Serious stuff made simple through humour

Author: Ritesh Jain

The truth about FDI

Interesting article from Vivek Kaul

Simultaneous rise in these three asset classes is big trouble

I am worried about signals emanating from outside as well as within the country. Rising oil prices and sticky core inflation could lead India towards stagflation.

By this stage of the cycle, corporate capex should have picked – which hasn’t happened, and Govt spending should be reducing – which is not: the question therefore is whether we are in day 3 or perhaps already in day 5 of this test match (market cycle)

With a fundamental shift in US policies, countries dependent on global trade or dollar funding can run into serious trouble.

Simultaneous rise in US dollar, US bond yields and US equity markets will spell significant trouble for many economies and markets – and we are already seeing signs of all three asset classes rising in unison.

(My Last interview before i left BNP Paribas}

http://www.wealthforumtv.com/FundTalkBNPParibas.html#.Wzy3-vZuLIU

The World’s 100 Most Valuable Brands in 2018

According to Forbes, the world’s 100 most valuable brands are worth a staggering $2.15 trillion.Jeff Bezos, the founder of Amazon, once said, “Your brand is what other people say about you when you aren’t in the room.” We might add that if almost everybody is saying great things about you, then you have an extremely valuable brand.

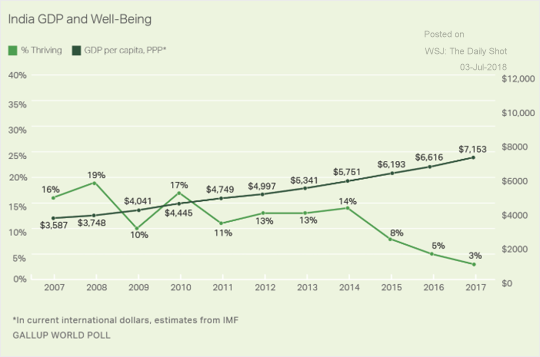

Indians well being diverging from its GDP

The new Gallup poll finds Indians unhappy. The GDP per Capita, in India, when adjusted by Purchasing Power Parity is equivalent to 34 percent of the world’s average and is marching upwards ,but somewhere around 2014 the trendline of well being diverged from the still upward trending per capita GDP.

Bond markets send signals of a looming recession- Dr Raghuram Rajan

One obvious explanation is that the European Central Bank and the Bank of Japan are continuing their quantitative easing. The sheer flow of money still pouring into the long end may be keeping yields down — after all, the five-year German Bund is at -0.3 per cent and 10-year Japanese bonds yield zero.

VXX -iPath S&P 500 VIX Short-Term Futures ETN

I love volatility and more so when the liquidity created out of thin air,almost USD 20 trillion built up by central bankers since lehman fiasco is going to start unwinding in next couple of months. We saw a glimpse of jittery market in the month of FEB and Mar where this ETN after staying at almost $30 for few months shot up to touch $70 in one day.So when everything fell in price the price of this security went up and thats why It is a great way of hedging equity portfolios.

This ETF offers investors a way to access equity market volatility, an asset class that may have appeal thanks primarily to its negative correlation to U.S. and international stocks. The VIX index tends to spike when anxiety increases, and as such often moves in the opposite direction of stocks. However, it’s important to note that VXX does not represent a spot investment in the VIX, but rather is linked to an index comprised of VIX futures. As such, the performance of this product will often vary significantly from a hypothetical investment in the VIX (which isn’t possible to establish).

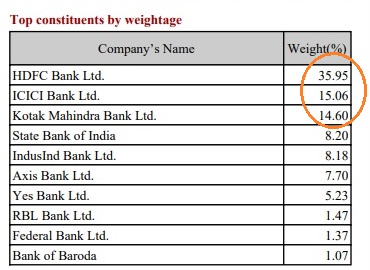

India becoming oligopoly and it is bad for job creation

It is very concerning to note that across sectors India is becoming a oligolopy.Telecom industry is poster boy of oligoloply where five companies got decimated and countless jobs lost. Banking has been one of the fastest growing industry but it is interesting to find that only three constituent account for around 65% of an index.

conclusion

- If you are trading bank nifty you are basically taking a call on three stocks

- The more succesfull and big a bank becomes the more it will automate ( hdfc bank has increased the size of Balancesheet by more than 20% in last one year but the headcount is down by 10%)

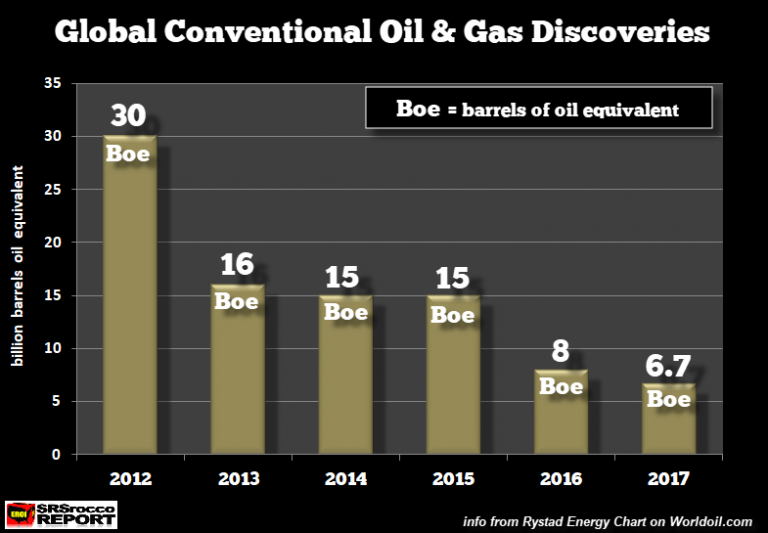

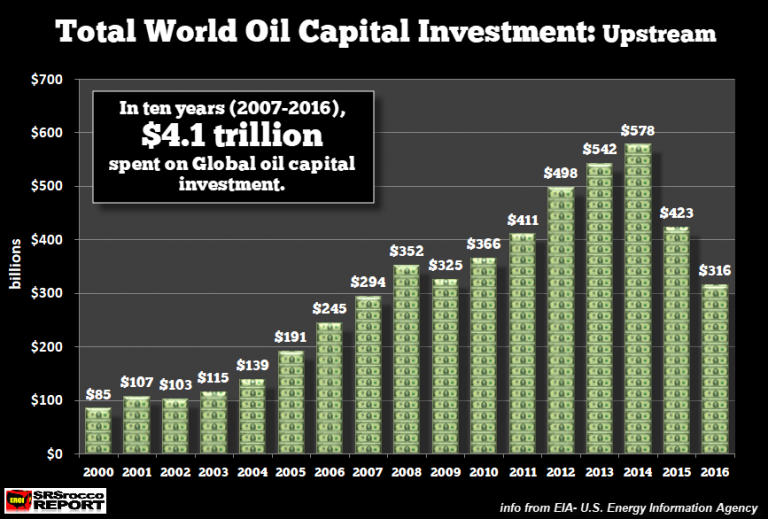

Energy Cliff

According to Rystad Energy, total global conventional oil and gas discoveries fell to a low of 6.7 billion barrels of oil equivalent (Boe). To arrive at a Boe, Rystad Energy converts natural gas to a barrel of oil equivalent. In 2012, the world discovered 30 billion Boe of oil and gas versus the 6.7 billion Boe last year:

global oil capital investment has fallen right at the very time we need it the most. In the EIA’s International Energy Outlook 2017, world oil capital investment fell 45% to $316 billion in 2016 versus $578 billion in 2014

The major global oil companies have been forced to cut capital expenditures to remain profitable and to provide free cash flow. coupled with low discoveries and more than expected run down from shale will impact oil production in the coming years.

Thus, the world will be facing the Energy Cliff much sooner than later.

Violation of rules…. Sadly nobody pays for it

Light Wrap on the Knuckles

Regulator Sebi is believed to have found ICICI Prudential MF in violation of rules during the last day bidding for IPO of the group firm ICICI Securities and has asked the fund house to pay back Rs240 crore, with 15% interest, to its five schemes from which the money was taken for the shares.