding we have a Sovereign Debt Crisis is the first step in framing your strategy. Stay away from government debt.

Next, understand that the broader trend will be toward higher interest rates. If you are a borrower as in a mortgage, that means you want to lock it in and do not sign up for any floating rates where you have to pay. If you are a lender, then you do not want to lend out at fixed rates.

Understanding there is a debt crisis, this means you need to develop a strategy of moving to the private asset classes.

The big boys will follow consumer trends. The government will try to convince everyone that they have control. This is simply a game of poker where you can bluff and win with a losing hand if you are good enough. That is the trick governments have been playing on everyone.

Record Lows

Dr Lacy Hunt at Hoisington Management has another sterling post in its third quarter review and outlook. He is the longest standing US bond bull and his views never wavered. Please find below his outlook and the link to the full post

Outlook

The global over indebtedness has clearly restrained growth, and therefore has had a profound disinflationary impact on every major economic sector of the world. This fact, coupled with an overzealous U.S. Central Bank have created the conditions for an economic contraction in the U.S. and abroad. This has also created a worldwide decline in inflation and inflationary expectations. It is therefore unsurprising that record lows in long term interest rates have been established in all major economic regions. A quick and dramatic shift toward greater accommodation by the Fed could begin to shift momentum from contraction toward expansion. However, policy lags are long and slow to develop, therefore despite the remarkable decline in long term yields this year, we are maintaining our long duration holdings. A shift towards shorter duration portfolios would be appropriate when the forward-looking indicators of expansion, in the U.S. and abroad, begin to appear.

full post below

Fiscal Policy and the growth slowdown

Fantastic view on Indian Economy by Dr Rathin Roy