Doug Noland writes……From the global Bubble perspective, it was one extraordinary quarter worthy of chronicling in some detail. The “Everything Rally,” indeed. Markets turned even more highly synchronized – across the globe and across asset classes. As the quarter progressed, it seemingly regressed into a contest of speculative excess between so-called “safe haven” sovereign debt and the Bubbling risk markets. It didn’t really matter – just buy (and lever) whatever central bankers want the marketplace to buy (and lever): financial assets.

March 29 – Bloomberg (Cameron Crise): “While the total return of the S&P 500 is going to end this month roughly 2% below its closing level in September, a 60/40 portfolio of equities and Treasuries is ending March at all-time highs. Even a broader multi-asset portfolio using an aggregate bond index rather than simply govvies is closer to its high watermark than stocks. Similar to equities, balanced portfolios have enjoyed a stunning quarterly return. The broad balanced portfolio mentioned above returned nearly 8%, its best since 2011.”

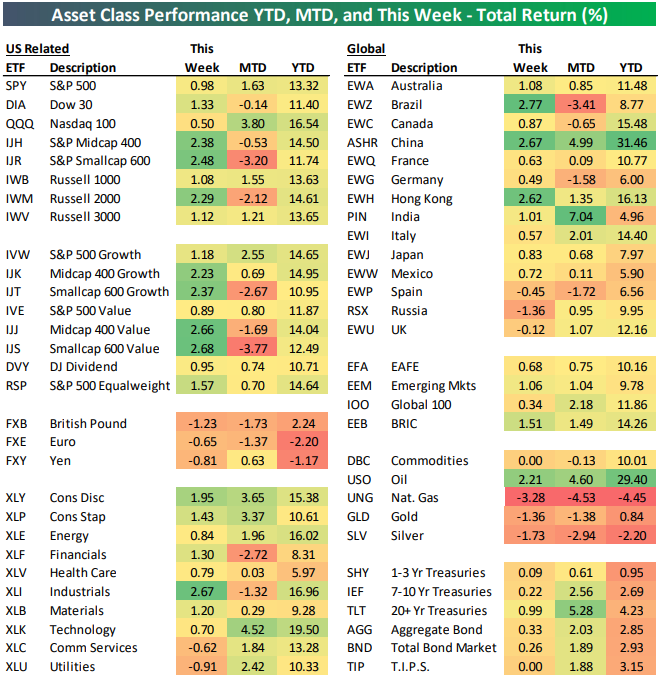

According to Bloomberg (Decile Gutscher and Eddie van der Walt), it was the best FIRST quarter for the S&P500 since 1998 (strongest individual quarter since Q3 2009); for WTI crude since 2002; for U.S. high-yield Credit since 2003; for emerging market dollar bonds since 2012; and for U.S. investment-grade Credit since 1995. According to the Wall Street Journal (Akane Otani), it was the first quarter that all 11 S&P500 sectors posted gains since 2014.

March 29 – Financial Times (Peter Wells, Michael Hunter and Alice Woodhouse): “Driven mostly by Wall Street, global stocks ruled off on their largest quarterly advance since 2010. The climb over the past three months was sealed on Friday on hopes for progress in US-China trade talks that resumed in Beijing, while a rally in sovereign bonds eased. The FTSE All World index has risen 11.4% so far in 2019, its biggest quarterly increase since the September quarter of 2010.”

The S&P500 returned 13.6% for the quarter, a stunning reversal from Q4 – yet almost blasé compared to gains in “high beta”. The Nasdaq100 returned 16.6%. The Nasdaq Industrials rose 15.8%, the Nasdaq Computer Index 18.7%, and the Nasdaq Telecom Index 18.3%. The Semiconductors jumped 20.8%, and the Biotechs rose 21.5%. And let’s not forget Unicorn Fever. Money-losing Lyft now with a market-cap of $22.5 billion. Up north in Canada, equities were up 12.4% for the “best first quarter in 19 years.”

The broader U.S. market gave back some early-period outperformance but posted a big quarter all the same. The S&P400 Midcaps jumped 14.0% and the small cap Russell 2000 rose 14.2%. The average stock (Value Line Arithmetic) gained 14.3% during the quarter. The Bloomberg REITs index rose 15.8%, and the Philadelphia Oil Services Sector Index jumped 17.5%. The Goldman Sachs Most Short Index gained 18.5%.

What conventional analysts fancy as “Goldilocks,” I view as acute Monetary Disorder and resulting distorted and dysfunctional markets. For a decade now, coordinated rate and QE policy has nurtured a globalized liquidity and speculation market dynamic. Securities markets have come to be dominated by an unprecedented global pool of speculative, trend-following and performance-chasing finance. The extraordinary central bank-orchestrated market backdrop has over years incentivized the disregard of risk, in the process spurring the move to ETF and passive management – along with a proliferation of leverage and derivatives strategies.

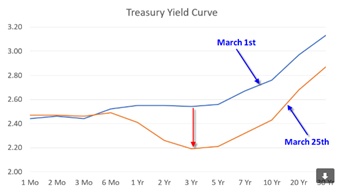

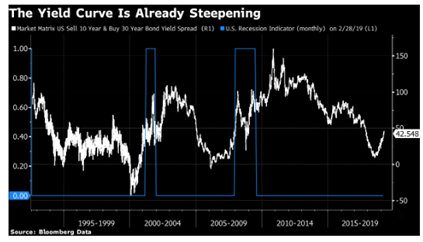

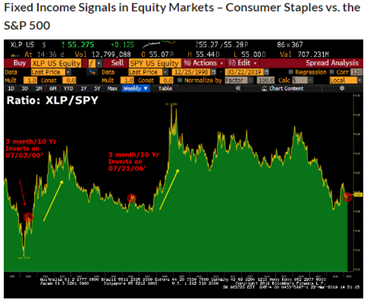

The end of the quarter witnessed the first inverted Treasury yield curve (10-year vs. 3-month) since 2007. Ten-year Treasury yields sank 28 bps to close the quarter at 2.40% vs. three-month T-bills ending March at 2.34% (down 7bps y-t-d). The quarter saw two-year Treasury yields drop 23 bps (2.26%), five-year yields 28 bps (2.23%), and 30-year yields 20 bps (2.81%). Five-year Treasury yields dropped an amazing 28 bps in March alone (10-year down 31bps). German 10-year bund yields dropped 31 bps during the quarter to negative 0.07% – the low since September 2016. Japan’s 10-year government yields fell another eight bps to negative 0.08%. Swiss 10-year yields dropped 13 bps to negative 44 bps.

March 28 – Financial Times (Robert Smith): “The amount of government debt with negative yields rose back above the $10tn mark this week, as central banks abandoned plans to tighten monetary policy. The idea of investing in bonds where you are guaranteed to lose money — if you hold them to maturity — has always seemed paradoxical. But it begins to make sense in a world where you are sure to lose even more money if you stick the cash in a bank. Parking your money in German government bonds, for example, is also safer than trying to stuff millions of euros under your mattress. More puzzling, however, is the negative-yielding corporate bond, a phenomenon that turns the idea of credit risk on its head. Here investors, in effect, pay for the privilege of lending to companies.”

Economic concerns supposedly pressuring sovereign yields much lower apparently didn’t trouble the corporate Credit sector. After starting the year at 88 bps, investment-grade CDS ended March at a six-month low 56 bps. The LQD investment-grade corporate ETF returned 6.18% for the quarter, closing March at a 14-month high. According to Bloomberg, BBB’s (lowest-rated investment-grade) 5.82% gain was the strongest quarterly return since Q3 2009. U.S. high-yield returned 7.04%, the strongest start to a year since 2003. The JNK high-yield EFT returned 8.11%, ending the quarter at a six-month high.

The quarter began with Chairman Powell’s dramatic January 4th dovish “U-Turn.” After raising rates and holding to cautious rate and balance sheet normalization at the December 19th FOMC meeting (in the face of market instability), such efforts were abruptly abandoned. The Fed will soon be winding down the reduction in its holdings, while markets now assume the next rate move(s) will be lower.

It was my view that Chairman Powell was hoping to distance his central bank from the marketplace preoccupation with the “Fed put” market backstop. The Fed’s about face delivered the exact opposite impact. Global markets have become thoroughly convinced that the Fed and global central banking community are as determined as ever to do whatever it takes to safeguard elevated international markets. Moreover, markets have become emboldened by the view that December instability impressed upon central bankers that a prompt wielding of all available powers will be necessary to avert market dislocation and panic.

As such, if markets lead economies and central bankers are to respond immediately to market instability, doesn’t that mean safe haven bonds should rally on the prospect of additional monetary stimulus while risk assets can be bought on the likelihood of ongoing loose “money” and meager economic risk? The Central Bank Everything Rally.

The Draghi ECB, fresh from the December conclusion of its latest QE program, also reversed course – indefinitely postponing any movement away from negative policy rates while reinstituting stimulus measures (Targeted LTRO/long-term refinancing operation). Even the Bank of Japan, permanently cemented to zero rates and balance sheet expansion ($5TN and counting!), suggested it was willing to further ratchet up stimulus. Putting an exclamation mark on the extraordinary global shift, the FOMC came out of their March 20th meeting ready to exceed dovish market expectations – booming markets notwithstanding. Message Received.

The dovish turn from the Fed, ECB and BOJ flung the gates of dovishness wide open: The Bank of England, the Reserve Bank of New Zealand, the Swiss National Bank, etc. The tightening cycle in Asia came to rapid conclusion, with central banks in Taiwan, Philippines, and Indonesia (at the minimum) postponing rate increases.

But it wasn’t only central bankers hard at work. Posting an all-time shortfall in February, the fiscal 2019 U.S. federal deficit after five months ($544bn) ran 40% above the year ago level. But this is surely small potatoes compared to the shift in China, where Beijing has largely abandoned its deleveraging efforts in favor of fiscal and monetary stimulus. After an all-time record January, it will most likely be a record quarter for Chinese Credit growth – monetary stimulus that spurred stock market gains while nursing sickly Chinese financial and economic Bubbles.

The Stimulus Arms Race accompanied intense Chinese/U.S. trade negotiations, in the process emboldening the bullish market view of a Chinese and U.S.-led global recovery. My market gains are bigger than yours. With both sides needing a deal, markets had no qualms with stretched out negotiations.

The Shanghai Composite surged 23.9%. China’s CSI Midcap 200 jumped 33.5%, with the CSI Smallcap 500 up 33.1%. The growth stock ChiNext index surged 35.4%. Underperforming the broader market rally (as financial stocks did globally), the Hang Seng China Financial Index rose 14.2%. Up 33.7%, the Shenzhen Composite Index led global market returns.

Gains for major Asian equities indices included India’s 7.2%, Philippines’ 6.1%, South Korea’s 4.9%, Thailand’s 4.8%, Singapore’s 4.7% and Indonesia’s 4.4%.

Losing 1.9% during the final week of the quarter, Japan’s Nikkei posted a 6.0% Q1 gain. Hong Kong’s Hang Seng index jumped 12.4%, and Taiwan’s TAIEX rose 9.4%. Stocks jumped 9.5% in Australia and 11.7% in New Zealand.

The MSCI Emerging Markets ETF (EEM) gained 9.9%, more than reversing Q4’s 7.6% loss. Gains for Latin American equities indices included Colombia’s 19.8%, Argentina’s 10.5%, Brazil’s 8.6%, Peru’s 9.0% and Mexico’s 3.9%. Eastern Europe equities somewhat lagged other regions. Major indices were up 12.1% in Russia, 9.0% in Romania, 8.9% in Czech Republic, 6.5% in Hungary, 5.4% in Russia and 3.4% in Poland.

It was a big quarter for European equities, with the Euro Stoxx 50 jumping 11.7%. Italy’s MIB gained 16.2% (Italian banks up 12.9%), France’s CAC40 13.1%, Switzerland’s MKT 12.4%, Sweden’s Stockholm 30 10.3%, Portugal’s PSI 11.2%, Germany’s DAX 9.2% and Spain’s IBEX 35 8.2%. Major equities indices were up 17.6% in Greece, 14.1% in Denmark, 12.8% in Belgium, 12.5% in Netherlands, 12.0% in Ireland, 10.8% in Iceland, 10.5% in Austria, 8.5% in Finland and 7.3% in Norway. UK’s FTSE100 rose 8.0%.

Especially as the quarter was coming to an end, the divergent messages being delivered by the safe havens and risk markets somewhat began to weigh on market sentiment. Increasingly, collapsing sovereign yields were raising concerns. U.S. bank stocks were hammered 8.2% in three sessions only two weeks before quarter-end, reducing Q1 gains to 9.1%. Portending a global economy in some serious trouble?

I view the yield backdrop as confirmation of underlying fragilities in global finance – in the acute vulnerability of global Bubbles – stocks, bonds, EM, China Credit, European banks, derivatives, the ETF complex, and global speculative finance more generally. While risk market participants fixate on capturing unbridled short-terms speculative returns, the safe havens see the inevitability of market dislocation, bursting Bubbles and ever more central bank monetary stimulus.

And it wasn’t as if global fragilities receded completely during Q1. The Turkish lira sank almost 6.0% in two late-quarter sessions (March 21/22), with dislocation seeing overnight swap rates spike to 1,000%. Ten-year Turkish government bond yields surged about 300 bps in a week to 18.5%. Turkey CDS jumped 150 bps to 480 bps, heading back towards last summer’s panic highs (560bps). With rapidly dissipating international reserves and huge dollar debt obligations, Turkey is extremely vulnerable. Municipal elections Sunday.

A surge in EM flows gave Turkey’s (and others’) Bubble(s) a new lease on life. But as Turkey sinks so swiftly back into crisis mode, worries begin to seep into some quarters of the marketplace that fragilities and contagion risk may be Lying in Wait just beneath the surface of booming markets. The sovereign rally gathered further momentum, while the risk markets saw lower yields and eager central bankers as ensuring favorable conditions. Yet the more egregious the Everything Rally’s speculative run, the more problematic the inevitable reversal. It should be an interesting second quarter and rest of the year.

Read More

http://creditbubblebulletin.blogspot.com/