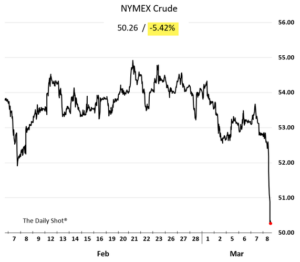

One market jolted out of complacency yesterday was crude oil where the price broke out of a range and fell 5%

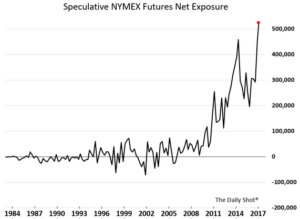

But the speculators are running all time high long positions. Every trader believes that OPEC cuts are for real and Saudi Arabia will not allow oil prices to fall before Saudi Aramco listing http://www.reuters.com/article/us-saudi-aramco-ipo-value-idUSKBN16D14Y after all ,if Saudi Aramco is valued at closer to USD 1.5 trillion then it is in the interest of Saudi Arabia to keep oil prices high till Aramco IPO …….. Hmm sounds logical

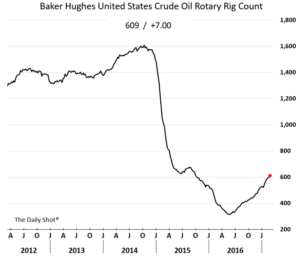

it seems Americans are not cooperating as US rig count and crude oil output continue to recover

and at the same time, US shale production is becoming more efficient with breakeven firmly below 40

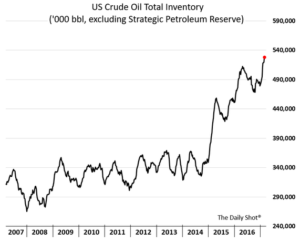

oh yes US crude oil stockpiles … hitting another post-WW-II record

Crude is knows as king of commodities because of its size and importance in global economy.The break down in price is a sign that REFLATION trade might be at the risk of reversal.

Finally it’s playing out…. But one thing which am not able to comprehend is when usd rallies… How will gold also rally (when it’s priced in usd). Risk aversion may lead to position build up in gold but won’t it gets negated by usd strengthening…