The WSJ on Monday night ran a story where Mr. Trump said he was not at all pleased with the “too strong Dollar

The Dollar has way too many brand-new bulls, is at a serious resistance area, and needs to sell off first, to be able to get thru that serious resistance area. The sentiment in the Dollar and the stock market has been, “what can possibly go wrong”. And the sentiment in bonds and gold has been, “what can possibly go right”. So this selloff in the Dollar is exactly what it needed to do.

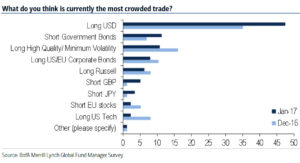

Bank of America Merrill Lynch released the results of its global fund manager survey for January which showed long US dollars was by far considered the most crowded trade. Almost half of the survey participants (47%) viewed long USD as crowded and the next most crowded trade was seen a short government bonds, see below:

I believe the trumflation will take breather for sometime and volatility will rise as this trade reverses.