Let me start by stating the obvious ” inflation is good for equities and deflation is bad for equities“. Historically rising oil prices are good for equities.

1. Higher oil prices lead to lower dollar and more money in the hand of oil producers which in turn gets recycled into US treasuries leading to lower US bond yields and rising consumer indebtedness (70% of US economy is consumer),or on spending on their population to suppress civil unrest or to buy assets abroad.

2. Higher oil prices lead to rising budget deficits and rising inflation for oil consuming countries. Rising deficits and rising inflation leads to investors buying assets (real estate,equities) to maintain the value of the money

This cycle has continued with some pauses from the time oil has started getting priced in US dollar and this whole arrangement is known as “PETRO DOLLAR”

what if this cycle is coming to an end?

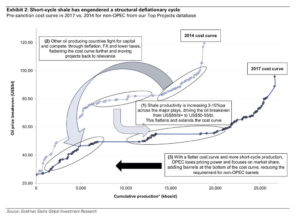

The above is a graph of shale gas curve and US is a big shale producer. The current price of shale production curve is less than the current price of oil. Last week G-20 meeting was historic in that sense where US decided to withdraw from the world stage by touting America first policy. Without Big brother and its current account deficit world has lost an anchor for Petro Dollar and current monetary system.

Your analysis is quite interesting. Just one grouse…the graphs/ pics are frankly illegible. Can something be done about them?

Thanks Amol let me have a look and see what can be done