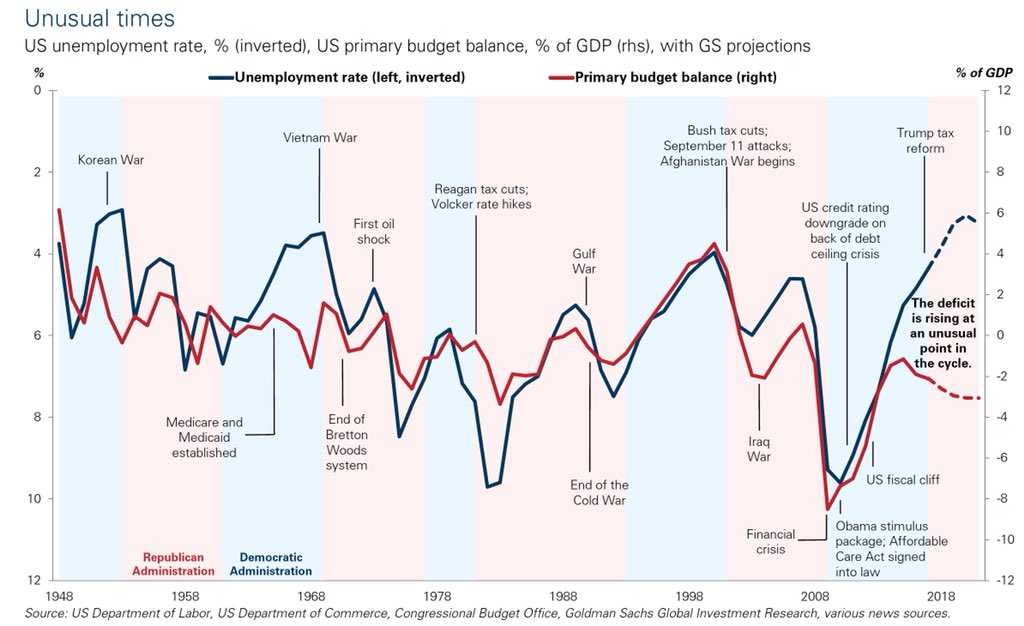

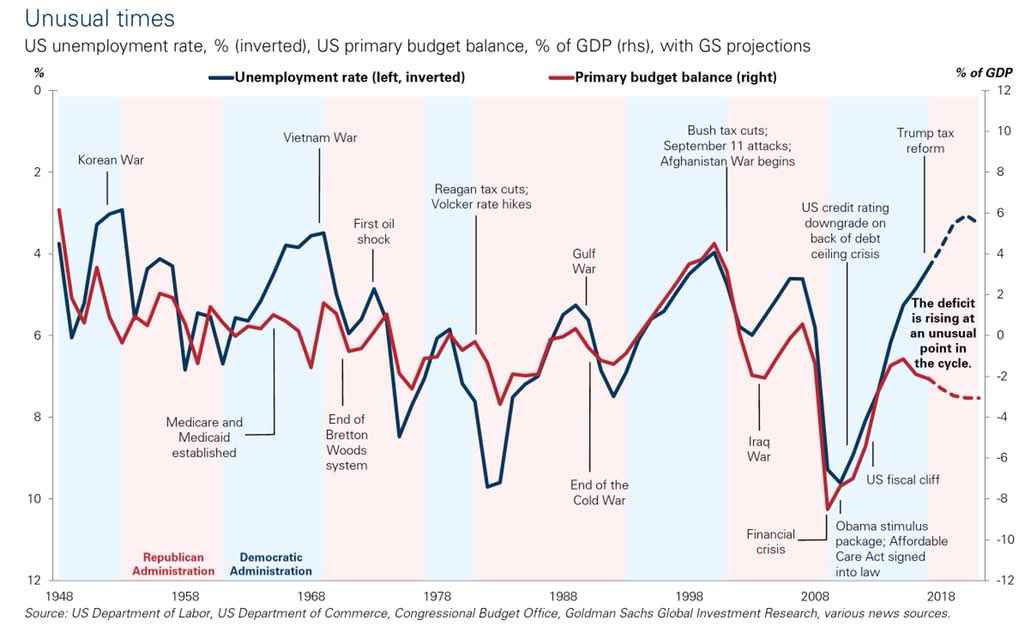

US fiscal policy is in uncharted territory: Running such a large primary deficit (federal revenues minus spending, not counting interest expense) in a period of strong growth and low unemployment is quite unusual, generally reserved for times of war, Goldman says.

why it will lead to higher rates across the globe?

- US would be requiring huge amount of private savings to fund this deficit, projected to top USD 1 trillion dollars next year inspite of a solid economy.

- US rates continue to rise as supply of bonds overwhelms demand for bond from local US private investors

- US 10 year continues to rise reaching 4% ( which I believe will happen in next 12-18 months) making US bonds attractive compared to rest of the world.

- The Foreign money invested in bonds across emerging markets will want to move to US to capture that rise in US yields unless Emerging markets raise rates sufficiently high to maintain the attractiveness of their local currency bonds

- That means EM would have to sacrifice the growth , raise the rates in lockstep to fund and to maintain FPI money in local markets otherwise money will move to US to fund its budget deficit

- The more EM raise rates , more their growth suffers and more US yields rise , the more money will move to US to take advantage of rising US dollar and rising US yields.

- Picture abhi baki hai ( story is yet to be completed …… we are only in 2nd day of 5 day test match)

I must put a caveat here…. I am expecting US 10 year to revisit 2.5% before we eventually break out to 4% over next couple of years.