6th Feb 2020

“Everything which might cause doubt about the wisdom of the government or create discontent will be kept from the people. The basis of unfavorable comparisons with elsewhere, the knowledge of possible alternatives to the course actually taken, information which might suggest failure on the part of the government to live up to its promises or to take advantage of opportunities to improve conditions–all will be suppressed. There is consequently no field where the systematic control of information will not be practiced, and uniformity of views not enforced.”

Friedrich August von Hayek, The Road to Serfdom.

These words not only describe the state of society, but also our markets where everybody is playing a game of musical chairs.

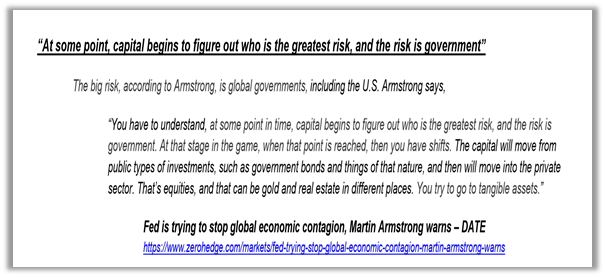

Repo crisis, Coronavirus, Fake news, desperation in governments around the world, that’s why it is important to heed the advice of Martin Armstrong.

Just like me, I am sure, you would also get an uncomfortable feeling when you read these lines from his blog.

On the last day of the month of January, US 10 year treasuries closed at 1.5% and 30 year at a six months low of 2%.

Russell Napier has been massively bullish US treasuries for a long time and see’s a deflationary shock coming.

And speaking of China, I realize that the baby of 2003 is a WWF wrestler on Global stage.

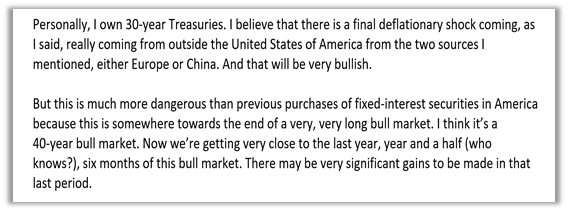

Kevin Muir believes that China will just throw kitchen sink in the aftermath of Coronavirus. That’s already evident with addition of more than 1 trillion Yuan in banking liquidity in first two days of February.

Coronavirus… Buy the periodic table

Macro Tourist further writes in his blog

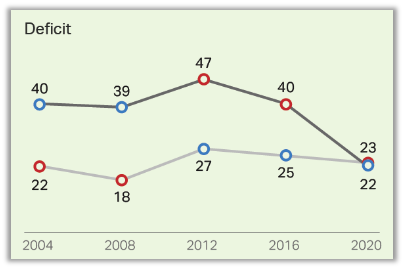

The best one comes from Luke Gromen who predicted the Repo crisis. He is used to connecting the dots and believes that US deficits are getting bigger and market is finding it difficult to absorb the supply. But who cares about the deficit?

As per a survey done by Gallup nobody ( Democrats or Republicans) gives a DAMN about deficits.

Foreign Central Bankers have already stopped buying US treasuries; hence Fed will have to step in to fund this deficit. This will also stop US dollar from rallying further. The result

Market outlook

By now, you must be all confused. I have scared everybody with a deflationary collapse, a banking crisis in China and Europe, buying periodic table and if that were not enough then sharing a 50000 Dow call and $5000 Gold call. I think we will see a combination of all these events, maybe not to such an extent but close enough. When China can make its stock markets go up in the face of a deadly epidemic by pumping enormous amount of liquidity and by suspending short selling, President Trump tweeting every new US stock market high, Tesla getting a major stock price target of $15,000 by ARK valuation model, Indian Central Bank announcing $15 billion LTRO, Fed Vice Chairman talking about capping the bond yields in next recession, ECB talking about funding climate change through its balance sheet, Bob Prince Co-CEO of Bridgewater declaring that we have seen the end of Boom Bust Cycles…… Honestly anything is possible and no target is unachievable. Patience is virtue and flexibility in your views should be the approach.

Regards

Ritesh Jain

Worldoutofwhack.com