The reason is simple. Budget deficits are rising, state and Municipalities are now having more pension obligations with falling revenues. It is easier to tax an immovable asset like property than movable assets because then technically you can move to low tax jurisdiction with your money.

I am seeing more and more evidence of states trying to squeeze the property markets. Simon Mikhailovich tweeted

“Got an annual letter from our coop board announcing a 9% (gulp, gulp) increase in the monthly maintenance. One key reason: “Manhattan buildings have been targeted by the City of New York, which has significant pension liabilities that it must address.”

This is the situation when interest rates are at an all time low and Global economy is still expected to grow around 3% this year as per IMF. Years of low inflation coupled with low interest rates have increased the shortfall in government pension liabilities and the only way this hole can be filled is by increasing the taxes. With interest rates near bottom, real estate owners are facing a double whammy of rising mortgage payments and rising property taxes and maintenance.

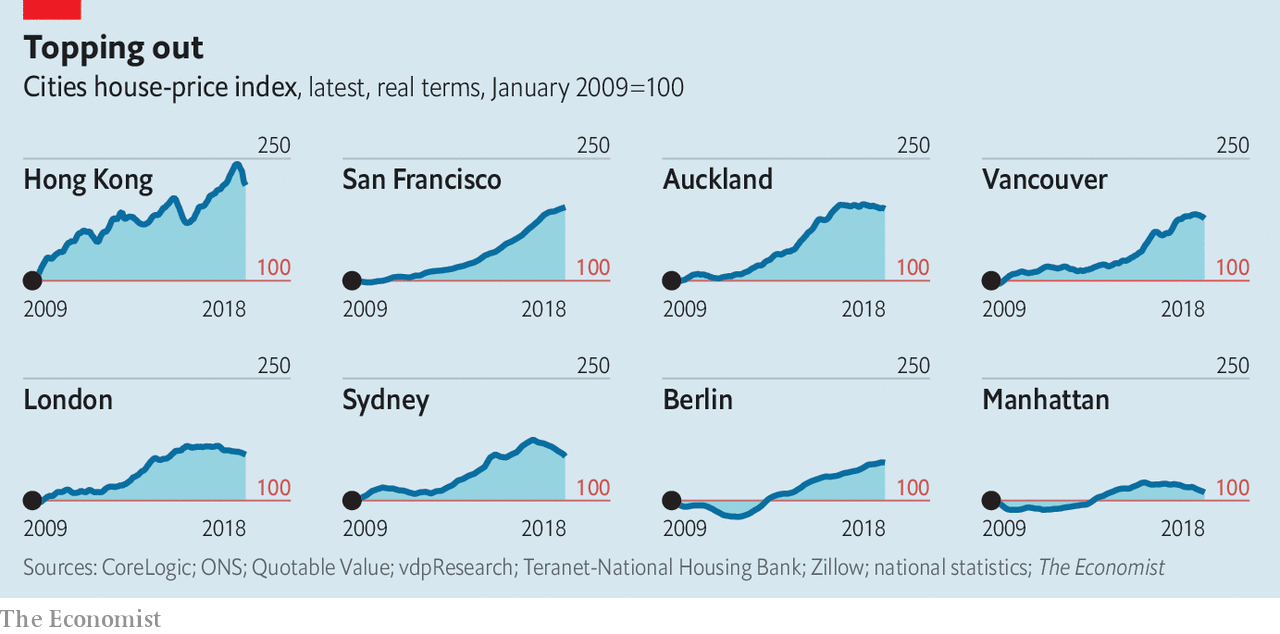

The stagnant incomes and hunt for taxes will increase the cost of ownership for average homeowner and will be the reason that real estate prices (especially in developed countries) are headed for steep fall in coming years.