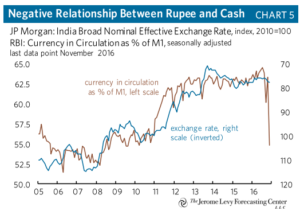

Higher currency in circulation in last few years has led to higher demand pull inflation. High inflation if not tackled by high interest rates leads to erosion in value of currency.In the accompanying chart you can see there is a direct correlation beetween currency in circulation as % of M1 and nominal exchange rates. Since currency in circulation has never come down before nov 8 ( demonetisation), Rupee has continued to depreciate against dollar.

The correlation is so tight that by looking at the chart you can infer that even if half of currency deposited with banking system post demonetisation does not come back into circulation than Rupee nominal exchange rate will appreciate rather than perpetual depreciation that we are so used to.On the other hand if bigger portion of the money deposited with banking system post demonetisation is withdrawn it could possibly lead to higher inflation and in turn depreciating rupee.

RBI changed its stance on monetary policy to neutral from accomodative against market expectation. Are they anticipating that most of this money will leak out of banking system?