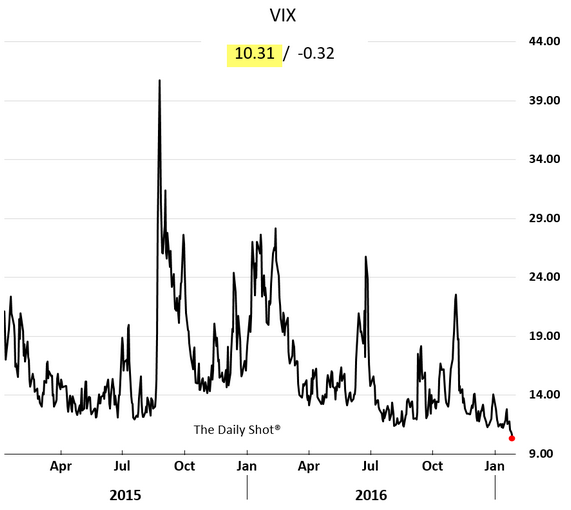

VIX (volatility index)index hit the lowest level since 2007 before recovering a bit on Friday . VIX is a trademarked ticker symbol for the CBOE Volatility Index, a popular measure of the implied volatility of S&P 500 index options; the VIX is calculated by the Chicago Board Options Exchange (CBOE). Often referred to as the fear index or the fear gauge, the VIX represents one measure of the market’s expectation of stock market volatility over the next 30-day period. Low level of VIX is often associated with high stock prices and high complacency and high VIX is often correlated to low and volatile stocks prices and great time to buy stocks

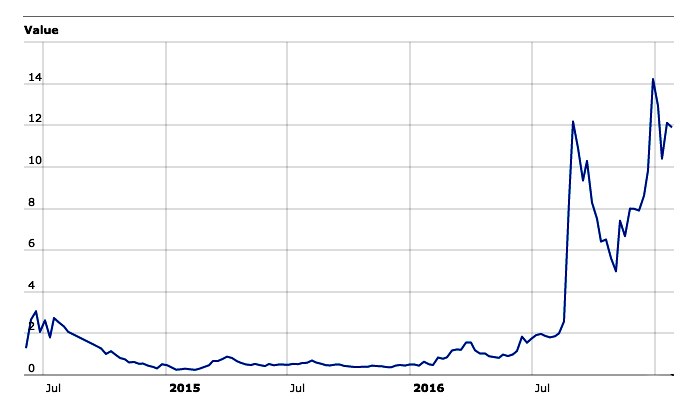

Indian VIX is also correlated to US VIX most of the time and although Indian equity markets have not touched a new high like US equity markets, Indian markets VIX at 16 is near lowest end.

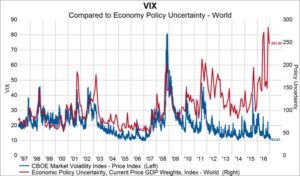

The following chart of global policy and VIX has also diverged . As per Gavekl Based on the level of the economic policy uncertainty in the world, a regression model would have predicted that the VIX would be pushing 30 instead of hovering around 10

So where is the equity market getting this confidence?

These days, markets have grown convinced that Beijing will avert Chinese financial and economic crisis. The Bank of Japan will secure bond prices in Tokyo – no matter how much government debt is issued. The ECB will hold together Italy, Portugal, Spain and euro integration more generally. The Fed will not tolerate any meaningful tightening of financial conditions, ensuring the sustainability of bull markets in U.S. financial assets. The U.S. and king dollar provide a stable foundation for global finance that, along with ongoing Chinese growth, will hold EM debt crisis at bay. And, more generally, the Fed and international central bankers will continue backstopping global markets, guaranteeing ample liquidity and buoyant securities prices. Bear markets – let alone crisis – are simply intolerable. Even if calm prevails, markets have grown way too complacent regarding the global monetary backdrop. So many unknowns. So many things that could go wrong. Whenever it unfolds, the next de-risking/de-leveraging episode should be quite captivating.