I did an interview with moneycontrol on current Macro backdrop, failure of monetary policy and what I see ahead apart form role of global assets and GOLD in diversification

Thucydides Trap & War between US and China

Martin Armstrong writes…

I have never seen the press so anti-president in the history of this nation. Every possible thing they claim will destroy the US economy. The US trade with China will by no means send the US economy into a deep recession. However, blocking US investment into China would send the Chinese economy down even harder.

This style of analysis always reduces the future trend to one simple event. The markets and the world economy are far more complex than a single event. This is the entire problem with Western Analysis – it is always linear and never cyclical. This is the same problem as Global Warming. They see a 1-degree rise, project that out for 50 years, and then assume the trend will remain the same – linear analysis. They always project the future in this manner and NEVER look at the trends in history to learn what are the “real” possibilities from similar events.

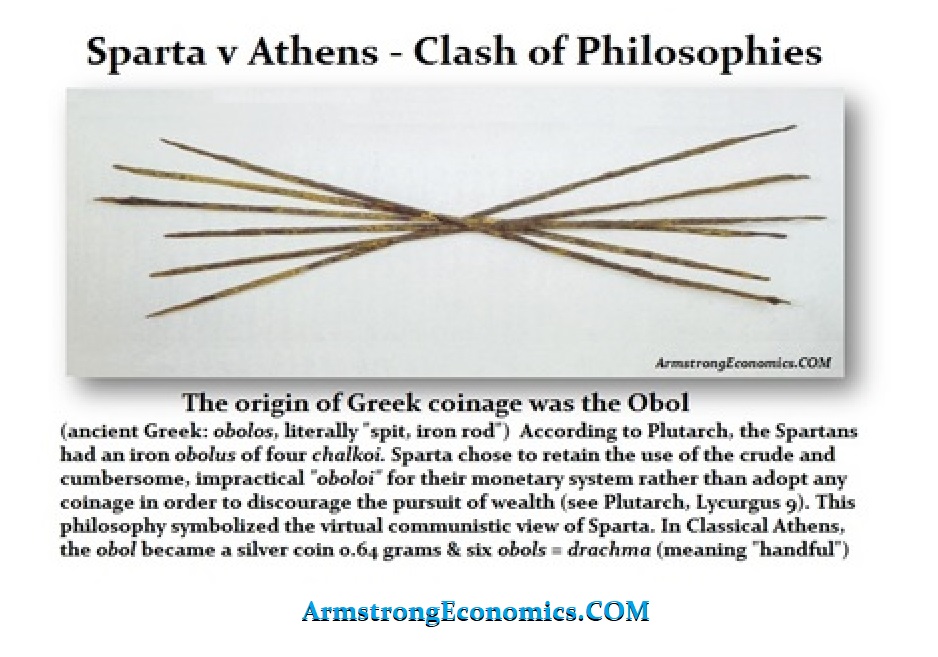

What you must understand is they often call this type of struggle between the current superpower (Financial Capital of the World) and the rising power to take that title, the Thucydides Trap. This is named after the ancient Greek historian Thucydides who wrote about a war that devastated the two leading city-states of classical Greece – Sparta & Athens.

Thucydides explained: “It was the rise of Athens and the fear that this instilled in Sparta that made war inevitable.”

He concludes

The Thucydides Trap is considered the violent aspect of the shift in the Financial Capital of the World. In most cases, the rivalry between the major power and the new contender has led to war. Only a few times the passing of the crown of the Financial Capital of the World changed hands without war such as the loss of that title from Britain to the United States. However, there was still war involved whereas Britain lost its economic status due to war in Europe primarily and then the rise of the Labour Party. It did not involve war with the United States.

Nonetheless, we are looking at the risk of a conflict between China and the United States as this struggle for power continues. The USA will lose the title to China. Our computer model will be correct on that. But it does not necessarily mean war will unfold. The West will fall because of the economic conflicts internally between the left and right as socialism is dying and all the promises cannot be funded. So we see this more as the case with Britain that it lost the title to the United States without a direct war between the two powers.

Zulauf’s Bottom Line, What’s Ahead

In early June 2019, Steve from cmgwealth.com shared notes from Felix’s keynote presentation at Mauldin’s Strategic Investment Conference in Dallas. You can find it here.

At that time, Felix said the global slowdown should eventually impact markets. He said, “The rally from the December low is over.” On December 27, he sent out a report to his clients saying this is the low. Then on May 2, he sent out a note saying there’s a “new sell signal.” I think we have started the second decline in this bear market that was interrupted by a nice rally. The S&P 500 peaked at 2,945, sold off and rallied to 3,000 in July. It sits at 2,976 today. His sell signal remains in place. On what to watch: He said, “The key is the Fed. If the Fed changes policy quickly and this weakens the dollar, we could have an extension of the business cycle. And that will be an investment decision we will have to make in the second half of this year. It depends on what they do…”

September 12, 2019 Webinar Notes and Link to Recording

Bottom line: In terms of big macro moves, Felix says the cocktail presented to investors is highly toxic.https://www.cmgwealth.com/ri/on-my-radar-zulaufs-bottom-line-whats-ahead/

- Felix believes a September 2019 stock market peak will be followed by a 20% correction with the low coming in late December or early January. That will send the S&P 500 back towards the December 24, 2018 low near 2,300. He believes interest rates are still headed lower and will bottom around the same time, perhaps making a long-term bottom.

- On top of a slowing world economy and already very low real and nominal growth, the world is facing a sharply deteriorating liquidity condition because the U.S. Treasury must replenish its account at the Fed from levels as low as $111 billion in mid-August, $156 billion in early September and $196 billion in mid-September to near $400 billion. Draining $250 billion of liquidity within two to three months could shock the financial markets, even if the Fed cuts rates. (Steve here: In 2015, Congress mandated that the Fed keep $400 billion of cash in their piggy bank in case of a Government shutdown or a crisis-like event. Last December the Fed’s balance went from $400 billion to $111 billion. That’s money that is injected into the system. A QE-like effect on markets. When they have to replenish the piggy bank, they sell more Treasury debt and put the cash proceeds back in the piggy bank. That’s like a quantitative tightening that pulls money out of the financial system. I believe the recent hit to the money market system is partially a result of the Treasury’s recent actions.)

- As they did in late 2018 and early 2019, the Fed and global central bankers will respond aggressively and that will put a floor on the downside. He believes this is a pattern we will be in for some time. Market support will be very much dependent on the Fed’s, central bankers’ and policymakers’ responses.

- Like Dalio, he believes we sit late in a long-term debt cycle and such cycles present significant challenges.

- China, the engine of growth to the world, is the major driver of the global economic slowdown. Their private market debt has peaked and they are stuck in terms of their ability to stimulate more growth. Trade wars are a concern.

- He believes gold is in a secular long-term bull market, but expects a short-term sell-off from recent highs. He likes gold on dips.

- He doesn’t see a 2008-like crash. More of a range-bound equity market with big swings up and then down and then up again. An environment that favors active management over passive. He thinks value is a better place to be over growth and shows you how you might time your entry.

Weekly Commentary- Doug Noland

Non-Financial Debt (NFD) expanded $408 billion during Q1 to a record $53.015 TN. This was down from Q1’s $765 billion expansion. On a seasonally-adjusted and annualized (SAAR) basis, Q2 NFD growth slowed to $1.652 TN from Q1’s booming $3.061 TN. The slowdown was chiefly explained by the timing of federal government borrowings. Federal debt expanded SAAR $1.751 TN during Q1 and then slowed markedly to $382 billion during Q2. Averaging the two quarters, NFD expanded SAAR $2.360 TN. This compares to 2018’s annual $2.274 growth in NFD, the strongest annual Credit expansion since 2007’s $2.518 TN. As a percentage of GDP, NFD slipped to 248% from 249% during the quarter. NFD ended 1999 at 183% of GDP and 2007 at 226%.

On a seasonally-adjusted and annualized basis, Household borrowings expanded SAAR $668 billion, up from Q1’s SAAR $323 billion, to a record $15.834 TN. Household mortgage debt expanded SAAR $330 billion, up from Q1’s SAAR $226 billion, to a record $10.440 TN. Total Business debt growth slowed to SAAR $680 billion, down from Q1’s booming $1.023 TN (strongest since Q1 ’16), to a record $15.744 TN. State & Local debt contracted SAAR $77 billion, after declining SAAR $36 billion during Q1, to $3.039 TN. Foreign U.S. borrowings expanded nominal $231 billion for the quarter (to $4.291 TN), the strongest foreign debt growth since Q1 ’17.

Considering recent “repo” market tumult, let’s take a deeper-than-usual dive into the Z.1 category, “Federal Funds and Securities Repurchase Agreements” (aka “repo”). “Repo” Liabilities jumped $239 billion (nominal) during the quarter, or 24% annualized. This pushed growth over the past three quarters to $710 billion, or 27% annualized. This was the largest nine-month growth since the first three quarters of 2006. At $4.280 TN, “repo” ended June at the highest level since Q3 2008.

It’s no coincidence that the $710 billion nine-month increase in “repo” corresponded with a spectacular 106 bps decline in 10-year Treasury yields. I’ll assume repo market ballooning continued into early-September, as yields dropped another 44 bps. The expansion of securities Credit (the “repo” market being a key component) generates new marketplace liquidity. Moreover, the concurrent expansion of “repo” Credit and system liquidity is in today’s highly speculative global environment powerfully self-reinforcing.

September 26 – Bloomberg (Vivien Lou Chen): “It may take as much as $500 billion in Treasury purchases by the Federal Reserve to fix all of the cracks exposed last week in the more than $2 trillion U.S. repo market. Estimates from analysts at TD Securities, Morgan Stanley, BMO Capital Markets and Pictet Wealth Management range from roughly $200 billion to half a trillion dollars. They’re not alone. Two former Fed officials said Thursday that the central bank might need to do $250 billion of outright Treasury purchases to prevent further pain in U.S. money markets. There’s a growing consensus that the central bank’s daily efforts to restore order in the short-term funding market are falling short of what’s needed: a much larger effort to build up a substantial buffer of bank reserves…”

As we’ve witnessed over the past two weeks, the unwind of securities Credit and the attendant contraction of liquidity turns immediately problematic. A Thursday afternoon Bloomberg headline (from the above article) resonated: “Repo-Market Cure May Take $500 Billion of Fed Treasuries Buying,” referring to Wall Street estimates of the scope of Fed intervention necessary to stabilize funding markets. I have posited a serious globalized de-risking/deleveraging episode would require multi-Trillion expansions of Federal Reserve and global central bank balance sheets.

“Brokers & Dealers” is the largest borrower by Z.1 category, with “repo” Liabilities up $92 billion during Q2 to $1.781 TN (high since Q3 ’13). Broker “repo” Liabilities surged $296 billion over three quarters, or 27% annualized.

As the second largest borrower, Rest of World (ROW) “repo” Liabilities increased $10 billion during the quarter to a record $1.102 TN. ROW “repo” Liabilities surged $254 billion over the past three quarters, or 40% annualized. ROW “repo” peaked at $857 billion during the previous cycle (Q1 ’08).

While not at the same level as the Wall Street firms or ROW, Real Estate Investment Trusts (REITs) have as well been notably aggressive “repo” borrowers. REIT “repo” Liabilities rose $30.3 billion during Q2 to a record $369 billion. REIT “repo” Liabilities were up $107 billion, or 41%, over the past year and $150 billion, or 69%, over two years. REIT “repo” Liabilities posted a previous cycle peak during Q2 2007 at $106 billion.

Money Market Funds (MMF) are a large holder of “repo” Assets (second only to Brokers & Dealers). MMF “repo” holdings jumped an eye-opening $153 billion during Q2 to a record $1.133 TN, with a gain over three quarters of $213bn, or 23%. It’s worth noting MMF “repo” holdings peaked at $618 billion during Q4 2007 (having doubled over the preceding two years).

It’s worth noting the Fed’s balance sheet contracted $58 billion during the quarter to $4.140 TN. Some have been confounded by the lack of impact to system liquidity from the Fed somewhat drawing down its securities portfolio. But with securities Credit expanding by multiples of the decline in Fed Credit, marketplace liquidity has been dominated by securities speculating and leveraging. As I often repeat, contemporary finance works miraculously on the upside. Fear the downside. The Fed’s balance sheet expanded as much over past week as it contracted during the second quarter.

Bank (“Private Depository Institutions”) assets increased $203 billion during the quarter to a record $19.506 TN, this despite a $159 billion decline in “Reserves at Federal Reserve”. Bank Loans jumped $192 billion during the quarter, or 6.8% annualized, bouncing back strongly after Q1’s slight contraction (and ahead of Q2 ‘18’s $174bn). Bank Loans were up $550 billion, or 5.0%, year-over-year. Bank Mortgage Loans expanded $76 billion (5.5% annualized) during the quarter to a record $5.540 TN, the strongest expansion in two years.

Bank holdings of Debt Securities jumped $112 billion, or 10% annualized, to a record $4.505 TN (one-year gain of $320 billion, or 7.7%). Debt Securities holdings were below $3.0 TN going into the 2008 crisis. Bank Agency/GSE MBS holdings jumped a huge $82.2 billion during the quarter, the largest increased since Q1 ’12. Over the past three quarters, Banks boosted Agency Securities by $217 billion, or almost 10%, to a record $2.588 TN. Banks’ Agency Securities holdings are about double the level from the crisis. Bank Holdings of Treasuries rose $34 billion during Q2 to a record $771 billion, jumping $121 billion over three quarters. Treasury holdings were up 22% y-o-y. For Comparison, Banks’ Corporate Bond holdings increased $25 billion y-o-y, or 3.9%, to $664 billion.

Broker/Dealer Assets jumped $132 billion during Q2, or 16% annualized, to $3.487 TN (high since Q2 ’13). This was a sharp reversal from Q1’s small ($4bn) contraction. Broker/Dealer Assets were up a notable $349 billion, or 11.1%, over the past year. Repo Assets jumped $227 billion y-o-y, or 20.0%. Over this period, “repo” Liabilities surged $326 billion, or 22.4%, to $1.781 TN. This was the highest level of “repo” Liabilities going back to Q3 2013, a period that corresponded with a sharp upside reversal in market yields and contraction in “repo” securities Credit.

Total system Debt Securities increased nominal $304 billion during Q2 to a record $45.771 TN. This boosted the gain since the end of 2008 to $14.825 TN, or 48%. As a percentage of GDP, Debt Securities ended Q2 at 214% (record 223% Q1 ’13). Equities jumped $1.602 TN to $49.799 TN, ending Q2 slightly below Q3 ‘18’s all-time record ($49.799 TN). Equities ended Q2 at 233% of GDP (record Q3 ’18 243%). Total (Debt and Equities) Securities jumped $1.906 TN during Q2 ($7.51 TN during the first half) to a record $95.569 TN. Total Securities-to-GDP ended June at 448% (record Q3 ’18 458%). Previous cycle peaks were 379% during Q3 ’07 and 359% in Q1 ’00. Total Securities-to-GDP began the eighties at 44% and the nineties at 67%.

I view the “repo” market expansion as indicative of overall speculative leverage. The rapid growth of Bank and Broker/Dealer debt securities holdings is symptomatic of speculative excess and likely associated with derivative-related trading activities. To simplistically connect the dots, the expansion of “repo” securities Credit along with ballooning Bank and Broker/Dealer securities holdings generate the liquidity abundance and speculative impulses for a general inflation of securities market prices (debt and equities). The inflation of perceived wealth then feeds into the real economy through strong consumer and business spending.

Accordingly, the Household Balance Sheet remains a Bubble Analysis Focal Point. Total Household Assets increased $2.024 TN during the quarter to a record $129.671 TN, with a $7.358 TN gain during 2019’s first half. And with Liabilities up $175 billion, Household Net Worth (Assets less Liabilities) jumped $1.949 TN during Q2 to a record $113.463 TN. Household Net Worth rose $7.177 TN during this year’s first-half, a record six-month advance. Net Worth rose to a record (matching Q4 ’17) 532% of GDP. For comparison, Household Net Worth-to-GDP posted cycle peaks of 492% during Q1 2007 and 446% to end Q1 2000. Net Worth-to-GDP began the eighties at 342% and the nineties at 378%.

Household Real Estate holdings increased $257 billion during the quarter, down from Q1’s $707 billion gain (strongest since Q4 ’05). Yet Real Estate jumped $1.692 TN over the past year to a record $32.676 TN (153% of GDP). Real Estate holdings posted a previous cycle peak of $26.466 TN (189% of GDP) during Q4 ’06.

Financial Assets are the unquestionable epicenter of this cycle’s Bubble. Household holdings of Financial Assets jumped $1.700 TN during Q2, after surging $4.544 TN in Q1. Financial Asset holdings ended Q2 at a record $90.689 TN, or 425% of GDP. Financial Assets-to-GDP ended Q3 2007 at 376% and Q1 2000 at 355%. Household Assets began the nineties at 267% of GDP.

Household Total Equities (Equities and Mutual Funds) holdings ended Q1 at record $27.427 TN, or 129% of GDP. The previous two cycles saw Household Equities peak at $14.930 TN (102% of GDP) during Q3 ’07 and $11.742 TN (117% of GDP) in Q1 ’00. Total Equities holdings began the nineties at 47% of GDP.

Rest of World (ROW) is key to Bubble Analysis as well, though with layers of ambiguity and complexity. ROW holdings of U.S. Financial Assets surged $843 billion during Q2 to a record $32.582 TN. Holdings were up $1.798 TN y-o-y, boosting ROW holdings-to-GDP to a record 153%. ROW holdings-to-GDP ended 2007 at 108% and 1999 at 74%. ROW holdings of U.S. Debt Securities increased $337 billion during Q2 to a record $11.906 TN. Debt Securities jumped $728 billion during the first half, with Treasury holdings rising $372 billion to a record $6.637 TN. ROW repo Liabilities jumped $187 billion, or 20%, during the first six months of 2019 to a record $1.102 TN.

Few see the Bubble, yet the Fed’s Z.1 report offers a compelling outline. This week saw “repo” market instability bumped from the headlines by instability at the White House. Markets reacted to whistleblower allegations and the opening of an impeachment inquiry in typical fashion: “The President under duress is more likely to strike a deal with China.” In comments Wednesday, the President was happy to play along: “They want to make a deal very badly… It could happen sooner than you think.” President Trump’s tough talk directed at China Tuesday at the U.N. didn’t leave one feeling the administration was softening up for an imminent deal.

And then came the Friday afternoon Bloomberg scoop (Jenny Leonard and Shawn Donnan): “Trump administration officials are discussing ways to limit U.S. investors’ portfolio flows into China in a move that would have repercussions for billions of dollars in investment pegged to major indexes, according to people familiar with the internal deliberations. The discussions are occurring as Washington and Beijing negotiate a potential truce in their trade war that’s rattled the world’s two biggest economies and investors for more than a year… A U.S. crackdown on capital flows would therefore expose a new pressure point in the economic dispute and cause disruption well beyond the hundreds of billions in tariffs the two sides have levied against each other.”

Markets would like to believe the administration is posturing ahead of the next round of trade talks. Bloomberg follow-up articles included comments from Wall Street analysts, including: “This is huge.” “Ludicrous.” “The news opens up a new front in the U.S.-China trade conflict.” “It’s another example of how every time people think this trade war is deescalating, it escalates again.” A Reuters article was on point: “…what would be a radical escalation of U.S.-China trade tensions.”

Chinese company listed ADRs were slammed in Friday U.S. trading. This creates Monday morning Chinese market and currency vulnerability. To this point, it’s been the Teflon President affixed to Teflon markets. But between “repo” market instability, Washington chaos, the risk of serious trade war escalation – in a world of heightened financial, economic and geopolitically instability – and there is a scenario where the unraveling begins. Markets have to this point demonstrated astounding faith that the President will ultimately act in their best interest. As always, markets are a contest of greed and fear. One of the bad scenarios would be the markets fearing an administration resorting to a “scorched earth” gambit.

HongKong and Risks in Asia

via armstrongeconomics.com

Cathay Pacific Airways Ltd. suffered a 12% drop in passengers due to the Hong Kong protests. Airfare prices are dropping in an attempt to win back visitors. Consequently, Cathay Pacific Airways is looking to sell a U.S. dollar bonds as there are rising fears that the Hong Kong peg may break with the protests. The potential bond offering is expected to be unrated. The deal size and coupon haven’t been made public. This is continuing to put pressure on dollar hoarding in Asia.

There are other issues at the core of the Hong Kong protests. As reported in South China Morning Post, graffiti was sprayed across a concrete barrier at a road in Kowloon’s Wong Tai Sin residential district that declared: “7K for a house like a cell and you really think we out here scared of jail?” They also reported that at an underpass in Central, a message scrawled on the wall read: “12K for 120 sq ft and you think that’s OK?”

Hong Kong’s protests began in June 2019 against proposals to allow extradition to mainland China. The extradition bill that triggered the first protest was introduced in April. It would have allowed for criminal suspects to be extradited to mainland China under certain circumstances. The opponents argued that they could be subjected to unfair trials and violent treatment in China. Therefore, this would undermine the city’s judicial independence and endanger dissidents. They argued that this violated the “one country, two systems” deal.

City leader Carrie Lam agreed to suspend the bill, but demonstrations have continued. They have now developed to include demands for full democracy and an inquiry into police actions. The clashes between police and activists have been becoming increasingly violent, with police using tear gas and activists storming parliament.

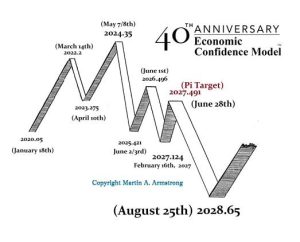

The biggest fears from a financial perspective is that (1) the peg will break, and (2) the financial sector will move quietly to Singapore. This is a very serious issue in Asia for it has been undermining the economy moving into the January low in the Economic Confidence Model.

Miami Real Estate Is About To Collapse…

This is an interesting article and it should be read not for the headline but the concept of real estate in todays time

The problem in todays real estate is Carrying cost

Why are prices dropping? It’s more than simple supply and demand—though the glut of new supply is clearly part of it. Rather, your typical condo has a carrying cost of 4-7% of fair value before financing costs (property tax/condo fees/insurance/maintenance/special assessments/etc). This adds up fast when a property is worth hundreds of thousands or even millions. It is pretty much mathematically impossible to have a positive yield from buying and renting out a Miami condo (trust me, I’ve done the math many times). The only way owning is viable, is if prices go up and allow you to extract capital to fund the carrying costs—though debt service then makes the monthly cash flow even worse. The basic law of Miami condo pricing is that if prices stop going up, they collapse due to the carrying cost. Suddenly, it seems as though a lot of owners are becoming financially distressed—forcing them to hit bids at a time when demand is somewhat lacking.

read full article below

NIFTY technical and global cycle by Neppolian

Some of you might recall a technical view posted on this blog some time back

http://worldoutofwhack.com/2018/10/06/technical-analysis-of-indian-markets/

He was kind enough to give me an update and allowed me to share it with you..

Here’s what Neppolian is looking at:

1. Indian indices, both Nifty and Bankex, are recovering from a good support level of 10 QMA. In my experience the first drop to 10QMA is always bought into and capable of producing a rally with or without any policy measures by the government (in this case a tax rate rationalisation).

2. However, I also note that prior to this rally both the indices had effected a widely followed measure of bear market definition called a “death cross” (50dma closing below 200DMA). This condition still persists even after a 10% rally in the indices. No one seem to be minding it. Any which ways I follow a more longer term measure of death cross (100DMA closing under 200DMA) to signal an onset of a bear market. This is the reason why markets actually rally even after publicly followed death cross settings of 50dma <200DMA condition.

3. Markets have reached the most important area of resistance 11600 in Nifty and 31000 in Bankex….this is the area defined by the election results day (23rd May 2019) gap. Please note that the indices had embarked on the June to September collapse only after falling under this gap post forming an all time highs in the results euphoria. So it is pertinent that the indices must eclipse this level of 11600 and 31000 on a monthly close basis for furthering the positive bias.

4. Even today 66% percent of Nifty constituents are Trading with a conventional death cross of being 50dma <200DMA. On my measure of 100DMA <200DMA 40% of Nifty components qualify. These are weak settings suggestive of a capped upside potential.

5. The ratio line of large cap v/s midcap index, still is tracking in favour of large caps. So a broad based rally may remain elusive till the ratio line decisively shifts in favour of midcap. A bull market in my sense is defined when midcap outperformance rules.

6. However we can remain open for a furtherance of rally to the past all time high of 12100 if the following developments appear:

a. The conventional death cross condition is reversed in both indices ( if 50DMA >200DMA comes true).

b. Midcap outperformance starts

c. In all future correction if any, Nifty holds above 11200.

On the global level, the 20 year cycle top measured from 1999 top to be ending in 2019 is yet to play out. We have 3 more months for this top to be put in. This could happen in the coming 3-6 months in parabolic fashion to seal a top or failing which we can assume that markets may have already topped. A falling USD, which may come true if USD index cracks 92 can give fillip to a commodity fueled /inflationary sympathetic parabolic rally in equities to end this long term cyclical top. Ideally next 3 years from 2020-2022 should be a down cycle for risk assets including equity. When this global down cycle plays out India will follow suit down along with global markets. The only missing piece in global recession possibility is the absence of commodity fueled inflation. Let’s see if it plays out.

Obviously, the big question to ask and answer is whether the cyclical top doesn’t come at all or gets extended in time because of unconventional policies of global central banks. I get asked this question umpteen times in a week. In my experience of cycle studies, of the past 125 years, long term cycles have never failed…they may get extended by a quarter or two but not fail completely.

Even as this cycle is yet to played out globally, indian mid and small cap sectors and some select large caps have clearly seen this cycle effect playing out for the last 18 months. Most midcap and small caps have lost 50-80% of their peak value. I have never seen so many corporations going bust in any of the previous cycles. Nifty holding up higher levels have been a mirage. The pain suffered by mid and small cap portfolios of even well diversified mutual funds have been colossal. I have personally witnessed absolute clueless state of PMs in the past 18 months. The best names have lost. Hope you remember, my 2018 year report highlighting a new proprietary metric that red flagged Indian mid and small cap indices along with Dow being in bubble territory. Rest is personally witnessed by you and me.

In spite of these trying times, I must confess that long term bullish settings (8+ years) remain intact in Indian shores. I feel in the next cyclical bull market to begin from mid 2022, India will hugely outperform global markets as lot of kitchen sinking is done now and the govt policy will continue to press on ethnic cleansing of dirty corporates.

Next cyclical top is likely in 2026 (8 years from 2019) and a much larger cycle top in 2035 (16 years counted from 2019 encompassing two 8 year cycles).

Hope I have given near, medium and long term views here.

Armstrong economics Risk assessment meter on ORANGE alert

Martin writes…..There is a clear rising risk factor emerging from both politics and geopolitics as we move into the January turning point on the Economic Confidence Model. As the economy turns down and as we head into the 2020 presidential elections in the United States, we are facing rising risk factors on many fronts. The Democrats bashed Russia over the 2016 elections, blaming them for releasing Democratic emails that revealed the extent of their corruption. This has increased the tensions with Russia, rekindled the Cold War, and placed us at a far greater risk of war than at any time post-Vietnam.

Liquidity Crisis

via armstrongeconomics

We have a liquidity crisis unfolding because of massive uncertainty. In October, Draghi leaves and Lagarde enters who believes the answer is to eliminate cash. This is causing dollar hoarding and there are more $100 bills in circulation now with 70% of the physical money supply being hoarded OUTSIDE the USA. Even Australia is hunting money aggressively. They are even proposing nano-chips in $50 bills and up to be able to track hoarding. So smart Australian’s won’t hoard A$ – they will use foreign currencies. Dah?

I mean what I say that the central banks are TRAPPED!!!!! People have NO IDEA what we face. The system is unraveling but not even those in government have understood how it was interwoven to begin with. This is all part of how we are headed into a major Monetary Crisis Cycle and I fear they will misunderstand it once again and create more stupid laws that will bring the entire house of cards down by the time we reach 2032.

If you just play out what has taken place in socialism, there will be $400 trillion of unfunded liabilities by the time we get to 2032. That cannot be dealt with and I suspect we will see more authoritarian usurpation down the line. This is also why I have stated, my fear is NOT Trump, it is what comes AFTER Trump!

So buckle up. We are going to witness things many never even thought were possible. This may be the real confrontation between good & evil.

The Dollar shortage and LIQUIDITY crisis

Via armstrongeconomics.com

The NY Federal Reserve announced last week that they will continue their repo operation until October 10th, 2019. The repurchase agreements will amount to up to $75 billion per day. Additionally, they plan to offer three two-week repo operations of up to $30 billion each round.

The constant intervention of the Federal Reserve into the REPO market is the result of a global dollar shortage on a monumental scale. There is a liquidity crisis unfolding as CONFIDENCE is collapsing in Europe and Asia. The Federal Reserve has been intervening into the REPO market in a desperate effort to maintain its lower target on interest rates.

I have been warning that about 70% of physical paper dollars is now circulating outside the USA. There are also now more $100 bills in circulation than $1. With the rising pressure outside the USA to eliminate cash in order to confiscate money from their citizens to support the broadening collapse of socialism, there has been a MAJOR panic pushing into the dollar.

Despite the fact that early in 2019 the headlines were that foreign governments were dumping US debt spinning this into stories that the dollar would crash. In reality, selling of US debt at that point in time was an effort to stop the dollar’s rise. However, as the world economy continues to implode going into the bottom of the business cycle as measured by the Economic Confidence Model, exactly the opposite has been taking place. As of July 2019, the foreign holding of US debt rose to $6,630.5 billion up from July 2018 $6,254.4 billion.

(SEE Fed Data: US Debt Foreign Holding July 2019)

The increase from $6.2 trillion to $6.6 trillion is showing the scramble into dollars even on an official level. As more and more US debt is taken up overseas as a hedge against the rising risk of the punitive sanctions of canceling foreign currencies as Christine Lagarde is preparing to take charge of the European Central Bank in October, the panic into the dollar assets is removing US debt from domestic holdings resulting in a LIQUIDITY CRISIS beyond anything you will find in the traditional economic textbooks.

We invented Capital Flows analysis. We have the only real database tracking capital flows historically. There will be numerous people who will now repeat what is written here as if it were their original analysis. Without a database, it is hard to imagine how they can make such claims since this is NOT based upon opinions or reading news headlines.

So welcome to the new world where economic theories are crumbling before our eyes and falling to the floor as dust in a world that no longer exists. We are entering a new period of reality where whatever you thought was happening may prove to be the opposite.