The Wolfstreet website gives an interesting spin on the Fed’s minutes, which the Fed used to explain why the curve was an unreliable recession indicator; basically that the long end was being suppressed by the Fed’s balance sheet. It also blamed a “reduction in investors’ estimates of the longer run neutral rate” and “lower longer-term inflation expectations” although I fail to see these as being anything but normal components of bond yields. According to “some participants” these factors “might temper the reliability of the slope of the yield curve as an indicator of future economic activity” the minutes said. The “information content” of the curve may therefore be distorted, hence why they looked at the spread from 0 to 6 qtrs. Interpreting the two curves as recession indicators, the 2’s – 10’s curve (blue line) is showing a rising probability, while according to the new indicator, “the market is putting fairly low odds” on this scenario. As the article says, just as the 2’s10’s curve is approaching zero, the Fed is beginning the process of throwing that out as an indicator, suggesting a more hawkish central bank.

Author: Ritesh Jain

The Solid Ground fortnightly – China – A Country Matures, An Exchange Rate Declines

Rusell Napier writes in this masterpiece on monetary economics why we will first see deflation and then Inflation.

The ability of China to extend the cycle has come to an end as the current account surplus has all but evaporated – a natural consequence of extending the growth cycle by keeping money too loose when the external account deterioration dictated that it should be kept tight. It has come to an end as the capital account is at best in balance rather than surplus. It has come to an end because the RMB is primarily linked to a strong currency in the form of the USD. It has come to an end because the Fed is both raising interest rates and destroying high-powered money to the tune of USD360bn a year (see Q1 2018 report Crowding Out: Higher US Real Rates and Lower Inflation). It has also come to an end because Jay Powell has warned China, and other emerging markets, that he will not alter the course of US monetary policy to assist with any credit disturbances outside his own jurisdiction.

And if that were not enough, it has come to an end because the US runs small current account deficits, by its own historical standards, and the President of the USA seems determined to make them even smaller. Investors now need to ask a bigger question when considering the future for Chinese, and thus emerging market, monetary policy. Why would anybody want to link their currency to the USD?

The initial shift to a more flexible Chinese exchange rate is deflationary and dangerous. The USD selling price of Chinese exports will likely fall, putting pressure on all those who compete with China – EMs but also Japan. The USD will rise, putting pressure on all those, particularly EMs, who have borrowed USD without having USD cash flows to service those debts. With world debt-to-GDP at a record high, such a major deflationary dislocation can easily trigger another credit crisis and The Solid Ground has previously focused on where such credit events are likely.

However, following the great dislocation, China will be free to reflate the world, for such will be the potency of the monetary policy of such a large economy relaxed about running a current account deficit. Investors should not bet on this happy outcome. There will be deflationary pressures and a potential credit crisis to navigate first. At any time in this process very unpredictable political feedback could delay or prevent China’s move to its new role. So, prepare for the deflationary consequences of this shift in the global monetary system, and expect as well as hope that it too will end as China helps the world to inflate away its debts. (Subscription required)

Investing Globally…….Some considerations

Diversification can protect you from having a home country bias and the risk of holding a concentrated position in a single economy or market. So international diversification is a risk management tool.

Even if it doesn’t enhance returns, it’s hard to put a price on the protection it provides from being invested in the wrong country at the wrong time for an extended period.

Engineers, PhDs among 5 lakh applicants for 4,257 guest teachers vacancies in Bihar

BOJ tapers quitely ..follows FED

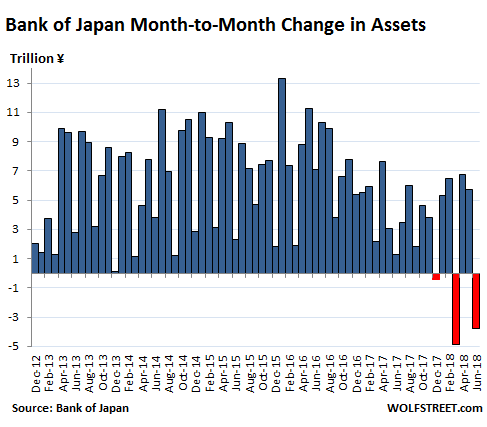

One more central banker takes away the punch bowl without any announcement.In June, total assets on the Bank of Japan’s balance sheet dropped by ¥3.79 trillion yen ($34 billion) from May, to ¥537 trillion ($4.87 trillion). It was the third month-over-month drop in seven months, and the first such drops since late 2012, when the Abenomics-designed blistering “QQE” (Qualitative and Quantitative Easing) kicked off.So three months out of last seven months BOJ has contracted its balancesheet

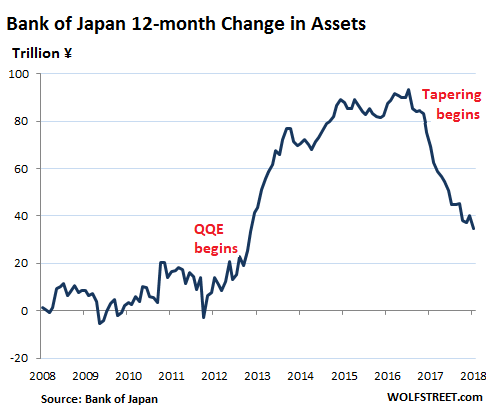

During peak QQE, in the 12-month period ended December 31, 2016, the BOJ added ¥93.4 trillion (about $846 billion) to its balance sheet. Over the 12-month period ended June 30, 2018, it added only ¥34.9 trillion to its balance sheet. That’s a 63% plunge from the peak.

This chart shows this rolling 12-month change in the balance sheet, going back to the Financial Crisis.In other words, the BOJ has started to let some government securities mature and roll off the balance sheet without replacement – much like the Fed’s QE unwind.

somewhere central bankers are realising that they are responsible for this inequality because their policies only helped rich becoming richer through asset markets and that is why its a matter of time we will see heightened volatility across asset markets as the central bank put ia wavering.

The same old question of Real Estate Investing

There are various factors which indicate that the lull in the real estate is here to stay. Therefore, it certainly does not make sense to buy a residential property from an investment point of view at this point in time. “Considering the rising interest rates and high maintenance cost and tax on rentals and capital gains, I would not suggest investment in physical real estate,”ASK Advisors

Markets Predicting Geopolitics

Karachi stock exchange is like a falling knife and as Rohit from indiacharts writes ….. this ugly looking charts should make us sit back and think about its geopolitics implication. Afterall it is time tested strategy to pin the blame of economic turmoil on foreign power .

on a seperate note Pakistan Rupee has gone through three devaluation is last one year and it seems it is not done yet

This is one more variable to an already complex market

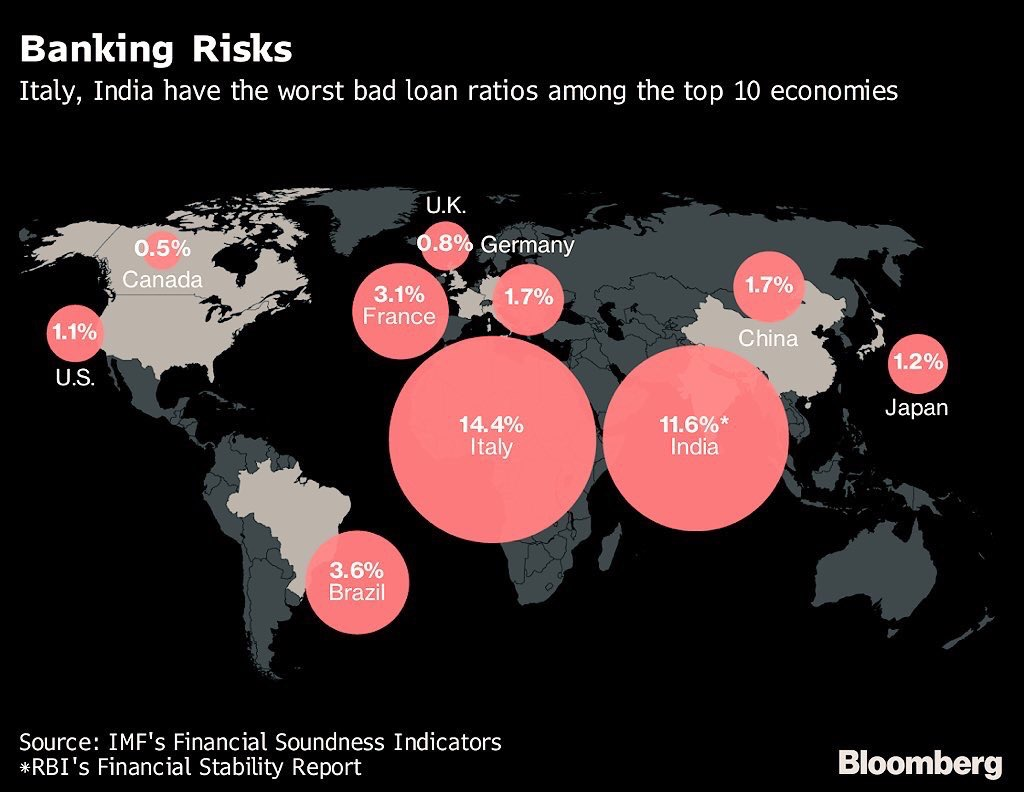

India NPL problem second highest in world

The chart says it all.

Realistically speaking there are only two ways of tackling this problem

1. Inflate away the debt ……accept higher inflation……..inflation reduces the value of debt and increases the value of asset….. currency takes a knock ……making India theoritically cheaper for foreigners… but inflation hurt only poor people

2. Extend and Pretend……makes it a long drawn process… muddle through economy……credit creation suffers as banking capital is slowly wiped away……..economy sees subpar growth for many years

Historically, Emerging Markets have chosen option 1 .India cannot choose option 1 now because it is bound by inflation targeting…..and option 2 is very painful.

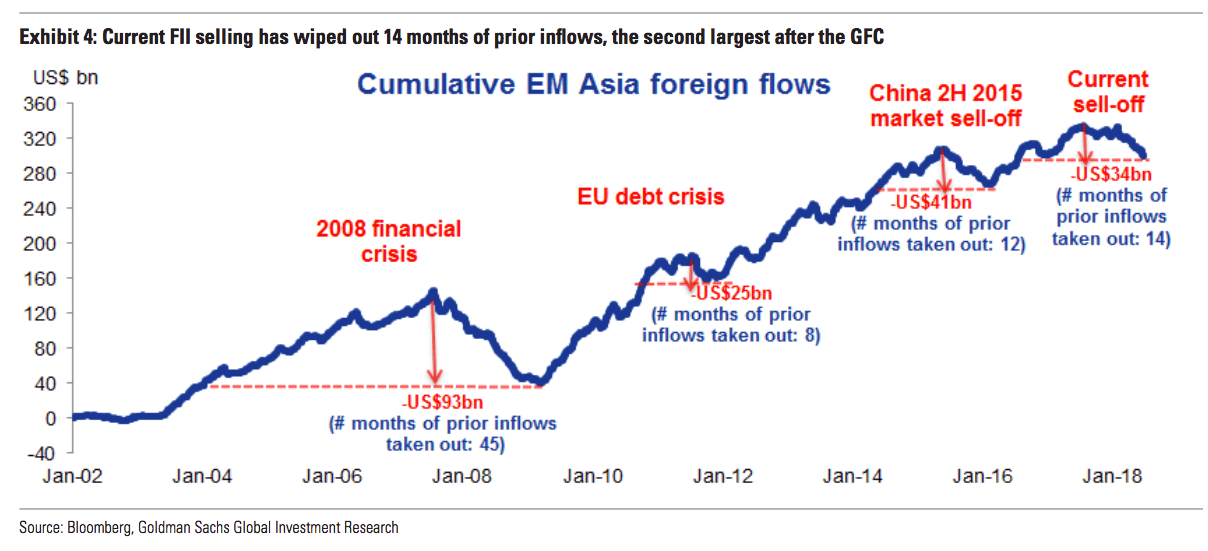

Foreign Money Is Fleeing Asian Stocks At The 3rd Fastest Pace In 16 Years

Goldman says “current FII selling has wiped out 14 months of prior inflows, which is the 2nd largest amount after the 2008 financial crisis (which took out 44 months of prior inflows) [and] to put it in context, outflows during the 2H 2015 China market crash took out 12 months of prior inflows.”

MSP hike impact on Indian economy

“The newly announced minimum support prices for Kharif crops mark a steep rise in prices. We estimate that the rise in support prices of cereals and pulses in FY 2019 will be nearly 25%, equivalent to the cumulative increase seen over the last five years. On a CPI-weighted basis, the increase amounts to 90 basis points, and we thus, expect at least 50 bps upside risk to forward-looking inflation estimate. Should the government rely on large-scale procurement of crops to implement these prices, then the fiscal cost could be around 0.3% of GDP, which will likely be shared by the central and state governments.

“As far as monetary policy is concerned, we expect the MPC to take note of the upside risk due to direct impact of higher MSPs, fiscal cost and second round effects. In tandem with further rise in oil prices and rupee depreciation since the June policy this development should cement the case for another hike. We continue to expect that hike to be delivered in the October meeting.” Prasanna ISEC PD