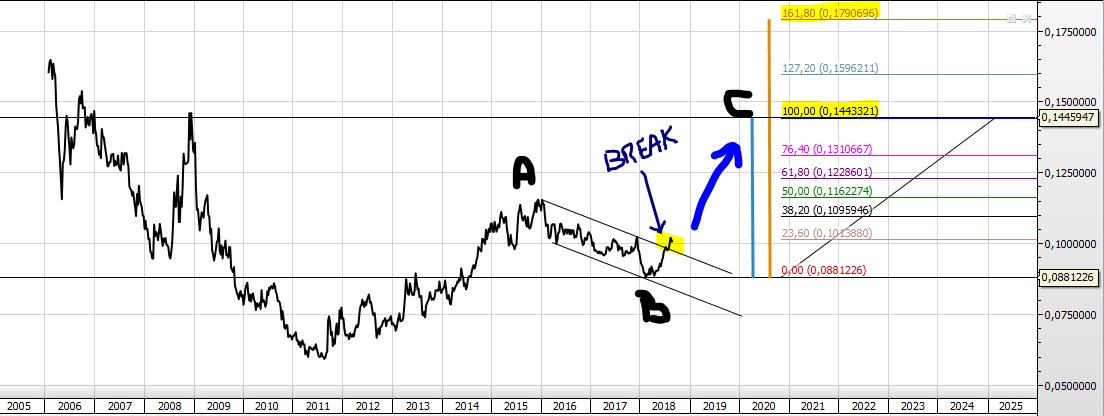

Henrik writes Disinflation vs.inflation can be expressed by TLT ( 20 year US treasury ETF) vs.Gold. When bonds start outperforming gold then that means market does not frear inflation because Gold is considered inflation proxy.

This graph shows that relationship. BULL FlAG and BREAK-UP show that DISINFLATION and not INFLATION is ahead.

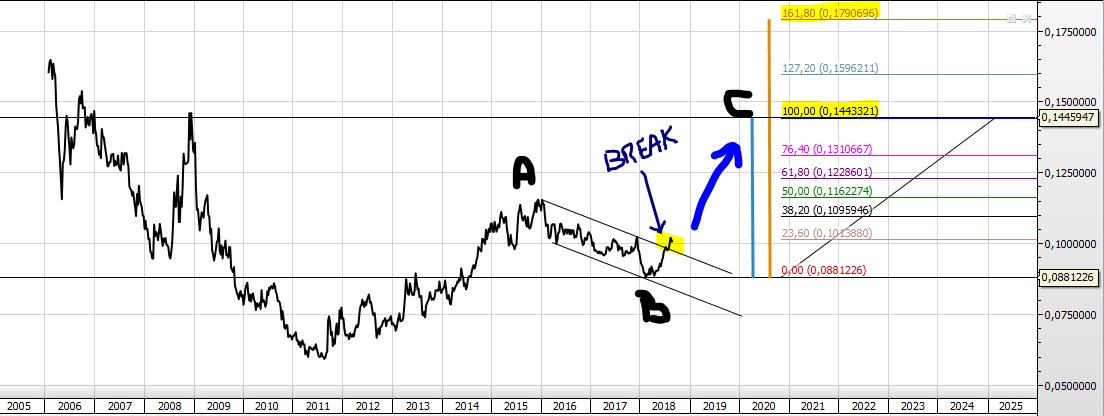

Disinflation vs.Inflation can also be gauged by AUD/USD. This is a very bearish outlook – i.e. Disinflation – or outright Deflation is ahead!. Why this relationship between these two currencies? ..because Aussie Dollar is proxy for commodities and in turn of Chinese demand. With dollar brakeout against Aussie ,is not good sign for Inflation

When I talk deflation winning over inflation, I am only referring to inflation in developed economies.