In one sentence ” The next economic growth cycle cannot start unless the old debts have been repaid or defaulted”

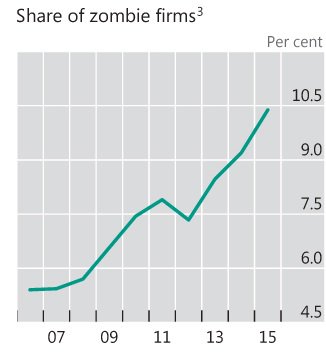

Low interest rates do not help reduce debt, they encourage debt and mal investment. Number of zombie companies (those that cannot pay interest expense with operating revenue) in Europe rise to all-time high.The Bank of International Settlements (BIS) has warned again of the collateral damages of extremely loose monetary policy. One of the biggest threats is the rise of “zombie companies”. Since the “recovery” started, zombie firms have increased from 7.5% to 10.5%. In Europe, BofA estimates that about 9% of the largest companies could be categorized as “walking dead”.

India also has the same problem .The excesses of over lending to unviable projects happened when interest rates were falling and banking liquidity was abundant. The worse part is by evergreening these loans bank’s profit have been overstated to that extent and previous profits needs to be restated lower to that extent. It was always in bank’s interest not to allow these companies to become NPA and that is how our economic growth cycle got stretched. With Regulatory bodies becoming strict along with rise in interest rates,banks are facing double whammy.

Always remember ” An economy is as good as its banking system”

https://www.dlacalle.com/en/the-rise-of-zombie-companies-and-why-it-matters-to-you/