Lewis Johnson writes …..

Capital Flows in the Pyramid as the Cycle Changes

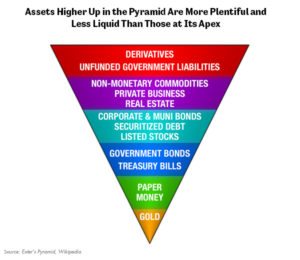

During an expansion, capital shuns the lower returns, greater liquidity, and safety of the pyramid’s apex to seek more profitable, but riskier, employment in less liquid markets up the pyramid. The longer the expansion continues, the more extended this pyramid becomes.

Once credit quality starts to worsen, however, this bloated structure pancakes back down upon itself in a flight to safety. The riskier, upper parts of the inverted pyramid become less liquid (harder to sell), and – if they can be sold at all – change hands at markedly lower prices as the once continuous flow of credit that had levitated those prices dries up