Is this turning out as badly as you thought it would?

First, the economic data seem worse than I had expected. The economic drawdown is going to be bigger than I originally thought, and we are currently estimating an economic contraction of well over 10 percent this year. Second, the Federal Reserve’s (Fed) response has been really good. They’ve managed to stem the liquidity crisis in the market pretty quickly with programs that intervene directly to stabilize markets. Third, the response out of Congress and the White House has been disappointing. The programs that have been put in place likely will not be anywhere near sufficient and, in some cases, they are somewhat misguided. Extending and increasing unemployment benefits is very good but sending out $1,200 checks to lower- and middle-class families is not going to have the kind of impact that we need to keep the economy going.

Probably the most surprising thing to me at this point is how well the markets are holding up. Given the economic data, and given the fact that large portions of the capital markets are still virtually closed for business, I would have expected stock prices to be lower at this point.

How are you allocating capital as the pandemic progresses?

Coming in to this period we were very conservative. We were concerned about valuations being too high and thought that interest rates could sink lower. We believe that this has left the portfolios we manage for clients in a terrific position to take advantage of opportunities that are being uncovered. At this point, we are opportunistically trying to move from some of our more conservative investments to securities that, in our view, look attractive. We are looking at investment-grade corporate bonds and municipal bonds, and select securities in structured credit and high-yield, where prices have dropped and spreads have widened significantly, look interesting. As this situation continues to play out, we will slowly increase our risk tolerance and watch for more buying opportunities.

As I have said before, we are in the value ZIP Code, and bonds are historically cheap, so it would be foolish to remain underweight. It’s time to start nibbling, not gorging on these values. At the very least it is probably best to get to neutral versus the benchmark, which is the position to which we have moved.

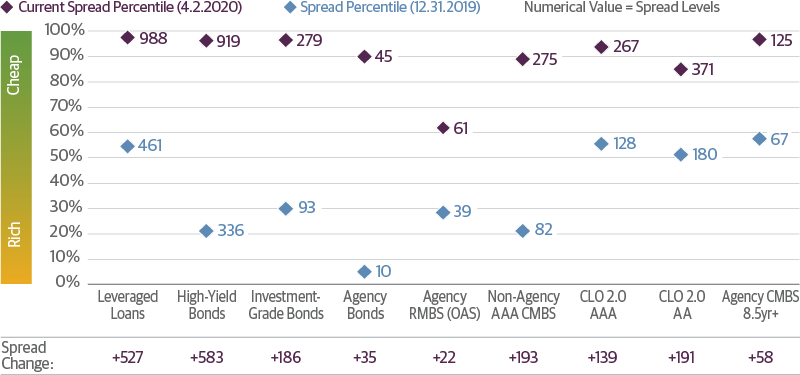

How cheap are corporate bonds and asset-backed securities right now? Looking at the historical spread relationships to U.S. Treasurys for domestic debt markets, virtually every sector is at or near extreme wides. But we still expect spreads could spike wider from here, and these kinds of spikes in the past have not always been short-lived. This is why we are still cautious.

Current Sector Valuations Are More Attractive, But the Selloff Is Not Over

Fixed Income Spread Percentiles (% of Time Spent at or Below Current Spreads Historically)

Source: Guggenheim Investments, Credit Suisse, BAML, Bloomberg Barclays. Data as of 4.2.2020. Index Legend: Credit Suisse Leveraged Loan Index, Credit Suisse High-Yield Corporate Bond Index, Bloomberg Barclays Investment-Grade Corporate Bond Index, Bloomberg Barclays US Aggregate Index (Agency Bond subset), Historical CLO spreads provided by Bank of America Merrill Lynch Research, current CLO spreads based on JP Morgan CLOIE Index, Non-agency CMBS spreads provided by JP Morgan Research.

What aren’t you buying?

It is difficult to try to buy what has really been hammered. Some of the hospitality stocks and airline stocks, for example, could be a death trap—some of them may never come back. One place to look for opportunity is in companies that will perform in what I expect to be a resurgence in the United States in manufacturing.

But one thing I would caution is that if earnings continue to fall as I expect them to, S&P earnings could get as low as $100 this year. Given the traditional market multiple of about 15 times earnings, that would put the S&P at about 1,500, still about a thousand points lower than we are today. Certainly, we are down from the recent peak of 3,386, so we’ve made a big move, but we still have a pretty good move to make. Investors should probably focus their activity on bonds at this point.

We need to see the other shoe drop. When the markets start to see some of the data on unemployment rising and economic growth and corporate earnings contracting, there will be another level of panic in the market. The most likely indicators that will coincide with a buy signal would be a sharp rise in the unemployment rate and a continued fall in the ISM Manufacturing Index.

read more