Summary

Wall Street Week…

S&P 500: All-Time High, Nasdaq: All-Time High, Mid Cap 400: All-Time High, Russell 2000: All-Time High

US Vix below 12, barely

US 3 month TBILL yield at 2.09% …. a 10 year high

Most global equity markets higher led by Asia.

Indian Markets all time high in local currency term (in dollar iShares MSCI INDIA is down -1.6% YTD)

Brazil 10-year yield blows out 21 bps and currency flop 5 percent on political concerns.(is this the next turkey)

Argentina peso weakening again but South Africa a bit stronger in sympathy with temporary rebound in Turkish lira, due primarily to closed markets

Nice bounce in metals

Gold up 1.8 percent on the week

Dollar chart looks weak after the blow off gravestone Doji candlestick on August 15, which took the index to 96.984. Nevertheless, 94to hold and the Dixie to trade in a 94-97 range unless U.S. politics gets real UGLY. Not unrealistic, by the way.

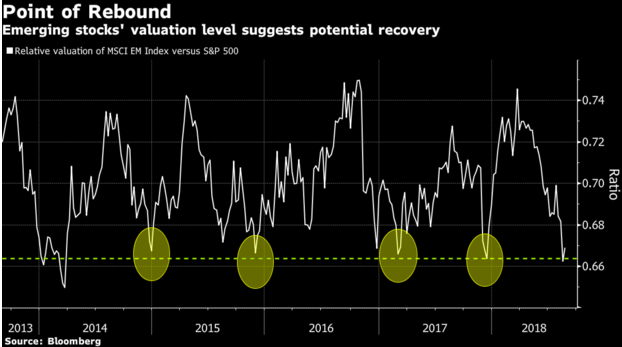

Everyone is looking to buy the emerging market sell-off . EM is oversold and ripe for a decent technical bounce. A fundamental buy is a long way off, however, and the probability a major market disruption is higher than being discounted. The Fed is still tightening the tap on global liquidity.

But EU & Japan are still loosening as is China now

yes but fourth quarter (sep-dec) is when all central banks combined liquidity will become negative