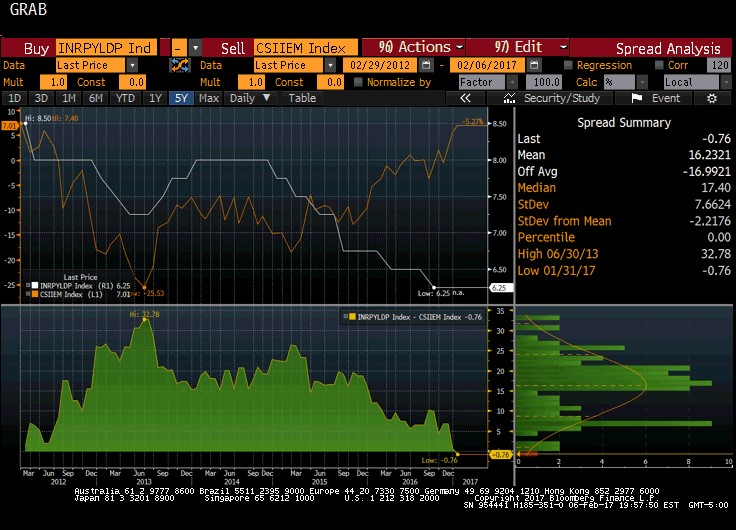

Citi publishes Emerging Market inflation suprise index every month . It measures price surprise relative to expectation . A positive reading means inflation is higher than expected and negative reading means that inflation has been lower than expected.This number which was benign at -0.59 as on 30th nov jumped to 7.01 in the latest january reading . This reading is at a 5 year high.India Repo rate has largely has a high correlation with this index till early months of 2016 when they started diverging, and this divergence also stands at all time high today.As i had discused in my previous article demonetisation led to agri commodities prices falling sharply as lack of money with traders resulted in dramatic fall in food prices in last three months dragging overall inflation down.This was at a time when world FAO food price index touched a two year high.

There is one more point which needs consideration. At the time of dollar strength it is important that countries running current account deficit like India should keep an extra margin of safety in the form of higher than normal interest rate differentials so as to protect currency volatility. The incoming Trump administration might not want strong dollar , the action on border tax, fiscal stimulus, lower taxes will all lead to stronger dollar in future.

Will RBI take into account strong dollar and look through the recent fall in inflation and instead prepare the market for end of easing?

agree with this view. Markets too complacent.