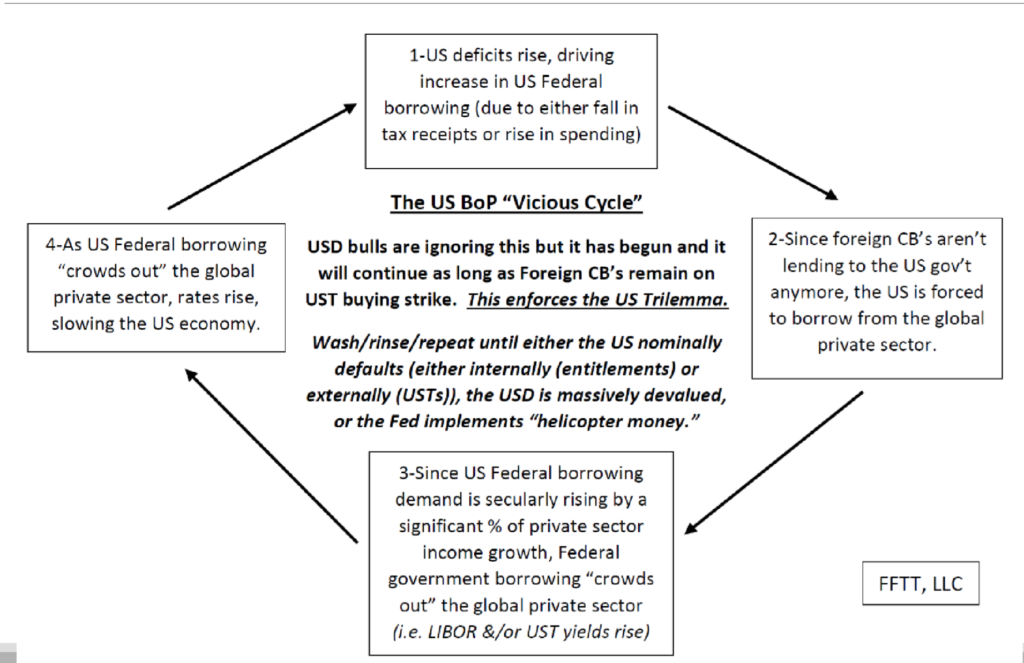

Doug Noland writes….My interest was piqued by a Friday Bloomberg article (Ben Holland), “The Era of Cheap Money Shows No One Knows How Monetary Policy Works.” “Monetary policy is supposed to work like this: cut interest rates, and you’ll encourage businesses and households to borrow, invest and spend. It’s not really playing out that way. In the cheap-money era, now into its second decade in most of the developed world (and third in Japan), there’s been plenty of borrowing. But it’s been governments doing it.”

I remember when the Fed didn’t even announce changes in rate policy. Our central bank would adjust interest rates by measured bank reserve additions/subtractions that would impact the interbank lending market. Seventies inflation forced Paul Volcker to push short-term interest-rates as high as 20% in early-1980 to squeeze inflation out of the system.

Federal Reserve policymaking changed profoundly under the authority of Alan Greenspan. Policy rates had already dropped down to 6.75% by the time Greenspan took charge in August 1987. Ending 1979 at 13.3%, y-o-y CPI inflation had dropped below 2% by the end of 1986. Treasury bond yields were as high as 13.8% in May 1984. But by August 1986 – yields were down to 6.9% – having dropped almost 700 bps in 27 months.

Lower market yields and economic recovery were absolute boon for equities. The S&P500 returned 22.6% in 1983, 5.2% in 1984, 31.5% in 1985, 22% in 1986 – and another 41.5% for 1987 through August 25th. Markets had evolved into a speculative bubble.

One could pinpointing the start of the great Credit Bubble back with the 70’s inflation. For my purposes, I date its inception at the 1987 stock market crash. At the time, many were drawing parallels between the 1987 and 1929 market crashes – including dire warnings of deflation risk – warnings that have continued off and on for more than three decades.

The Greenspan Fed made a bold post-crash pronouncement: “The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.” In hindsight, this was the beginning of central banking losing control.

The S&P500 returned 16.6% in 1988 and 31.7% in 1989 – the crash quickly forgotten. Not forgotten was the assurance that the Fed would be there as a market liquidity backdrop. GDP expanded at a blistering 7% pace in Q4 1987 – expanding 5.1% for the year. GDP accelerated to 6.9% in 1988. Instead of deflation and depression, the late-eighties saw one heck of a boom. As silly as it sounds these days, the eighties used to be called the “decade of greed.”

The decade’s sinking rates, collapsing bond yields, booming securities markets and the Fed’s liquidity assurances all contributed to what evolved into a three-decade proliferation of non-bank financial intermediation – money market funds, bond funds, repurchase agreements, asset-backed securities, mortgage-backed securities, junk bonds, corporate credit, the government-sponsored enterprises and derivatives (to name the most obvious).

Eighties’ (especially late-decade) excess came back to haunt the financial system and economy in 1990/91. The Savings and Loan fiasco had morphed from a few billion dollars issue to a several hundred billion serious problem. And following the collapse of real estate bubbles on both coasts, the U.S. banking system was left severely impaired. And similar to the period after the ’87 crash, there were more dire warnings of deflation and depression.

Following up on his post-crash promise to keep markets liquid, Alan Greenspan took another giant policy leap – orchestrating a steep yield curve. By dropping short-term rates to an at the time incredible 3% – banks could borrow fed funds and invest in government debt yielding 8% – magically replenishing depleted capital.

This maneuver empowered the rebuilding of banking system capital outside of deficit-busting Washington bailouts. Importantly, this was also a godsend for the nascent hedge fund community that was overjoyed to borrow at 3% and leverage in higher-yielding credit instruments – confident that the Fed would be there to backstop system liquidity in the event of trouble. Ditto for Wall Street derivatives and prop-trading desks.

They surely didn’t realize it at the time, but our central bank had begun sliding down a most slippery slope: The Fed had created unprecedented incentives for leveraged speculation. And there was so much resulting demand for debt securities to lever that a shortage developed. Wall Street securitization and derivatives machines went into overdrive to meet demand. By 1993, debt markets had evolved into a dangerous speculative bubble.

On February 4th 1994, the Fed took a so-called baby-step, raising rates 25 bps to 3.25%. After beginning February at 5.6%, 10-year Treasury yields quickly traded to 6% after the rate increase – and were up to 7.5% in May and 8.0% by November. The wheels almost came off, as the leveraged speculators were forced to deleverage. To the great long-term benefit of leveraged speculation, it would be the last time in decades that the Fed would move forcefully to tighten financial conditions.

The Fed conveniently looked the other way in 1994 as GSE holdings surged an (at the time) unprecedented $150 billion, their buying accommodating hedge fund and Wall Street firm liquidations. The GSEs stealthily operating as quasi-central banks worked so well that they boosted buying to $305 billion during tumultuous 1998 and another $317 billion in 1999. I doubt we’ll ever have an answer: Did the Greenspan Fed simply not appreciate of the effects of this massive GSE credit creation – or did they clandestinely support it?

The Federal Reserve certainly promoted the Mexican bailout, an aggressive policy maneuver that stoked the Asian Tiger bubbles (devastating collapses coming in 1997). Then in the fall of 1998 – with the simultaneous collapses of Russia and the hedge fund Long-Term Capital Management (LTCM) bringing the global financial system to the precipice – the Fed helped orchestrate a bailout of LTCM. In the dozen years since Volcker, the Greenspan Fed had made incredible strides in “activist” policymaking. In 1987, the early-nineties, 1995 and again in 1998, the Fed was content to use new tools and assume new power in the name of fighting deflation and depression risk. Speculative finance turned more powerful at every turn.

With Wall Street finance booming, GSE liquidity bubbling and Greenspan market backstopping, extraordinary tailwinds saw Nasdaq almost double in 1999. I thought the Bubble burst in 2000/2001, and I believe the Fed did as well. Then Fed and Washington establishment panicked with the U.S. corporate debt market in 2002 at the brink of serious dislocation. The prevailing theoretical expert on reflationary policymaking, Dr. Ben Bernanke, joined the Federal Reserve Board of Governors in 2002 – and replaced Greenspan in February 2006.

Greenspan had profoundly changed central banking. Bernanke, with his radical monetary views including the “government printing press” and “helicopter money,” took things to a whole new level. Greenspan was happy to manipulate rates, yield curves, market perceptions and incentives for leveraged speculation – all in the name of developing a powerful new monetary transmission mechanism. Dr. Bernanke was ready to add aggressive use of the Fed’s balance sheet to Greenspan’s toolkit. But in 2002, 3% short rates and just Bernanke’s talk of where the Fed was headed were sufficient to initiate a mortgage finance Bubble (that would see mortgage Credit more than double in six years).

I believe the Fed willfully used mortgage Credit and home price inflation to reflate system Credit. There were certainly vocal Wall Street analysts egging them on. This was a momentous error in analysis and judgement – with only bigger mistakes to come. The bursting of this Bubble in 2008 unleashed Bernanke and global central bankers’ experiment with directly inflating markets with central bank liquidity. The Bernanke Fed and others moved deliberately to force savers out of safety and into inflating risk markets. Low rates and central bank purchases unleashed governments to issue debt like never before.

Draghi’s 2012 “whatever it takes” battle cry ensured that increasingly speculative markets would envision “QE infinity” and decades of loose finance. Bernanke the next year further emboldened speculative market psychology with his proclamation that the Fed was ready to “push back against a tightening of financial conditions.” When markets faltered on China worries in early-2016, markets came to believe central banks and governments everywhere had adopted “whatever it takes” – certainly including Beijing (powerful monetary and fiscal stimulus), Europe (unprecedented ECB QE), Japan (unprecedented QE) and the Fed (postponement of policy normalization).

Global markets went to parabolic speculative excess. From February 2016 lows to 2018 highs, the Nasdaq Composite surged 93% and the small cap Russell 2000 jumped 85%. Over this period, the S&P500 gained 62%, Japan’s Nikkei 63% and Germany’s DAX 57%.

And while the notion that “deficits don’t matter” had been gaining adherents since QE commenced in 2008, by late-2016 it had essentially regressed to The Crowd convinced “deficits will never matter.” The election of Donald Trump ushered in a replay of “guns and butter” – tax cuts (huge cuts for corporations) and a boost of military spending to go with a steady upswing in entitlement spending. Infrastructure spending, why not?

What unfolded was a complete breakdown in discipline – in central banking, in Washington borrowing and spending, and throughout highly speculative markets. And I do believe the new Fed Chairman had hopes of normalizing Fed policymaking, letting the markets stand on their own, and commencing the long-delayed process of system normalization. Pressure – markets and otherwise – became too much to bear. Fed U-Turn, January 4, 2019 – soon transmitted globally.

So, returning to the Bloomberg article in my opening paragraph: No one has a clue how monetary policy works anymore – transmission mechanisms, financial and economic system reactions and long-term consequences. The world is in complete uncharted territory.

We saw in December how abruptly markets can turn illiquid and approach dislocation. And we have witnessed beginning in January just how quickly speculation can be resuscitated and excess reignited. Those that believed central bankers would quickly cave have been emboldened – as have the believers that Beijing has things well under control with as many levers to pull as needed.

The Bank of Japan has doubled its balance sheet to $5 TN in four years – with no end in sight. The ECB wound down its $2.6 TN QE program in December, and just last week announced that it would begin implementing additional stimulus measures. Understandably, markets believe Fed balance sheet “normalization” will end soon – with “balloonization” commencing at any point the markets demand it.

March 12 – CNBC (Yun Li): “After a stellar rebound, Jeffrey Gundlach still thinks stocks are in a bear market. ‘The stock market was and still is in a bear market,’ the founder and chief executive officer of Doubleline Capital said… He also said stocks could go negative again in 2019.”

I struggle somewhat with the traditional “bear” and “bull” market terminology in the current backdrop. It looked like a “bear” in December, while the market has performed rather bullishly in the initial months of 2019. But I still believe the global Bubble was pierced in 2018. But we’re dealing with a unique – I would suggest deviant – global market structure. There’s this massive pool of speculative, trend-following finance. Hedge funds, ETFs and such. There is, as well, a colossal derivatives complex – for speculating, leveraging and hedging. When markets begin turning risk averse, De-Risking/Deleveraging Dynamics can quickly push increasingly illiquid markets to the breaking-point.

But this structure also creates the potential for destabilizing short squeezes and the unwind of hedges to spark powerful rallies. And these rallies can in short order entice the mammoth pool of trend-following finance to jump aboard. Who, these days, can afford to miss a rally?

I would furthermore argue that more than ever before, the Financial Sphere is driving the Real Economy Sphere. As we’ve seen over the past couple of months, risk market rallies can spur a rather dramatic loosening of financial conditions. There has been a recovery in household perceived wealth and an attendant resurgence in consumer confidence and spending.

The bulls see Goldilocks as far as the eye can see. Sure nice to have the once-in-a-lifetime crisis out of the way back in 2008. And good to have this cycle’s correction wrapped up in December. Central banks got our backs. “Deficits don’t matter,” and recessions and crisis are a thing of the past. An election year coming up is good. China has too much to lose not to keep their boom going.

At least from the perspective of my analytical framework – things continue to follow the worst-case scenario. What started with Greenspan, expanded dramatically with Bernanke, spread globally through the entire central bank community, further escalated by Draghi’s “whatever it takes” and Kuroda’s “it takes everything”, to yet further emboldened by Powell’s U-Turn and the accompanying flock of dovish central banks worldwide.

The heart of the issue is that monetary policy has come to chiefly function through a massive global infrastructure of speculative finance. Over the past three decades, things evolved from monetary policy operating subtly to encourage/discourage bank lending at the margin – to central banks expressly working to ensure that Trillions of levered holdings and perhaps tens of Trillions of speculative positions don’t face risk aversion and liquidation.

Speculative finance became the marginal source of liquidity for markets and economies generally. This all appears almost magical when the markets are rising, but in reality this is a highly unstable situation. We’re at the stage of the cycle where there is an incredible excess of finance that is speculative in character, while speculative market psychology has become deeply emboldened. The upshot is a bipolar world: too much risk-embracing finance chasing inflating markets, ensuring excessively loose financial conditions; or, when risk aversion hits, intense de-risking/deleveraging quickly leading to illiquidity, faltering markets and an abrupt tightening of financial conditions. There’s little middle-ground.

The entire notion of some so-called “neutral rate” is delusion. With markets so highly speculative and market-based finance dictating financial conditions, what policy rate would today equate with stable markets and economic conditions? Good luck with that.

It’s similar to the issue faced in 2007, although today’s global backdrop has closer parallels to 1929. Speculative finance and asset Bubbles run amok, while economic prospects dim. And nowhere are such dynamics more at play than in China.

March 14 – Financial Times (Hudson Lockett): “The cost of new housing in China’s major cities rose more quickly in February… Prices for new housing across 70 large cities rose 10.4% year on year in January… That marked the equal-quickest gain in 21 months. Every city saw average home prices rise compared to a year ago except Xiamen, where they stood unchanged… The latest reading marks a nine-month run of quickening price gains across major cities. That is good news for top officials gathering in Beijing this week for the National People’s Congress, as China’s property sector is estimated to account for 15% of the country’s gross domestic product, or closer to 30% if related industries are included.”

March 10 – Bloomberg: “China’s credit growth slowed in February after a seasonal surge the previous month, with the net development in the first two months of the year signaling continued recovery in credit supply. Aggregate financing was 703 billion yuan ($105bn) in February…, compared with an estimated 1.3 trillion yuan in a Bloomberg survey. Broad M2 money supply gained 8.0%, matching its slowest-ever expansion… Financial institutions offered 885.8 billion yuan of new loans in February, versus a projected 950 billion yuan.”

Combining a booming January and a less-than-expected February, China Aggregate Financing increased $794 billion – 25% greater than the comparable 2018 expansion. Total Aggregate Financing jumped $3.025 TN over the past year (10.1%), with growth down somewhat from the comparable year ago period. And while “shadow bank” instruments continue to stagnate, bank loans grow like gangbusters.

China New Loans were up $2.46 TN over the past year, or 13.4%. Over the past three months, New Loans expanded $773 billion, or 15.5% annualized. Consumer Loans actually suffered a small contraction in February (after a record January), the first decline since February 2016. For the past year, Consumer Loans expanded $1.06 TN, or 17.1%. Consumer Loans expanded 42% over two years, 77% over three years and 139% in five years. What a Bubble.

http://creditbubblebulletin.blogspot.com/2019/03/weekly-commentary-no-one-knows-how.html