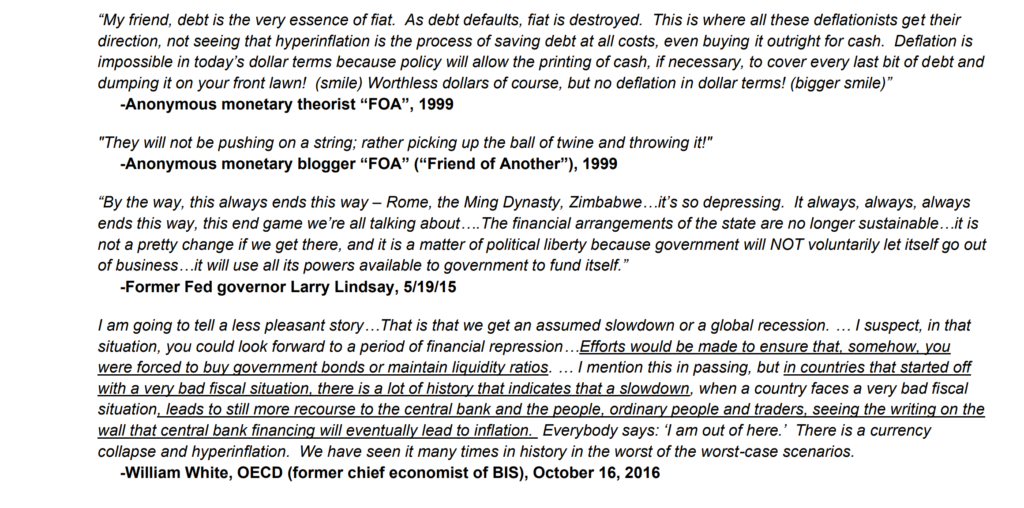

“Bubble” is commonly understood to describe a divergence between overvalued market prices and underlying asset values. And while price anomalies are a typical consequence, they are generally not among the critical aspects of Bubbles. I’ll start with my basic definition: A Bubble is a self-reinforcing but inevitably unsustainable inflation.

Bubbles, at their core, are fueled by Credit – or “Credit inflation.” Asset inflation and speculative asset price Bubbles are a common upshot. At their core, Bubbles are mechanisms of wealth redistribution and destruction.

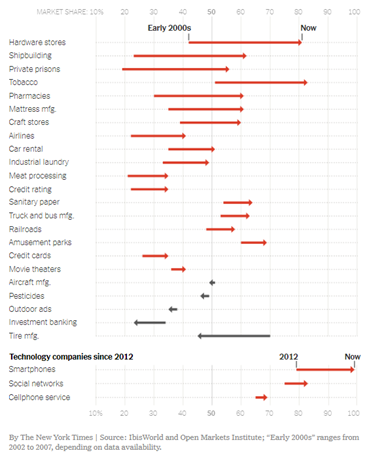

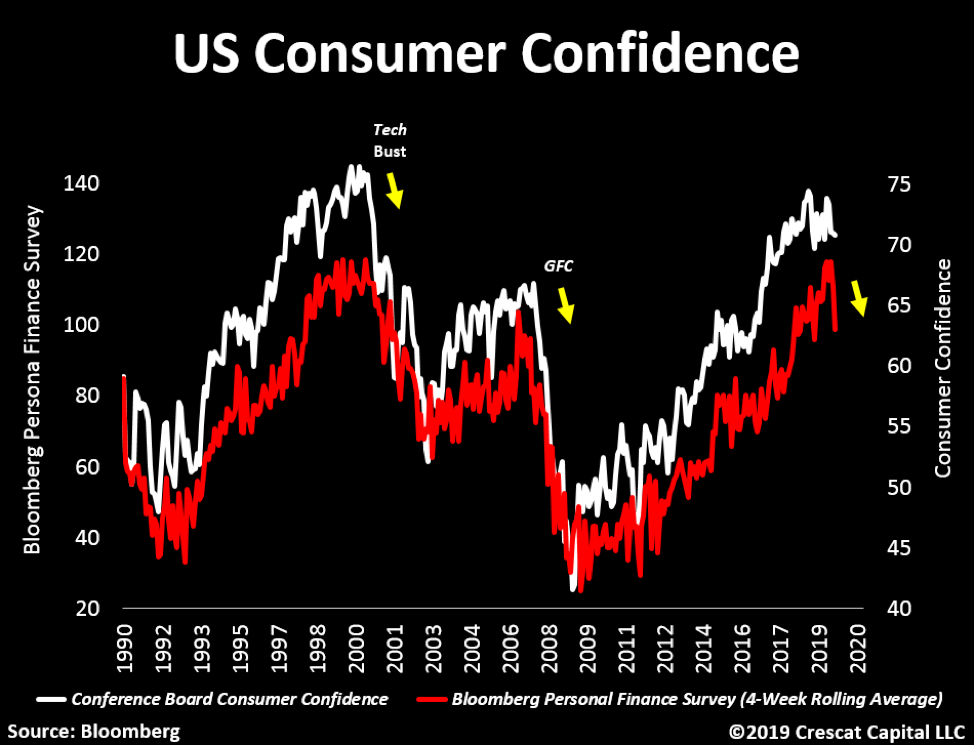

The more protracted the Bubble period, the greater the maladjustment to underlying financial and economic structures. And the longer the Bubble inflation, the greater the wealth disparities and underlying social and political strain. While Bubble-related inequalities reveal themselves more prominently later in the up-cycle, the scope of wealth destruction only becomes apparent as the Bubble finally succumbs. As Dr. Richebacher always stressed, there’s no cure for Bubbles other than not allowing them to inflate. The catastrophic policy failure over the past 20 years has been the determination to aggressively inflate out of post-Bubble stagnation.

Bubbles can have profound geopolitical impacts as well. The inflation of Bubbles and corresponding booming economies promote the view of an expanding global economic “pie”. The inflating Bubble phase is associated with cooperation, integration and solidarity. The backdrop shifts late in the Bubble phase, as inequities and maladjustment become more discernible. Bursting Bubbles mark a radical redrawing of the geopolitical landscape. The insecurities and animosities associated with a shrinking economic pie see a rise of nationalism and “strongman” leadership. The backdrop drifts toward fragmentation, disintegration and conflict.

Regular CBB readers are familiar with this analytical framework. It is being reiterated this week because of the value I believe it provides in understanding this most extraordinary of environments. To disregard that the world was late in a historic Bubble period prior to COVID leaves analysts disadvantaged. Whether in the markets, real economies, politics or geopolitics, Bubble Dynamics these days play a profound role. This is becoming clearer by the week.

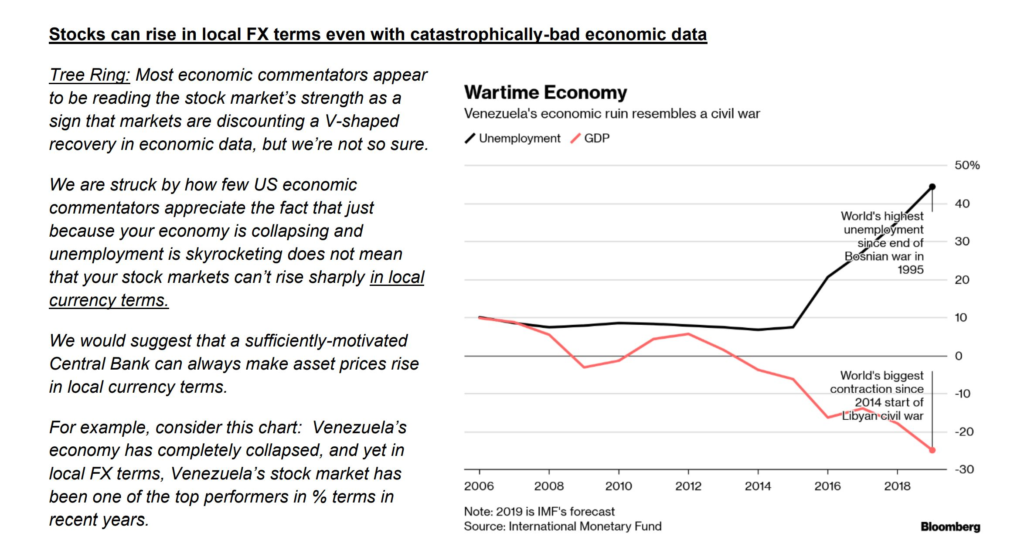

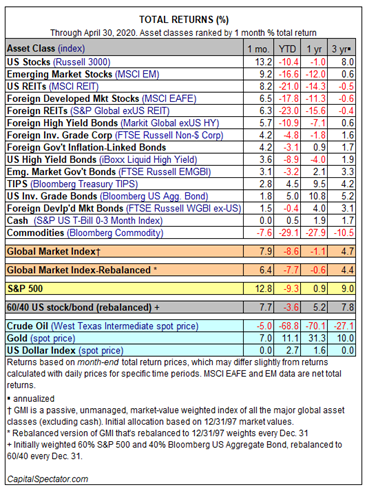

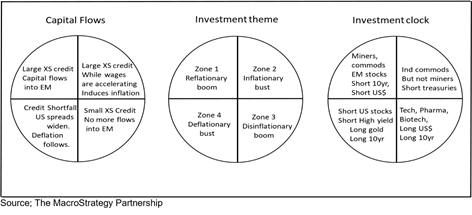

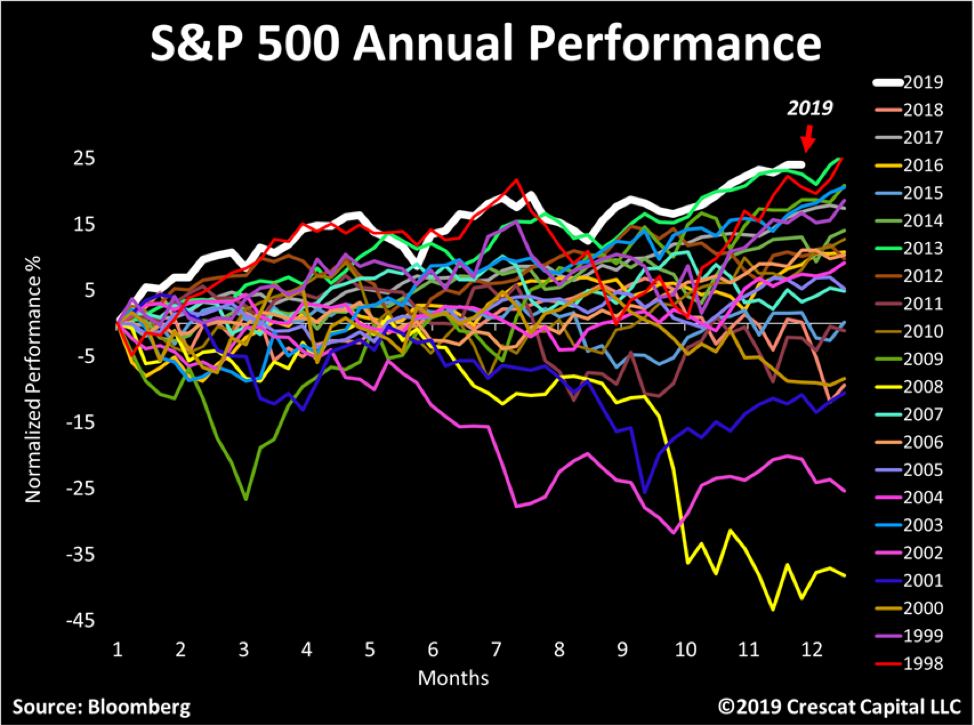

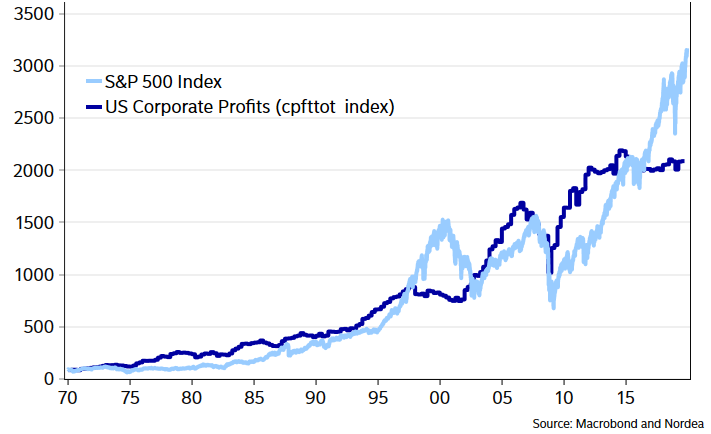

Let’s start with the markets. So, U.S. equities have diverged dramatically from underlying fundamentals. Most believe this is simply the marketplace peering over the valley to the reemergence of growth once the economy moves past the pandemic. More plausible analysis focuses on the securities price impact from unprecedented monetary inflation.

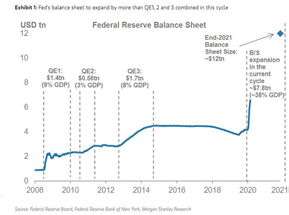

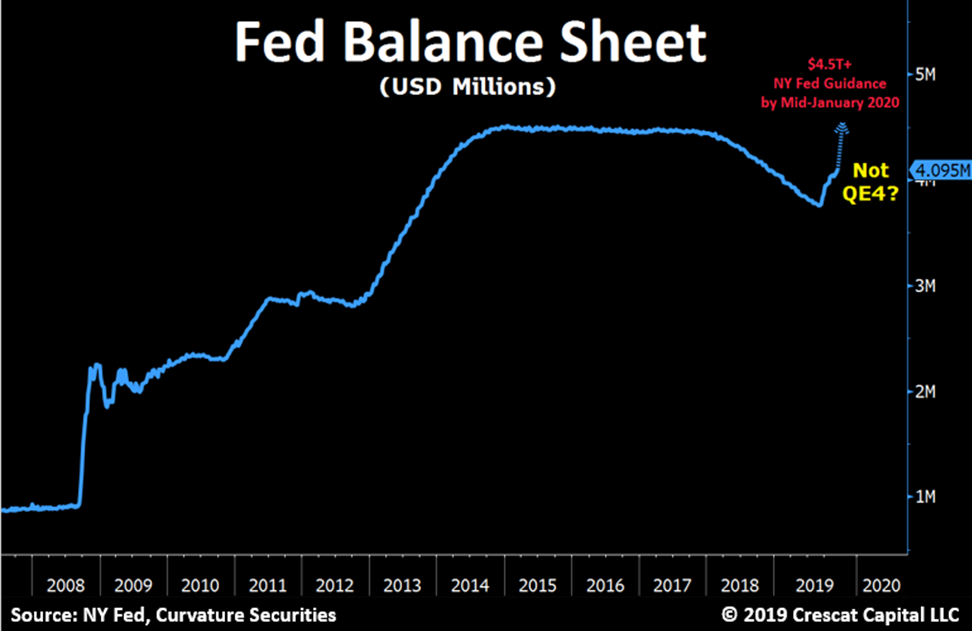

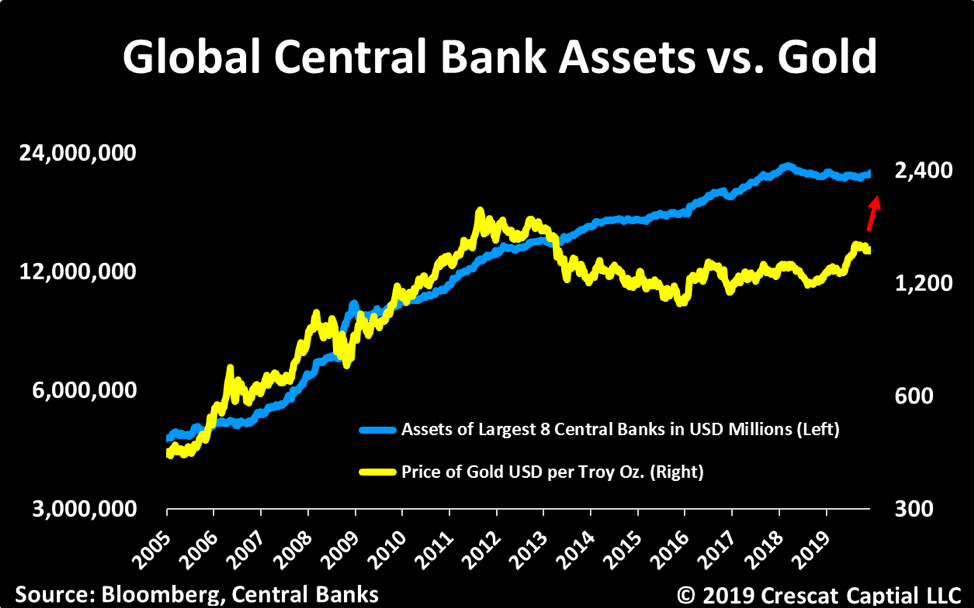

Federal Reserve Assets surged $213bn last week to a record $6.934 TN, pushing the 10-week gain to $2.693 TN. M2 “money supply” (with a week’s lag) expanded another $199bn, with a 10-week rise of $2.257 TN. Institutional Money Fund Assets (not included in M2) added $15bn, boosting its 10-week expansion to $961bn.

There is clearly ample monetary fuel to push equities higher in the short-term. Yet our analysis must also factor in the Market Structure that evolved over a most protracted Bubble period. In particular, powerful speculative Bubble Dynamics fundamentally altered market perceptions and mechanisms. Assorted trend-following strategies supplanted traditional investment analysis. Algorithmic trading changed market behavior. The massive ETF complex fostered trend-following and performance chasing strategies. Negative fundamentals notwithstanding, “FOMO” (Fear of Missing Out) plays a profound role in today’s highly speculative market backdrop. To be sure, sustaining a vigorous speculative market dynamic was one cost of the Fed’s hasty and massive market bailout.

Derivatives are also playing a momentous role in market dynamics. During the boom, faith in central bank backstops promoted risk-taking. Why not revel in risk so long as derivative market “insurance” is so cheap and readily available? This whole notion of hedging market risk is a dangerous case of “fallacy of composition.” Individual market participants can hedge market risk, offloading exposure to a counter-party in the event of a significant market decline. However, it is not possible for much of the market to offload risk. There will be no one within the marketplace with the wherewithal to absorb such losses in a crisis environment.

Much of the market protection these days is offered by sellers using dynamically-traded (“delta”) hedging strategies. If an institution purchases put options that strike below current market levels, the sellers of those puts will short futures or ETFs to hedge their rising exposures in the event of a declining market. As was witnessed in March, a market fall can quickly spiral into illiquidity and self-reinforcing dislocation – as writers of market protection flood the marketplace with sell orders (to hedge put option exposures that rise parabolically as strike prices are reached and these options trade “in the money”).

This problem was identified with the popularity of “portfolio insurance” strategies leading up to the 1987 stock market crash. But the benefits of cheap market “insurance” (i.e. risk-taking, loosened financial conditions, higher asset prices, wealth effects and associated economic stimulus) ensured policymakers were willing to ignore this risk. As I’ve highlighted over the years, much of the massive derivatives complex operates on the assumption of liquid and continuous markets, a specious premise made credible only with central bank liquidity backstops. Keeping this backstop viable during a period of expanding Bubbles has required increasingly egregious policy measures and market interventions.

I’ll posit that we’re witnessing the overarching risk associated with this scheme coming to fruition. Derivative-related hedging strategies became a commanding aspect of late-cycle speculative market dynamics. Derivatives then played prominently as markets collapsed into illiquidity in March, only to see the Fed resort to unprecedented monetary inflation ($2.7 TN and counting).

Egregious “money printing” operations provoked a sharp market reversal. This spurred a major unwind of hedges and bearish bets instrumental in fueling a dramatic market recovery. And as the market rallied, targeting stocks with large short (and put option) positions became quite a rewarding speculative endeavor. A major short squeeze unfolded, powering the market higher. A surging market in the face of a faltering Bubble recalls the period August to October 2007. Watching the big tech stocks going into melt-up recalls the final derivative-induced Q1 2000 speculative blow-off (at the precipice of a major down-cycle).

After fomenting risk-taking during the Bubble period, the marketplace for market “insurance” has turned hopelessly dysfunctional. It now ensures bouts of “risk off” liquidation quickly risk escalating into illiquidity and dislocation. And during “risk on,” the unwind of hedges will stoke upside dislocation and speculative excess. Importantly, these dynamics negate traditional market adjustment and correction dynamics. The resulting extreme divergence between securities prices and economic prospects raises the odds of a market crash – along with Trillions more Federal Reserve stimulus.

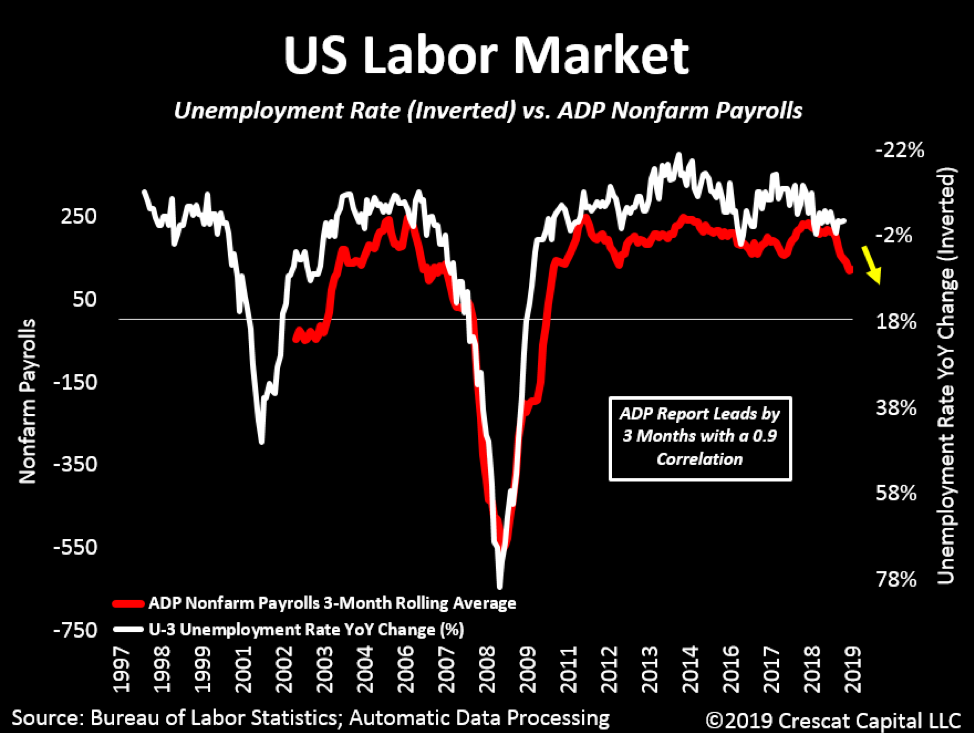

The U.S. was a “Bubble Economy” – having suffered from years of structural maladjustment. There was ongoing proliferation of enterprises that would prove uneconomic in a post-Bubble backdrop of tighter financial conditions, negative wealth effects and altered spending and investing patterns. A meaningful segment of the economy was driven by boom-time discretionary spending, creating latent vulnerabilities. Moreover, such an economic structure (over-indebted, savings deficient and replete with negative cashflow entities) becomes a Credit glutton. We’re beginning to see how Trillions of federal fiscal spending will be absorbed like a huge dry sponge.

May 15 – Bloomberg (Erik Wasson and Billy House): “The House passed a $3 trillion Democratic economic stimulus bill Friday that Republicans and President Donald Trump have already rejected and isn’t likely to trigger bipartisan negotiations any time soon. The measure, passed 208-199, would give cash-strapped states and local governments more than $1 trillion while providing most Americans with a new round of $1,200 checks. House Speaker Nancy Pelosi said it should be the basis of talks with the GOP-controlled Senate and White House, which have called for a ‘pause’ to allow earlier coronavirus recovery spending to work.”

On the other side of the globe, China faces the consequences of historic Bubble Economy maladjustment. New Chinese credit data this week corroborates Bubble Analysis. Total Chinese Aggregate Financing jumped $435 billion for the month of April, a typically slow month for lending (compared to April 2019’s $240bn). This pushed system Credit growth to an alarming $2.0 TN for just the first four months of 2020, 38% ahead of comparable 2019 growth (then a record). Bank Loans rose $240 billion in April, with one-year growth of $2.669 TN, or 13.1%. Aggregate Financing surged $4.156 TN, or 12.0%, over a year of historic Credit growth.

China’s M2 “money supply” expanded another $177 billion during April. M2 expanded $2.09 TN, or 15.1% annualized, over the past six months. M2 gained $2.95 TN, or 11.1%, over the past year. Over two years, M2 ballooned $5.018 TN, or 20%.

If the scope of monetary inflation isn’t alarming enough, the parabolic rise in Chinese Credit comes in the throes of a major economic contraction. Enormous state-directed lending has supported the economy and markets, while holding Credit losses at bay. Beijing is gambling that stimulus will return China’s growth to its pre-COVID trajectory. But with China’s consumers remaining cautious and global depression becoming a major problem for the nation’s colossal export sector (and banking system), odds of disappointing growth are high.

May 10 – Bloomberg: “The People’s Bank of China said it’ll resort to ‘more powerful’ policies to counter unprecedented economic challenges from the coronavirus pandemic… The central bank will ‘work to offset the virus impact with more powerful policies,’ paying more attention to economic growth and jobs while it balances multiple policy targets… It reiterated that prudent monetary policy will be more flexible and appropriate and it’ll keep liquidity at a reasonable level. The remarks reflect the PBOC’s growing concern over the unprecedented economic downturn and the risk of a second quarter of contraction, given sluggish domestic demand and the collapsing global economy.”

Relative Chinese stability masks mounting risk. It is difficult to see how this doesn’t manifest into a crisis of confidence in Chinese finance. Systemic risk is in parabolic rise (rapid growth of Credit of deteriorating quality). I expect wary households to hold back on discretionary spending, while overcapacity will haunt the business sector for years to come. We can assume fraud is commonplace throughout China’s financial sector. I suspect enormous speculative leverage has accumulated over this protracted cycle, buoyed by China’s managed currency regime and the perception of PBOC and “national team” market liquidity backstops. I believe the vulnerable renminbi much remains a global crisis Fault Line.

May 13 – Financial Times (Tom Mitchell and Don Weinland): “Donald Trump’s order to stop the US government’s main pension fund from investing in Chinese equities will only hurt US investors, Beijing has warned as trade tensions between the countries threatened to turn into a ‘financial fight’. Beijing officials have been worried since late last year that Mr Trump would follow up his two-year China trade battle with action in financial markets. The latest shot in that conflict was fired… by the US president.”

This so-called “financial fight” was inevitable – and appears to have commenced in earnest. When do they invoke the threat of liquidating Treasury holdings? The unfolding U.S. vs. China cold war has entered a dangerous phase. The U.S. is less than six months from elections, while China is facing acute Bubble fragility. But as serious as the threat of this escalating “war” is to global finance, growth and the “world order” more generally, U.S. markets remain short-term focused. The assumption is President Trump will not risk pushing this confrontation too far ahead of November – all bark, no bite. Markets further assume vulnerabilities in China will restrain Beijing’s reaction to Trump’s animus.

Yet faltering Bubbles ensure great uncertainty. I’ve always believed a bursting Bubble would see China directing blame at the U.S. (along with Japan). Beijing has employed significant stimulus in repeated moves to hold crisis at bay. Bubbles only inflated larger. At this juncture, it’s doubtful such measures will work, while the Trump administration has really ratcheted up hostilities. Fanning anti-U.S. public vitriol throughout China today requires minimal effort. So, it’s not a completely inopportune juncture for Beijing to take some tough medicine and begin focusing on financial and economic restructuring. It would be painful, but communist party leadership can deflect blame upon the global pandemic and America.

The Trump administration’s tough approach with trade negotiations created animosity and a breakdown of trust. There are indications that Beijing’s “hawks” have gained influence. I would anticipate an increasing amount of intransigence out of Beijing. The move to a bipolar world will accelerate. And don’t expect Beijing to sit back and watch the Trump administration work to shift global supply chains to the U.S. without adopting strong countermeasures.

If the direct consequences of the global pandemic weren’t enough, this crisis comes at such a critical juncture. The unstable geopolitical backdrop is turning increasingly problematic.

The Brazilian real dropped another 2.1% this week, as a troubling economic and financial backdrop is compounded by Brazil becoming a global COVID hot spot. EM currencies were again under pressure, with the Czech koruna declining 2.1%, the Hungarian forint 1.8%, the South African rand 1.3%, and the Mexican peso 1.3%. Asian currency weakness saw the Singapore dollar and South Korean won drop 1.0% and 0.9%. Declining 0.4%, China’s renminbi is nearing March lows versus the dollar.

Global bank stocks were under notable pressure again this week. U.S. banks were clobbered 9.8%, trading Thursday to the lows since April 2nd. European banks (STOXX 600) were smashed 6.8%, trading back to March lows. The Hang Seng China Financials Index dropped 2.6% this week, trading Friday at the low since early April. Japan’s TOPIX Bank Index fell 2.7%, trading to a three-week low.

Global bank Credit default swap (CDS) prices moved meaningfully higher this week. Goldman Sachs (5yr) CDS jumped 15 bps to 116, a six-week high. JPMorgan CDS rose 14 bps to a six-week high 87. BofA CDS rose 14 bps (to 90), and Citigroup nine bps (to 105). Other notable increases included Wells Fargo up 21 bps (to 101), Morgan Stanley 14 bps (to 104), Commerzbank 17 bps (to 97), UniCredit 14 bps (to 192) and Intesa Sanpaolo 14 bps (to 190). I would take the signal being provided by bank stocks (corroborated by safe haven bond yields) over that from Nasdaq.

May 15 – Bloomberg (Jesse Hamilton and Rich Miller): “The Federal Reserve issued a stark warning Friday that stock and other asset prices could suffer significant declines should the coronavirus pandemic deepen… The Fed made the assertion in its twice-yearly financial stability report, in which it flags risks to the U.S. banking system and broader economy. The document highlighted the central bank’s race to intervene in markets and temporarily dial back regulations on financial firms in response to the Covid-19 crisis. ‘Asset prices remain vulnerable to significant price declines should the pandemic take an unexpected course, the economic fallout prove more adverse, or financial system strains reemerge,’ the Fed said…”

It would appear probabilities have increased for COVID-related risks remaining elevated for months to come. From the Bubble analysis perspective, this would seem to ensure a scenario where economic fallout proves more adverse than generally expected. Securities and asset prices are acutely vulnerable. And I would further argue the Fed-induced market rally over recent weeks has only exacerbated systemic fragilities. Global Bubbles are Deflating, with far-reaching consequences.

http://creditbubblebulletin.blogspot.com/2020/05/weekly-commentary-global-bubbles-are.html