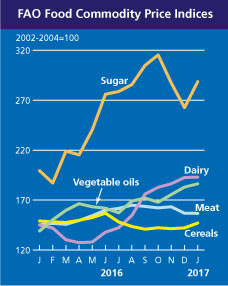

According to the Food and Agricultural organisation, The FAO Food Price Index* (FFPI) averaged 173.8 points in January 2017, up 3.7 points (2.1 percent) from the revised December 2016 value. At this level, the FFPI is at its highest value since February 2015 and as much as 24.5 points (16.4 percent) above its level in the corresponding period last year. The strong rebound in the January value of the FFPI was driven by a surge in international sugar prices and sharp increase in export prices of cereals as well as vegetable oils. Meat and dairy markets remained more stable. FAO’s Food Price Index is a trade-weighted index tracking international market prices for five major food commodity groups.

While 2016 marked the fifth consecutive year the index has fallen, January 2017 marked its sixth monthly increase in a row. Take the instance of wheat, where depressed prices till August led to one of the lowest planting worldwide.

(Money managers remain bearish — they’ve bet on lower prices for 17 months straight)

But there are signs the glut may not last much longer, or at least that supplies may tighten enough to halt the four-year slump in wheat futures.Farmers are planting less because many are losing money. At the same time, global consumption is at an all-time high. And the risk of crop-damaging weather lingers over key exporting countries this year. As Rabobank says there is a “real possibility” of a supply shock in the U.S. and Europe if farmers shift to more profitable crops.

An NIFPB research paper has found strong correlation between global and domestic food prices although the correlation is not as tight at individual commodity levels. The correlation broke down since Nov 2016, and the reason in my view is demonetisation. There is no denying the fact that good monsoon led to better planting but demonetisation led to perishable commodities getting dumped at throwaway prices as shortage of cash with traders led to sharply falling prices and hence low food inflation.

I think low food inflation in India is behind us and it is poised to rise and catch up to its correlation to world agri prices which are going through perfect storm of low planting, high global consumption and tight supplies.

Rural India has gone through rough phase in last few years, first depressed agri output prices and then demonetisation. Rising global food prices coupled with increased budgetary allocation for MNREGA and rural development bodes well for rural economy.

Bet on rural economy, rising soft commodity prices and higher inflation

One thought on “Global food prices on a sprint, up 16% in last one year, diverge from Indian prices”