Heisenberg writes…….there will be more than a few stories written over the next several days about how the combination of a cooler-than-expected August CPI print in the U.S. (Thursday), a larger-than-expected rate hike from the Turkish central bank (Thursday) and a surprise rate hike from Russia (Friday), are all signs that the situation for developing economies could stabilize.This week, the dollar has come off pretty handily, with gains across Emerging Market currencies . US Retail sales missed pretty handily on Friday which, all else equal, should put more downward pressure on the dollar. The sharp rise in bond yields across EM prompted Goldman to comment that ” EM now has a potentially adequate “yield cushion”, which the bank says could support the space going forward”.

All of the above (i.e., a couple of negative surprises from the U.S. economy with CPI and retail sales missing, rate hikes from Turkey and Russia, and rising real rates) suggest stabilization might be in the cards. There are more key EM central bank meetings on the horizon, and they’ll be watched closely.

Despite all of this, it’s still unclear that emerging markets are out of the woods. Trade escalations have played dollar positive since April and U.S. foreign policy is becoming more unpredictable seemingly by the day. In almost all cases, that unpredictability has a positive read-through for the dollar What’s needed here are convincing signs that the U.S. economy is losing momentum and/or some kind of dovish lean from the Fed. In the absence of that, it seems just as likely as not that the market will continue to oscillate between fleeting bouts of dollar weakness and a renewal of greenback strength, with the latter continually chipping away at fragile EM sentiment..

In conclusion although an argument has been made of EM stabilization SocGen has take on who’s most vulnerable, ( in case positive script does not play out)

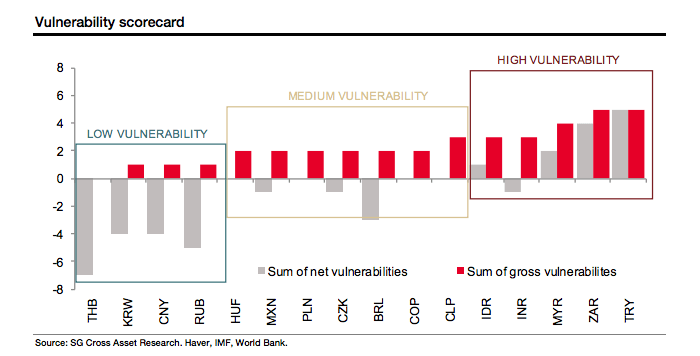

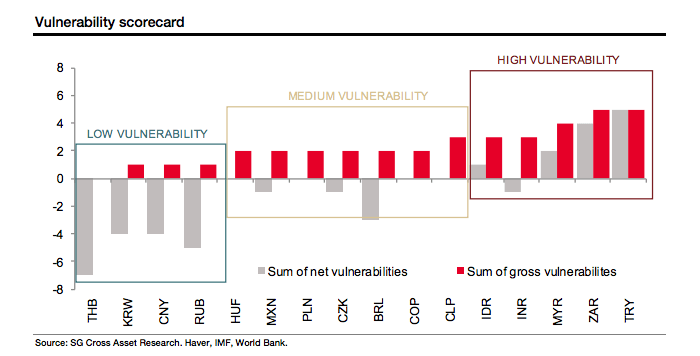

To assess vulnerabilities across emerging markets, we examine external positions, short-term external debt, foreign currency-denominated debt, fiscal and debt positions, reserve adequacy, and foreign bond ownership. A scorecard of gross (i.e. total number of indicators that suggest high vulnerability) and net (the summation of negative, neutral, positive vulnerability factors) vulnerabilities sheds light on which currencies might experience additional stress as the Fed continues to tighten monetary policy or if other factors impair EM sentiment.

High vulnerability: Turkey, South Africa, Malaysia, India, Indonesia.

Medium vulnerability: Mexico, Chile, Brazil, Colombia, Czech Republic, Hungary, Poland.

Low vulnerability: Korea, China, Thailand, Russia.

I believe that the 2008 DM problem is now coming on fully to EMs… they had enough time to prepare. Now the music has begun. Companies with high forex debt (unhedged), high forex requirements, countries with high external debt…. are in grave risk. The biggest one under threat is the whole non profit making startup business…. hope we dont see a startup meltdown in next 1 year.

Hi Gaurav, excellent observation and as you said time is of essence. my view, we are headed to 110 on dxy in next 2 years so the liquidity will just get sucked out of EM including India.