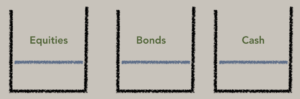

Excess savings in the form of capital typically has 3 places to live. (Dont insult me by asking where is real estate in this matrix)

Think of these as investment buckets, where you will keep your investments in the most favourable bucket or buckets at any one time.

In a stable goldilocks economy where inflation is neither too high nor too low, where debt is low and manageable, and where faith in currency is not in question we could argue that investors would be OK with the above setup.

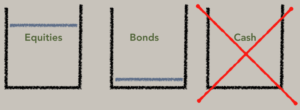

What about when inflation is rising sharply? How do investors re-allocate?

Simplistically, like this:

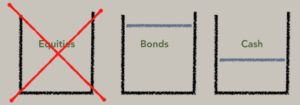

How about a strong deflationary environment?

Simplistically like this:

Now, I only look at capital flows when investing my money and one thing I’ve learned over the last 20 odd years in finance is that capital flows are extremely important and have become increasingly important as globalisation has taken hold. Europe is on precipice and uncertainty rising, not falling. A blow up in Europe, which looks more and more inevitable with each passing day, will see capital flee.

This will have to go somewhere, and so much of it will first go into US treasuries causing the dollar to strengthen and then it will head into equities .This will stoke fears of inflation and the Fed who are way behind the curve already will scurry to catch up, raising rates. Ironically, raising rates will further exacerbate the spreads between US and non-US paper causing more capital to head to the US, creating a self-perpetuating cycle.

Note that this capital flowing into the US will have nothing to do with US corporate profits and none of this will really have anything to do with policies enacted by the Trump administration.

I see the same thing playing out in India where demonetisation and positive real rates have killed the “I only invest in real estate” argument, RBI has decided that currency is more important than interest rates hence decided to change the policy guidance to neutral (loud and clear no more interest rates cuts) and globally inflation is rising which will show up in domestic inflation ……. Early stages of inflation is good only for one asset class and that means equities is the only game left till the time inflation does not turn into stagflation.

This is when gold will turn into the best performing asset class (I must confess here I am a gold bug). Don’t want to leave my hard-earned money in the hands of few academics who run central bank.

Aaaand so….

Is the US and Indian equity market overvalued? Yes!

There are many pieces to this puzzle and I don’t pretend to know them all or how they will interact with one another.

What I do know is that capital flows often overwhelm any “fundamental valuations” (I never believed in fundamentals anyway, only flows matter) .

Wait for a correction in equities but don’t run when you get one

Good article. Do you think smart money would have already moved to US since they would be making the same argument about the future. When the event finally happens and capital moves to US, they would be the first ones to get out?

i think the Em to DM trade will play out over next few years and what we are seeing is just a start. at some point dollar will get so strong that it will hurt US profit growth and US equity markets . but this is a trend in making

In general, dollar index and gold are inversely correlated. Still you said gold will be best performing assets (despite of the capital flows to US), why is that sir?

Also, why this correction is acting like recession?

we are in last few years where US dollar will be reserve currency and hence when US budget deficit blows out some countries will try to diversify to gold because even euro will be on the verge of disintegrating

this correction is coming from artificial flow of money into market which drove markets to obscene heights now there is no more money left secondly society mood is changing for worse that’s why it feels like a recession