How will a US-China trade deal take market share from other countries who sell to China? This is a zero sum game with US being the only winner at the expense of basically everybody else.

Making sense out of Chaos

How will a US-China trade deal take market share from other countries who sell to China? This is a zero sum game with US being the only winner at the expense of basically everybody else.

Bryce Coward writes in Knowledge Leaders Capital Blog…..

With US stocks up 11% YTD and nearly 19% since the Christmas Eve low, one could surmise that the economic slowdown that occurred in the back half of 2018 both globally and in the United States was a thing of the past, or at least would be over soon. After all, the Fed is no longer tightening policy, China has been easing for over a year and expectations for an ECB rate hike keep getting punted further down the line. Yet, we shouldn’t forget that the Fed has done nothing more than alter forward guidance, China’s stimulus appears to be not working as well as it did in the past, and the ECB has few conventional or even semi-conventional policy arrows left in the quiver. Furthermore, and more importantly, the tightening of financial conditions that occurred in 2018 has yet to fully feed through to economic conditions and still has a long way to run. After all, changes in financial conditions are like hangovers in that they only start to be felt by the body (real economy) long after the intoxicant (easing of financial conditions) stops being ingested. Therefore, it’s the changes in financial conditions that happened in the previous 1 to 2 years that we should be paying attention to to get an accurate read on where the economy is headed in the months and quarters ahead. And by changes in financial conditions we simply mean changes in interest rates and measures of credit creation.

Read Full Article Below

The technology is changing dramatically and rapid innovation will mean that the companies and industries that do not understand this phenomenon and more importantly do not invest a significant part of their budgets in R&D will have hard time competing. There is an exciting ETF ( I have written it before also) known as Knowledge Leaders ETF ( KLDW) which invests in these highly innovative companies. Below is a small three minute video link to their presentation.

Indians investors looking to diversify are allowed to invest in this ETF through LRS route.

The market commentary and Some interesting investment ideas with rationale towards the end of Broyhill Asset Management newsletter

http://www.broyhillasset.com/wp-content/uploads/2019/02/The-Broyhill-Letter-2019.02-FINAL.pdf

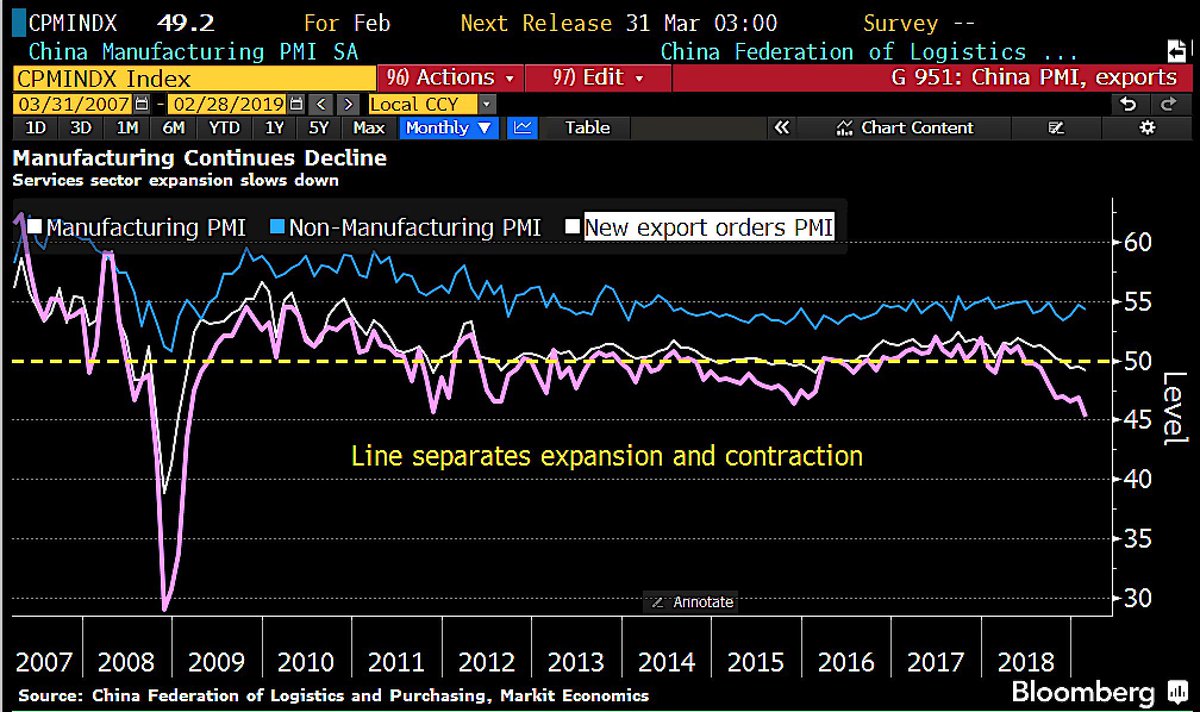

China February factory activity shrinks to 3year low, export orders worst in a decade. https://reut.rs/2EDr83r

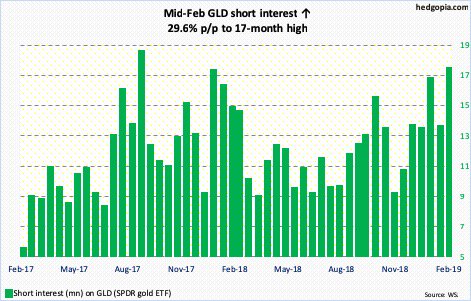

As Gold’s relentless rally from early Oct approaches multiyear resistance, shorts hold ground. Short interest at 17-month high.

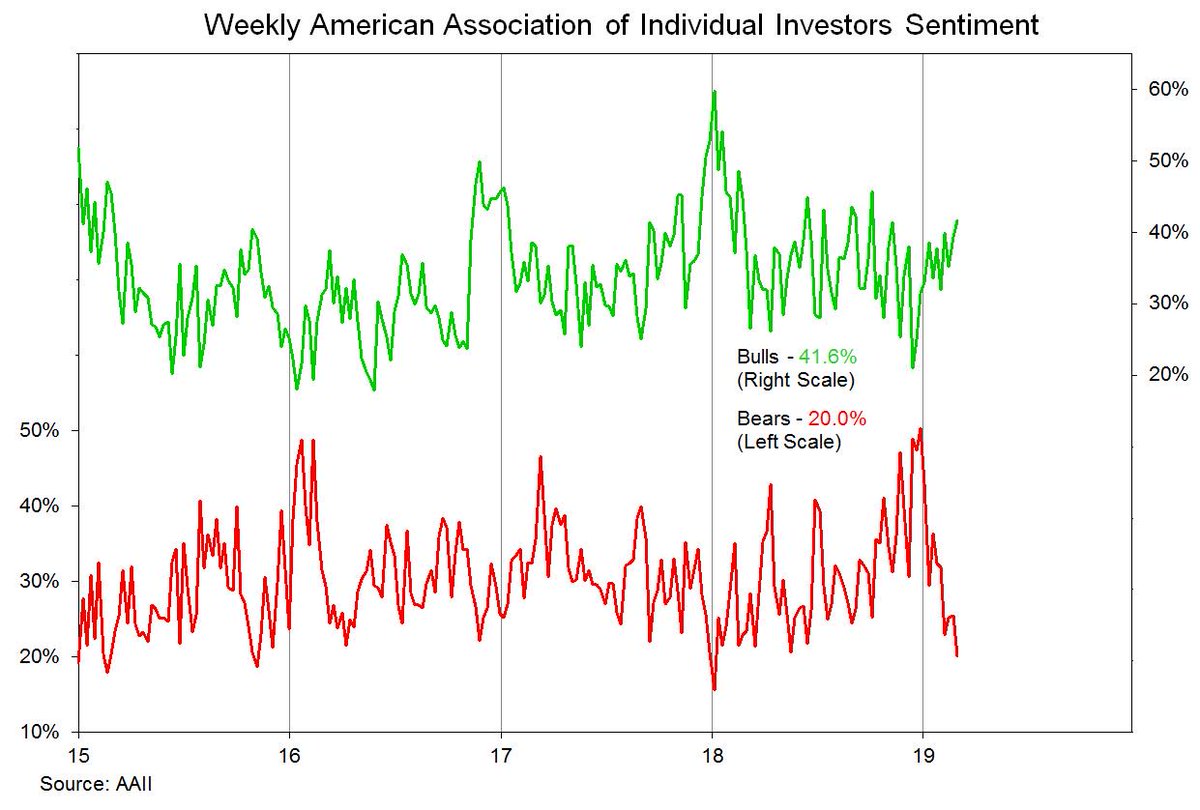

Fear has left the building: AAII bears have fallen from a December peak above 50% to just 20% this week, the lowest level since January 2018.

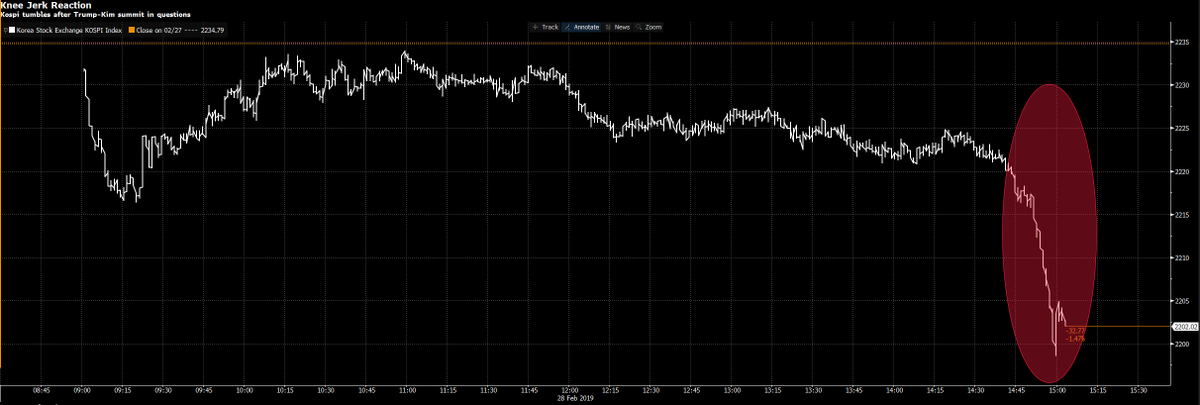

South Korea’s stock market is tumbling as the Kim Jong Un-Trump summit is suddenly thrown into question https://www.bloomberg.com/news/live-blog/2019-02-22/day-two-of-trump-kim-meet-in-vietnam-for-second-historic-summit …

China’s export orders slump –

The concentration Risk

“Never before has the fate of hedge funds turned on so few stocks: According to quarterly filings compiled by Goldman Sachs, the top 10 holdings on average made up 70% of a fund’s long portfolios, the highest since at least 2002” https://www.bloomberg.com/news/articles/2019-02-27/hedge-funds-cool-on-stocks-but-ones-they-like-they-really-like?srnd=premium …

Something is not right

Fed conundrum: the S&P 500 (black) is back to its average level in 2018, but market pricing has swung from 2 hikes on average for 2019 to 20% of a cut (blue) and gone from flat in 2020 to 100% chance of a cut (red). This decoupling from financial conditions is unsustainable…

That did not age well

Just your regular reminder that the Fed cuts rate on average 5 months after their last hike

The estimates keep on getting trimmed

Global economic growth forecasts continue to fall. In the past two months, another cut, led by the Eurozone and Japan.Focus economics

On 26th of February, 2019 Fed’s chair, Powell testified to Senate Banking Committee and indicated an accommodative monetary policy to be in play now on. Well, here is a classic case of efficient markets. Traders had already priced in the decision that Powell announced yesterday i.e. to pause hiking rates and hold balance sheet runoff which made US markets day ending flat(equity market). However, the 10 year treasury yield dropped a little on confirmation that Fed will be buying more Treasuries in future to maintain its Treasury holdings on its balance sheet .

This doesn’t people weren’t thrilled on this news, they instead displayed that they were expecting this and had already (rationally) adjusted the prices. The same thing happened when Trump announcement postponement of tariffs on china. Markets, after opening higher gave away all the gains by day end.

These are classic cases of Buy the rumor and sell the fact.

(with inputs from Apra Sharma)

The correlation between Chinese stocks and CNY is at its highest level in history! This relationship is poised to break. New PBOC stimulus is unlikely to be positive for both stocks and currency. China can’t have its cake and eat it too. Something has to give.

Emerging Market import volumes crashed in December: https://www.topdowncharts.com/single-post/2019/02/26/Emerging-Market-Imports-Crash …

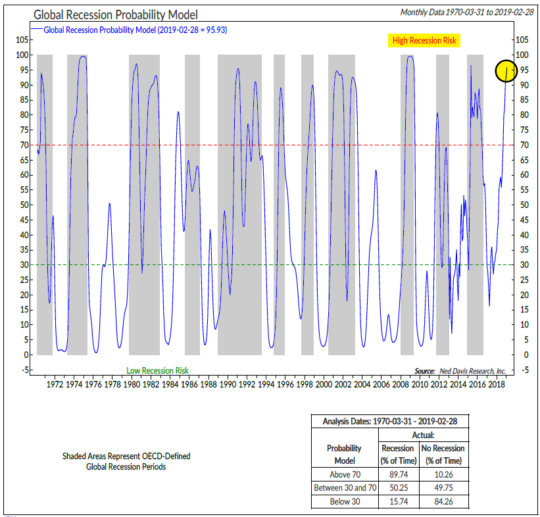

NDR’s Global Recession Probability model almost 96%…

“More chief executives are stepping down from their posts than at any time since the wake of the 2008 financial crisis” https://www.ft.com/content/390a6984-37b1-11e9-b72b-2c7f526ca5d0?segmentid=acee4131-99c2-09d3-a635-873e61754ec6 …

Seriously why would you do that?

The incredibly shrinking US stock market is not an isolated phenomena, we’re seeing the same thing across other developed markets (while capitalization continues to increase) via Bernstein

US Housing starts collapse -10.9%, biggest drop in 8 years

“The most important cause of their pessimism is bad policy and bad leadership,” said Minxin Pei, a professor at Claremont McKenna College in California who is in frequent contact with business figures. “It’s clear to the private businesspeople that the moment the government doesn’t need them, it’ll slaughter them like pigs. This is not a government that respects the law. It can change on a dime.”

Many members of the business elite are unhappy that the leadership’s economic policies favor state-owned enterprises even though the private sector drives growth. They are angry that the party is trying to put a Mao-era ideological straitjacket on an economy driven by private enterprises and young consumers. They are upset that the party eliminated term limits last year, raising the prospect that Mr. Xi could become president for life.

Many businesspeople feel increasingly insecure, especially as some entrepreneurs are “disappeared” by the government to assist in the anticorruption campaigns.

“In the eyes of some senior officials, even people like Jack Ma and Pony Ma are just small-time businessmen,” Mr. Chen said in an interview, referring to the founders of Alibaba and Tencent, two of China’s biggest private enterprises.

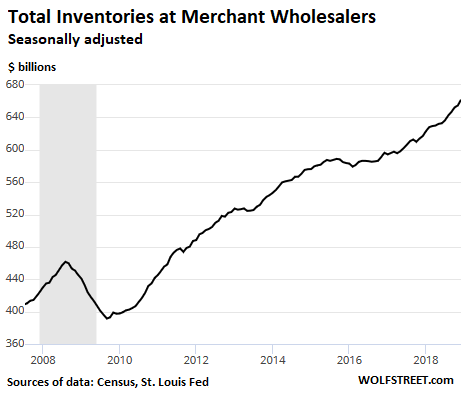

Wolf Richter writes..

Sales at merchant wholesalers (except manufacturers’ sales branches and offices) fell 1% in December 2018, compared to November, to $497.2 billion on a seasonally adjusted basis, and inched up only 1% compared to December 2017, according to the Census Bureau estimates this morning.

But inventories at these wholesalers rose 1.1% from November and jumped 7.3% from December 2017, to $661.8 billion. Over the two-year period through December, inventories have risen 11%. This includes inventories of durable and non-durable goods (we’ll look at them separately in a moment):

https://wolfstreet.com/2019/02/25/inventory-pileup-sounds-alarm-for-goods-based-economy/

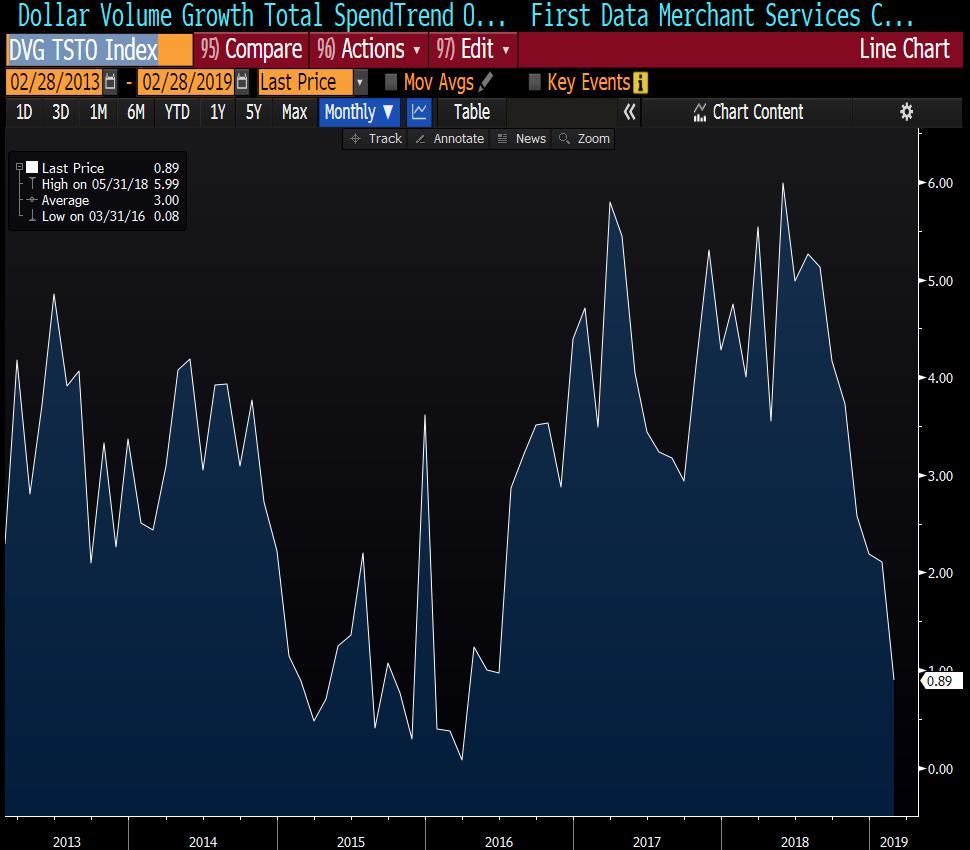

Separately,For everyone that thought the most recent retail sales print was a fluke, January and Feb credit card data still off a cliff.