Gary writes that The following set of circumstances are probably a recipe for market reversal (atleast it used to be)

1.tightening in China

2.Chinese econ rolling over

3.plunging commodities

4.EM priced to perfection

That fourth point is critical.

EM has already shaken off the beginning of what’s supposed to be a Fed tightening cycle and EM equities have recently decoupled from commodities.

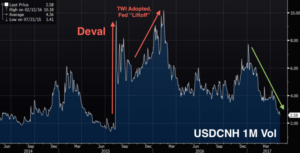

So the obvious question is how many more bullets can a priced-to-perfection EM complex deflect? There’s certainly an argument to be made that the only thing keeping this thing from going off the rails is a stable yuan ( like every other market even chinese yuan volatility has just collapsed)

But stepping back from the recent commodities carnage, metals mayhem, and Chinese econ data, there’s a kind of argument for why EM could soon stumble upon its day of reckoning. Have a look at this:

Simply put, if that is indeed the “leading indicator” it’s billed to be, then history tells us that Emerging market rally probably is due for a much needed correction .