via Evergreen gavekal blog

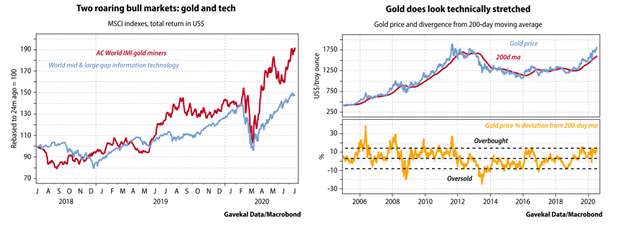

The sustained outperformance of very large-cap tech stocks means that any manager who substantially underweighted the sector has likely lost clients. The exception may be those who favored gold and gold miners, which have experienced a “stealth” bull market (see chart below). I say stealth because the precious metals rally has garnered limited headlines, scant investor interest and fewer reflections on either its causes, or consequences.

The reason that investors focus on tech—and don’t care about gold—is largely down to size, as the “Fab Five” tech stocks make up some 20% of the S&P 500. As a result, tech exposure has dictated relative performance in recent years, and this situation is almost certain to continue; performance will still revolve around the decision of whether, or not, to overweight tech. So given this backdrop, who cares about gold? After all, in spite of a near doubling over the past two years, the total market value of the precious metal mining sector is only about US$550bn—roughly what Amazon has added to its market value this year, or less than a month’s asset purchases by the Federal Reserve.

For now, the market for gold and gold mining stocks tick a number of boxes:

- Both are showing strong momentum.

- Unlike tech, both markets are small enough to keep running without hitting the big numbers problem (see Have Equities Become A Bubble?).

- Neither has become a crowded trade.

- There has been no rush of secondary placements and IPOs usually seen in gold miner bull markets (as repeated capital destroyers, gold miners normally jump at the chance to push paper down the market’s throat!).

- Both assets remain a clear diversification choice for investors worried about runaway budget deficits and an unprecedented expansion of monetary aggregates globally, but especially in the US.

In short, precious metals are in a bull market. A concern may be that the gold price is about 12%, or one standard deviation, above its 200-day moving average (see right-hand chart below). But one has to question what will stop this run up. Historically, precious metals tend to “trend”, with both bull and bear markets lasting three years, or more. Indeed, looking back through gold bull markets in the post Bretton Woods era, one finds the following:

- 1976-80: As inflation rose bonds and equities de-rated, while gold rallied. This changed when US short rates were jacked up to break inflation’s back.

- 1985-88: The Plaza Accord saw major economies agree to a US dollar debasement. Gold and gold miners thrived in this era, only ending when Germany pulled out of the deal and US real rates started to rise.

- 2001-11: President George W. Bush’s “guns and butter” policies spurred a weak US dollar. The concurrent rise of emerging markets meant that a new buyer showed up in the gold markets. This ended when the dollar began to strengthen.

- 2018-?: Deglobalization, high US budget deficits, and surging monetary aggregates seem to have created a new gold bull market. Any breakdown in the US dollar from here will likely push gold higher. Looking at recent history, when gold bull markets get going they usually feed on their own momentum for quite a while and only end when facing (i) higher nominal interest rates, (ii) a stronger US dollar and (iii) a rise in real rates. Hence, consider these threats to the unfolding gold bull market.

Momentum: Gold bull markets may build up over multi-year periods as the metal speaks to the public’s imagination. For millennia, gold has been valued for its beauty, which may explain why it becomes more attractive as its price rises. The new thing—certainly in 2001-11—was most new wealth being created in emerging markets, where investors have a strong cultural affinity for gold. In contrast, the past decade saw most of the world’s wealth created around technology campuses on the US west coast by people with scant interest in the “barbarous relic”. This is interesting, as gold has ripped higher in the past two years in spite of a market consensus that global wealth creation in the coming years will match that of the last decade. In short, gold is showing strong momentum despite emerging markets having broadly been dogs with fleas for a decade. Imagine if the dollar is now done rising and EMs, led by Asia, again thrive. What a tailwind that would be for gold.

Higher nominal rates: It is easier to find an alluring candidate in the US presidential race than an OECD central banker even thinking of raising interest rates in his or her lifetime. Higher nominal interest rates are simply not a threat to the unfolding gold bull market.

Stronger US dollar: The main case for a stronger US dollar is that foreigners spent decades borrowing in the currency and a turnaround in the US’s current account deficit (thanks to its energy boom) will make it hard for foreigners to get dollars and service their debts. Cue a “US dollar short-squeeze” which would see the dollar exchange rate sky-rocket. There are many problems with this theory starting with the fact that—instead of improving—the US current account deficit is actually worsening (US consumers are shoveling ever more dollars offshore). Secondly, rather than rising, the cost of borrowing dollars continues to fall. Thirdly, since the Fed has swap lines with some 15 other key central banks, how can a dollar shortage develop? Moreover, how can dollars be scarce when US M2 is growing at about six times nominal US GDP growth, or 24.5% per annum—an absolute and relative record. Instead, the more interesting question is whether, over the next decade, foreigners find themselves using US dollars more to settle their foreign trade, or less. If less, then that should be structurally bearish for the dollar.

Surging gold supply: A key mantra of commodity investing is that the solution to high commodity prices is high commodity prices, just as the reverse holds true. Yet increases in commodity output, spurred by rising prices, is always lagged (why commodity prices usually trend for five to 10 years). A key question is thus whether the recent gold price rise is enough to trigger big production gains in the coming quarters. The answer is “no”. Rather than pour capital down new holes, gold miners have spent the past year consolidating with record takeover activity seen.

A rise in real rates: The above leaves a rise in real rates as the most credible threat to the unfolding gold bull market. Yet if nominal rates are not going to rise, the only way the US and other OECD countries can experience surging real rates is through an already low inflation rate collapsing more. But how? Energy prices seem to be done falling and labor costs are being supported by government diktat and purchasing power protection schemes. A possible source of future global deflation could be a collapse in real estate prices or alternatively a huge fall in the renminbi. So far, there are few signs of such shocks unfolding and it seems clear that policymakers in both the West and China are intent on stopping such developments. So with this in mind, it seems likely that a surge in real rates is not an immediate threat.

Putting it all together, the odds thus have to be that the stealth gold bull market will continue.