In this week’s Abundance Insider: Tesla robo-taxis, eco-friendly transparent wood, and Alphabet’s Wing drones get FAA certification.

Read Full post below

https://www.diamandis.com/blog/abundance-insider-apr-26th-2019

Making sense out of Chaos

In this week’s Abundance Insider: Tesla robo-taxis, eco-friendly transparent wood, and Alphabet’s Wing drones get FAA certification.

Read Full post below

https://www.diamandis.com/blog/abundance-insider-apr-26th-2019

There were two completely different sets of news which caught my eye today and since I correlate everything with markets here is what was reported on BBC via Gallup”https://www.bbc.com/news/world-48063982

People around the world are becoming more angry, stressed and worried, according to a new global survey.

Of some 150,000 people interviewed in over 140 countries, a third said they suffered stress, while at least one in five experienced sadness or anger.

The above is supposed to be a news which required Gallup to spend money and tell us the Obvious.

what is news in my view is the following from Michael Harnett of BOFA which writes

“robots outperforming humans; bullish humans are “frustrated” (have not made enough money), “paranoid” (quick to take profits, see China/EM price action this week), “exhausted” by trying to play contrarian in TIPS, value, Europe, banks, “clustered” happily more & more in tech & corporate bonds.”

Frustrated in life and now frustrated in Markets ….Now this completes the picture

By Apra Sharma

Capitalist productivity, now 200+ old, is becoming capitalist financialization. Financialization is profit margin growth without labour productivity growth. Financialization is the zero sum game aspect of capitalism, where profit margin growth is both pulled forward from future real growth and pulled away from current economic risk – taking. Financialization is a global phenomenon. In China, it’s transmitted through real estate market. In US, it’s transmitted through stock market.

According to Stephen G. Cecchetti and Enisse Kharroubi of the Bank for International Settlements, the impact of finance on economic growth is very positive in the early stages of development. But beyond a certain point it becomes negative, because the financial sector competes with other sectors for scarce resources.

Financialization is zombiefication of an economy and oligarchification of a society.

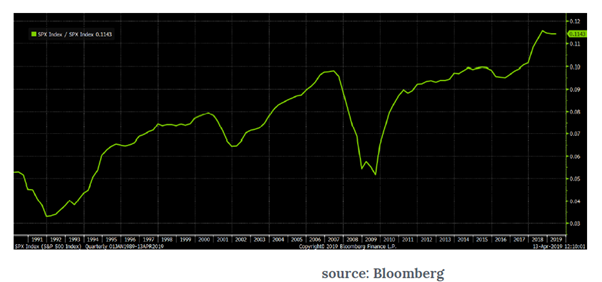

This is a 30-year chart of total S&P 500 earnings divided by total S&P 500 sales. It’s how many pennies of earnings S&P 500 companies get from a dollar of sales, earnings margin, essentially, at a high level of aggregation. So at the lows of 1991, $1 in sales generated a bit more than $0.03 in earnings for the S&P 500. Today in 2019, we are at an all-time high of a bit more than $0.11 in earnings from $1 in sales.

It’s a marvellously steady progression up and to the right, temporarily marred by a recession here and there, but really quite awe-inspiring in its consistency. Yay, capitalism!

It’s a foundational chart because I believe that the WHY of earnings margin growth in the 1990s and early 2000s is fundamentally different than the WHY of earnings margin growth since then.

WHY do we get three times as much in earnings out of a dollar of sales today than we did 30 years ago, and twice as much than we did 10 years ago?

The common knowledge answer is technology!

We can’t exactly say why technology would improve earnings margins and efficiency over the past decade, but we believe it must be technology. Of course it’s technology. Everyone knows that its technology that makes anything in the world more efficient.

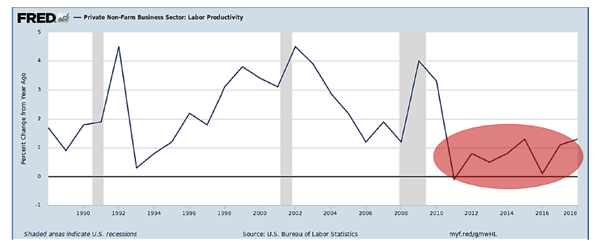

Corporate management was making constant process improvements and technology-based productivity enhancements to squeeze more and more profits out of the same sales dollar. During the 1990s and early 2000s – the so called Great Moderation of the Fed’s Golden Age –we had significant advancements in labour productivity year after year, corporate management was able to drive earnings margins higher. I think the driver of profit margin growth over this period was actual technology.

However, technology and productivity advancements might not be responsible for earnings margin improvements for the past decade.

As Akerlof and Shiller says in Animal Spirits, ‘The United States made the goal clear for itself in Employment Act of 1946: “It is the responsibility of Federal Government…. To use all practicable means… to promote maximum employment, production and purchasing power.”’

Fed was convinced that an easy money policy would lead to corporate management investing more in technology and plant and equipment etc. to drive productivity. Instead, corporate management followed the Zeitgeist.

This is a chart of Labour Productivity growth in the US for the past 30 years. It’s how we generated earnings efficiency and margin growth for the right reasons in the 1990s and early 2000s. It’s how we’ve been reduced to squeezing tax policy and ZIRP-supported balance sheets for earnings efficiency ever since. This chart is the failure of monetary policy for the past decade. This chart is the zombiefication and oligarchification of the US economy.

According to a new report from the International Labour Organization, a United Nations agency, financialization is by far the largest contributor in developed economies. The report estimates that 46 percent of labour’s falling share resulted from financialization, 19 percent from globalization, 10 percent from technological change and 25 percent from institutional factors.

The reason companies aren’t investing more aggressively in plant and equipment and technology is because we have the most accommodative monetary with the easiest money to borrow that corporations have ever seen. No central bank in the developed world is looking to tighten today, and we’re on the cusp of fiscal policies like MMT, or at least trillion dollar deficits forever to accelerate the shift in the modern Zeitgeist towards fiat everything. This is not a mean-reverting phenomenon. This doesn’t get better going forward. It gets worse.

As Ben Hunt says, “I think, as labour is calculated on national incomes and all this is corporate data, in other words the declining share of household income for labour is an effect of financialization, not a cause. If squeezing labour was a cause of profit margin growth, you would see increases in labour productivity. In fact, that’s why productivity number always spikes when recession hits, people get fired.”

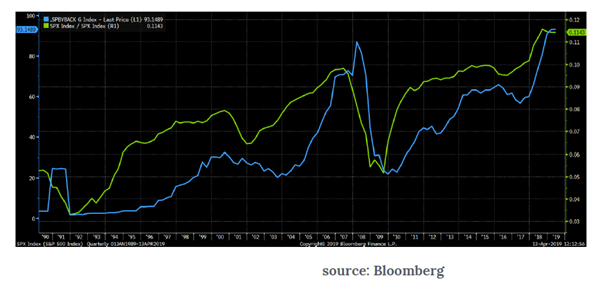

This is a chart of the S&P 500 price-to-earnings ratio in yellow and the price-to-sales ratio in blue.

When we grow profits through productivity growth – when our “supply” of earnings is directly connected to the operations that generate sales – P/E and P/Sales multiples go up and down together. When we extract excess earnings through financialization – when our “supply” of earnings increases for no operational reason connected with sales – the P/E multiple becomes depressed relative to the P/Sales multiple. How many times in the past ten years have you heard that the market is not expensive on a valuation basis? The market narrative of valuation is completely dominated by the vocabulary of earnings, not of sales. Sure, the S&P 500 P/Sales ratio is near an all-time high, but who cares about that? The S&P 500 P/E ratio today is right at 19, neither crazy low nor crazy high and we all care about that. But here’s the thing: Without financialization, my guess is that the S&P 500 P/E ratio today would be 28. Good luck selling that to a value investor, Wall Street.

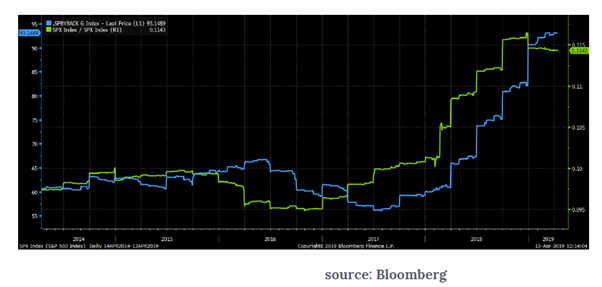

This is a chart of S&P 500 buybacks per share (in blue) imposed over the ratio of S&P 500 earnings-to-sales in green. You’ll see that share buybacks spike afterprofit margins spike. You’ll see that share buybacks spike before and during recessions. When do stock buybacks accelerate dramatically?

In 2006 and 2007, when management is rolling in record profits and profit margins, despite meagre productivity growth.

In 2018 and 2019, when management is rolling in record profits and profit margins, despite meagre productivity growth. This is not an accident. Here’s the past five years so you can see the temporal relationship more clearly.

Stock buybacks are what you do with the excess earnings you’ve made from financialization.

Why? Because stock buybacks are part and parcel of the financialization Zeitgeist. They’re part and parcel of the tax-advantaged issuance of stock to management, which is then converted into tax-advantaged income for management through stock buybacks.

What does Wall Street get out of financialization? A valuation story to sell.

What does management get out of financialization? Stock-based compensation.

What does the Fed get out of financialization? A (very) grateful Wall Street.

What does the White House get out of financialization? Re-election.

What do YOU get out of financialization?

You get to hold up a card that says “Yay, capitalism!”

(reference epsilon theory.. “this is water”)

World trade volume, which had been growing at a strong pace last year, peaking at 5.6% year-over-year growth in October, started turning down in November, and by February — according to the Merchandise World Trade Monitor, released today by CPB Netherlands Bureau for Economic Policy Analysis — it was down 3.4% from the peak in October and down 1.1% from February a year earlier.

The less volatile three-month moving average sank for the fourth month in a row, and is down 2.4% from the October peak and down about 1% from a year earlier. This kind of decline in world trade just hasn’t happened since the Global Financial Crisis:

read more

Some Tit Bits of Christoph Gisiger with legendary investor Howard Marks

Howard Marks, Co-Chairman of Oaktree Capital, cautions about the growing pressure for risky behavior and explains why it’s time to play defense.

Today, many investors are what my late father-in-law used to call «handcuff volunteers». They are doing what they have to do, not what they want to do. In the US, the typical institutional investor, meaning a pension fund or an endowment, needs an annual return rate of 7 to 8% to make the math work. But in a low-return world this is very hard to achieve, and impossible without bearing significant risk. This means that people acknowledge that they have to move out on the risk curve. I see rather that than euphoria.

Attractive investment opportunities arise when you spot some security or some part of the market being ignored and you come to the conclusion that it’s languishing cheap. But today, I don’t think anything is being ignored. Investors are willing to do almost everything.

From 2008 to 2013 there were roughly 80 new credit funds of which 20 were first time funds. But in the last five years, there have been around 320 new credit funds of which more than 80 were first time funds, as I wrote in my September memo. To me, the ability of asset managers to raise first time funds is indicative of risk tolerance on the part of clients. Even though many of these asset managers never managed such an investment vehicle before, they’re offering to learn with the money of their clients.

There is a belief in markets and in managers and thus a willing to take risk. What comes to mind is what I consider the number one investment adage: «What the wise man does in the beginning, the fool does in the end.

Investing is a funny thing because a lot of people think that the long-run is a series of short-runs. Yet, the long-run is a thing in itself: If you aim to pursue superior long-run performance then it doesn’t work to try to accomplish superior short-run performance every year.

The major volatility of the market is the result of fluctuations in psychology: Good news makes people excited and buy. Bad news makes them depressed and sell. But if you get excited when things go well and depressed when things go badly you’ll buy high and sell low, and you are unlikely to have superior results. By definition, your reaction has to be different from that of others.

There are three ways to calibrate your portfolio: Number one is go to cash. But that’s very extreme and easy to be wrong. Number two, you change your asset allocation: bonds rather than stocks, high grade bonds rather than low grade bonds, US rather international markets, developed world rather than emerging markets, large companies rather than small ones, and defensive companies rather than cyclical or growth companies. And then, the third way is to be defensive even within your existing asset allocation, just by shifting to safer approaches and safer managers within your asset classes. It’s challenging today to invest in a low-return, highly priced world. But I think a cautious approach can enable you to access returns even while behaving prudently.

McKinsey report:

“Our latest mobility start-up and investment tally shows the industry invested $120 billion in the last 24 months as it prepares for the years to come”…https://themarketear.com/

Argentina CDS price rise above 1,000 bps, highest in Macri era, as election stokes default fears. Mkts price probability of default at 53.4%… these guys just got a $50 billion bailout last year

Demographics as leader of valuation?

Stocks & sex: “trends in conceptions significantly precede expansions & contractions in the economy… Most noticeably, lows in procreation coincide with stock market lows, not economic lows, which follow shortly thereafter” – Robert Prechter – http://ow.ly/xKtP50rlhr1

Jeffrey Snider writes….

Once you see the whole thing, you can’t unsee it. But therein lies the problem. It is so far out there away from mainstream convention getting anyone to recognize what their eyes are recording is an enormous task. Even when someone happens to uncover, for themselves, a significant piece it is often too unfamiliar to truly appreciate its significance.

In Plato’s Republic, the philosopher tells of his brother being taught by Socrates through the allegory of the cave. Prisoners chained up living forever inside the dark space only perceive the wider outside world via shadows projected upon a blank wall as objects or other people pass by a fire. These inmates even give these shadows names and think of them as real.

They never desire to leave, either. What they know of existence is all they want to know. The shadows suffice for their worldview, having never seen the outside. But once broken out and into the world, the world of observation, they can never go back to the shadows.

Read Full article below

https://www.alhambrapartners.com/2019/04/24/chinas-dollar-problem-comes-out-of-the-shadows/

“An untold future lies ahead, and for the first time, I face it with a sense of hope. For if a machine, a Terminator, can learn the value of human life; maybe we can too.” — Sarah Connor

I was a kid when I first heard this quote, and It was shocking how we could even think of machines having feelings. Even more, it was interesting the idea in that quote referring that human beings don’t appreciate life.

At that moment I wasn’t a big fan of terminator and to be honest I’m still not the biggest follower, yet, that bit of the end of the movie was nailed into my memory even -especially these days- several years after.

Some years after Terminator, the first movie of The Matrix was released and from the very first time, I was hooked into the whole concept, the world, the characters, the problem though never stopped to think about some of the reasoning behind that movie, just thought, “man, that’s cool!”

There was no literal messaging, just the whole concept to me was exciting and in part was what took me interested in programming and to be honest to try to be “different” because, you know, it felt good at that age to be Neo and I’m not going to lie it still does!

I’ve watched The Matrix so many times, but never really thought to myself what it meant to me or how I would connect it to The Terminator until these days.

It has been more than a year that I’ve been commuting to work. Takes me around 30 to 60 min to get there, during which I do some headbanging at the sound of metal music, read tech books or stare at the traffic jams going on the city. One thing I do from time to time is to watch other people behaviors while listening to music, just because sometimes is a good way to keep your mind away from work, to think of something else for a change. One of those days I started experiencing that the more people jumped into the train, the more evident was a particular behavior: Everyone on the train was holding their phones! I was shocked seeing how everyone would go through whatever they were seeing with just barely blinking. The most concerning part to me is I ignored this before because I was looking down to my phone.

You may think, well it’s 2019, it’s been like that for a couple of years now, so what’s the big deal?

One of my objectives for the previous year for me was to be more in contact with the external world. Doing so took me to really notice how bad it is. What I think it is sad, is that from the moment I forced myself to lay down my phone, was the moment I realized how the world looks like, how all these situations deeply connect with movies that date back at least 20 years behind the current times.

It’s more common now that I find myself watching others during commute just because I want to see how smartphones are influencing normal human behaviors. Every day you can see things like people bumping into each other without apologizing. Parents so into their phones that they forget to watch their kids, couples that won’t cross a single word for a whole 30 more min ride and going to touristic places is a bit of a nightmare especially when everyone wants the same selfie to post it to Instagram.

In 2019 we can say there is a fair amount of technological advances in software development, all of them at our reach thanks to our ever-connected smartphones. Apps and tools, in general, are getting smarter to provide more profound or more personalized experiences to users but none of them is even close to creating something so bright that would or could outreason a human being (At least not yet).

Thanks to smartphones, humankind is being alienated of its true nature, and the best part of that is it didn’t require machines to be self-aware, feel or think but a bunch of brilliant, hard-working developers. We are preferring contact through limited voice messages rather than having a real talk. We are interrupting real conversations to read what someone else texted you. We are caring more about the unknown folk cat rather than the friend in front of us looking for advice. We seek to be more connected to people “we care about” creating connections that are meaningless or superficial. We are caring too much about how others see our “perfect” lives, and all this is more accessible thanks to the apps we love and use on our daily basis.

Human beings are a social species by design, and in my opinion, and it’s natural to try and find connections or to look for a tool that makes us socialization simpler. But the way we are “socializing” is not the best way. If we care more about the digital world than the real one, our reality can be easily replaced by an idea that would not necessarily be the truth just only what we want to see. We are digging our own tombs and allowing controlling mechanisms. We are the ones that are creating these situations, and if we don’t change that, we will be seating on chairs with screens on our faces all day (Wall-E?), or is that happening already?

Movies like The Matrix, Terminator or any other film in that genre is they all refer to the times (in a made-up future) where there is a machine take over and we humans are enslaved to their will. Even with a slight difference in their main argument, they all seem to concur to the fact that controlling humans is best for the sake of the world.

The following are the highlights from the minutes of the Apr 2-4 meeting of the Reserve Bank of India’s Monetary Policy Committee, released by the central bank today:

SHAKTIKANTA DAS

===============

* Need to mull rate moves other than 25 bps or multiples

* Appropriate to maintain neutral monetary policy stance

* Bank credit flows to MSMEs remain extremely weak

* High frequency indicators show more loss of growth pace

* Fisc situation at general govt level needs careful vigil

* Inflation has continued to surprise on the downside

* Since Feb policy, seen more weakening of growth impulses

VIRAL ACHARYA

=============

* Feb core inflation “uncomfortably close” to 5.5%

* Would’ve voted for rate cut Apr if MPC hadn’t cut in Feb

* Momentum of crude oil prices cannot be taken lightly

* Oil price pass-through will eventually hit retail prices

* Fiscal steps to tackle farm distress an upside risk to CPI

* MPC not reacting to high core CPI on low food inflation

* Saw some seasonal rise in many food items’ prices in Feb

* Soft food inflation may not persist for long

* This is a “particularly inopportune time” to cut repo rate

* Repo rate of 6.25% may be just “right” to meet 4% CPI aim

* Continuing oil price rise may need some tightening later

* May need some tightening later if vegetable prices rise

* Fiscal impulses would likely require some tightening later

* Only huge collapse in global growth justifies rate cut now

MICHAEL PATRA

=============

* Inflation projection path in Apr down 30-40 bps vs Feb

* Inflation likely to stay below aim over 12-mo horizon

* If CPI aim met durably, some space open for growth focus

* Maintain view that biggest risks to growth are global

* Some global risks to growth are already materialising

* Watchful on likely food price upturn ahead of monsoon

* Monetary policy orientation “overarchingly domestic”

* “Drivers of growth are fading”

* Capacity use in mfg above trend in absence of new invest

* If capex doesn’t pick up, tough to grow at current pace

* Must not waste policy “ammunition” amid GDP-CPI dilemma

CHETAN GHATE

============

* Elevated core inflation continues to be a concern

* Extent of food price disinflation is falling

* RBI CPI forecast for Jan-Mar 2020 “on the lower side”

* See sub-7% GDP growth only in Oct-Mar

* Various RBI surveys don’t depict an economy in collapse

* Competitive populism may jeopardise durability of inflation

* Can create uncertainty with frequent rate, stance changes

PAMI DUA

========

* Vote to cut rate on lower global growth, benign CPI outlook

RAVINDRA DHOLAKIA

=================

* Relation between output, unemployment gap crucial

* Core CPI likely to show sharp decline in coming mos

* Energy prices likely to be subdued for 10-12 mos

* “We need to give a sustained boost to the economy”

* Don’t see CPI breaching 4% aim in foreseeable future

* Cut in CPI forecast gives space to correct real rates

* Post Feb policy, had space for 40-50 bps rate cut

My Two cents

RBI is using all instrument at its disposal to not only ease the LIQUIDITY shortage in the banking system but preparing grounds for a larger rate cut in future. This is no different than what other central bankers are trying to do as fiscal side expansion is not readily available. Government will never take the blame for mismanaged finances and will always lean on central banks (whose independence is now getting questioned) https://fareedzakaria.com/columns/2019/4/18/populist-assault-on-central-banks-could-have-long-lasting-coststo jump start the economy. The recipient of central bank largesse have understood this game and instead of putting this money to use in the real economy, this excess liquidity flows into asset markets creating asset bubbles. Do some forex swaps to add INR liquidity and do some more in the form of Open Market Operations ( indirectly funding government deficit) in the face of rising crude oil and messy govt finances ……. honestly what can go wrong?

Martin Armstrong writes “Nomura’s chief Koji Nagai took over as Nomura’s chief executive back in 2012 and followed that appointment with a $1bn cost-reduction plan that was criticized both externally and internally for failing to target the inefficient divisions of Nomura’s domestic operations in Japan. The latest program will see the company close more than 30 of its 156 domestic retail branches. What is far more interesting is that fact that Mr Nagai has stated that there are macroeconomic “megatrends” that have affected the industry as a whole. He stated that: “There is no liquidity any more so the market is dead because of the central bank’s monetary policy.” Mr Nagai confirmed what I have been stating that “The fixed-income market is dead due to the zero interest rate.”

Both the central bank of Japan and of Europe have destroyed their respective bond markets. Looking forward, we are facing a very dark period when it comes to the ability of governments to continue to function.

He concludes…..This is why the capital flows are going crazy pouring out of Europe into US Equities.