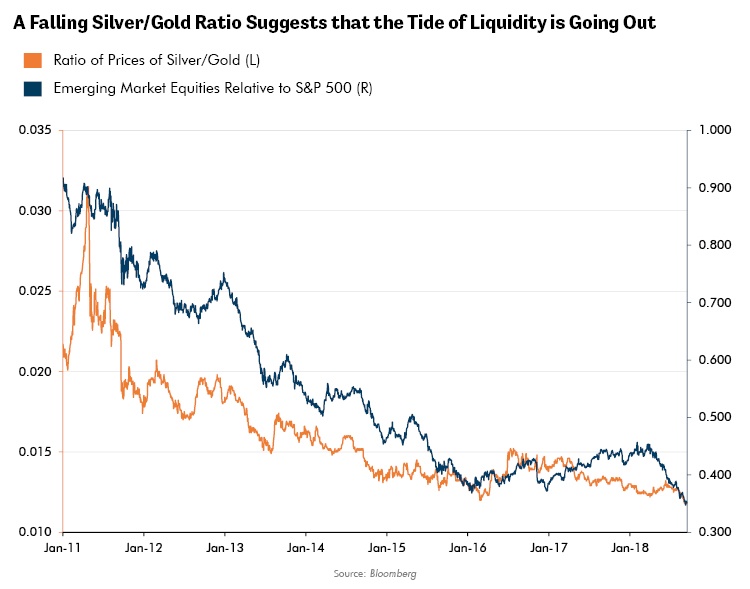

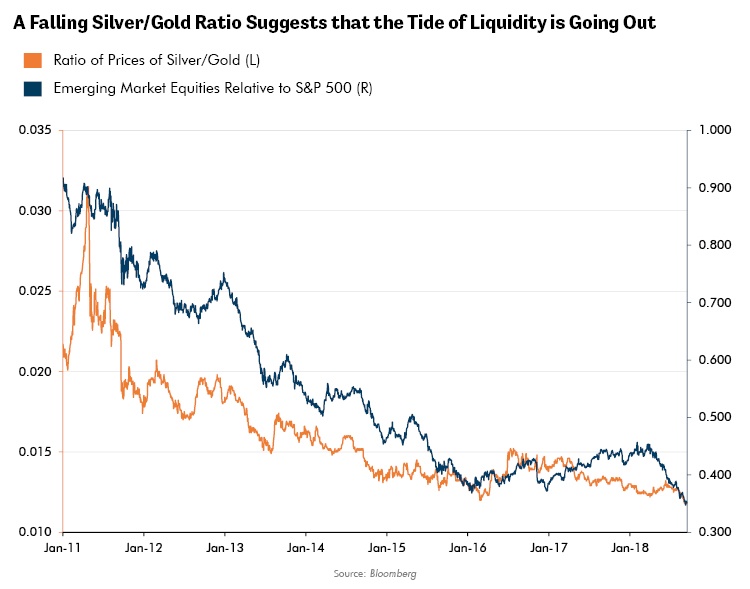

Lewis Johnson writes…Our experience has been the silver/gold ratio is one of the most sensitive leading indicators of liquidity. We believe that a fundamental reality lies behind this relationship. Both gold and silver are precious metals. The nature of the supply and demand for these metals, however, varies. Our experience is that silver is the more sensitive of the two to incremental changes in liquidity and/or inflationary expectations. My experience in real-time watching the silver/gold ratio move from its lows was helpful in both 2003 and again in 2008. In 2003, its rise indicated that the long bruising decline in emerging markets was finally over. Again in 2008, while the world was crashing, the silver/gold ratio demonstrated its insight by turning up in late 2008. I believe this ratio can be equally insightful when booms turn into busts, as this indicator amply displayed in mid-2008 and again in 2011.

Conclusion

We are now nearing historic lows in this ratio. This may suggest that we are in the zone during which we may reasonably expect that values in many emerging market investments will become compelling (I believe it will be commodities heavy markets like Brazil and South Africa). Our discipline, however, learned through many trading cycles, is to pair our valuation-driven insights with an informed view on liquidity. It is our expectation that a sustained turn in the silver/gold ratio may very well be the final link that turns us into more aggressive buyers of the select investments that our research team has identified among this challenged asset class.