This is probably the most thought provoking piece on markets I have read in long time .

Victor shvets of Macquaire writes

“About working horses & people ‘There was a type of employee at the beginning of the industrial revolution whose job and livelihood largely vanished in the early 20th century. This was the horse. The population of working horses actually peaked long after the industrial revolution… there was always a wage at which these horses could have remained employed. But that wage was so low that it did not pay for their feed’, Brynjolfsson & McCaffe”.

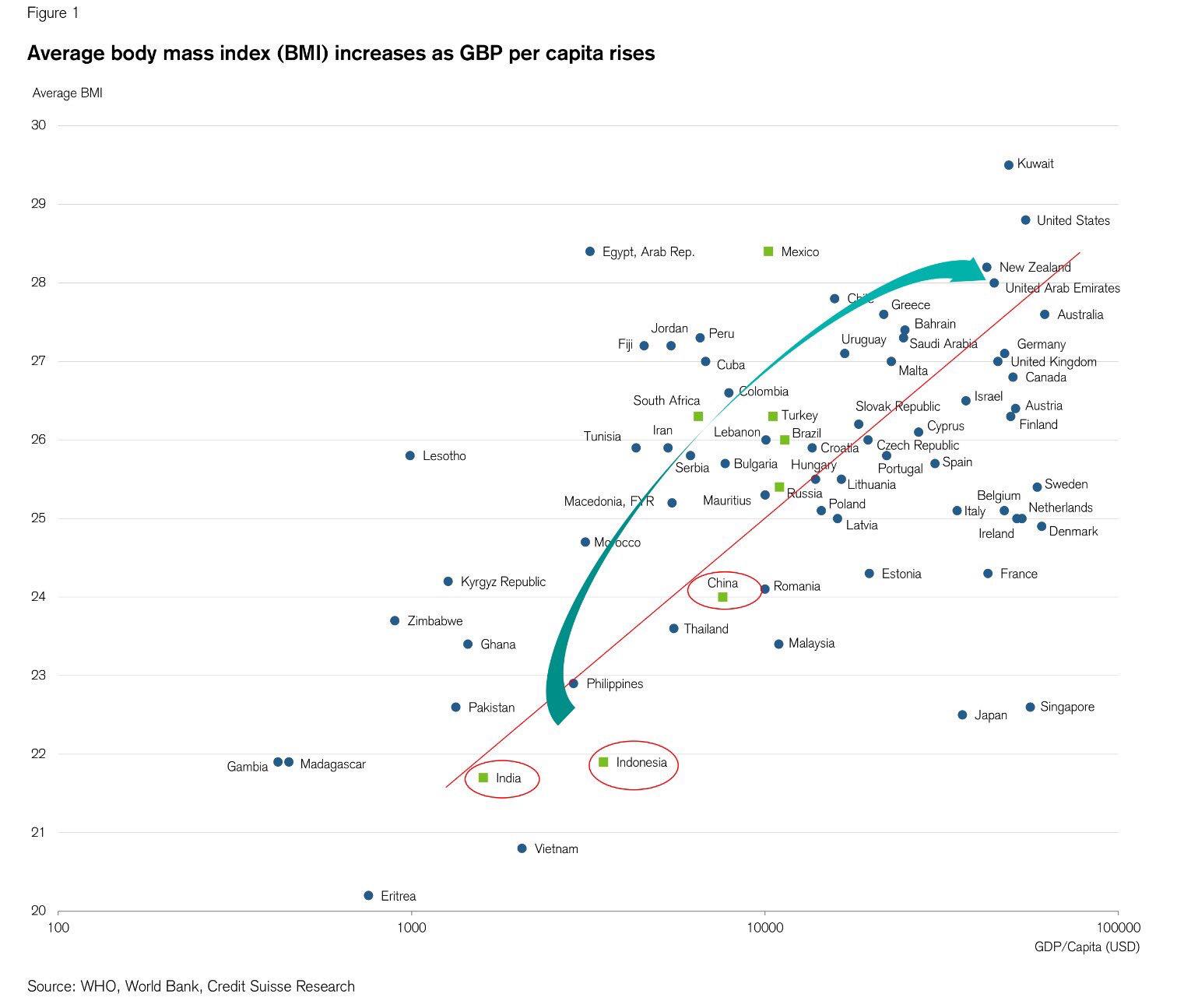

we are residing in a world where return on labour is declining while returns on ‘superior brain, social capital and connectivity’ are rapidly rising. for e.g Robotics, automation, internet of things and AI is already responsible for 80%+ of global trading of financial instruments while rapidly destroying professions (ranging from paralegals to accountants) and starting to dominate the retail and wholesale sectors. The revolution is also now rapidly moving into manufacturing.Robotic factories, 3D printing and a decline in moving parts is starting to impact supply and

value chains. Just several examples would suffice. GE is planning to print as many as 100,000 parts of their aircraft engines; Divergent 3D is now able to print a super car in a garage in California whilst Apis Corp has recently 3D printed an entire house for $10,000 and within 24 hours. This is not to mention, robotic (or ‘dark’) factories that are springing up from the US to China. The Fujitsu (2016) survey projects that around 90% of manufacturing

companies expect a significant change in their business model within a decade or less.

And he concludes philosophically …In other words, in a somewhat callous fashion, the quote above by Brynjolfsson & McCaffe implies that humans today, are the equivalent of extinct working horses of late 19th -early 20th centuries. It is likely that within a decade or two, value would gravitate so strongly towards what Peter Thiel called ‘zero to one’, that only people with strong empathy and EQ (i.e. entertainment, priests, psychiatrists) as well as technocratic and some managerial elite,would continue to play a significant role. This also promises to be the world of even sharper income and wealth inequalities and quite likely a world of extreme political reaction against the trend of declining importance of human inputs, potentially rivalling a modern equivalent of 1789 French revolution.

What does it mean for INVESTOR.

‘There is nothing so disastrous as a rational investment policy in an irrational world’,John Maynard Keynes

The above quote from John Maynard Keynes, who apart from being an economist was also an exceptionally savvy investor, encapsulates dilemma facing investors. Current investment climate (and indeed for more than a decade) is the one of non-existent business and capital market cycles. This implies that any trading and investment strategies

based on conventional tools and variables (such as sector rotation, mean-reversion) are bound to fail.

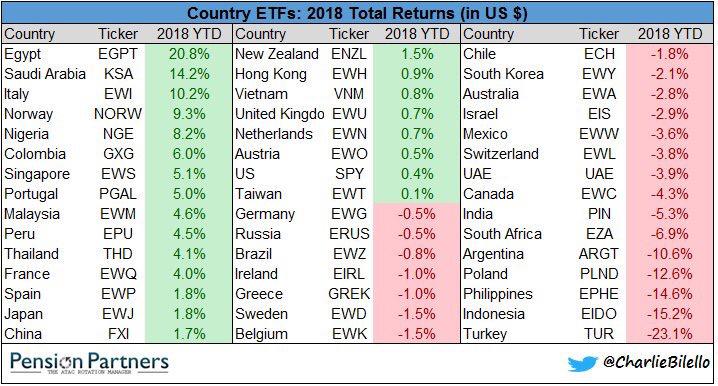

Macquaire has and continue to recommended two complementary strategies – ‘Quality Sustainable Growth’ and ‘Thematics’. They particularly like Thematics,as these directly invest into dystopian trends of ‘declining returns on humans and capital’.

Qaulity and sustainable growth is easy to understand with relatively large universe of ideas investable ideas

what is included in Thematics is interesting.

Theme 1: “Replacing Humans”: Robots, Industrial Automation & AI

Theme 2: Asia’s High Technology niches

Theme 3: “Opium of the people”: Games, Casinos/Virtual Reality

Theme 4: “Bullets and Prisons”: Defense, Security,Prisons/Correction Centres

Theme 5: “Education & Skilling

Theme 6: “Demographics”: Funeral Parlours, Hospitals and Psychiatric Centres

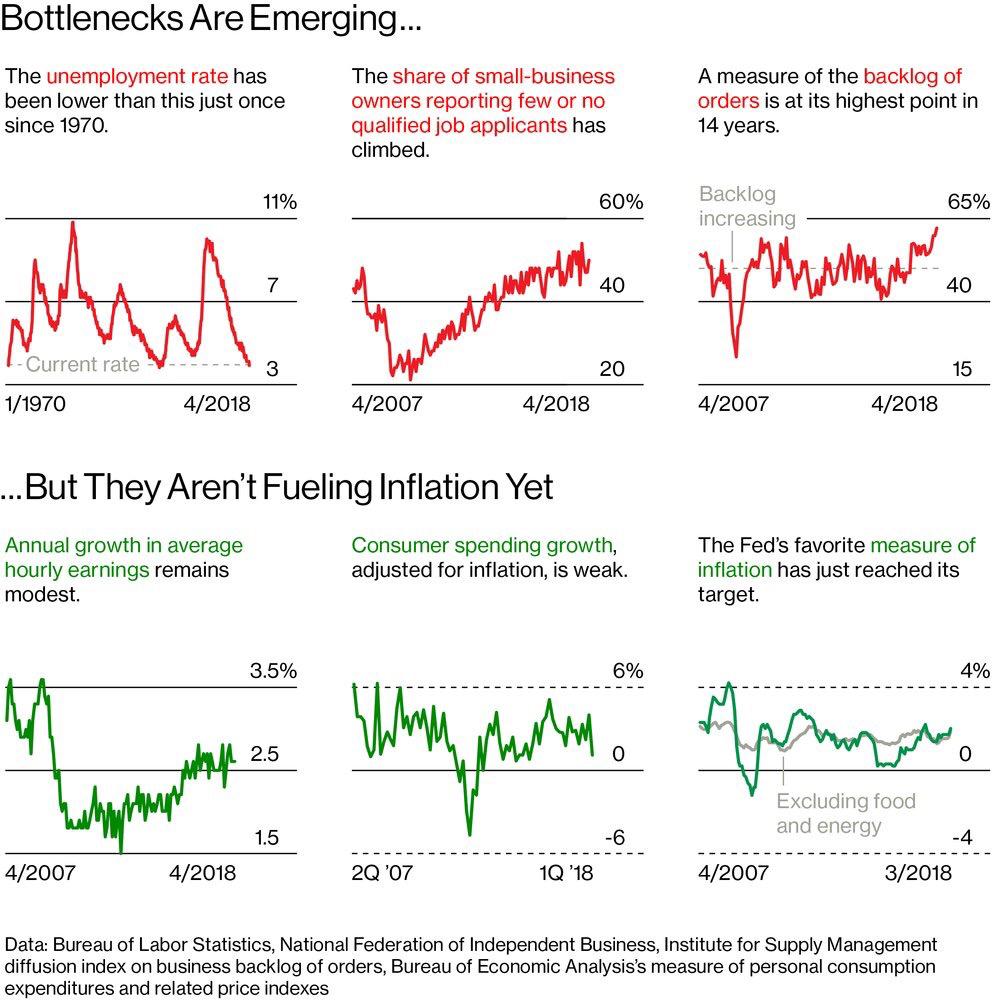

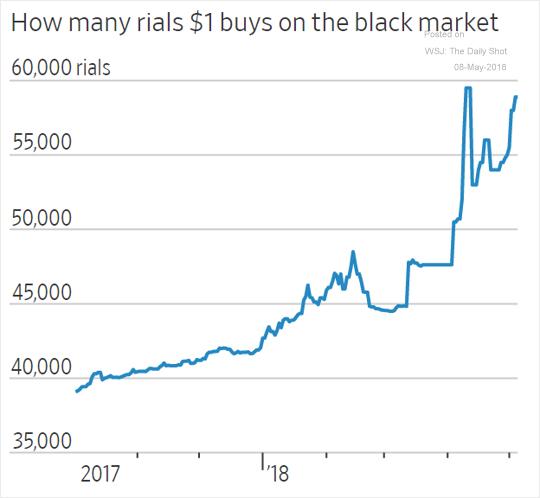

The only way out is Loan waivers, basic minimum wages for majority of population and continue leveraging to continue to prepone consumption and yes it also means BIGGER GOVT and SHRINKING PRIVATE SECTOR. Peter Drucker once presciently remarked, the government is now increasingly in the business of not just ensuring that the climate is conducive to business, but instead it attempts to micro manage weather (i.e. not too cold; not too hot).Thus, they believe that a combination of rapidly evolving technology, a high degree of operating flexibility and limited demand visibility, there would be no break-out of wage pressures. Vicotr believe that it also implies that the global economy continues to reside in a deeply disinflationary climate hence invest in quality sustainable growth and Thematics