1.Emerging Markets including India are facing a double whammy of falling domestic currency and stable or rising crude oil prices in US Dollar. This is the simple reason that prices at Pump keep rising on daily basis.

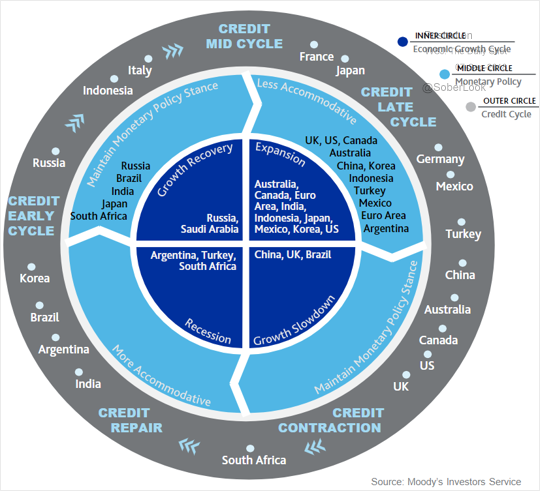

2.The chart by Moody….. according to them India is expanding but also that balance sheet repair is underway. The global liquidity is shrinking fast, which means India might not have enough time left to clean Banking system. The result could be slowing of Indian economy by early next year.

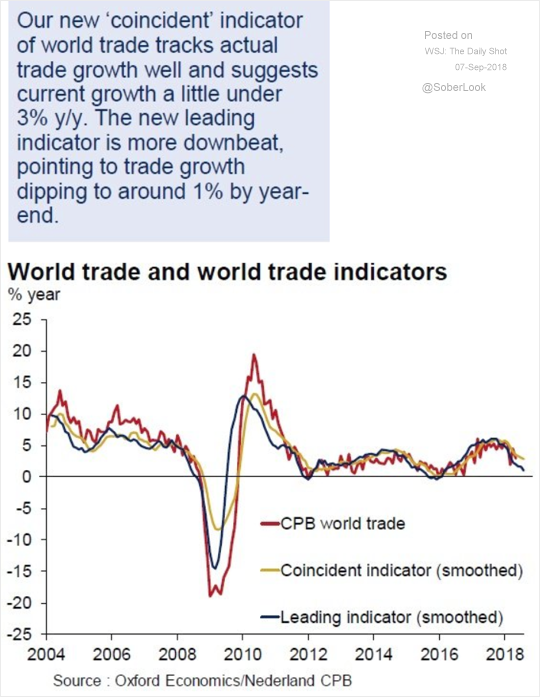

3.It was a matter of time. Global trade activity is finally slowing down. This is Bad for India because our exports are more sensitive to global trade growth than our imports.

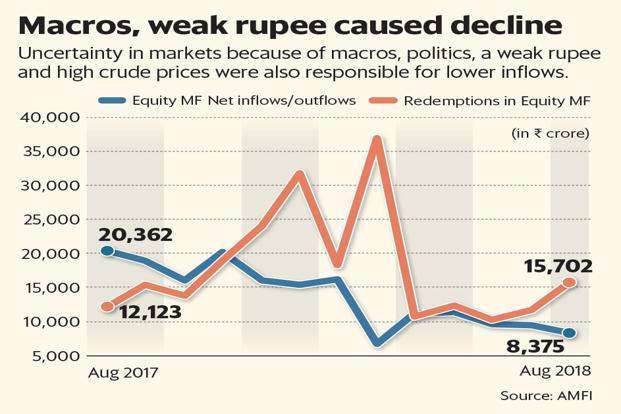

4.Net inflows into domestic mutual funds slowed down to a five-month low in August because of uncertainty in the markets.Data from the Association of Mutual Funds of India (AMFI) showed that net equity inflows saw a steady decline, slipping 11.39% to ₹8,375 crore in August. Equity mutual fund schemes saw an infusion of ₹9,452 crore in July.

However, redemption pressures from mutual funds’ equity schemes also increased in August, jumping 35% as investors opted for profit booking with the markets scaling record highs.