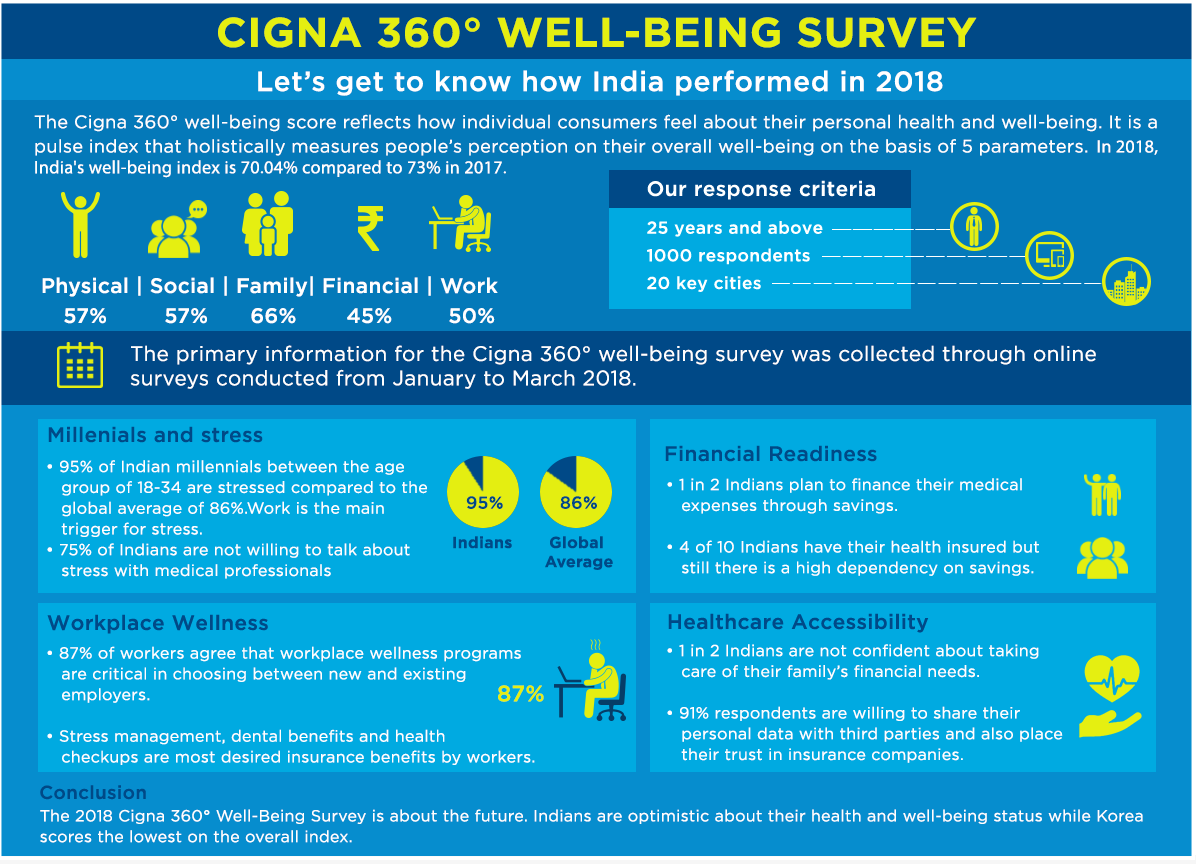

1.About 89 per cent of those surveyed in India said they suffer from stress, compared to the global average of 86 per cent

2.Work and finances are the key reasons for stress, with millennials (18-34 years) suffering more than other groups: 95 per cent millennialls reported feeling most stressed and least able to cope.

3.Nearly, 75 per cent of respondents in India do not feel comfortable talking to a medical professional about their stress; cost is a barrier to seeking professional help.

4.In the Social pillar, over 50 per cent of those surveyed from India said they do not spend sufficient time with friends or have enough time for hobbies.

Author: Ritesh Jain

The Global recession of 2019

Gavekal explains in this must read piece

A world-wide recession is looking more and more probable. And if the time lag is similar to those in the past, it could hit by March 2019. Indeed, looking at the performance of markets over the last six months, it looks as if a bear market may have already started everywhere but in the US. As they have written repeatedly in recent months, bears are sneaky animals. Their victims seldom see them coming (see America First, The Rest Of The World Second).

1.Global Banks have lent too freely in US dollars, and their shares are suffering

2.And to add insult to injury, the US dollar is appreciating

3.The eurozone is in no fit state to weather another recession

4.The big danger is a runaway rise in the US dollar ( and my views on this are very vocal…)

5. Investors should sell the shares of companies with negative cash flow, especially if they are short US dollars. 6. The big risk is an uncontrollable rise in the US dollar if Europe’s fixed exchange rate system falls apart, much as earlier US dollar liquidity crises led to the collapse of fixed exchange rate systems in Latin America and Asia.

We are in the fourth day of five day test match and you have been warned

Charts that Matter- volume 3

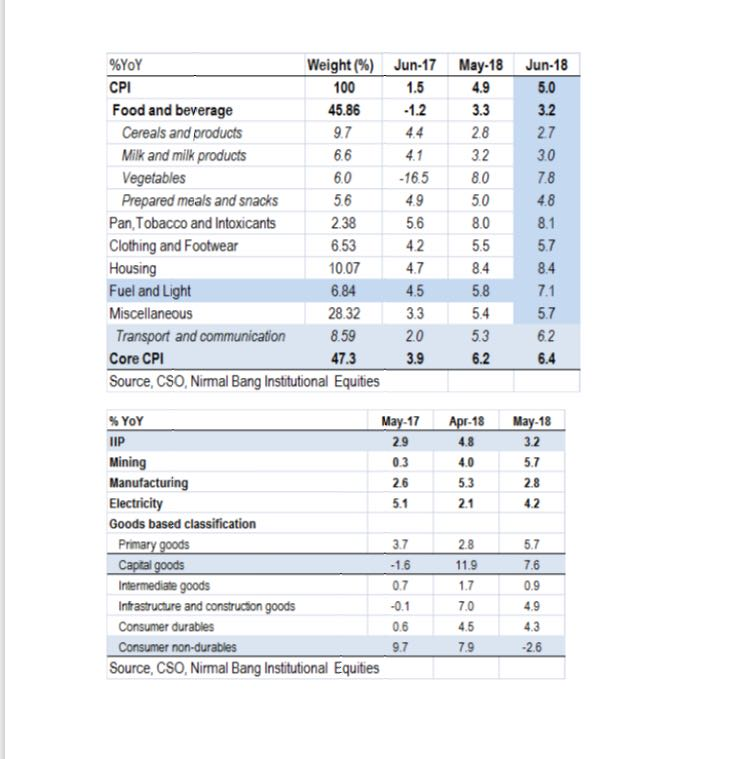

1.India CPI rises to 5% & IIP slows to 3.2%. The downside surprise came from Food inflation whereas core inflation stood at 6.45%.The IIP slowdown can be attributed to consumer non durables.Expect one more rate hike in H2 2018 but MPC to stay on hold in August policy.

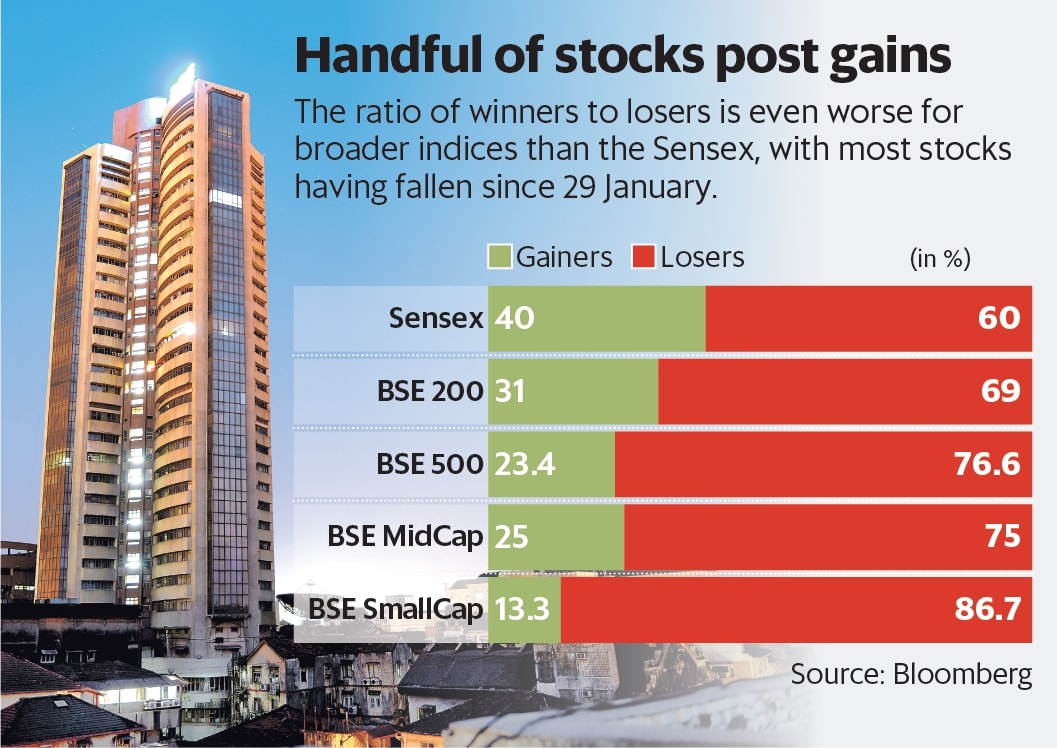

2.Indian benchmark equity indices recorded new highs on Thursday, but the rally is tilted in favour of a handful of stocks, and is far from being a broad-based one. This is classic sign of late stage bull market

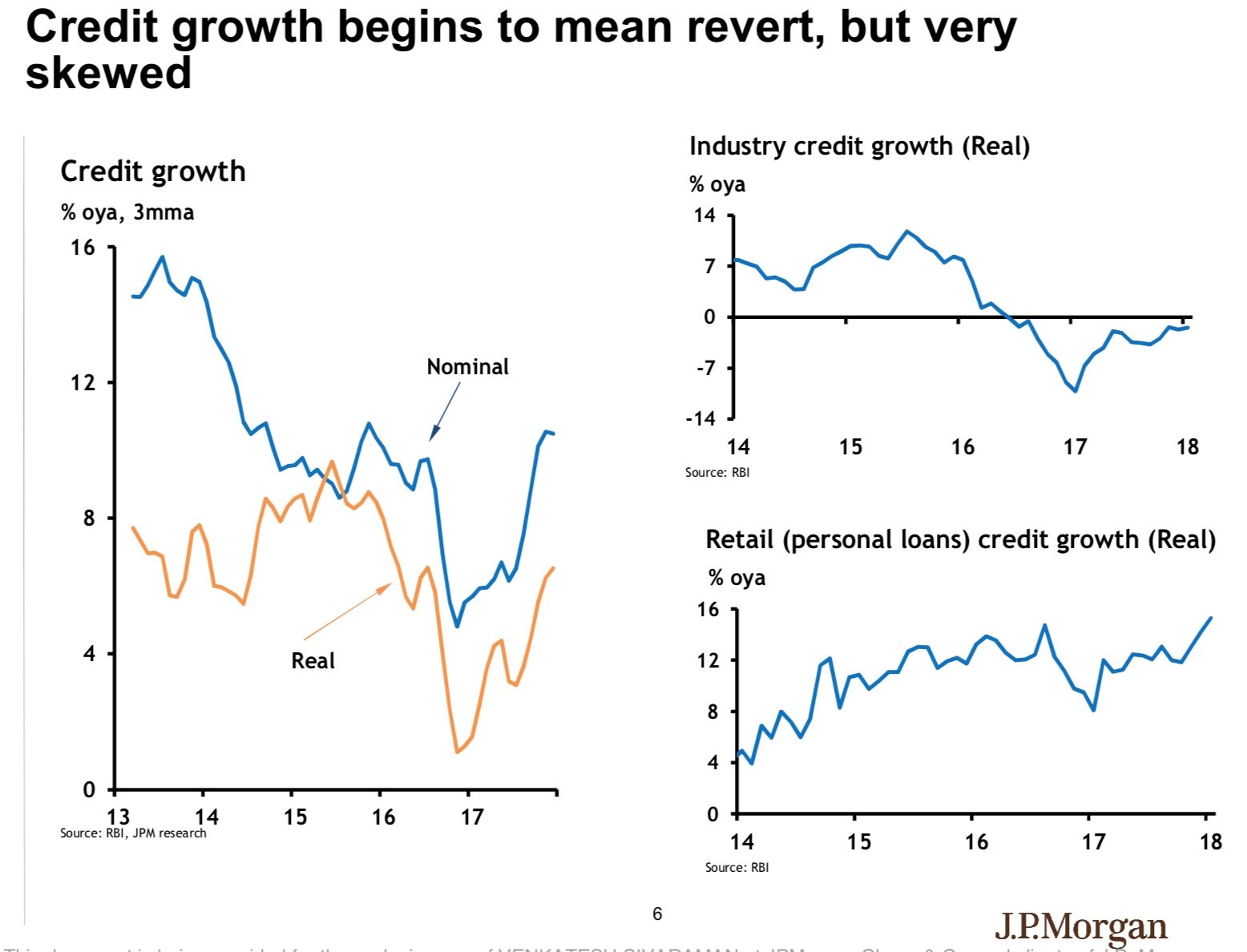

3.India credit growth is still retail driven, Household continue to leverage . Corporate credit growth still restricted to working capital

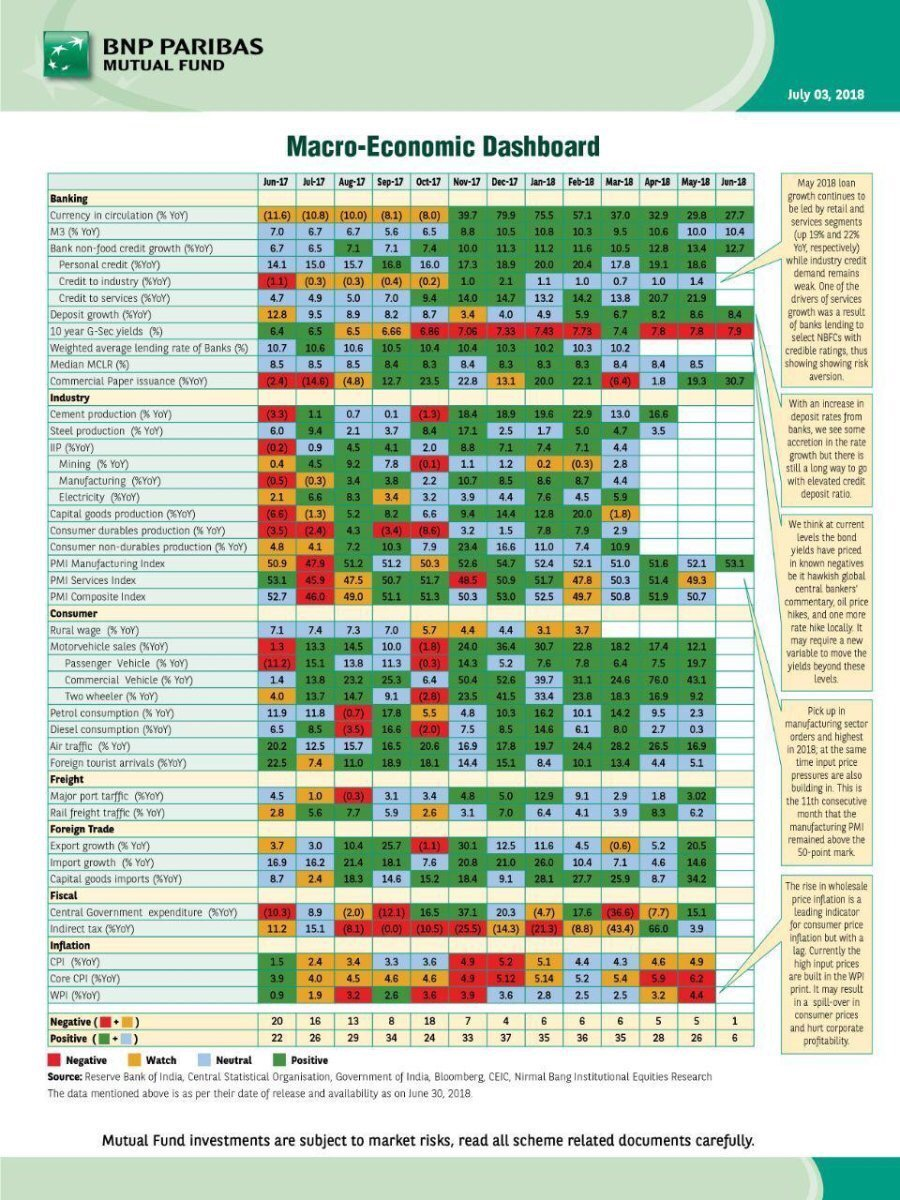

4.Macro-Economic Dashboard – Most indicators continue to be in green

5.India outperforming other EMs. A strong dollar favors India over other EMs. Oil falling is cherry on top.

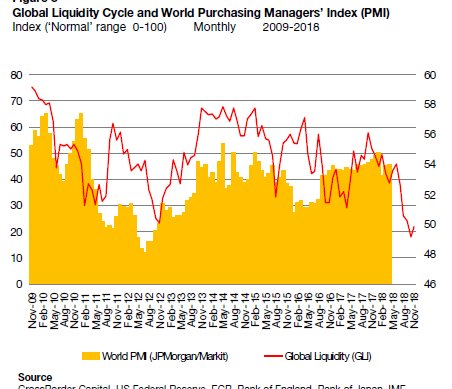

6.Global Liquidity Latest: The Risk Cycle Has Peaked…Are Economies Next? as PMI and Liquidity dips

7.One story about Turkey is the falling Lira and weak BoP. But in many respects that story is a symptom, not the cause. The real story is that 2017 saw a government-led lending boom, boosting growth big time. The credit impulse has now turned negative,weighing on growth big time.India is also doing some of that stuff to boost growth, if private sector does not pick up the slack we could also end up in trouble in 2019.

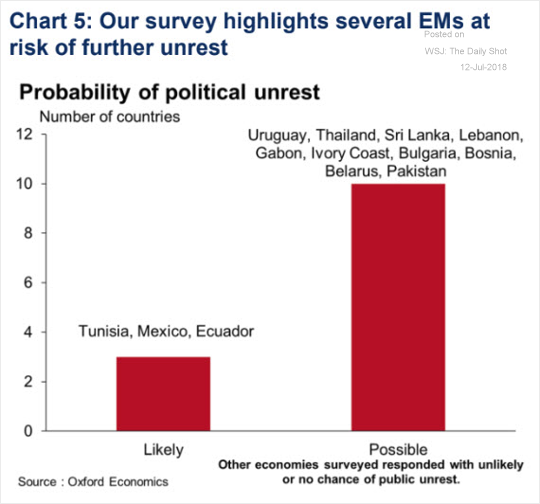

8.Two of our neighbours are on this list and one can actually create serious trouble to divert attention

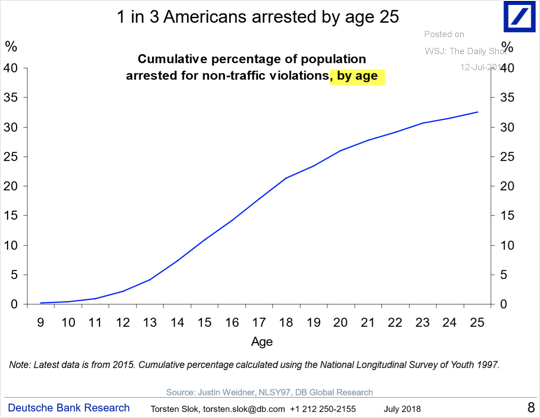

9.Speechless!!!!

Charts That Matter- Volume 2

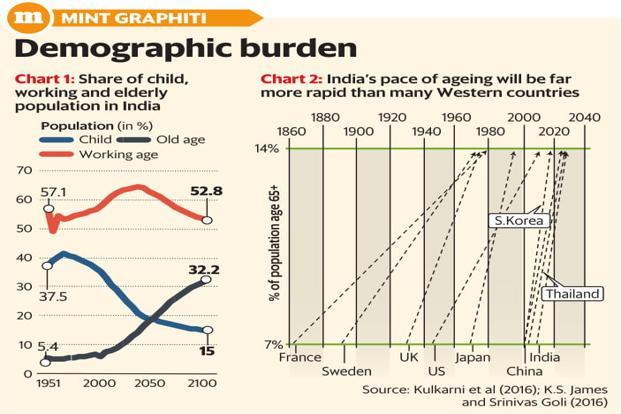

1.While India’s overall population would grow for another 20-30 years, much of the growth would happen in poorer states, resulting in a huge spike in internal migration. Kerala or Tamil Nadu are far closer to Western Europe in terms of the fertility rate, and the Gangetic belt closer to Africa. A tiff similar to the ongoing international backlash against migration may play out within India

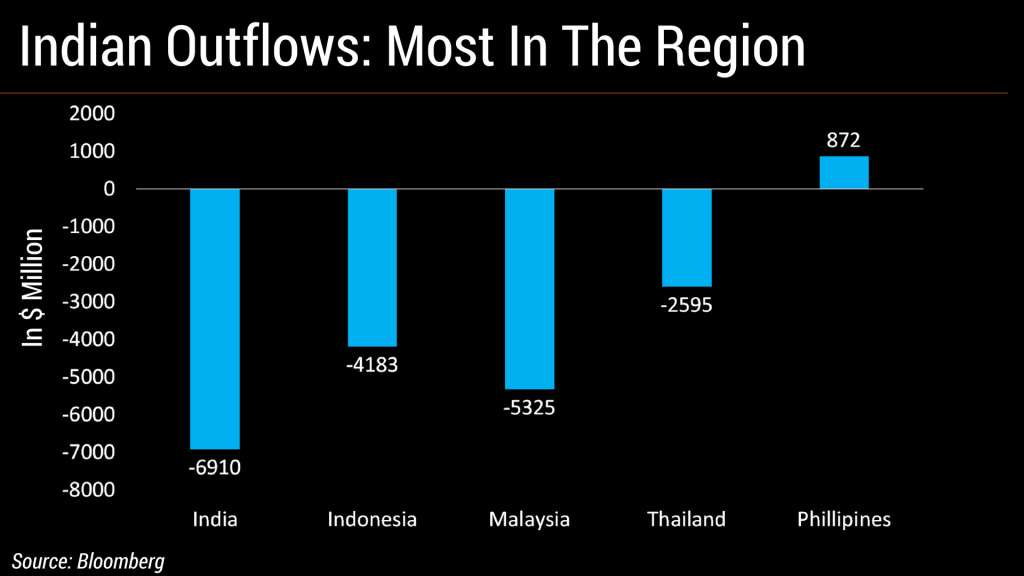

2.India has seen the highest foreign fund outflows among its emerging south and southeast Asian peers so far this year as the rupee depreciates and global trade tensions escalate.Equity market is holding up purely on SIP flows whereas bond yields are bearing the brunt of added outflows from domestic investors

3.The Foreign outflows can also be seen from the lens of currency depreciation. All countries which have seen significant depreciation have seen worsening macros or political instability

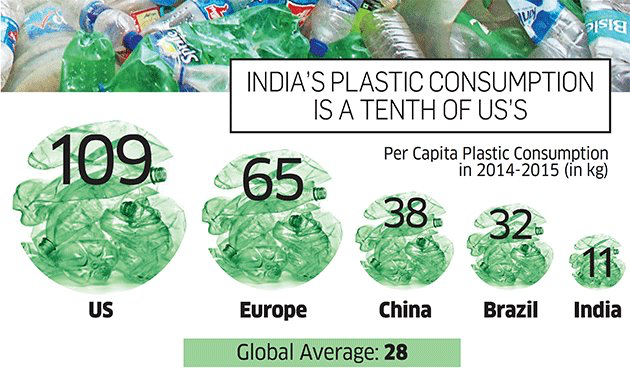

4.Lot of debate on plastic consumption in India, but our consumption is barely 1/10 that of US .

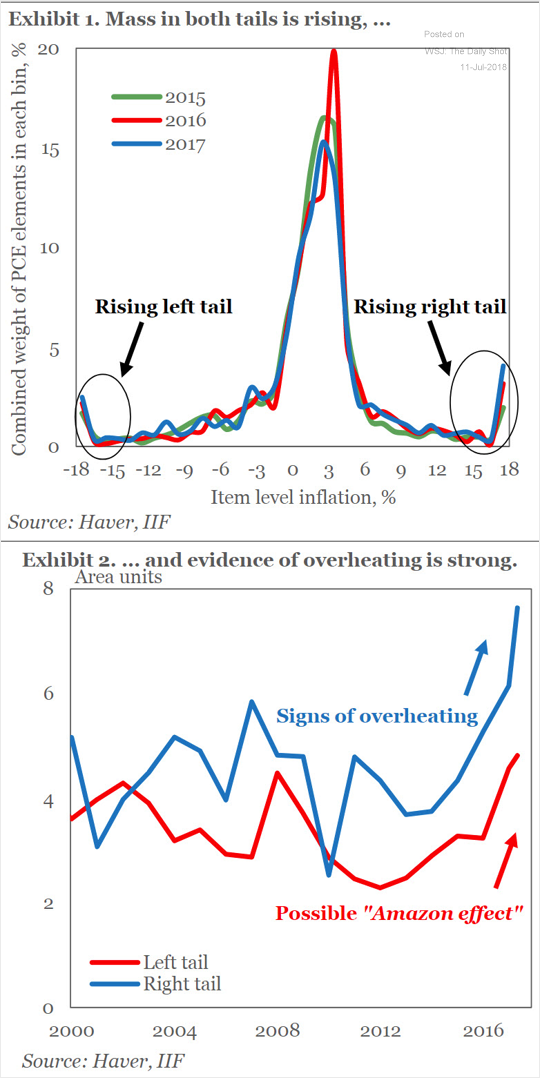

5.Amazon effect on inflation fading as overheating concerns start cropping up.

Below is a chart of US consumer inflation distribution by item. Both “tails” are on the rise. IIF attributes the lower tail to the “Amazon effect.” The upper tail, however, shows “signs of overheating.”

This can be a significant driver of Global inflation

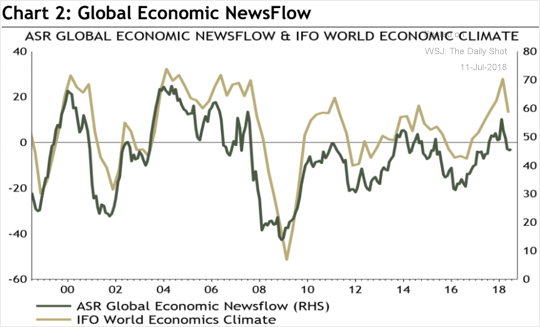

6.But the below proprietary chart from Absolute strategy research on Economic news flow points to a coming global slowdown.If I combine global slowdown with inflation concerns then it points to STAGFLATION

7.The US 1 year yield is at a 9 year high making , highest in the developed world increasing the allure of USD

July ’09: 0.45%,July ’10: 0.30%,July ’11: 0.17%,July ’12: 0.20%,July ’13: 0.13%,July ’14: 0.11%,July ’15: 0.28%

July ’16: 0.50%,July 17: 1.20%

Today: 2.36%

Charts that matter

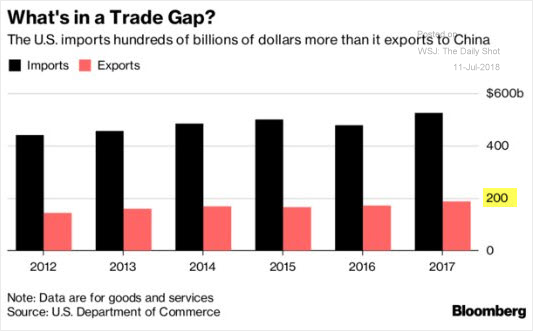

What’s so special about $200bn? China doesn’t import that much from the US, making a tit-for-tat tariff-based retaliation impossible.So how will china retaliate?

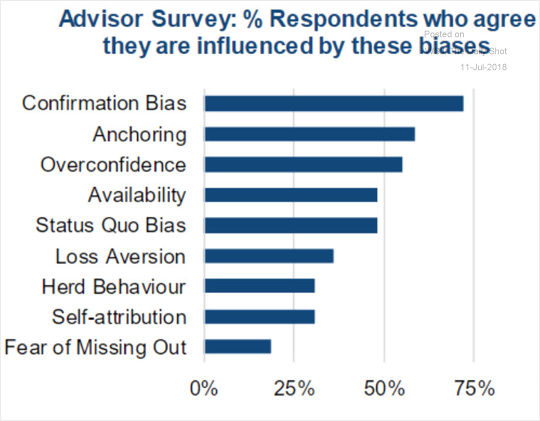

what are the most common investor biases? Apart from confirmation Bias , I always thought it is FOMO ( Fear of missing out)

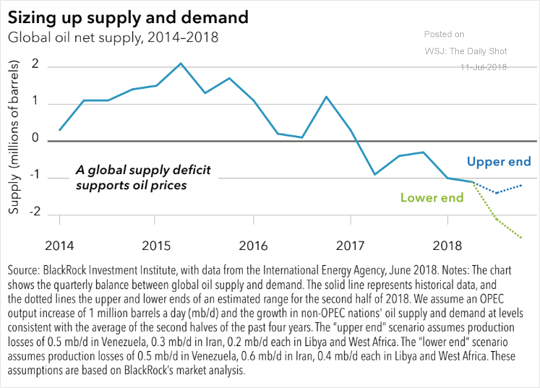

Global crude oil markets are expected to remain in deficit.This is why prices can remain stubbornly high for sometime to come.

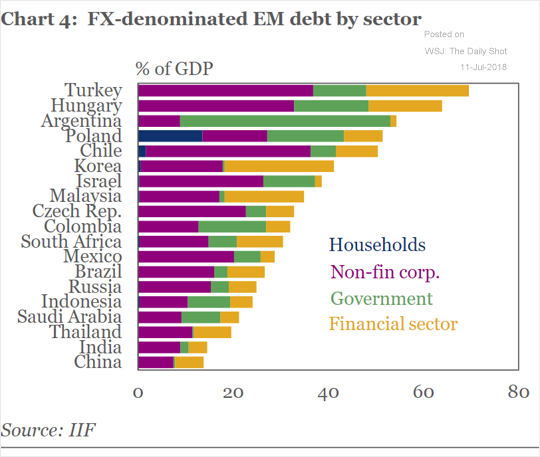

FX denominated debt…. India is way down, thanks to our prudent central bank

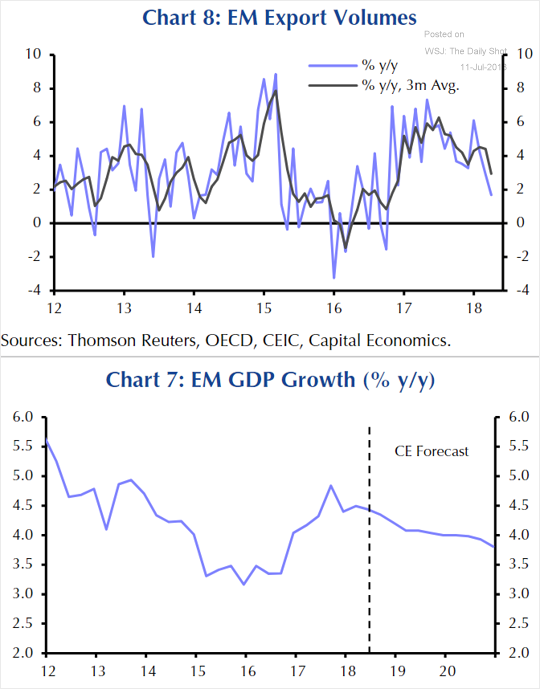

EM exports growth is slowing. India export volume was already struggling even during good time of EM export growth.

Dr Copper is also signalling slowdown ahead. King of base metal is a leading indicator of Global growth

China Makes More Cement Than The Rest Of The World

An incredible statistic from Bill Gates’ blog shows that between 2011 and 2013, China consumed more concrete than the U.S. did in the entire 20th century. The Three Gorges Dam alone required 16 million tons of cement. The country’s insatiable thirst for the stuff hasn’t been quenched and it comfortably remains the world’s king of concrete. In 2017, China produced more cement than the rest of the world combined, according to the U.S. Geological Survey.

Russian Oligarchs and Indian “Bollygarchs”

The way oligarchs is associated with Russia, some people are associating word “Bollygarchs” with India. Both mean same but probably it gives a’ filmy twist’ to an otherwise menacing term for common man.

The last three decades have seen an extraordinary explosion of wealth at the top of Indian society. In the mid-1990s, just two Indians featured in the annual Forbes billionaire list, racking up around $3bn between them. But against a backdrop of the gradual economic re-opening that began in 1991, this has quickly changed. By 2016, India had 84 entries on the Forbes billionaire list. Its economy was then worth around $2.3tn, according to the World Bank. China reached that level of GDP in 2006, but with just 10 billionaires to show for it. At the same stage of development, India had created eight times as many.

Now the billionaire club has swelled to 119 members,according to Forbes magazine. Last year their collective worth amounted to $440bn – more than in any other country, bar the US and China. By contrast, the average person in India earns barely $1,700 a year. Given its early stage of economic development, India’s new hyper-wealthy elite have accumulated more money, more quickly, than their plutocratic peers in almost any country in history.

Nonetheless, India remains a poor country. In 2016, to be counted among its richest 1% ,Indians required assets of just $32,892, according to research from Credit Suisse. Meanwhile, the top 10% of earners now take around 55% of all national income – the highest rate for any large country in the world.

Raghuram Rajan – asked an even more pointed question about his country’s tycoon class: “If Russia is an oligarchy, how long can we resist calling India one?”

The nexus between business and politics lies at the heart of this problem of India’s billionaire Raj, namely the boom-and-bust cycle of its industrial economy. In recent decades, China went on the largest infrastructure building spree in history, but almost all of it was delivered by state-backed companies. By contrast, India’s mid-2000s boom was dominated almost exclusively by its private-sector tycoons, giving the industrialists and the conglomerates they run a position of outsized importance in India’s economic development.

Bollygarchs borrowed huge sums from state-backed banks and invested with gleeful abandon, in one of the largest deployments of private capital since America built its railroad network 150 years earlier. But when India’s good times came to an end after the global financial crisis, the tycoons’ hubris was exposed, leaving their businesses over-stretched and struggling to repay their debts. In 2017, 10 years on from the crisis, India’s banks were still left holding at least $150bn of bad assets.

“The main danger with extreme inequality is that if you don’t solve this through peaceful and democratic institutions then it will be solved in other ways … and that’s extremely frightening,”( honestly this is my biggest worry as indians get more educated but with less opportunities of employment leading to demographic dividend turning into demographic challenge) as French economist Thomas Piketty has said of India’s future, pointing to likely rising future tensions between the wealthy and the rest.

Meanwhile, as democracy falters in the west, so its future in India has never been more critical. To make this transition, India’s billionaire Raj must become a passing phase, not a permanent condition. India’s ambition to lead the second half of the “Asian century” – and the world’s hopes for a fairer and more democratic future – depend on getting this transition right.

Excerpt fromThe Billionaire Raj: A Journey Through India’s New Gilded Age by James Crabtree

Selecting equity mutual funds from Clutter

Arun writes is this easy to understand blog on ” how to select equity funds” with a great analogy from Steve jobs.

There are essentially only four categories to invest… rest everything is actually a noise for small investor

- Large Cap

- MultiCap

- Mid Cap

- Small Cap

Large cap ( for first time investor) category, investor should invest through https://economictimes.indiatimes.com/wealth/invest/forget-direct-plans-these-etfs-charge-only-0-05-per-cent/articleshow/53075935.cms these direct plans of AMC which charge as low as 5 basis points. why do you need to pay 2% plus for any actively managed large cap fund when 80% of the investment fund manager makes is essentially in large cap stocks ( most largecap fund managers are not beating their benchmarks in last couple of years). I personally prefer Multicap category because of the risk adjusted returns of this category and the space Portfolio managers have for manouverability.

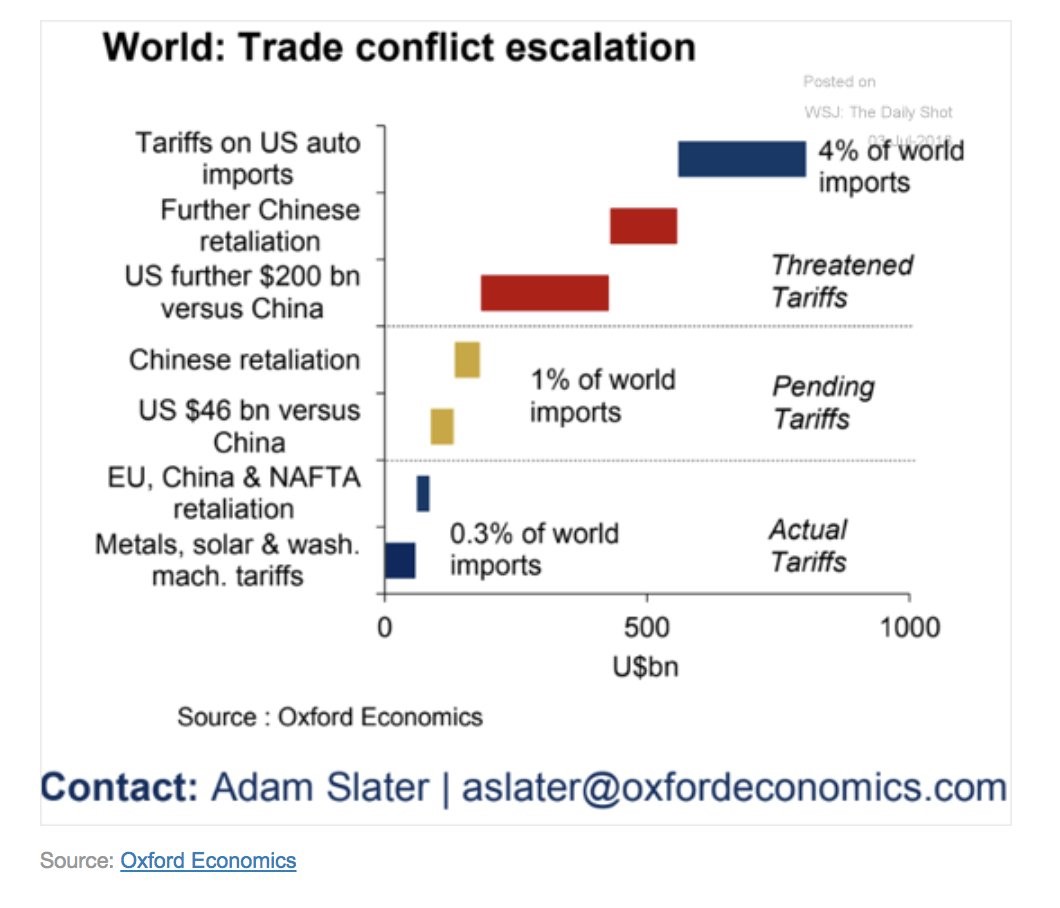

Tariff Barriers only 0.3% of world imports

The Oxford Economics chart below shows the effect tariffs, pending tariffs, potential tariffs will have on global trade.

The current and pending tariffs will have a small impact on global trade growth, but the threatened tariffs will have a medium sized impact on trade which could cause a temporary but sizable decline in trade. The scary part is the threats keep increasing which means the potential for a recession caused by tariffs is getting more likely (it still has a low probability now).

Rupee at 70 and clamour for NRI bonds

In case Dollar continues to appreciate it is but natural that INR will depreciate in line with other currencies and in due course it may hit 70. what is more interesting is that fear of Rupee weakness is coupled with clamour of NRI bonds.

Last time we did NRI bonds, India import cover was down to less than 7 months of import but today our macros are nowhere in that position. But NRI bond is also a drain on exchequer . When India did last NRI bond issue in 2013 Indians basically subsidised NRI’s to the tune of approx USD 3 billion for shoring up our Rupee and not to forget the huge commision earned by intermediaries.