Daniel Kahneman, a Nobel Memorial Prize-winning behavioral economist, explains

” when people can trust their intuitive judgement and when they should be wary of it.”

“Intuition is defined as knowing without knowing how you know,” he explained. “That’s the wrong definition. Because by that definition, you cannot have the wrong intuition. It presupposes that we know, and there is really a prejudice in favor of intuition. We like intuitions to be right.”

According to Kahneman, a better definition — or a more precise one — would be that “intuition is thinking that you know without knowing why you do.” By this definition, the intuition could be right or it could be wrong, he added.

Because, according to Kahneman, intuition can often be wrong. To show an example of this, Kahneman had the crowd guess the GPA of a college senior he called Julie. He told the crowd one fact about Julie — that she read fluently at a young age — and then asked them to judge how good of a student she had been.

From research, Kahneman, who wrote The New York Times bestseller “Thinking, Fast and Slow,” said that most people guess that Julie has around a 3.7 GPA.

“You might think that this is a good answer,” he said. “It’s a terrible answer. It’s an intuition, and it’s absolutely wrong. If you were to do it statistically, you would do it completely differently. Actually, the age that people read is very little information about what student they will be 20 years later.”

According to Kahneman, this is an example of an intuition that is generated automatically with high confidence, and it’s wrong statistically.

“In general, confidence is a very poor cue to accuracy. Because intuitions come to your mind with considerable confidence and there is no guarantee they’re right.”

There are certain times when intuition can be correct. For instance, Kahneman explained, chess players and married couples generally have accurate intuition.

“Intuitions of master chess players when they look at the board [and make a move], they’re accurate,” he said. “Everybody who’s been married could guess their wife’s or their husband’s mood by one word on the telephone. That’s an intuition and it’s generally very good, and very accurate.”

According to Kahneman, who’s studied when one can trust intuition and when one cannot, there are three conditions that need to be met in order to trust one’s intuition.

The first is that there has to be some regularity in the world that someone can pick up and learn.

“So, chess players certainly have it. Married people certainly have it,” Kahnemen explained.

However, he added, people who pick stocks in the stock market do not have it.

“Because, the stock market is not sufficiently regular to support developing that kind of expert intuition,” he explained.

The second condition for accurate intuition is “a lot of practice,” according to Kahneman.

And the third condition is immediate feedback. Kahneman said that “you have to know almost immediately whether you got it right or got it wrong.”

When those three kinds of conditions are satisfied, people develop expert intuition.

60% of Fortune 1000 companies will be out of business in just next 10 years

I had written about some observation from singularity university almost 18 months back and if you look around then it seems everything is falling in place

The original article below

Singularity University, based in NASA Campus in Silicon Valley is the world’s leading learning-cum-incubator university for innovation and technology set-up in collaboration with NASA, Stanford etc and we had leading Silicon Valley entrepreneurs presenting here including the guy behind Google Maps.

OBSERVATIONS OF VARIOUS SPEAKERS THERE

We are witnessing more disruption in human history over next 10-20 years than what we have seen in the last 20,000 years. Their prediction is that 60% of Fortune 1000 companies will be out of business in just next 10 years.

There is a convergence of exponential development & convergence of technologies and also business models across industries (Blockchain, Artificial Intelligence, Biotech & Genetics, 3D Printing, Solar Energy, Cellular Agriculture etc). These are no longer technologies in the lab, but are already commercialised. So a 10 year old for example will never need to go to college or ever get a driver’s license!

KEY actionable and insights for every business are 1. Organisations built for the 20th Century are destined for failure. Organisations built for efficiency and predictability will fail. They are unable to think and grow exponentially but are predicated on linear growth models. We all come from scarcity mindsets where as the world is moving rapidly to abundance. Ability to rapidly iterate, learn and execute will be required. Today’s 18 year old has the ability to approach the same problem very differently and successfully.

2. People from completely outside the business will end up disrupting these businesses (Zerodha, Alipay did it to broking businesses without any background). Exponential is when you can deliver price-performance which is 10x better – not 20-50% better. There are several areas and technologies where price-performance is doubling every 12-18 months (Moore’s law from Intel days).

3. Everything which is information based will priced at or move quickly to ZERO. They call this “democratisation” of information (We are seeing signs of this in Equity Research, MF Distribution etc).( In the Dec 2016 quarter, there were more than 450 conference calls held by corporate bodies discussing quarterly results, with discussion note available while I remember less than 50 per quarter a decade ago. Institutional Investors with their superior management access will not offer any distinction in investment performance though may suffer from their herd behavior). The sorry state of mutual fund industry in the US is a prime example in front of us.Entrepreneurs will have to work on alternative revenue streams. Huge implications for all businesses. (Zerodha makes money from float rather than commissions,so is Alipay and so will be Paytm ). Move towards building platforms rather than products. (Google, Apple are platforms whereas Blackberry, Yahoo etc were products).

4. Everything is moving to a Service/Subscription model from a Sales model. Rolls Royce has moved to this model for their aircraft engines! They no longer sell engines. They charge for hourly use and provide analytics on actual usage to optimise for their clients.(my monthly subscription for various services just continue to add up)

4. Large organisations cannot change and do not have the time to change.(if you are working for these organisations then this is your warning, get out). There is an immune system response, legacy business becoming a barrier and hierarchical structures where anyone over 30 years of age today has very limited clue as to what is happening to the world which will prevent organisations from rapidly transforming.( get it guys most companies will just not survive ….. have a look at GE or GM)

5. The recommended solution for large organisations is to build teams completely outside their existing business

– which have NO people from existing businesses

– They are given he mandate to build a business model which completely disrupts our own existing business, leveraging these key trends

– to set up a multi-skilled team of 6-7 people which is under 35 years of age, NOT from the existing business or people who are the most willing to challenge status-quo

– Housed independently with no corporate processes at all

– Working on lean startup principles (Design thinking/MVP/Agile)

If such a business turns out to be successful, do NOT bring it back into the Mother organisation. Always keep it independent. In fact, make that the centre of gravity for building new businesses. (Unilever has implemented this globally and 5 of such initiatives/products have become the most profitable of all)

Framework for building Exponential Business Models

Each business needs to drop the vision, mission statement and have a simple Massive Transformational Purpose (MTP) that everyone in the team can understand and aspire to. For example Google has “To organise the world’s information”

Businesses need at lease 4-5 of the following 10 things to create exponential growth.

*S-C-A-L-E & I-D-E-A-S*

S – Staff on Demand (Uber)(How many full-time employees vs Contractors) C – Community & Crowd involvement (Google Maps, Facebook, Quora etc) A – Algorithms (Uber – Matching drivers and passengers, Amazon – recommendations) L – Leverage existing Assets (AirBnB, Uber)(You must never own assets) E – Engagement (Contests, Gamification to driver user engagement)

I – Interfaces (Tech that allows external world to connect seamlessly and easily, example App Store) D – Dashboards (Real-time MIS on key metrics, knowing every key metric in real time) E – Experimentation – (Ability to constantly experiment, iterate and learn) A – Autonomy (How much autonomy to the lowest levels to decide) S – Social (How do you leverage social networks to listen, learn and engage).

Flying Cars Are Closer Than You Think

Flying cars were thought to be coming as soon as four years from now, but actually commercial models are coming up sooner than what had been thought. Air taxi startup Kitty Hawk already has FAA approval to test its prototype in “uncongested areas.” Boeing air taxi prototypes are in the works and the company expects to fly them within one year. German startup Volocopter is planning tests in Singapore next year. Audi and Airbus are testing out a trial run that will soon covert over to a flying car taxi service.

“It’s coming because it has to,” said Robin Lineberger, the leader of Deloitte’s Aerospace & Defense industry practice, over speculation on why major companies are investing heavily in the technology. “We have no more room on the ground to move cars around.”

Audi is conducting tests in South America in cooperation with the Airbus subsidiary Voom. Customers book helicopter flights in Mexico City or Sao Paulo, while an Audi is at the ready for the journey to or from the landing site. It will feed data into its autonomous, electric flying taxi prototype, which was shown taking its first public test flight yesterday at Drone Week in Amsterdam.

In its first public test flight, the Audi and Airbus flight module accurately placed a passenger capsule on the ground module, which then drove from the test grounds in autonomous vehicle mode. It’s expected that as soon as the next decade starts, Audi customers could use a convenient and efficient flying taxi service in large cities. It will operate both in the sky and on the ground, and it being designed around the goals of providing customers with the opportunity to turn drive time into leisure or work time while still in the vehicle.

Audi and several of its global automaker competitors see advanced ride services as the inevitable wave of the future.

“More and more people are moving to cities. And more and more people will be mobile thanks to automation. In future senior citizens, children, and people without a driver’s license will want to use convenient robot taxis. If we succeed in making a smart allocation of traffic between roads and airspace, people and cities can benefit in equal measure,” said Dr. Bernd Martens, Audi board member for sourcing and IT, and president of the Audi subsidiary Italdesign.

Industry watchers and proponents see flying cars becoming part of the global transportation network and generating as much as $5 billion a year in service revenue. It ties in closely to automakers and tech giants investing heavily into automated, electric vehicles expected to soon come to roads.

Autonomous vehicles are expected to face a long phase of dealing with heavy traffic and competition for road space with human-driven cars and trucks. Some analysts see the worsening of urban traffic around the world leading to startups and majors exploring electric scooters as a mobility option.

Air mobility promises to lift vehicles out of clogged streets and quickly over to their destinations. Another incentive thought to be supporting flying cars is the high cost of housing in big cities. Construction projects are common around the world, but it takes these projects years to be completed. It also faces the challenge of mounting political opposition in several cities and dwindling supply of available land.

On the autonomous vehicle side, Waymo, Ford, General Motors, Apple, Uber, and Lyft, are working hard on testing out these vehicles and integrating them into shared ride services for corporations and individual riders. That’s where the concept of “robotaxis” has come from, which has generated a lot of interest and enthusiasm. Younger consumers, in particular, are more interested in having convenient, affordable rides than owning cars.

On the flying car side of the business, aerospace giants like Boeing and Airbus, Silicon Valley icons like Uber, and auto giants like Toyota, Volkswagen, and Daimler are jumping into the market. Jeff Bezos and Amazon are well-known for testing out drone package delivery test projects, which will help foster the technology into the commercial side of the business.

Google co-founder Larry Page has played his part in pushing for the new technology to comet to market. He’s backed a startup called Opener that is scheduled to have its first product on sale next year.

Opener’s first air/land craft, which is called BackFly, is capable of vertical takeoffs and landing. It’s powered entirely from a battery that gets recharged like an electric car. The startup says that BackFly will be capable of a fully autonomous flight, but it’s not clear if that will be ready at the time of its debut.

As ride-hailing giant Uber continues to push its potential 2019 initial public offering, the company sees its Uber Air flying taxi division to be part of its future. Uber has been in discussions with several companies, including Textron’s Bell, in its list of vehicle concepts with partners. The company wants Uber Air to have 60 miles of flying taxi range, so that customers can be airlifted across traffic-congested cities where Uber already has a strong presence.

By Jon LeSage for Oilprice.com

As India Becomes Wealthier, More Indians Leave Its Shores

Indiaspend writes……As India has become wealthier, more of its citizens are leaving its shores.

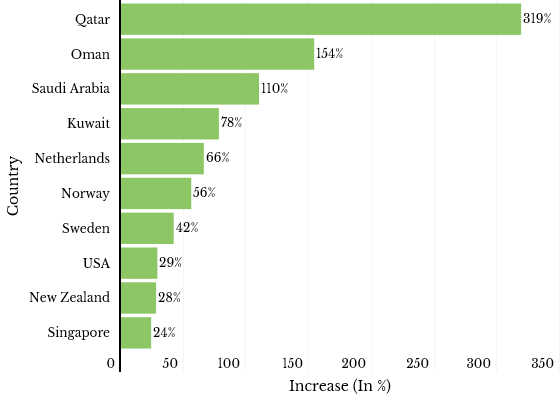

An estimated 17 million Indians were living abroad in 2017, making India the largest source country for international migrants globally, up from 7 million in 1990 and a 143% increase, according to an IndiaSpend analysis of data from the United Nations Department of Economic Affairs.

Over the same period, India’s per capita income increased by 522% (from $1,134 to $7,055), providing more people the means to travel abroad in search of employment opportunities they were not finding at home.

At the same time, the number of unskilled migrants leaving the country has been falling: An estimated 391,000 left India in 2017, almost half the number in 2011 (637,000), according to a new report by the Asian Development Bank (ADB).

However this does not necessarily mean that an increasing proportion of India’s emigrants are likely to be higher skilled or that policymakers should be worried about a rise in ‘brain drain’–the exodus of highly trained professionals from their native country.

read full article

https://www.indiaspend.com/as-india-becomes-wealthier-more-indians-leave-its-shores/

why you need space in LIFE

Siddharth Rastogi of Ambit writes is his usual Philosophical way “The single objective of humans is to make progress. Progress is nothing but achieving the state of happiness. If you have achieved moments of happiness, you start longing for it to last… not just for a few minutes or hours but forever.

The ultimate objective of humans is to attain a constant and irreversible feeling of contentment. Some name it success, some security while others may call it opulence.

But what does HAPPINESS actually mean?

And when someone tells you that he or she is trying to achieve that feeling of eternal happiness, what is he or she trying to convey?

Happiness is a state of the mind, body and soul where one is in equilibrium with the current environment. You are in a happy space and desire that this feeling lasts till perpetuity.

There are three kinds of spaces mortals seek:

· Physical

· Mental

· Higher consciousness

All three are in the order of preference each one of us strives for unless someone is born differently with supernatural or extraordinary consciousness. The irony is, as one tends to work towards a lower level of space the higher one or the one next in order diminishes disproportionately at a higher speed.

Let me elaborate with a simple example. To seek happiness, you try and seek a bigger place to live in, a bigger car to drive, a higher bank balance to secure your future and that of your near and dear ones. In this endeavor, you start engaging yourself in a multitude of things. As you progress with a lot more objectives, your mental space gets reduced for achieving enjoyment and happiness because of all your paraphernalia. The consequence of this is that you are not able to stay long on the act which you actually love doing as other apparatus seek your time and attention.

Similarly, for a man who wishes to become the master of everything, he ends up reading and absorbing more of everything, gaining more knowledge temporarily but giving up happiness in the process.

Another disadvantage of seeking more is an increase in choices. As one desires to achieve more, get more, acquire more, he is hit with even more to choose from. The interesting part here is that Higher Choices are inversely proportionate to the happiness and contentment quotient.

As one gets more choices, the distance between the best and the second best gets reduced. Even when one chooses the best option, he feels let down that the choice he made is not as good as the one he left, thus casting doubts on his or her abilities and reducing happiness. Also, with more choices, one needs to keep evaluating those choices; this takes away more space, leading to more indecisiveness and more dissatisfaction.

The same philosophy applies to Investments as well.

People tend to invest their money beyond the subjects they are passionate about as they believe what has worked for someone else might work for them too. Nobody is alike, we are all different. Given the same surrounding, same environment and same prospects, two people will have different expectations from each investment and a different perception of each investment.

For example 3 people investing in a startup at the same time might have different objectives. One person might have borrowed some money to invest, so that he can get rich faster and has a huge appetite for risk. Another might be the friend of the promoter who has seen him successful in the past and believes that this can be a multi-bagger. A third one might have sprayed some money to keep a tab on the sector or innovation as his business might get impacted if this startup changes the way business is done.

The key for an investment to succeed is to evaluate businesses or opportunities in which one has thorough knowledge and, more important, interest to learn and grow with it. Peripheral interest and knowhow will only lead to more cluttering of space, whether physical or mental, thereby leading to more dissatisfaction.

Hence, whenever in doubt remember the key words of Life and Space

“The need for MORE often results in a Life of LESS”

Framework for Monitoring Financial Stability

Doug Noland dissects the financial market is his own unique way in credit bubble bulletin …

Upon the public release of Jerome Powell’s Wednesday speech, came the Bloomberg headline: “Powell: No Preset Policy Path, Rates ‘Just Below’ Neutral Range.” When the Fed Chairman began his presentation to the New York Economic Club just minutes later, the Dow had already surged 460 points. From Powell’s prepared comments: “Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth.” When he read his speech, he used “range,” as opposed to “broad range” of estimates.

Equities responded to the Chairman’s seeming dovish transformation with jubilation (and quite a short squeeze). It certainly appeared a far cry from, “We may go past neutral, but we’re a long way from neutral at this point, probably,” back on the third of October. Powell’s choice of language was viewed consistent with the ‘much closer’ to the neutral level, as headlines ascribed to vice chair Richard Clarida. What he actually said in Tuesday’s speech: “Although the real federal funds rate today is just below the range of longer-run estimates presented in the September [Summary of Economic Projections], it is much closer to the vicinity of r* than it was when the FOMC started to remove accommodation in December 2015. How close is a matter of judgment, and there is a range of views on the FOMC.”

The “neutral rate” framework is problematic. Back in early October, the Fed was almost three years into a “tightening” cycle (first rate increase in December 2015). Yet the Atlanta Fed GDP Forecast was signaling 4% growth; consumer confidence was near decade highs; manufacturing indices were near multi-year highs; corporate Credit conditions remained quite loose; and WTI crude had just surpassed $75 a barrel. The S&P500 traded only fractionally below record highs in the hours before Powell’s evening of October 3rd “long way from neutral…” With unemployment at (a multi-decade low) 3.7% and CPI up 2.3% y-o-y, there was a reasonable case at the time that significantly higher interest rates would be necessary for policy to reach some so-called “neutral rate.”

In our age of speculative financial markets dictating overall financial conditions, major backdrop shifts unfold in spans of days and weeks. The S&P500 dropped about 10% from early-October highs, while corporate Credit conditions tightened meaningfully. The Atlanta Fed GDP forecast has dropped to 2.6%. Consumer confidence has weakened, and housing has slowed. WTI is trading near $50, down about one-third from early-October. One could argue the so-called “neutral rate” has collapsed in recent weeks. Did it jump, along with hyper-volatile stocks, this week?

I’m not taking exception with the market’s view of a more dovish Fed. Of course, they are going to turn more cautious in the face of a significant tightening of financial conditions. At the same time, I expect they’ll be keen to jump back on the normalization track if markets rally and financial conditions loosen. When the Fed says “data dependent,” I would read “market dependent.” Market conditions will lead the data. The substance of both Powell and Clarida’s presentations were more balanced than dovish.

Powell’s Wednesday presentation was titled, “The Federal Reserve’s Framework for Monitoring Financial Stability” (with a reference to Hyman Minsky!). The Fed’s introductory Financial Stability Report had been published the previous day. “This report summarizes the Federal Reserve Board’s framework for assessing the resilience of the U.S. financial system and presents the Board’s current assessment. By publishing this report, the Board intends to promote public understanding and increase transparency and accountability for the Federal Reserve’s views on this topic. Promoting financial stability is a key element in meeting the Federal Reserve’s dual mandate for monetary policy regarding full employment and stable prices.”

I appreciate the Fed’s attention to financial stability, stating explicitly the central role it plays within its broader mandate. Powell’s speech offered a definition of “financial stability:” “A stable financial system is one that continues to function effectively even in severely adverse conditions. A stable system meets the borrowing and investment needs of households and businesses despite economic turbulence. An unstable system, in contrast, may amplify turbulence and prolong economic hardship in the face of stress by failing to provide these essential services when they are needed most.”

It’s a commendable effort to craft such complex subject matter into a characterization accessible to the general public. However, I would broadly argue that unfettered contemporary finance – dominated by securities markets, derivatives and speculative trading – is an “unstable system.” Conditions will gravitate to excessive looseness during booms, only to tightened dramatically come the inevitable eruption of “risk off.” The monetary policy approach that evolved from serial boom and bust dynamics has been to backstop marketplace liquidity, while assuring participants that central banks will respond aggressively in the event of market or economic instability. By extending boom phases, this policy doctrine has created the allusion of stability for an innately unstable system.

Significant thought and effort went into crafting the Fed’s 37-page document. It is full of important data and insight. And, from my perspective, it as well illuminates key holes in the Fed’s approach to monitoring financial stability. There’s certainly a “generals fighting the last war” predisposition embedded within the Fed’s analytical framework.

The Fed’s “framework focuses primarily on monitoring vulnerabilities and emphasizes four broad categories based on research:” “Elevated Valuation Pressure;” “Excessive Borrowing by Businesses and Households;” “Excessive Leverage in the Financial Sector;” and “Funding Risks.”

The Fed’s current “financial stability” framework would have been generally suitable for the previous “tech” and “mortgage finance” Bubbles. These periods were characterized by major expansions in corporate debt, household borrowings and U.S. financial sector leverage, with financial intermediaries issuing huge quantities of perceived safe short-term liabilities to finance increasingly risky long-term assets.

Today’s “global government finance Bubble” has markedly different dynamics. Most consequential, rapid expansion and leverage have characterized government and central bank balance sheets – across the globe. The U.S. cycle, in particular, has experienced an extraordinary expansion of government borrowings. After ending 2007 at $6.051 TN, outstanding Treasury debt expanded 182%, to end June at $17.091 TN. Treasury debt growth is now projected to surpass $1.0 TN annually for the foreseeable future.

For this cycle, traditional analysis of household and corporate balance sheets will underrate systemic risk. The problematic balance sheet expansion has been in the government sector, debt growth that has worked to this point to bolster household and corporate finances. The federal borrowing and spending boom has inflated Household incomes, while inflating Corporate sector profits. Nonetheless, according to the report, “After growing faster than GDP through most of the current expansion, total business-sector debt relative to GDP stands at a historically high level.”

Traditional analysis has also been distorted by the past decade’s extraordinary monetary policy backdrop. Low rates and QE (growth in central bank liabilities) significantly reduced debt service costs (slowing household debt growth), while dramatically inflating Household Net Worth (Net Worth up 80% since the crisis to a record $107 TN). For the Corporate sector, unprecedented loose finance reduced debt service and the overall growth in corporate borrowings, while providing inexpensive finance for stock buybacks, M&A and easy EPS growth. QE-related liquidity was funneled into corporate coffers already bloated from enormous federal deficit spending.

With ongoing extraordinarily low market yields and federal deficits, I would argue that traditional valuation metrics will also understate systemic vulnerabilities. The previous crisis illuminated how quickly a perceived sustainable profit boom can implode spectacularly. Fed analysis has stock market valuation on the high-end of the historical range. I would argue that today’s inflated profits are unsustainable and extremely vulnerable to the downside of a phenomenal cycle.

Ignoring the federal government balance sheet is a critical shortcoming of the Federal Reserve’s “financial stability” framework. Fed officials would surely prefer to stay clear of fiscal politics, but the harsh reality is that monetary policy promoted unprecedented debt issuance and a tolerance for fiscal irresponsibility that has run unabated throughout a protracted economic boom. Treasury yields remain extraordinarily low in the face of a rapid deterioration in the Treasury’s Credit profile. The report also didn’t address potential financial stability issues associated with the scantly-capitalized government-sponsored enterprises and their almost $9.0 TN of outstanding agency (debt and MBS) securities. A spike in yields – a scenario not to be dismissed considering the risk trajectory of Treasury and agency obligations – would have a momentous impact on U.S. and global financial stability.

The Fed’s analysis of “leverage in the financial sector” is interesting, especially considering their own balance sheet provided much of the leverage for this cycle. “Leverage at financial firms is low relative to historical standards…” “A greater amount and a higher quality of capital improve the ability of banks to bear losses…” “Capital levels at broker-dealers have also increased substantially relative to pre-crisis levels, and major insurance companies have strengthened their financial positions since the crisis.”

The Fed then turns nebulous. “…Some indicators suggest that hedge fund leverage is as post-crisis highs.” “Several indicators suggest hedge fund leverage has been increasing over the past two years.”

Our central bank (along with others) doesn’t have a good handle on speculative leverage. They place hedge fund “total assets” at $7.27 TN, having expanded 13.5% over the most recent year (2017). “A comprehensive measure that incorporates margin loans, repurchase agreements (repos), and derivatives-but is only available with a significant time lag-suggests that average hedge fund leverage has risen by about one-third over the course of 2016 and 2017.” “The increased use of leverage by hedge funds exposes their counterparties to risks and raises the possibility that adverse shocks would result in forced asset sales by hedge funds that could exacerbate price declines.”

Without a well-defined and comprehensive analysis of global speculative finance, an insightful appraisal of financial stability will remain forever elusive. There are questions fundamental to gauging financial stability. Rest of World (from the Fed’s Z.1) holdings of U.S. financial assets have more than doubled since the end of 2008 to $27.5 TN. U.S. Debt Securities holdings were up 55% to $11.252 TN. How much foreign-sourced leverage has been behind the enormous flows into U.S. securities and financial assets – speculative, financial sector and central bank leverage? How vulnerable is global dollar liquidity to a bout of “risk off” speculative deleveraging? How vulnerable are inflated U.S. asset markets to the end of global QE and the deleveraging of central bank balance sheets (i.e. EM central banks selling U.S. securities to support faltering local currencies)?

The Fed’s financial stability report touches on global risks, including Brexit, Europe, dollar-denominated EM debt and China. But I would argue that the U.S. economy and markets are more susceptible to global forces today than ever before. It’s difficult to envisage a scenario of a bursting Chinese Bubble and faltering EM and Europe that doesn’t have profound consequences for U.S. financial stability. Global fragilities alone pose great systemic risk for the U.S. Combined with our stock market and asset Bubbles, escalating fiscal risk, corporate Credit vulnerability and deep structural economic maladjustment, the prognosis for financial stability is dire.

The Fed’s fourth broad category is “Funding Risk.” “A measure of the total amount of liabilities that are most vulnerable to runs, including those issued by nonbanks, is relatively low.” I don’t disagree that “bank funding is less susceptible to runs now than in the period leading up to the financial crisis.” “An aggregate measure of private short-term, whole- sale, and uninsured instruments that could be prone to runs-a measure that includes repos, commercial paper, money funds, uninsured bank deposits, and other forms of short-term debt-currently stands at $13 trillion, significantly lower than its peak at the start of the financial crisis.”

But… “Total assets under management in corporate bond mutual funds and loan mutual funds have more than doubled in the past decade to over $2 trillion… The mismatch between the ability of investors in open-end bond or loan mutual funds to redeem shares daily and the longer time often required to sell corporate bonds or loans creates, in principle, conditions that can lead to runs, although widespread runs on mutual funds other than money market funds have not materialized during past episodes of stress.”

Throughout this Bubble period, I have referred to the “Moneyness of Risk Assets.” A “run” on money-like Credit instruments sparked the collapse of the mortgage finance Bubble. Runs unfold when holders of perceived safe and liquid instruments suddenly recognize risk is much greater than previously appreciated. Past crises have typically originated in the money markets. But never have central bank and government policies so fostered the perception of safety and liquidity (“moneyness”) for risk assets – equities and corporate Credit, in particular. I would argue the proliferation and massive growth of index fund products poses a major risk to financial stability. And when it comes to policy-induced distortions, already extraordinary risks to financial stability are only compounded by the proliferation and growth of derivative trading strategies, both retail and institutional.

One might ponder the notion of financial stability when the S&P500 sinks 3.8% one week and then rallies 4.8% the next. Expectations are now high that the Fed will be soon winding down “normalization,” and that President Trump is hankering to strike a deal with the Chinese. Should be an interesting weekend. It was an interesting market rally – or lack of a rally in corporate Credit. Leveraged loans had a notably poor week. High yield debt remains suspect with crude at $50. Weak link GE was notably weak in the face of market strength. And while dollar weakness stoked the short squeeze in EM, the Shanghai Composite struggled to end the week little changed. Moreover, seeing German bund yields decline another three bps (to 0.31%) hardly conjures bullish imagery. Financial Instability.

Read full article below

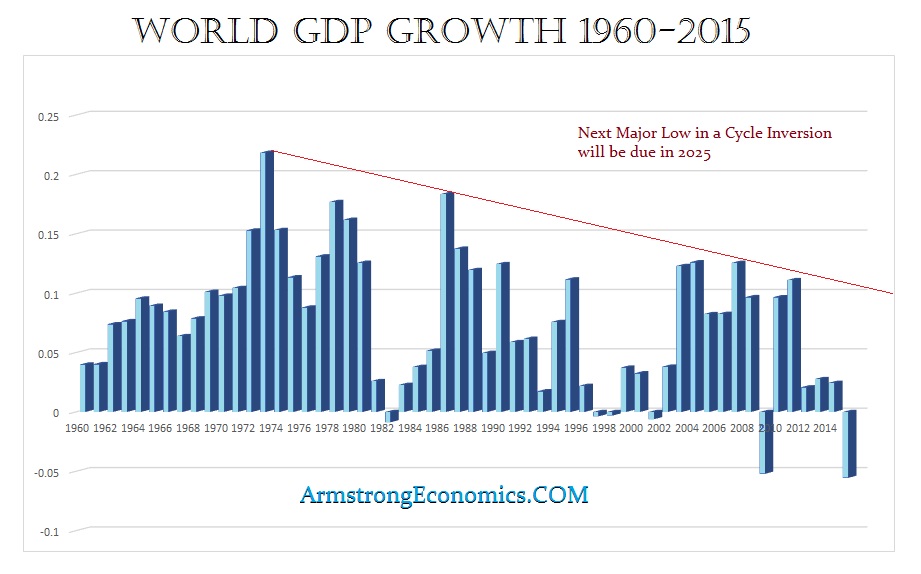

The Business Cycle & the suicide cycle

Martin Armstrong writes in his blog “The press is all abuzz about the suicide rate is up 33% in 20 years and they blame the lack of funding as if this alone will cure the problem. They never seem to simply correlate this with economics. Now we have more than 47,000 Americans committed suicide in 2017, according to the Centers for Disease Control and Prevention. They also said that this is contributing to an overall decline in U.S. life expectancy rate. Even in Japan, there is a place known as the Suicide Cliffs. People jump from the cliffs in Japan cyclically. They jump during financial crises more than during any other period. They also will commit suicide when winter ends and the sun returns. People then see the requirement of returning to a routine they view as their torment and misery. In Japan, the intense pressure of Japanese schools has also been seen as a major contributing factor.

As the largest continent in the World, Asia accounts for about 60% of World suicides with China, India, and Japan accounting for about 40% of the World’s suicides. On an international basis, there are about 1 million suicides that take place every year. The difference in the suicide methods between the Western and Asian countries is rather significant. While in financial centers jumping from buildings also took place in New York and Chicago during the Great Depression, there were also jumpers in Japan from the Panic of 1990. The use of firearms is the favored suicide method in many Western countries, but not in Asia perhaps due to the lack of access. Asian suicides often take the form of pesticide ingestion, charcoal burning, and self-immolation. Hanging seems to be also a leading suicide method both in the East and the West, as well as in prisons. Prison suicides will also take the form of deliberately trying to create a lethal confrontation with someone to get killed as they are compelled to engage in self-defense.

Suicides correlate to economic hardship which can be personal or imposed upon by society and the business cycle. The higher the tax rate and the lower the standard of living is also a key factor for people will be driven to commit suicide facing economic failure. As the world economy continues to decline in real growth, it is not surprising that the suicide rate has increased by 33% since 1999 in the United States alone. This trend is part of the cycle. When people face that decision of whether to stay or to go into the light seeking relief and peace, sometimes they will take their entire family with them because the pain is so great yet they have responsibilities they also cannot leave behind. They will take their family in their mind relieving them of the same pain.

The meaning of MATRIX

The one which made a difference to my life was the movie “Matrix”. There is a deeper meaning to this movie which will be evident to you when you carefully read the following quotes.

Morpheus: This is your last chance. After this, there is no turning back. You take the blue pill – the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill – you stay in Wonderland and I show you how deep the rabbit-hole goes. ( this is my favorite quote)

Morpheus: Neo, sooner or later you’re going to realize just as I did that there’s a difference between knowing the path and walking the path.

Morpheus: You have to let it all go, Neo. Fear, doubt, and disbelief. Free your mind.

Morpheus: The Matrix is a system, Neo. That system is our enemy. But when you’re inside, you look around, what do you see? Businessmen, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inured, so hopelessly dependent on the system, that they will fight to protect it.

Morpheus: Throughout human history, we have been dependent on machines to survive. Fate, it seems, is not without a sense of irony.

Morpheus: What is real? How do you define ‘real’? If you’re talking about what you can feel, what you can smell, what you can taste and see, then ‘real’ is simply electrical signals interpreted by your brain.

Agent Smith: I’d like to share a revelation that I’ve had during my time here. It came to me when I tried to classify your species and I realized that you’re not actually mammals. Every mammal on this planet instinctively develops a natural equilibrium with the surrounding environment but you humans do not. You move to an area and you multiply and multiply until every natural resource is consumed and the only way you can survive is to spread to another area. There is another organism on this planet that follows the same pattern. Do you know what it is? A virus. Human beings are a disease, a cancer of this planet. You’re a plague and we are the cure.

RBI makes LEI mandatory for market participants regulated by it

The LEI code has been conceived of as a key measure to improve the quality and accuracy of financial data systems for better risk management post the global financial crisis.

“The Reserve Bank of India (RBI) has decided to make Legal Entity Identifier (LEI) code mandatory for all market participants regulated by the central bank.

“All participants, other than individuals, undertaking transactions in the markets regulated by the RBI — government securities markets, money markets (markets for any instrument with a maturity of one year or less) and non-derivative forex markets (transactions that settle on or before the spot date) — shall obtain LEI codes by the due date,” it said in a notification.”

But as Martin Armstrong writes the LEI is “just another means of collecting data to be able to hunt for global taxation.”

He further writes in his blog “A Legal Entity Identifier (or LEI) is a 20-character identifier that identifies distinct legal entities that engage in financial transactions. The LEI is a global standard, designed to be non-proprietary data that is freely accessible to all so they can track what entities are doing worldwide. More than 600,000 legal entities have registered from 195 countries. This was created as a consequence of the 2007-2008 Financial Crisis. It is interesting how all governments manage to expropriate more power and control with each financial crisis. It was the CDOs created by Goldman Sachs which blew up the world just as the Black & Schol models in options blew up the financial world back in 1998 with the Long Term Capital Management crisis. But the legal entities that have created these catastrophes are NEVER punished. Not a single entity lost its license and not a single director ever when to jail. The people who blow-up the world are always UNTOUCHABLE and the rest of us lose our rights and freedom in the process.

The argument back during the 2007-2009 financial crisis was that there was no way to identify corporations and financial institutions to recognize the counterpart corporation on financial transactions. Therefore, the GOVERNMENTS could not figure it out while the counterparties knew who they were dealing with and accepted their credit position. Accordingly, it was impossible for governments to identify the transaction details and track the money flows of individual corporations and institutions. Governments argued they needed a simple identification method of everyone in the world.

In 2011, the G20 (Group of Twenty) called on the Financial Stability Board (FSB) to provide recommendations for a global Legal Entity Identifier (LEI). They wanted a cross-border entity to track everyone in the world. This led to the development of the Global LEI System which began issuing these LEIs to create a unique identification of legal entities acting within the entire world economy. The G20 claims this is necessary so they can know the total risk amount in a crisis. However, the G20 is still incapable of estimating individual corporations’ and the financial institution’s amount of total risk exposure. They are incompetent when it comes to analyzing risks across the entire global marketplace. They cannot even resolve the failing financial institutions in Europe because of local regulation that prevents cross-border solutions within the Eurozone.

The G20 blames this lack of knowledge was one of the factors that made it difficult for the early detection of the financial crisis, they will NEVER act to prevent anything in the first place. Adding more regulation simply reduces liquidity and shrinks the world economy. The G20, in response to these inabilities of financial institutions to identify organisations uniquely, claim that was the problem so that their solution was that financial transactions in different national jurisdictions can be fully tracked. Currently, the ROC (Regulatory Oversight Committee), a coalition of financial regulators and central banks across the country, cannot possibly act in advance for they fail to comprehend the dynamics of the world economy.

Hence, this is just another means of collecting data to be able to hunt for global taxation.”

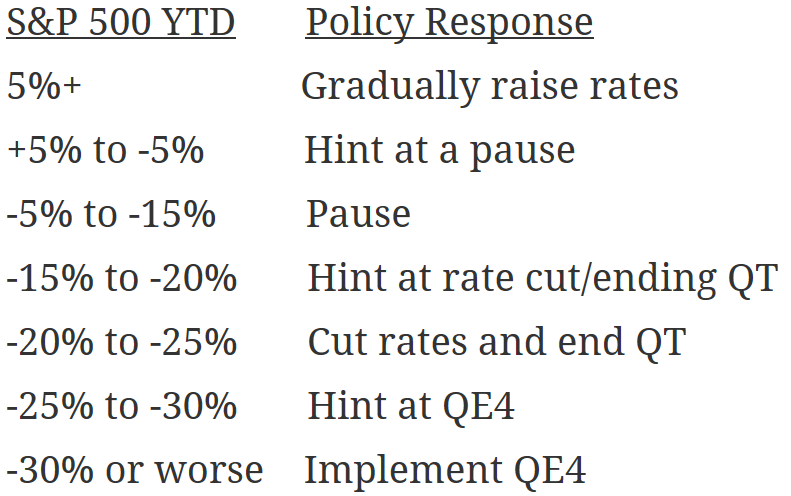

FED cheat sheet

Eric Cinnamond gives a handy FED cheat sheet . He writes

‘Now that we have a better understanding of the Federal Reserve’s tolerance for financial instability (not much), I believe investors are in a better position to gauge future policy responses related to further declines in equity prices. I put my best guess together in the Federal Reserve Cheat Sheet below:

S&P 500 YTD Policy Response

5%+ Gradually raise rates

+5% to -5% Hint at a pause

-5% to -15% Pause

-15% to -20% Hint at rate cut/ending QT

-20% to -25% Cut rates and end QT

-25% to -30% Hint at QE4

-30% or worse Implement QE4

Source: Conversation with myself on the way home from grocery store

Margin of error: +/- a lot’

Full post below