I posted Technical views on market by Neppolian http://worldoutofwhack.com/2018/10/06/technical-analysis-of-indian-markets/ few days back .

We had an interesting discussion today when he asked my view on why market action is so anaemic even in a face of 10 dollar fall in crude, shouldn’t we have got a bigger bounce?

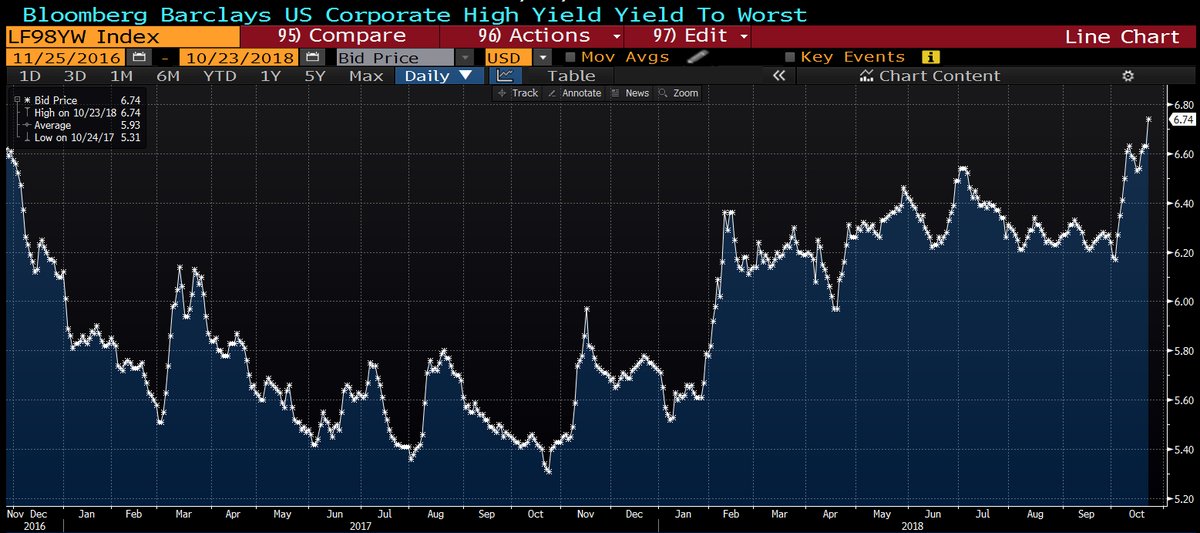

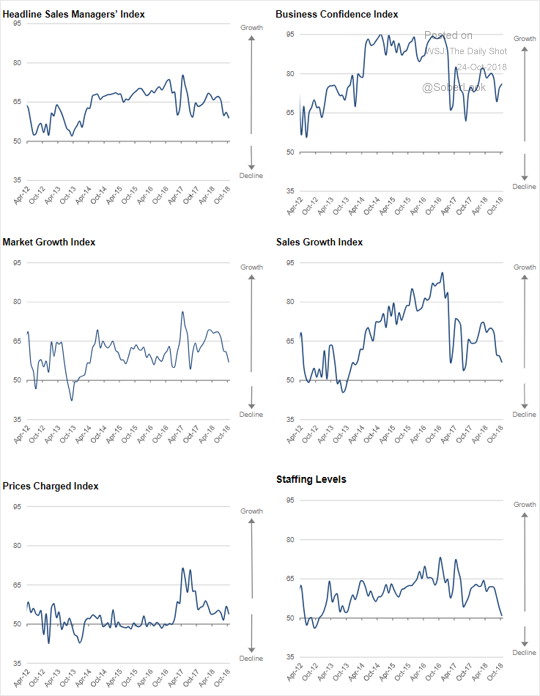

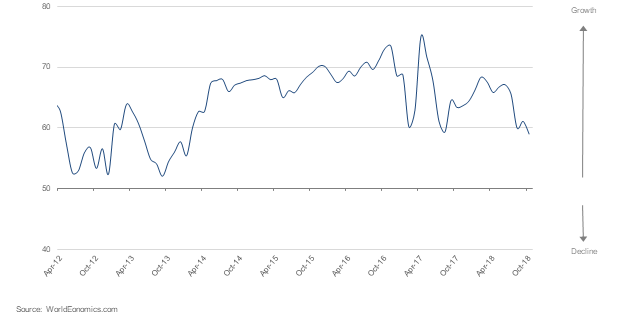

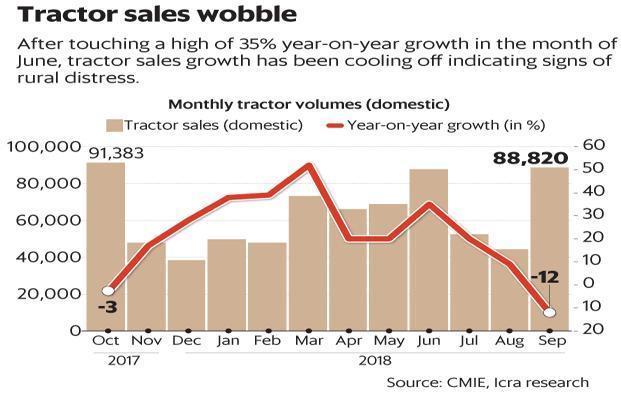

My two cents…… I said look around you, the last fall, few days back coincided with a news story on India shadow banking system and Lehman Moment https://www.wsj.com/articles/a-big-problem-in-the-shadows-for-indias-financial-system-1538479585 in WSJ, raising concerns on already damaged credibility of our financial system. Incidences like what is happening currently at the CBI is eroding trust .Foreign investors think that rule of law is not getting followed and they don’t like it. Even if India has these policies why do you advertise them. Turkey , Argentina , South Africa are already spooking foreign investors and now India is also doing that… they will not invest incrementally till they see formation of new govt and its policies.

He agreed with me but also showed concern for Indian mutual fund industry because lot of money is riding on it and returns are falling short of expectation

My two cents….. Most Indian MF are not asset managers , they are asset gatherers and investors come lower in the priority of these MF . They need to concentrate more on Fund management than thinking of ways of just going after AUM. I guess they know it but just don’t care. My own worry is that the portfolios have become quite illiquid , have taken sub optimal risk and any forced redemption could wipe out market cap of these companies and he agreed with me .

He said that he sees a pattern in a large cap stock which has a very strong support 10% lower than current levels and from their it can rally 50-80%

My two cents……. I said that means this particular stock will become the largest weight in the benchmark ,other large cap will fall a lot more in coming years and concentration of market cap will become more acute. Unfortunately most MF don’t like that stock and their NAV will fall more than the Benchmark in coming fall.

He said that destruction phase in Midcap and small cap has played out…..In the second phase these sectors will see many constituents getting delisted or become extinct.

Now the turn of wealth destruction will be played out through large cap names….

He concluded that Base case for NIFTY is 10700-11000 and then a steadier correction to 8500 types… wherein large cap will suffer too. I agree

you can also write to him directly at

neppolian@jadellp.com