Siddharth Rastogi at Ambit Asset Management writes an interesting take on why passive management is the future for Indian Markets

“Lot of Intelligent fund managers & advisors believe active fund management is here to stay & clients will keep paying fee for their skill, judgement & biases(pun intended) in hope to generate Alpha.

Unfortunately hope & trend both seem to be fading away atleast in the West. India will follow this investment mania sooner than later, as Investors are becoming smarter & sharp witted.

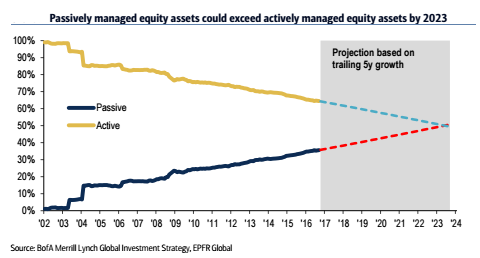

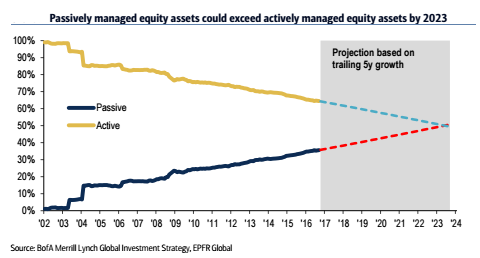

Passively managed funds/ Index funds/ ETFs found their way in financial system less than 30 years (1989) ago yet this format of investing is revolutionizing the fund management industry World wide.

According to a BlackRock survey 2018, ETFs are just two years away from hitting a landmark milestone, where half of all U.S. investors have a position in at least one ETF. As per Blackrock team currently, one in three U.S. investors own at least one ETF. Last year, one in four investors owned one.

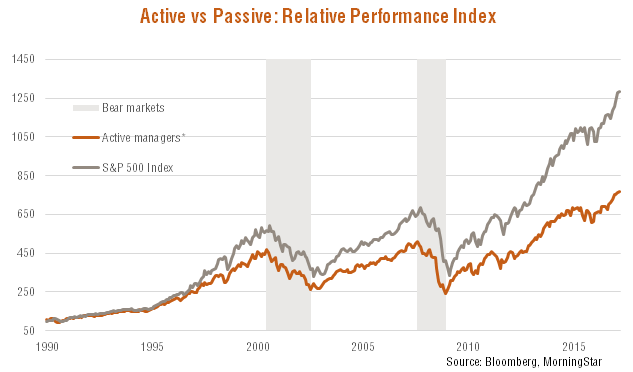

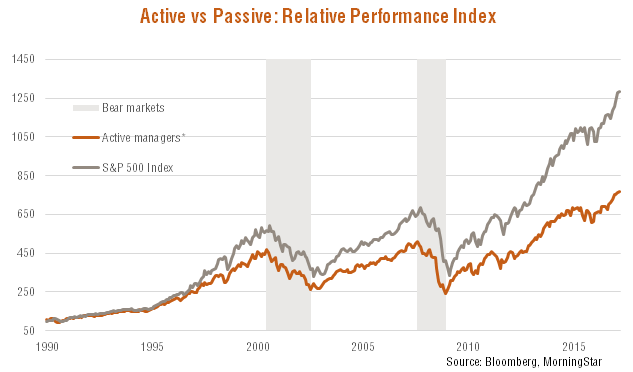

Most fund managers in the west have been performing poorly as compared to the benchmark for long periods of time and hence the shift from Active to Passive is Swift & visible. (See the chart for US Equities)

However till recently (less than half a decade ago) Emerging market fund managers including India were generating Alpha through Active management.

Question arises, When West is not able to generate Alpha, how Indian fund managers were beating the benchmarks till very recently?

Information asymmetry – Connects with Promoters / management of the company, Advance information of the private & confidential data, market inefficiencies, leakage of details through various channels & intermediaries etc.

Different Categorization, different name, different stock pick – Some fund manager in large cap oriented schemes used to have large significant allocation towards Small & mid cap stocks and those funds during bull phases of the market outperformed the market. With SEBI’s new regulation, that skill of Alpha generation is no more asset for the fund manager or for the Investment company.

Excessive Churn, Hit & Trial – Keep predicting daily trends and keep churning the portfolio incessantly to perform better.

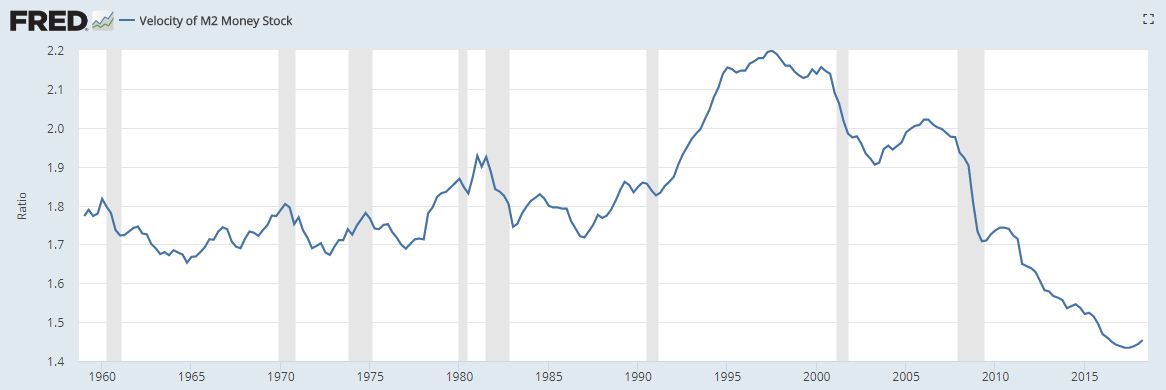

Few experts believe that Quantitative Easing(QE) by US post 2008 financial meltdown led to death of Alpha and it’s all set to come back. QE did increase money flow in system which led to jump in US equities and inturn higher appetite for risky assets including emerging market equities. Benefit accrued to both Active as well as passive funds. Study of large cap funds vs Index in India shows some contrasting results.

US Fed’s first round of QE started in Nov 2008, with purchase of 800 billion USD in bank debt & mortgage backed securities(MBS). This continued till about June 2010. Next round of QE was from Nov 2010 till about June 2011 with a monthly buying program of 75 billion USD.

Last one came in from Sept 2012 till Oct 2014 with monthly buyout of 40 billion USD of MBS. Interestingly from 2009 till 2011(peak of US fed’s bond purchase program), Active funds outperformed the Index by an average of ~7.50%, whilst post QE from 2015 -2017, active funds could barely outperform index by ~1.75%.

For 2017 and 2018, Active funds have under performed the indices by ~4%.

So called perception that Liquidity supports or works against the ACTIVE fund managers is nothing but a Sham.

There is no secret sauce for Wealth Creation, it’s simply driven by discipline, Patience & Quality (filters for revenue, PAT, ROCE), rest all is NOISE.”

My two cents

Democratization of information and efficiencies will lead to less asymmetry in information and hence lower outperformance of actively managed fund returns from benchmark. The future lies in combination of Product innovation along with asset allocation done through low cost passively managed strategies.