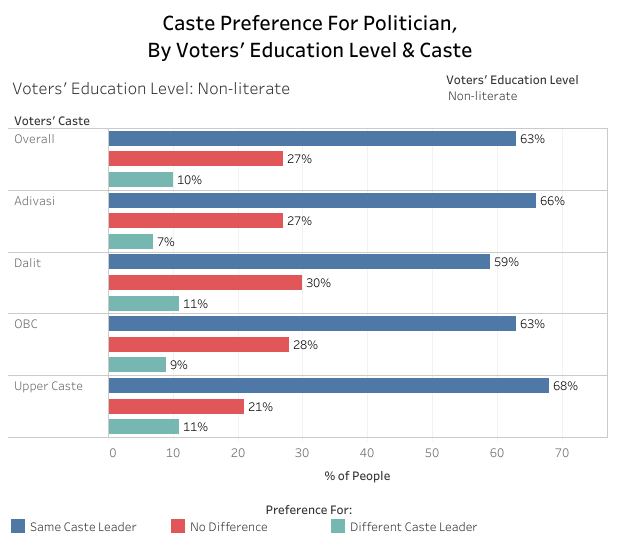

1.A recent survey by Indiaspend shows,a majority of Indians prefer political leaders from their own caste, tribe or religion, indicating how identity politics plays a significant role in state and general elections. This was especially so among non-literates across caste and religious groups. There is a general election coming up in 2019 and this does not bode well for India.

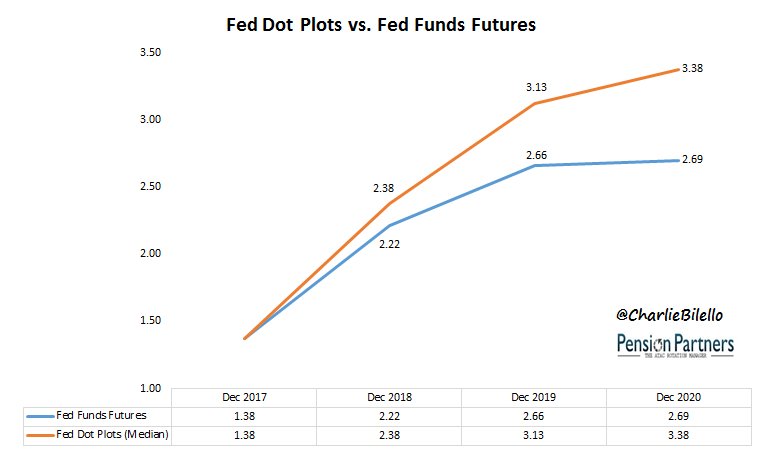

2.The Fed is projecting 6 more 25 bps rate hikes by the end of 2020.The market is currently pricing in 3 more hikes.If FED continues to hike rates and takes the short term rates to around 4% then US will simply continue to attract more money from rest of the world.

3. BofAML’s main takeaways from July FMS: Sentiment/expectations bearish, lowest equity allocation since Nov 16′, cash levels elevated & near triggering “extreme bearish” contrarian buy signal. Markets don’t make a long term top with this kind of cash levels.

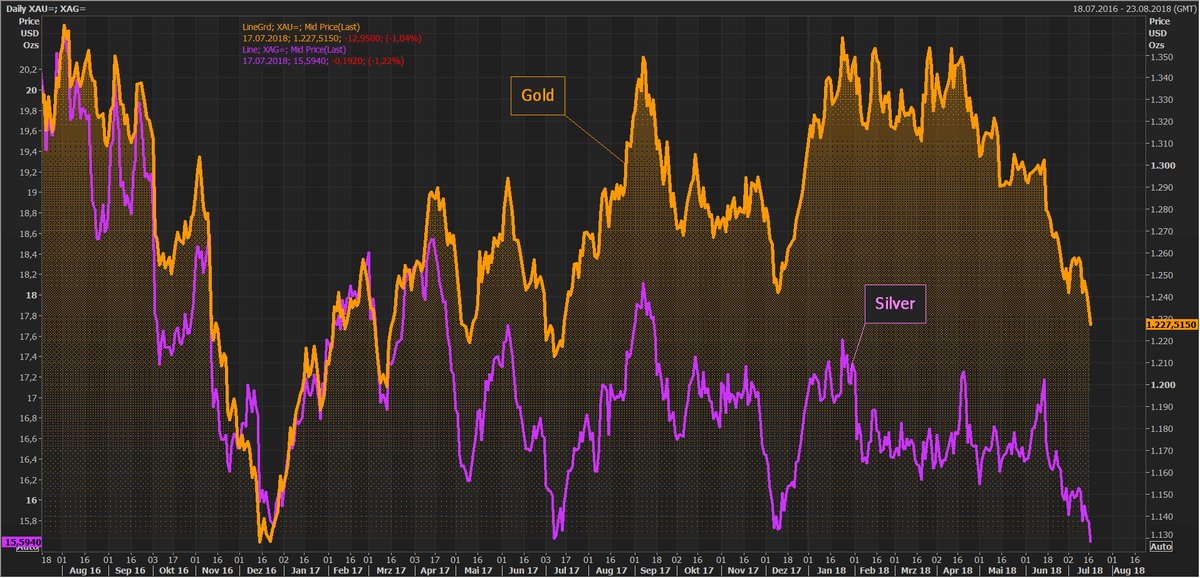

4. Ouch! Gold and Silver fall after Fed’s Jerome Powell’s upbeat remarks about US economy and projection of gradual hikes in key interest rates boosted the dollar. Gold at 1y low, Silver at 2y low.

And for some Mind boggling statistics

If we exclude the market cap of top 10 stocks, the remaining over 4,000 stocks listed on BSE have lost a whopping Rs 16.70 lakh crores since January 2018! More than 300 stocks have fallen anywhere from 50% to as high as 90% from their one-year high prices. If, as experts say, the stock market is a leading indicator of the economy, then the economy is not in great shape and may get worse.