June 25 – New York Times (Jeanna Smialek): “Jerome H. Powell, chairman of the Federal Reserve, said… that the central bank is weighing whether an interest-rate cut will be needed as trade risks stir economic uncertainty and inflation lags. But he made clear that the institution considers itself independent from the White House and President Trump, who continues to push publicly for a rate cut. Mr. Powell said the case for a rate cut has strengthened somewhat given that economic ‘crosscurrents have re-emerged, with apparent progress on trade turning to greater uncertainty and with incoming data raising renewed concerns about the strength of the global economy.’ But he stopped short of saying a cut was guaranteed, noting that the Fed would continue to watch economic events unfold and would avoid reacting to short-term issues.”

June 24 – Bloomberg (Christopher Condon and Rich Miller): “Federal Reserve Bank of Dallas President Robert Kaplan… sounded a note of caution about cutting interest rates. ‘I am concerned that adding monetary stimulus, at this juncture, would contribute to a build-up of excesses and imbalances in the economy which may ultimately prove to be difficult and painful to manage,’ Kaplan wrote in an essay released by the Dallas Fed.”

June 28 – Bloomberg (Craig Torres and Michael McKee): “It’s too early to know whether policy makers should cut interest rates and whether such a reduction should be a quarter or half percentage point, Federal Reserve Bank of San Francisco President Mary Daly said…”

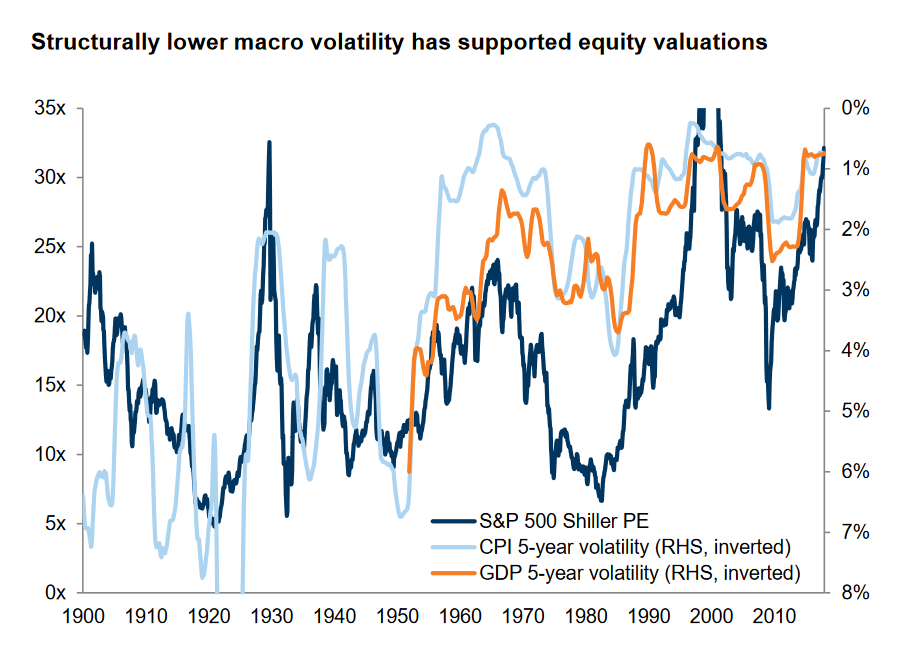

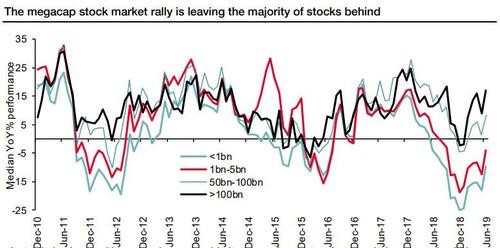

It would be one rather atypical backdrop for commencing monetary stimulus. Fox Business: “Dow Celebrates Best June in 81 years, S&P Best in 64 Years.” USAToday: “Stocks Post Best 1st Half Since 1997.” Newsmax: “Wall Street Soars 18%, Global Stocks Surge $18T in 1st Half.”

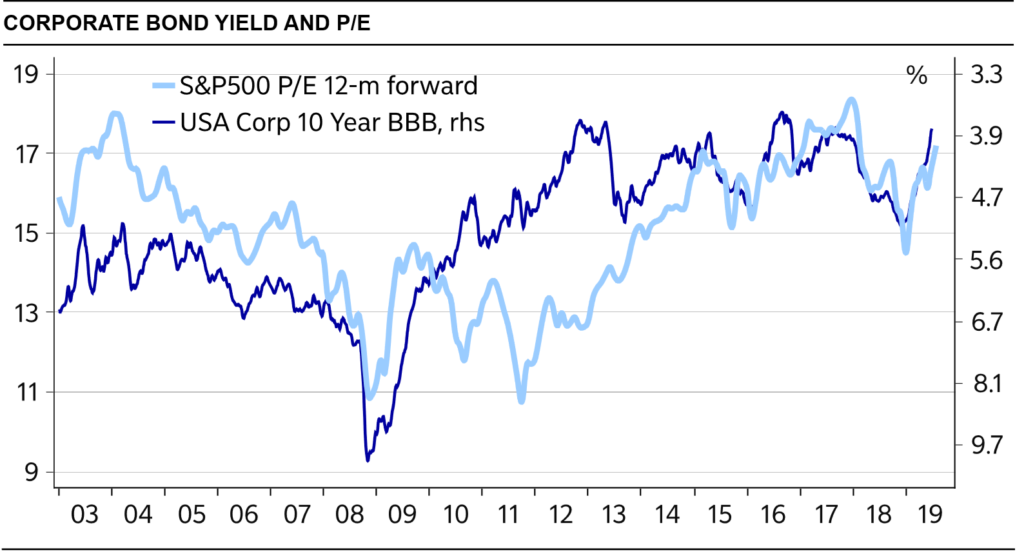

Bloomberg headline (Gowri Gurumurthy): “Junk Sales Hit 21-Month High as Issuers Lock in Lower Rates.” Junk issuance jumped to $28 billion in June, following May’s $26 billion. Year-to-date issuance of $130 billion is running 18% above comparable 2018.

June 28 – Bloomberg (Drew Singer and Vildana Hajric): “For anyone who was anxious that U.S. investors would be bowled over in 2019 by the biggest crush of new listings in more than a decade, some news. You were wrong. So far. Not only has one deal after another surged after pricing, but the market itself has shown no ill effects with billions of dollars of new equity sloshing around. In June alone, as the S&P 500 surged to records, 10 initial public offerings rose by 50% or more in their debut sessions, the most of any month since at least 2008. The average return of 37% is double gains earlier in the year. ‘We’re partying like it’s 1999,’ said Kim Forrest, chief investment officer at Bokeh Capital Management… ‘We’re bringing new companies to the public that we either use or we want to own.’”

According to Axios (using Baker McKenzie data): A total of 62 initial public offerings raised $25 billion during the second quarter, the strongest pace in five years. “Average IPO returns were 30% as Beyond Meat and the tech sector took flight.”

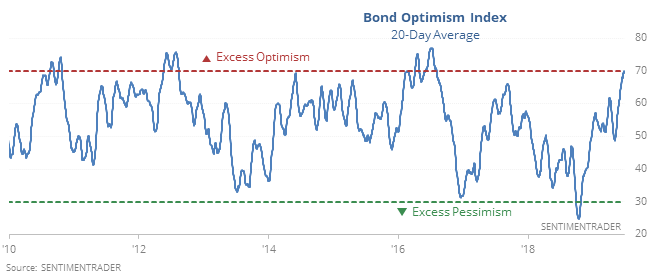

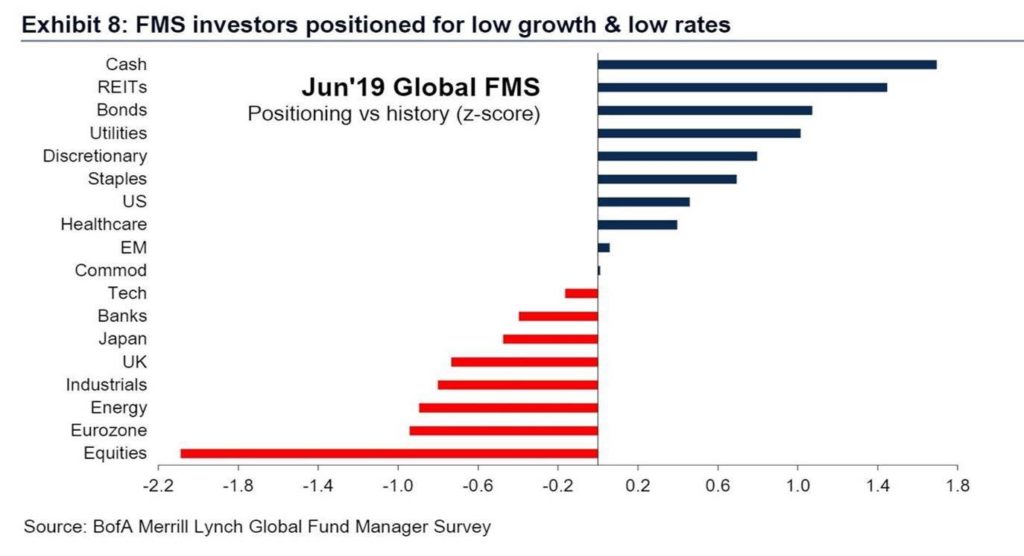

June 25 – Bloomberg (Vildana Hajric and Carolina Wilson): “As the risk of an economic slowdown lingers, exchange-traded fund investors are seeking shelter in bond funds. They’ve poured about $72 billion into fixed-income ETFs this year through June 24, with the funds on track for their biggest first-half inflows ever… Those bets have also fueled assets in the debt strategies to hit an all-time high of nearly $741 billion.”

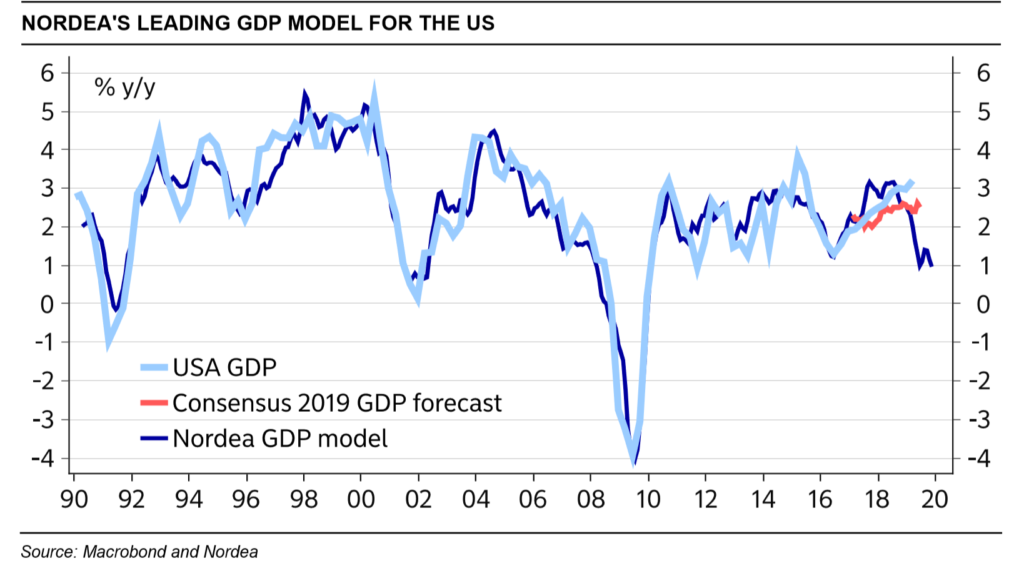

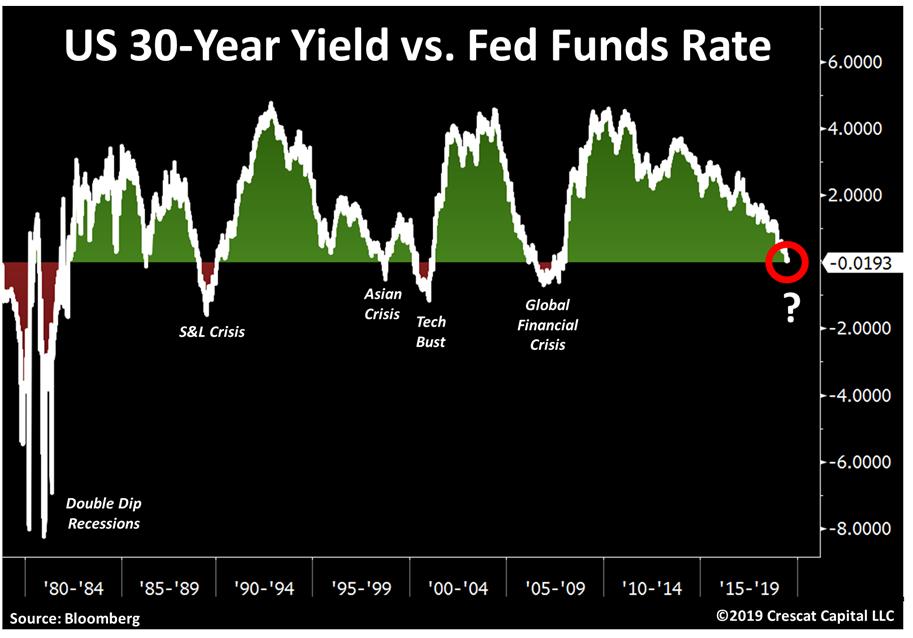

It requires some creativity on the Fed’s part to justify additional monetary stimulus based on domestic conditions (I know, “inflation below target.”). Yet this is much more about global fragility than the U.S. economy. A positive outcome in Osaka would be constructive for sentiment from China to the U.S. Why then do global sovereign yields seem to look past the G20 (while equities can’t seem to shake the giddies)? Why would 10-year Treasury yields end the week down another five bps to (a near 30-month low) 2.00% – in the face of some Fed pushback on imminent rate cuts? How about German bund yields down four bps to a record low negative 0.33%. Swiss yields down to negative 0.58%, and Japanese 10-year yields at negative 0.16%? French 10-year yields turn negative (0.005%) for the first time, with Spanish yields down to only 0.40%.

Why do bond markets at home and abroad have about zero fear of a Trump/Xi agreement with positive ramifications for risk market sentiment and economic prospects (with, seemingly, receding central bank dovishness)? Because, I would posit, the collapse of bond yields is chiefly about unfolding global financial fragilities rather than trade disputes and slower growth. More specifically, faltering Chinese Bubbles significantly raise the likelihood of the type of global de-risking/deleveraging dynamic that would wreak havoc on securities and derivatives markets across the globe.

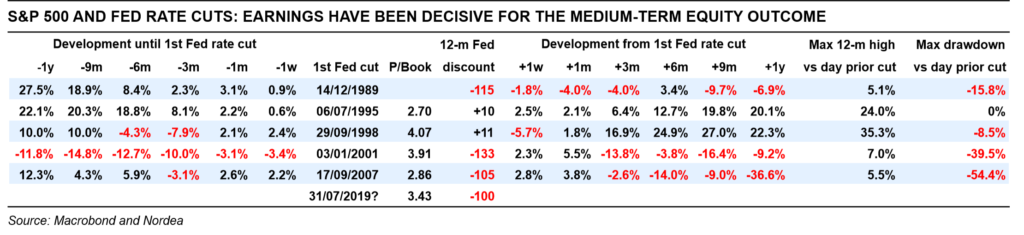

There are key elements of the current environment reminiscent of 2007. Recall that after the initial subprime scare that pushed the S&P500 down to 1,370 in mid-August, the index then rallied back to post a record high 1,576 on October 11th. After a weak November, the S&P500 ended 2007 at 1,475 (returning 5.6% for 2007). Meanwhile, the bond market was having none of it. After trading to 5.30% in mid-June, yields sank 127 bps by year-end (on the way to March’s 3.31% low) despite the widely held view the inconsequential subprime issue was to be quickly relegated to the dustbin of history.

These are two distinct Bubbles – the U.S. “mortgage finance Bubble” and the “global government finance Bubble.” Bond yields collapsed in 2007 in response to an unsustainable financial structure. There were Trillions of mispriced mortgage securities and derivative contracts that, because of egregious late-cycle excesses, were acutely vulnerable to any tightening of finance. Moreover, large quantities of mispriced securities were held on leverage.

“Crazy” end-of-cycle lending, risk intermediation, and speculative excesses became increasingly untenable. The more sophisticated market operators started to reduce exposure to the most suspect instruments. Subprime securities began to lose market value, and the marketplace turned increasingly illiquid. Credit conditions for the marginal (subprime) home buyer tightened significantly, which set in motion deflating home prices, pressure on higher-tier mortgage securities (i.e. “alt A”) and a more systemic tightening of mortgage Credit. What started at the “Periphery” gravitated to the “Core,” with Trillions of mispriced securities, speculative leverage, and ill-conceived derivatives coming under heightened pressure.

Even in the face of the subprime dislocation, the view held that “Washington will never allow a housing bust.” Indeed, the implicit government guarantee of GSE securities was more crucial than ever heading right into the crisis. Agency Securities actually increased a record $905 billion in 2007 (to $7.398 TN), perceived money-like Credit instrumental in sustaining “Terminal Phase” excess.

U.S. Non-Financial Debt expanded $2.478 TN in 2007, accelerating from 2006’s $2.432 TN and 2005’s $2.246 TN. The Credit Bubble was sustained by the combination of market confidence in the implicit federal guarantee of Agency Securities along with prospects for aggressive Federal Reserve stimulus (the Fed cut 50bps in September ’07 and another 25 bps in October and December), along with sinking market yields and lower prime mortgage borrowing costs.

This is where it gets interesting. Rapid Credit growth throughout 2007 underpinned stock prices, general consumer confidence and overall economic activity. Nominal GDP expanded at a 5% rate during 2007’s first half, 4.3% in Q3 and 4.1% during Q4.

Meanwhile, bond yields completely detached from equities and traditional fundamental factors. Why were yields collapsing in the face of booming Credit growth and inflating risk markets? Because the preservation of “Terminal Phase” excess was fomenting a late-cycle parabolic rise in systemic risk: inflating quantities of increasingly risky Credit instruments, dysfunctional risk intermediation, destabilizing market speculation, and extreme late-cycle imbalances/maladjustment. Stated somewhat differently: efforts to sustain the boom were exacerbating structural impairment. The bond market discerned an increasingly untenable situation.

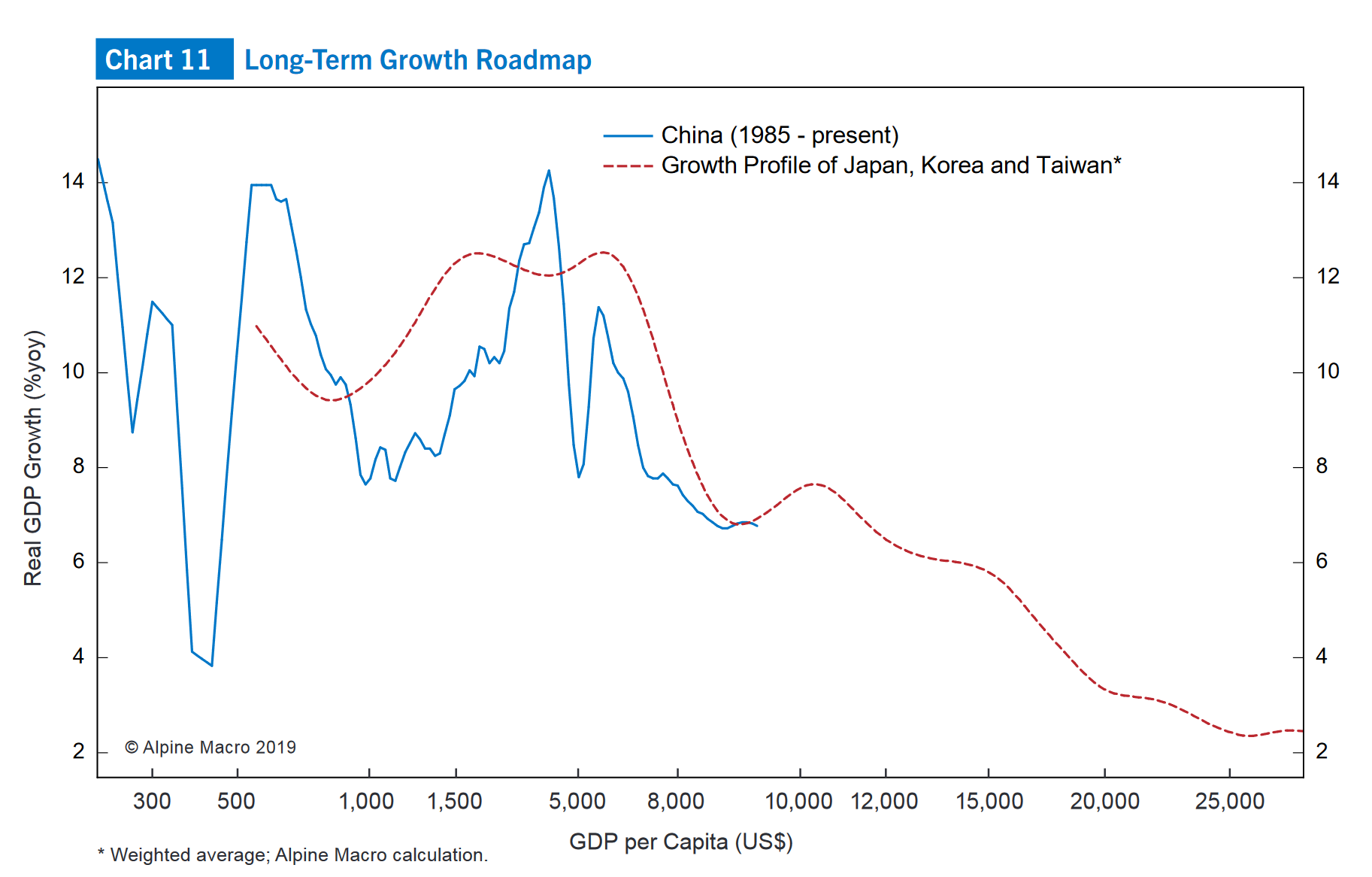

History Rhymes. China’s Aggregate Financing (approx. non-government system Credit growth) jumped $1.60 TN during 2019’s first five months, 31% ahead of comparable 2018 Credit growth. So far this year, Aggregate Financing is expanding at better than 12% annualized. This is a rate of growth sufficient to sustain the economic Bubble (Beijing’s 6.5% growth target), apartment prices, corporate profits, stock prices and general market and economic confidence.

But extending the “Terminal Phase” has ensured a historic parabolic surge in systemic risk. Consumer (chiefly mortgage) borrowings have increased 17.2% over the past year (40% in two years!). Thousands of uneconomic businesses continue to pile on debt. Unprecedented over- and mal-investment runs unabated. Millions more apartments are constructed. The bloated Chinese banking system continues to inflate with loans of rapidly deteriorating quality.

Global risk markets have been conditioned for faith both in Beijing’s endless capacity to sustain the boom and global central bankers’ determination to maintain system liquidity and economic expansion. So long as Chinese Credit keeps flowing at double-digit rates, inflating perceived wealth ensures Chinese spending and finance continue to buoy vulnerable emerging market booms and the global economy more generally. Global risk markets remain more than content.

At this stage, however, global bonds have adopted an altogether different focus: China’s financial and economic structures are untenable. Sustaining rapid Credit growth is increasingly fraught with peril. With market players now questioning Beijing’s implicit guarantee for smaller and mid-sized banks and financial institutions, financial conditions are in the process of tightening at the financial system’s “Periphery.” And tightened Credit conditions have begun to reverberate in the real economy.

And what about the possible impact of a positive G20 and momentum toward a U.S./China trade deal? Stocks, no surprise, are readily excitable. For global safe haven bonds, however, it’s of little consequence. How can this be? Because even a trade deal would at this point have minimal impact on what has become deep and rapidly worsening structural impairment. Trade deal or not, Chinese exports to the U.S. will decline, right along with capital investment. Even with a deal, the Chinese financial system faces the consequences of years of rapid expansion, as economic prospects deteriorate. Sure, 6% growth as far as the eye can see. This implies a further surge in consumer debt and even more dangerous mortgage finance and apartment Bubbles. Unparalleled overcapacity and maladjustment.

Record U.S. stock prices in October 2007 made it easy to dismiss the momentous ramifications associated with subprime borrowers (the “Periphery”) losing access to cheap Credit – to disregard the blow-up of two Bear Stearns structured Credit funds, widening Credit spreads, pockets of market illiquidity, and waning confidence in some sophisticated derivative structures. Acute monetary instability (i.e. equities and $140 crude) was mistaken for resilient bull markets.

I would closely monitor unfolding developments in Chinese Credit – funding issues for small and mid-sized banks; ructions in the money markets; trust issues with repo collateral, inter-banking lending, and counterparties; vulnerabilities in local government financing vehicles (LGFV); heightened concerns for speculative leverage; and the overarching issue of the implicit Beijing guarantee for essentially the entire Chinese financial system. The overarching issue is one of prospective losses of monumental dimensions. These losses will have to be shared in the marketplace. As much as global markets bank on Beijing bankrolling China’s entire financial apparatus, the Chinese government will not welcome the prospect of bankrupting itself.

The solution, of course, is for China to simply inflate its way out of debt trouble – just like everyone else. What an incredibly dangerous myth the world fully bought into. Reflation – in the U.S., China, Europe, Japan and globally – has only inflated the size and scope of Bubbles. China could see $4 TN of new Credit this year – debt of increasingly suspect quality. Such reckless Credit excess is placing the Chinese currency at great risk. It took about 18 months from the initial U.S. subprime blowup to full-fledged financial crisis. While one could certainly argue for earlier (i.e. December), China’s crisis clock began ticking no later than with last month’s takeover of Baoshang Bank.

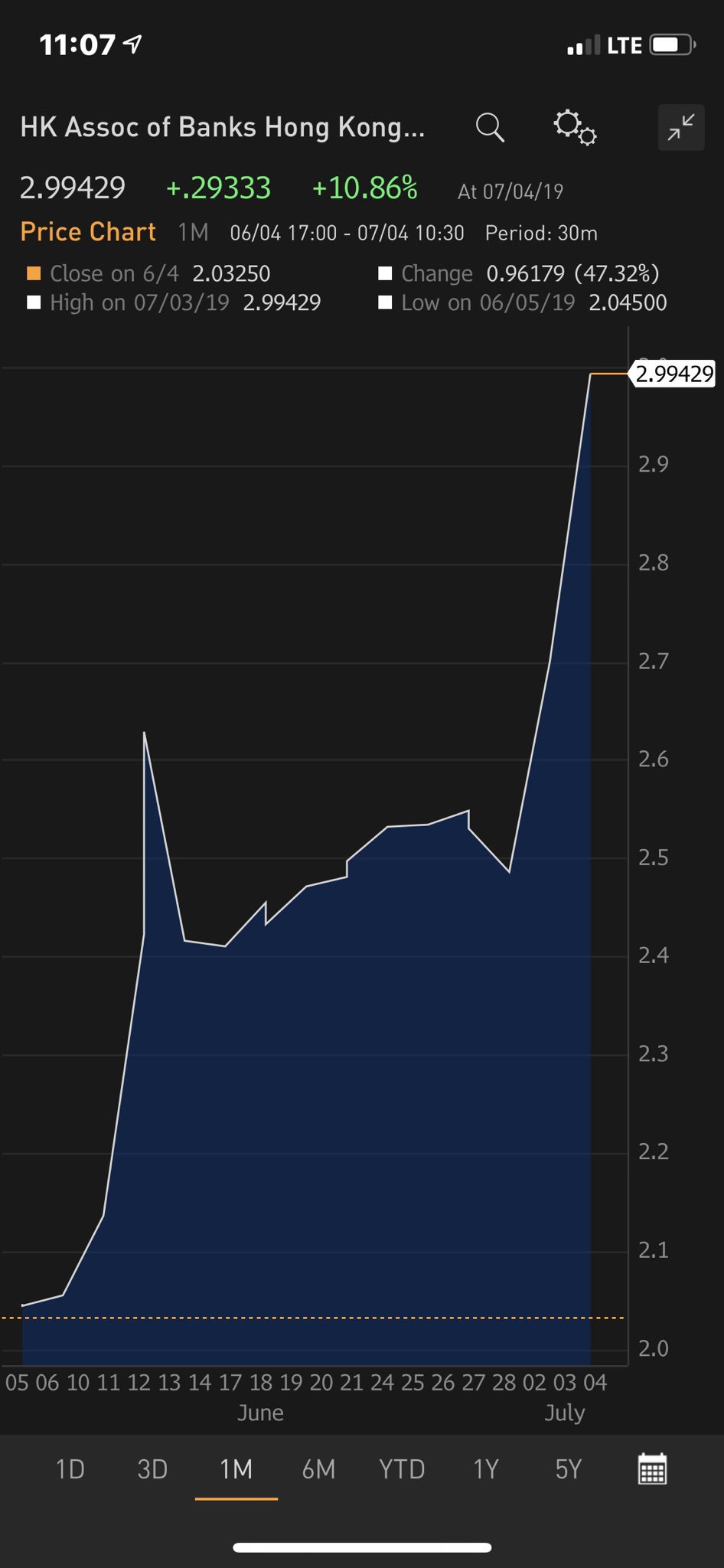

June 27 – Bloomberg: “Almost five weeks after Chinese officials shocked investors by taking over a regional bank, smaller lenders are still struggling with the consequences. Demand for their debt is tumbling. Debt issuance by small banks this month has tanked to a 16-month low. The cost of borrowing is surging. Lenders paid record high premiums on negotiable certificates of deposits — a type of short-term debt that they rely heavily on for funding — relative to bigger peers. While the central bank has injected a net 325 billion yuan ($47bn) into the nation’s financial system last week and lifted the short-term debt quota for big brokerages to ease the crunch affecting smaller banks, the measures have failed to shift investor concerns. The fact that some of Baoshang Bank Co.’s creditors may face losses has driven financial institutions to reassess counterparty risks and become more selective in whom to lend to… ‘Some institutions are mulling making white and black lists for small banks and that will affect credit expansion of those banks,’ said Lv Pin, an analyst with Citic Securities.”

June 24 – Bloomberg: “Liquidity conditions for China’s lenders and its non-banking financial institutions are heading in different directions following the surprise seizure of a bank last month. A measure of cash in the interbank system fell to its lowest close since 2009 on Monday, as the central bank has been providing liquidity to the market to ease concern over credit risks at small and medium-sized banks. That’s just as financial firms like insurers continue to face financing difficulties almost a month after the government takeover of Baoshang Bank Co. The People’s Bank of China injected a net 285 billion yuan ($41.5bn) of funds via open market operations last week, the most since late May. The problem is injections like these have not benefited non-banking firms that rely on corporate debt for funding because bond traders are still worried about counterparty risks. ‘Non-bank financial institutions have been having more difficulty in acquiring capital via negotiable certificates of deposit,’ said Ken Cheung, a senior Asian currency strategist at Mizuho Bank Ltd. ‘Large banks are less heavily affected.’ China’s overnight and seven-day pledged repurchase rates for the overall market rose to as high as 8% and 18.3% on Monday…Those prices indicate what non-bank financial institutions could be paying to get funding. The same rates for lenders were at 0.99% and 2.27%.”

June 26 – Bloomberg: “Investors in China’s local government financing vehicle bonds — the market’s hottest trade earlier this year — have a new risk to consider. At least that’s what yields are signaling, a month after the big jolt from the government’s Baoshang Bank Co. seizure. LGFV notes pay less than company debt because of the assumption that they carry an implied government guarantee, so they should have done relatively better in a risk-averse environment. Instead, borrowing costs for lower-rated LGFVs are rising while yields on corporate bonds are trending lower. It’s another example of the linkages between players in China’s financial system, not all of which are evident on the surface. As small banks struggle to access liquidity amid the Baoshang Bank fallout, that becomes a potential problem for their big borrowers — often weaker LGFVs. ‘As the risk appetite in the market has become quite low, lower rated LGFVs will have difficulties in refinancing and they will come under bigger pressure to repay debt,’ said Liu Yu, a fixed-income analyst with Guosheng Securities Co. ‘The risk of lower rated LGFVs is increasing and some may default on their borrowing through non-standard financing channels.’”

June 25 – Financial Times (Don Weinland and Sherry Fei Ju): “A rare public default at a Chinese trust company is drawing attention to cracks in the Rmb7.9tn ($1.13tn) market for the investment products in the country, where similar failures have been dealt with behind the scenes in the past. Anxin Trust, which missed payments on Rmb11.8bn for 25 trust products earlier this year, has been forced to publicly document its default because, unlike most trusts, it is listed on the Shanghai stock exchange. The situation has offered a rare glimpse into the factors leading up to failed trust products, which for Anxin include giving loans to an acquisitive property group that has since been delisted from a Chinese bourse. The trust company’s shares tumbled more than 9% on Tuesday after it said its parent company’s shares had been frozen by a court in Shanghai.”

June 24 – Bloomberg: “One of the most opaque areas of China’s credit markets involves the practice of companies buying their own bonds. That may soon get a lot tougher, contributing to financing difficulties that are already bedeviling the nation’s policy makers. At issue is a sharp increase in scrutiny by financial institutions of the collateral that their counterparties offer up in the repurchase market, a crucial channel for short-term funding. If the debt sold by issuers that indirectly purchased a portion of their own bonds — which could account for as much as 8% of China’s corporate bonds, according to Citic Securities Co. — is shunned, that will squeeze liquidity for a swathe of the nation’s businesses.”

June 26 – Financial Times (Don Weinland): “Chinese regulators are hitting the brakes on a record surge in US dollar bond sales by local government financing companies despite unprecedented demand for the debt. Local government financing vehicles, which have been used for years by Chinese cities and provinces to raise funds for local infrastructure projects, sold $12.4bn in US dollar bonds in the first half of the year, according to Dealogic, nearly doubling issuance from the same period last year. The boom in debt deals, however, is expected to come to an abrupt end on Friday, after which Chinese regulators are likely to impose stricter rules on the companies.”

http://creditbubblebulletin.blogspot.com/2019/06/weekly-commentary-history-rhymes.html