Doug Noland Writes

The Dow (DJIA) jumped 545 points (2.1%) in Wednesday’s post-midterms trading. The S&P500’s 2.1% rise was overshadowed by the Nasdaq Comp’s 2.6% and the Nasdaq100’s 3.1% advances. Healthcare stocks surged, with the S&P500 Healthcare Index up 2.9% (Healthcare Supplies index jumping 4.5%). Led by Amazon’s 6.9% (113 points!) surge, the S&P Internet Retail Index gained 6.1%. From October 29th trading lows to Thursday’s highs, the S&P500 rallied 8.1% and the Nasdaq100 jumped 9.6%.

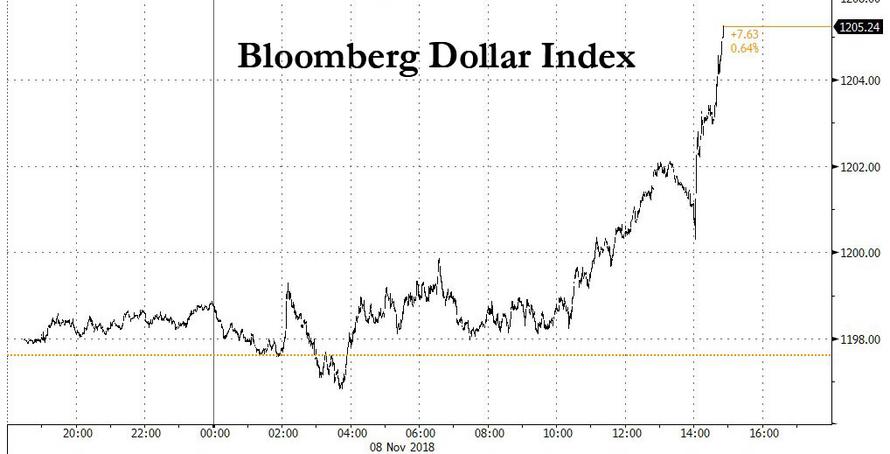

The post-election bullish battle cry was a resolute “back to fundamentals!” With the market surging, analysts were proclaiming “reduced uncertainty” and “the best possible outcome for the markets.” The President and Nancy Pelosi both adopted restrained tones and spoke of efforts to cooperate on important bipartisan legislation. Prospects for a market-pleasing infrastructure spending bill have improved. What’s more, a positive spin was put on the return of Washington gridlock. Less Treasury issuance would support lower market yields generally, ensuring the U.S. economic expansion maintains ample room to run. The weaker post-election dollar was said to be constructive for global liquidity.

The EEM emerging market ETF rose 1.9% Wednesday, pushing the rally from October 29th lows to 11.0%. The South African rand and Indonesian rupiah gained 1.5%, as most EM currencies temporarily benefited from the weaker dollar.

Wednesday provided a good example of news and analysis following market direction. Stocks were up, so election results must have been positive. I would tend to see Wednesday trading as heavily impacted by the unwind of hedges – and yet another short squeeze. After trading as high as 20.6 in Tuesday trading, the VIX (equities volatility) index ended Wednesday’s session at 16.36, an almost one-month low.

Market weakness in the weeks leading up to the midterms created an unusual backdrop. A pivotal election combined with a vulnerable market backdrop ensured a double-dose of hedging activity heading into Tuesday. And with the election having avoided “tail risk” outcomes (blue wave with Democratic control of both houses, or Republicans maintaining full control), post-election trading saw a significant reversal of risk hedges and bearish speculations.

It did not, however, take long for the joyful “gridlock is good” rally to face a reality check. The President’s tweet: “If the Democrats think they are going to waste Taxpayer Money investigating us at the House level, then we will likewise be forced to consider investigating them for all of the leaks of Classified Information, and much else, at the Senate level. Two can play that game!” NYT: “Jeff Sessions is Forced Out as Attorney General as Trump Installs Loyalist.” And then came Friday’s (post-election) barbs from the director of the White House’s National Trade Council:

November 9 – Bloomberg (Andrew Mayeda and Shawn Donnan): “White House trade adviser Peter Navarro warned Wall Street bankers and hedge-fund managers to back down from their push for President Donald Trump to strike a quick trade deal with China’s Xi Jinping. ‘As part of a Chinese government influence operation, these globalist billionaires are putting a full-court press on the White House in advance of the G-20 in Argentina,’ Navarro said… Their mission is to ‘pressure this President into some kind of deal’ but instead they’re weakening his negotiating position and ‘no good can come of this.’ Navarro said investors should be re-directing their ‘billions’ of dollars into helping rebuild areas hit by manufacturing job losses. ‘Wall Street, get out of those negotiations. Bring your Goldman Sachs money to Dayton, Ohio, and invest in America.'”

As another extraordinary market week came to its conclusion, the bulls “Back to Fundamentals” mantra from Wednesday was being hijacked by the bear camp. From my analytical perspective, the outcome of the midterms wasn’t going to materially alter the Bursting Global Bubble Thesis. Global financial conditions continue to tighten. Very serious issues associated with China’s faltering Bubble remain unresolved. Italy’s political, financial and economic problems won’t be disentangled anytime soon. And the midterms weren’t going to solve the more pressing issues in the U.S., certainly including inflated asset and speculative Bubbles and a Federal Reserve determined to stay on a policy normalization course.

November 8 – Wall Street Journal (Justin Lahart): “Anybody who thought the Federal Reserve might scale back its plans for future rate increases after all the recent turmoil in the stock market has to be disappointed. The Fed on Thursday left interest rates unchanged, and it didn’t change much else. The statement it put out following its two-day meeting contained only minor tweaks from its September statement. It noted that the unemployment rate had declined since its September meeting (as opposed to ‘stayed low’), and that business investment has ‘moderated from its rapid pace earlier in the year’ (rather than ‘grown strongly’). The two things roughly offset each other and both have been clear from the data.”

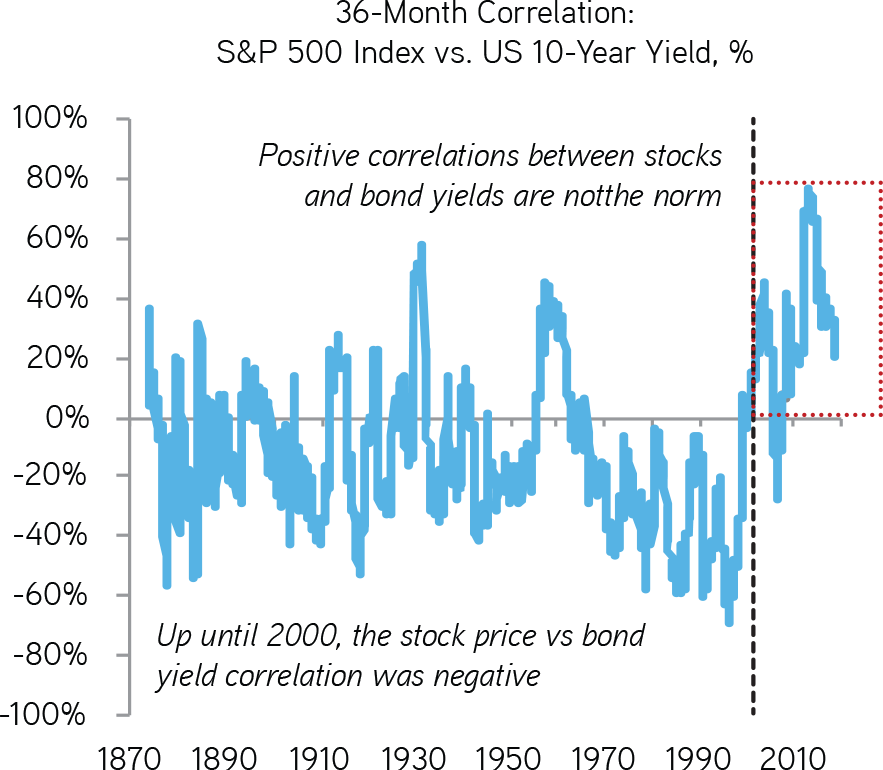

WSJ: “Treasury Bond Auction Draws Weakest Demand in Nearly a Decade.” Thursday’s 30-year auction incited spiteful name calling: “weak,” “sloppy,” and “nasty.” It’s worth noting that 10-year Treasury yields traded to 3.25% election night, the high going back to April 2011. Benchmark MBS yields ended Thursday at 4.10%, also a high since 2011. Ten-year Treasuries enjoyed a little relief late in the week as equities reversed lower, ending Friday at 3.18% (3 bps lower for the week).

Dollar post-election weakness reversed sharply into week’s end. After trading down to 95.678 Wednesday, the U.S. dollar index surpassed 97 on Friday before closing the week up 0.4% to 96.901. After closing at 41.63 on Wednesday, emerging market equities (EEM) sank almost 5% to close the week at 39.80.

Perhaps more noteworthy from a global liquidity and “risk off” perspective, EM bonds came under renewed pressure this week. Brazilian 10-year (local currency) bond yields jumped 27 bps (to 10.41%). Russian yields surged 31 bps (8.91%) and Mexican yields 23 bps to a multiyear high (8.85%). Ominously, Mexico’s 10-year (peso) yields are up almost 100 bps in six weeks. Brazil, Russia and Mexico dollar-denominated bond yields also turned higher, seemingly ending eight weeks of relative bond market calm.

After a recent modest pullback, Italian 10-year yields jumped eight bps this week to 3.40% (Italian CDS up 11 to 270 bps). With German bund yields declining two bps (0.41%), the Italian to German 10-year sovereign spread widened 10 bps to 299 bps. European periphery bonds notably underperformed, with spreads to bunds widening 11 bps in Greece, eight bps in Portugal and five bps for Spain.

For me, Back to Fundamentals means a return of “Periphery to Core Crisis Dynamics” – rising yields, widening Credit spreads, de-risking/deleveraging, faltering global liquidity and, to be sure, China.

November 9 – Bloomberg: “China aims to boost large banks’ loans to private companies to at least one-third of new corporate lending, said Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission. Shares of lenders retreat on the mainland and in Hong Kong. Guo’s comments are the latest attempt by authorities to try to improve funding access for China’s non-state companies… It’s the first time financial regulators have given targets on private lending, a reflection that earlier efforts haven’t triggered the necessary credit activity… The target for small and medium-sized banks is higher, at two-thirds of new corporate loans, Guo said…”

November 9 – Bloomberg (Tian Chen): “Chief economists at Chinese brokerage firms should make efforts to guide market expectations and also effectively promote and analyze government policies, says the head of the nation’s top securities regulator. Economists should properly understand, interpret and promote President Xi Jinping’s remarks on supporting private companies, Liu Shiyu, chairman of the China Securities Regulatory Commission, said at a meeting with economists this month. The analysts should cherish the reputation of the industry, improve their ability to conduct research and properly use their influence on the public, Liu said…”

Beijing faces the critical issue of a deeply maladjusted economic structure that, at this point, requires in the neighborhood of $3.5 TN of annual (and sustained) system Credit growth to keep the Bubble from deflating. Moreover, the last thing China’s incredibly inflated banking system needs is rapid growth in risky late-cycle lending. Determined to rein in non-bank “shadow” lending, Beijing faces no good alternatives. Granted, Chinese officials have the capacity to recapitalize their banking system down the road. And markets to this point have been comfortable with the implicit Beijing guarantee of banking system liquidity and solvency.

There is, however, a very serious problem brewing: Systemic risk expands exponentially during the “Terminal Phase” of excess, as rising quantities of increasingly risky loans imperil the entire financial system. The past two years have seen extremely rapid (speculative “blow-off”) Credit growth in two particularly problematic sectors: lending against equities and apartments – both at inflated prices. There will come a point when the market begins to question the validity of Beijing’s banking system fortification. This type of waning confidence could initially manifest in the currency market.

November 7 – Reuters (Kevin Yao and Fang Cheng): “China’s foreign exchange reserves fell more than expected to an 18-month low in October amid rising U.S. trade frictions, suggesting authorities may be slowly stepping up interventions to keep the yuan from breaking through a key support level. Reserves fell by $33.93 billion in October to $3.053 trillion… The drop was the biggest monthly decline since December 2016, and compared with a fall of $22.69 billion in September.”

November 9 – Bloomberg: “Chinese President Xi Jinping’s mantra that homes should be for living in is falling on deaf ears, with tens of millions of apartments and houses standing empty across the country. Soon-to-be-published research will show roughly 22% of China’s urban housing stock is unoccupied, according to Professor Gan Li, who runs the main nationwide study. That adds up to more than 50 million empty homes, he said. The nightmare scenario for policy makers is that owners of unoccupied dwellings rush to sell if cracks start appearing in the property market, causing prices to spiral.”

Contemplating an economy with 50 million empty apartments entangles the mind. Granted, this is not a new issue. For years, a steady flow of workers vacating the countryside for booming urban centers has provided seemingly endless housing demand. But after a decade (or two) of cheap Credit and booming mortgage lending growth, China now confronts an inescapable comeuppance: a historic speculative Bubble with prospects for declining prices, a speculative bust, massive oversupply and an acutely vulnerable financial sector.

The Shanghai Composited dropped 2.9% this week (down 21.4% y-t-d). China’s CSI Financials index sank 4.3%, and Hong Kong’s Hang Seng Financials fell 2.9%. China’s renminbi dropped 0.95% this week vs. the dollar, increasing y-t-d losses to 6.47%. Copper sank 4.7%, increasing y-t-d losses to 19%. It’s stunning how quickly crude and commodities indices erased what were until recently decent 2018 gains. Everywhere, it seems, Perceived Wealth is Vanishing into Thin Air. What is it that Warren Buffett says about “when the tide goes out”?

November 9 – Bloomberg (Saijel Kishan): “After beleaguered hedge fund managers had their worst month in seven years, many are bracing for an industry D-Day: Nov. 15. That’s the deadline for investors to put managers on notice to get some — or all — of their money at year end. If history is any guide, the rush for the exits will be swift and accelerate. Clients have already pulled $11.1 billion even before funds fell into the red for the year. The last time the industry careened toward annual losses was in 2015…The fallout: clients withdrew $77.2 billion between the fourth quarter of that year and the first quarter of 2017 — the biggest withdrawals since the global financial crisis. Investors can cash out of most hedge funds quarterly after giving 45 days notice.”

“Hedge Funds Face Reckoning After Worst Month Since 2011,” was the headline to the above Bloomberg article. Other notable headlines this week included: MarketWatch: “Hedge Funds Are on Pace for the Worst Annual Year Since Lehman Brothers.” WSJ: “Quants are Facing a Crisis of Confidence;” “Quant King D.E. Shaw Finds Stock-Picking Can Be Difficult;” and “Tech Swoon Stings Hedge Funds.” Also from Bloomberg: “Hedge Fund ‘Hotels’ Burned Managers Who Sought Refuge in October.” And from the FT: “Hedge Funds Overly Optimistic on Risk, SocGen Finds.”

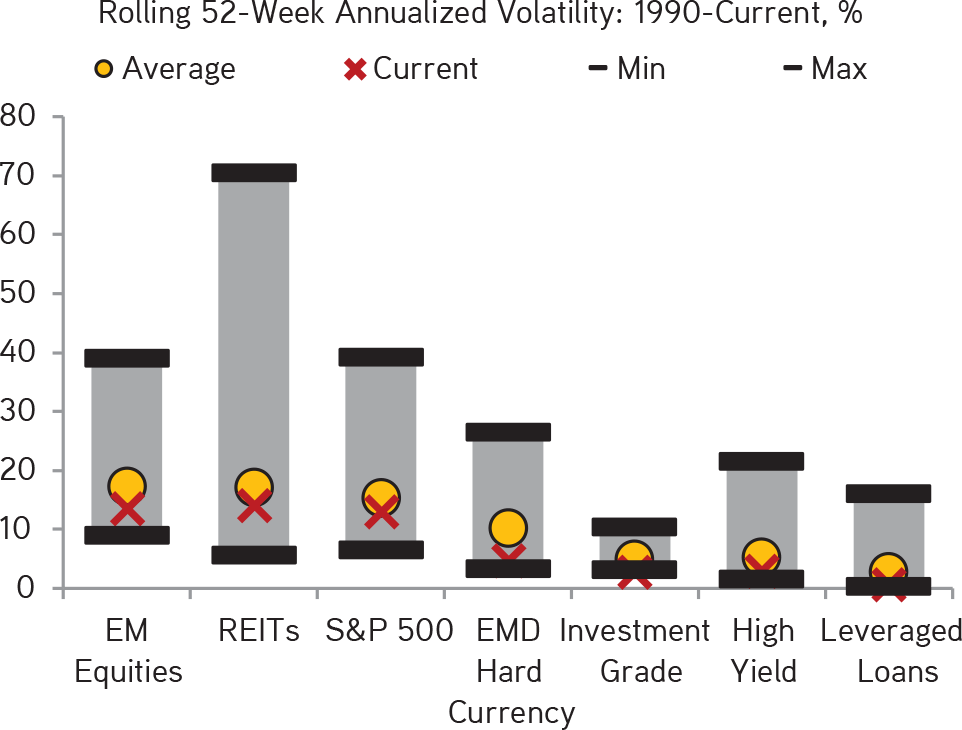

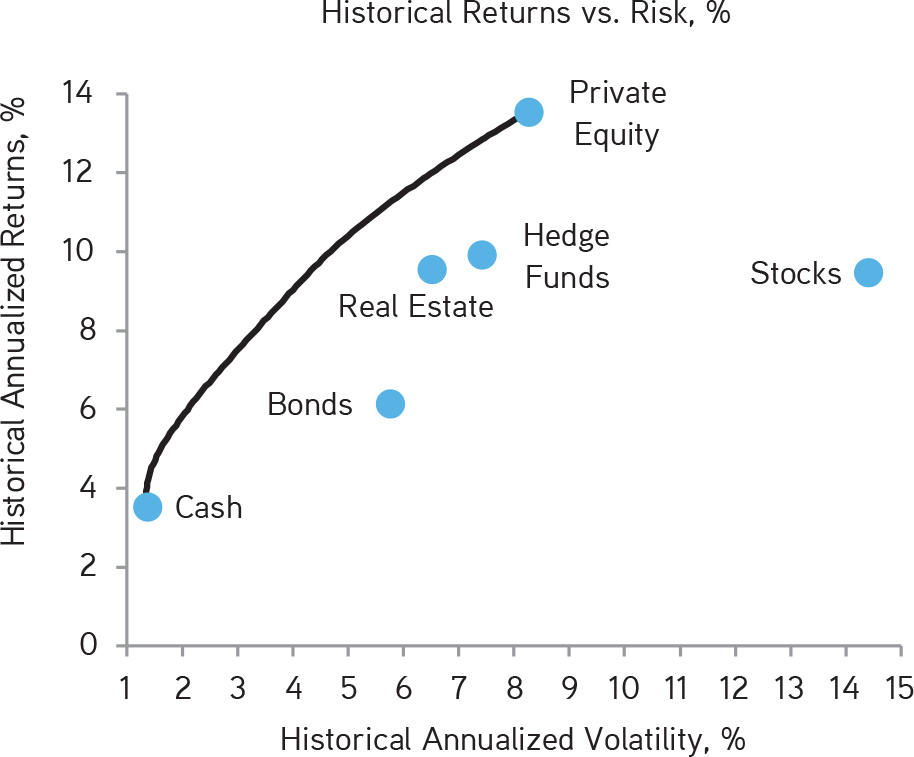

Odds are mounting that de-risking/deleveraging dynamics attain destabilizing momentum. Many hedge funds now have losses for the year, which forces managers to take down both risk and leverage in anticipation of year-end outflows. I believe deleveraging is having a growing impact on marketplace liquidity around the world – and across asset classes. Yields are rising and spreads are widening throughout global fixed-income. Unstable equities markets around the globe are indicating a fragile liquidity backdrop. And this week’s $2.68 (4.3%) drop in WTI has all the appearances of a major leveraged speculating community panic liquidation (portending challenges for the – to this point – resilient junk bond market).

Bloomberg this week posed a most-pertinent question: “When will funding squeezes impact the Fed?” The market continues to focus on building rate pressures throughout the money markets, with added concern now that year-end funding issues are coming to the fore. The system is, after all, in its first experimental unwind (QT or “quantitative tightening”) of some of the Fed’s QE holdings. Market analysis is only further challenged by the enormous issuance of T-bills necessary to fund ballooning fiscal deficits. Three-month LIBOR added another two basis points this week to a decade high 2.61%. The effective Fed Funds rate (2.20%) remains stubbornly near the top of the Fed’s target range (2-2.25%). There are also hints of waning liquidity in the mortgage marketplace. Furthermore, ebbing foreign demand at Treasury auctions is an increasing concern.

At this point, conventional analysis has yet to factor in the liquidity impact from speculative deleveraging – in terms of money market rates, fixed-income yields and the risk markets more generally. The degree to which speculative leverage has accumulated over this long cycle is The Momentous Unknowable. Indeed, there’s a portentous lack of transparency for something of such vital importance. For the most part, the contemporary realm of speculative leveraging operates outside of traditional banking. As such, this issue was just too convenient for the Bernanke Fed and global central bankers to ignore as they collapsed borrowing costs, flooded the world with liquidity and committed to market liquidity backstops.

At this point, I seriously doubt the Fed has a solid grasp of the (direct and indirect) sources of the Trillions of global liquidity that have flooded into U.S. securities and asset markets over the past decade. I take them at their word that they don’t discern the degree of leverage that would typically indicate a Bubble. Yet this has been the most atypical of global Bubbles. I am not convinced the Fed knows where to look for the leverage most germane to today’s global Bubble. And, I’m compelled to add, the whole world seems oblivious. Speculative deleveraging is not on the Fed’s radar, and this is a problem for the markets.

Read Full Bulletin below

http://creditbubblebulletin.blogspot.com/2018/11/weekly-commentary-back-to-fundamentals.html

.

. .

.