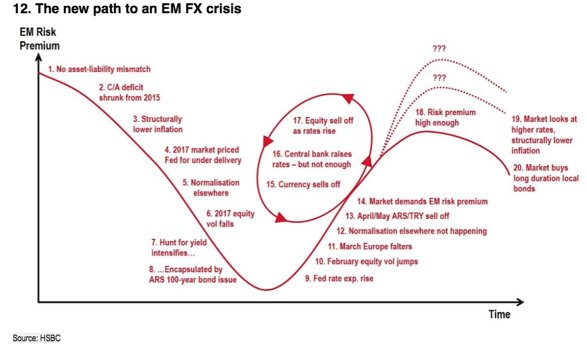

1.The new pathway to an EMerging Market FX crisis via HSBC.

In my view India is still at stage number 14.Long way to go.

2. If anyone tells you that the Indian stock market is in terrific shape just because it’s at an all-time high, show them this chart and see what they say.Breadth is just too narrow

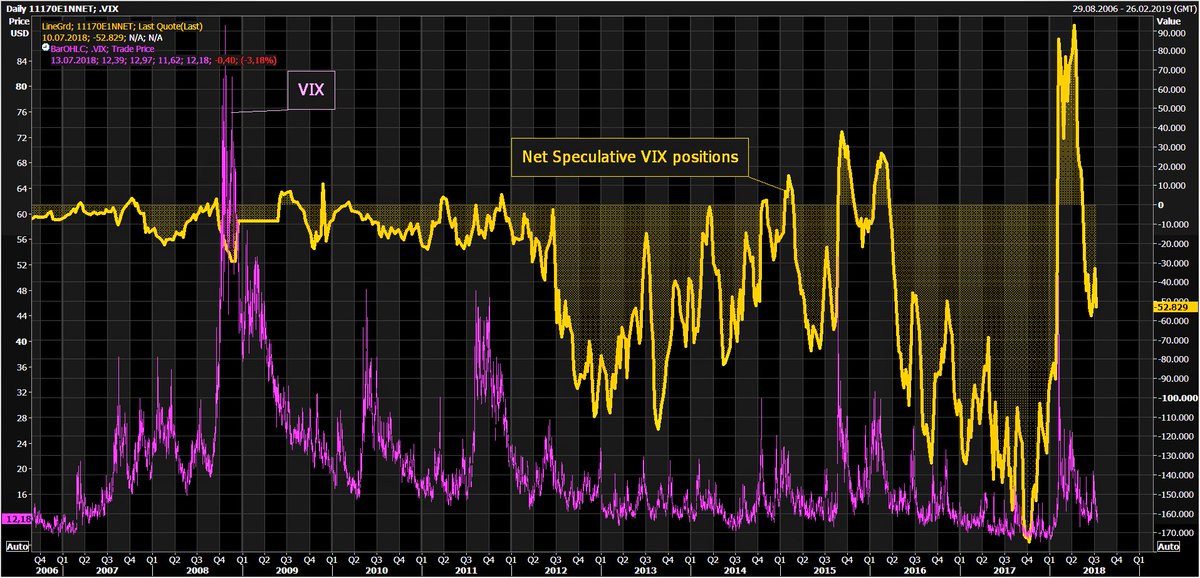

3.Compacency has started creeping and as usual Investors have very short memories: The Short-VIX trade is back only 5mths after Feb Short-VIX massacre.

Boys will always be boys.

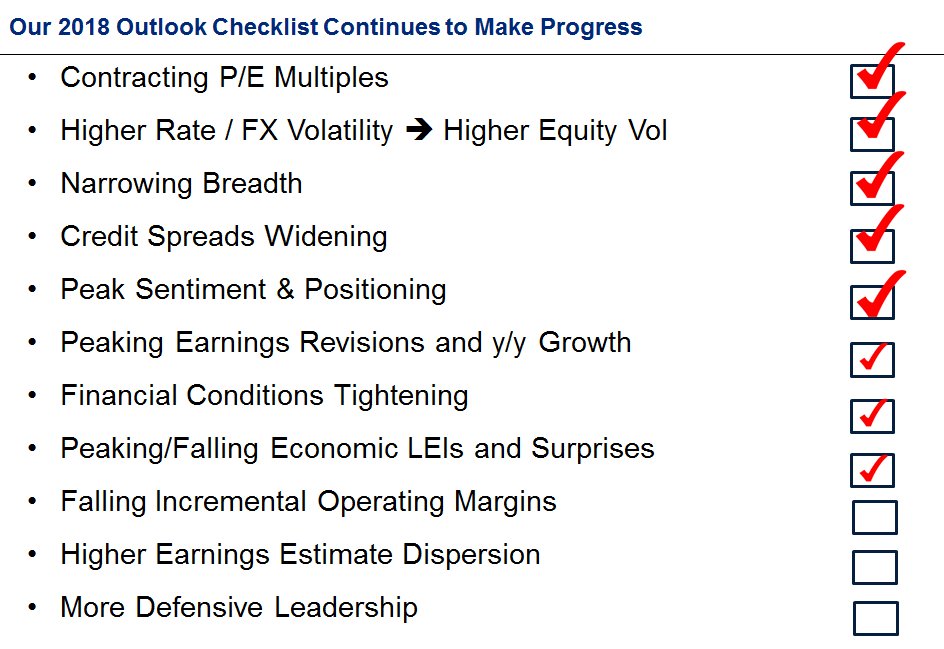

4.Morgan stanley Risk outlook checklist. We still need to check few boxes before we go into Red Alert

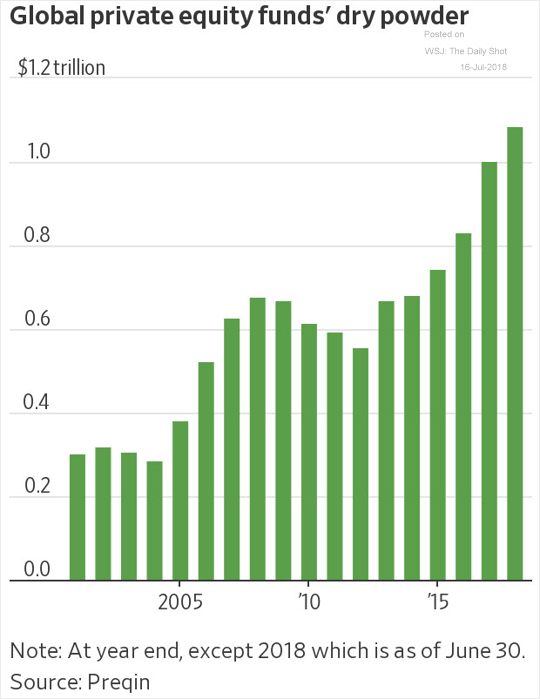

5. Private equity firms are sitting on a record amount of “dry powder.” This trend doesn’t bode well for PE performance (too much capital chasing fewer deals).This is also the reason that we might not have seen the final high in equity markets

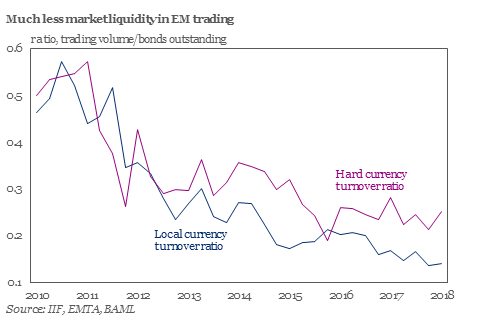

6. Lower levels of liquidity in Emerging Markets are likely to mean more market volatility going forwards. This also means that large size Funds should underperform Smaller size funds. Invest accordingly

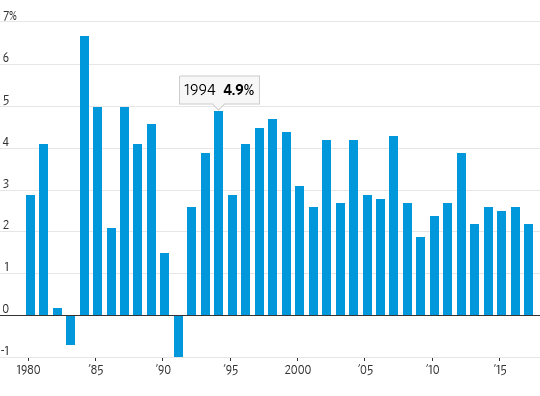

7. An unparralaled feat in post world war era

Australia is experiencing an amazing economic run—a 27-year expansion that survived a regional economic crisis in the 1990s, a global economic crisis in the 2000s, and a boom-boost cycle in its core commodity sector in the 2010s.

8. The next country……

Turkey isn’t close to hyperinflation yet. But the path it’s on is a guaranteed way to get there.

Turkey on Venezuela’s Path.Erdogan jailed political opponents.Parliament effectively made Erdogan prime minister for life.Erdogan took over the press.Erdogan took over the courts.Erdogan took over finance.Erdogan about to take over the central bank names his son in law as central bank governor

Hyperinflation Nearly Inevitable

Venezuela did not hop straight into hyperinflation and Turkey likely won’t either.

However, if Turkey remains on the same path, which seems highly likely, hyperinflation is the inevitable outcome.

very interesting analysis