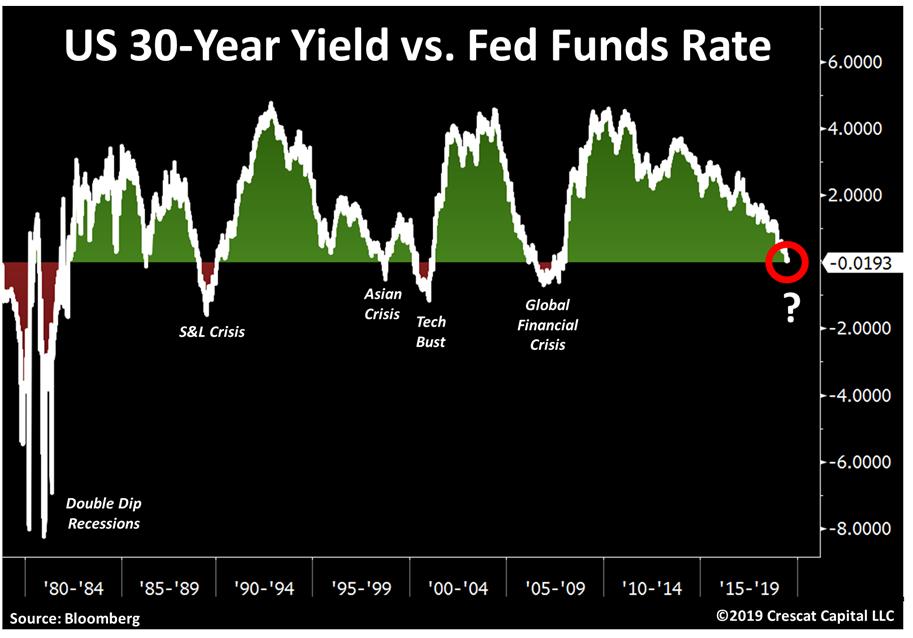

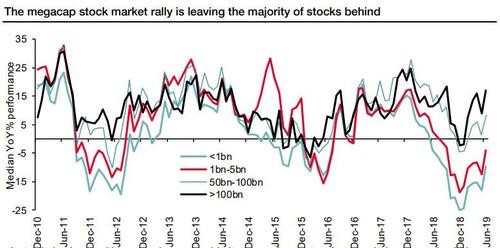

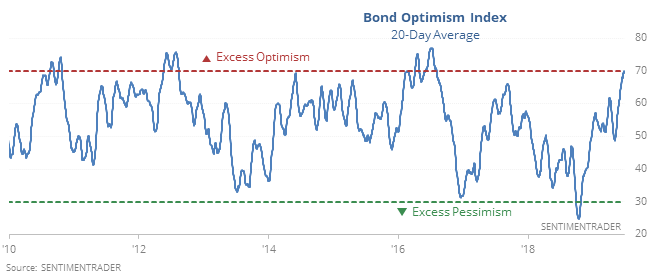

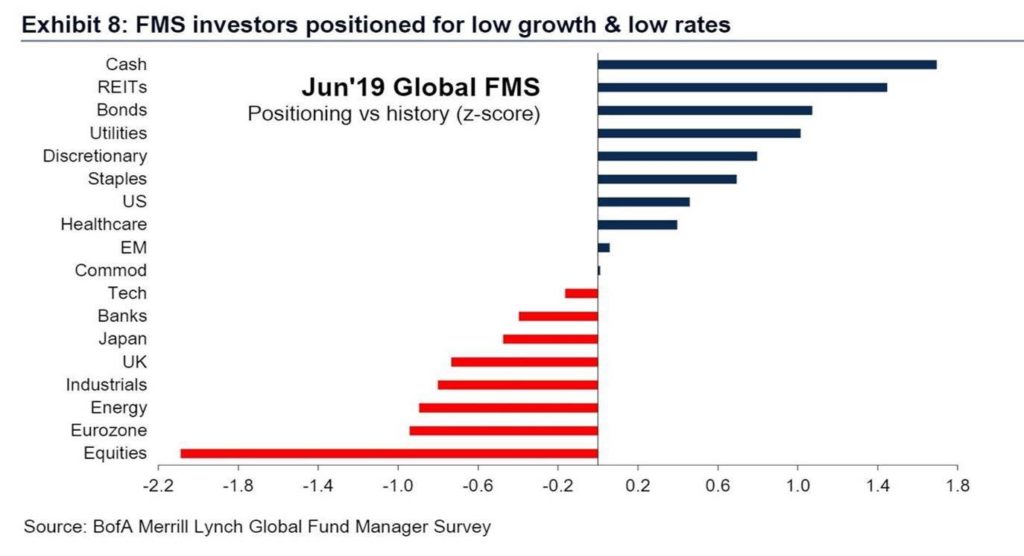

Indian budget, for the first time in history has created a provision for borrowing in Dollar from international markets .The immediate benefits of borrowing from international market outweighs its concern. There is just too much money chasing global bonds, with almost USD 12 trillion of global government bonds negative yielding. Perennial defaulter like “Argentina” is able to raise 100 years money. Sierra Leone, Angola’s dollar bonds are trading at the same yield as India’s domestic bond. The demand outweighs supply, and international investors are content to buy anything with yield attached to it. But, India is not borrowing to take advantage of this situation, it is borrowing because there is not enough saving left in the country to fund its deficit without crowding out every other borrower.

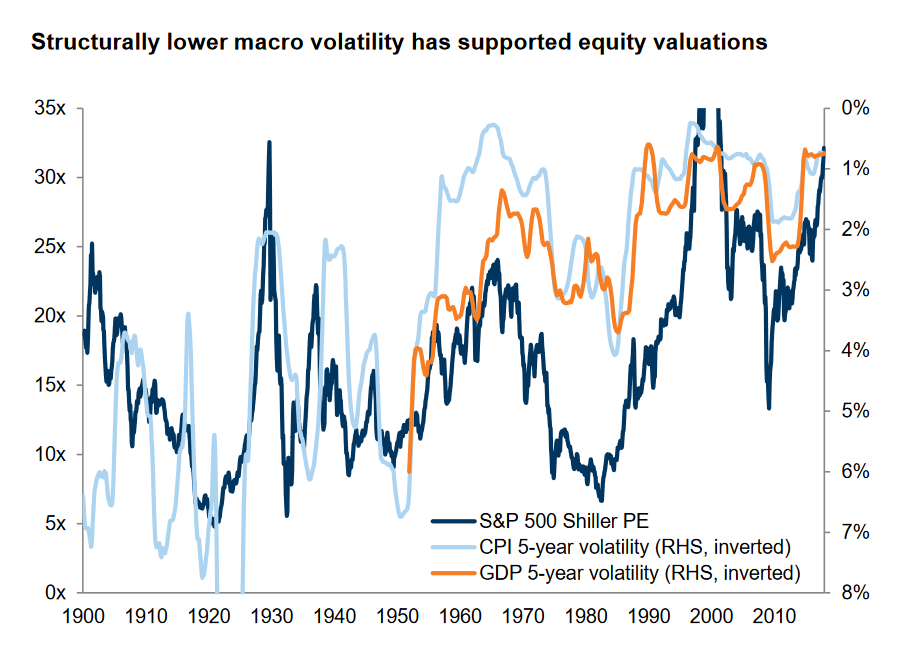

Mk Venu write in the wire “The government – Centre, states and public sector companies – is by far the largest borrower in the domestic market and tends to squeeze out borrowings by the private sector. Just to illustrate this phenomenon with official data, the total household financial savings, constituted mostly by bank deposits and various other liquid saving schemes, are about 8% of GDP. The total borrowings by the Centre, states and PSUs are also about 8% of GDP. So the household financial savings are almost entirely appropriated by the government. Of course, household savings have another component – in the form of physical assets such as real estate, gold etc. which are not strictly available in liquid form to be tapped by either the government or private sector for productive investment. This should constitute another 10% of GDP. So the total household savings are about 18% of GDP.

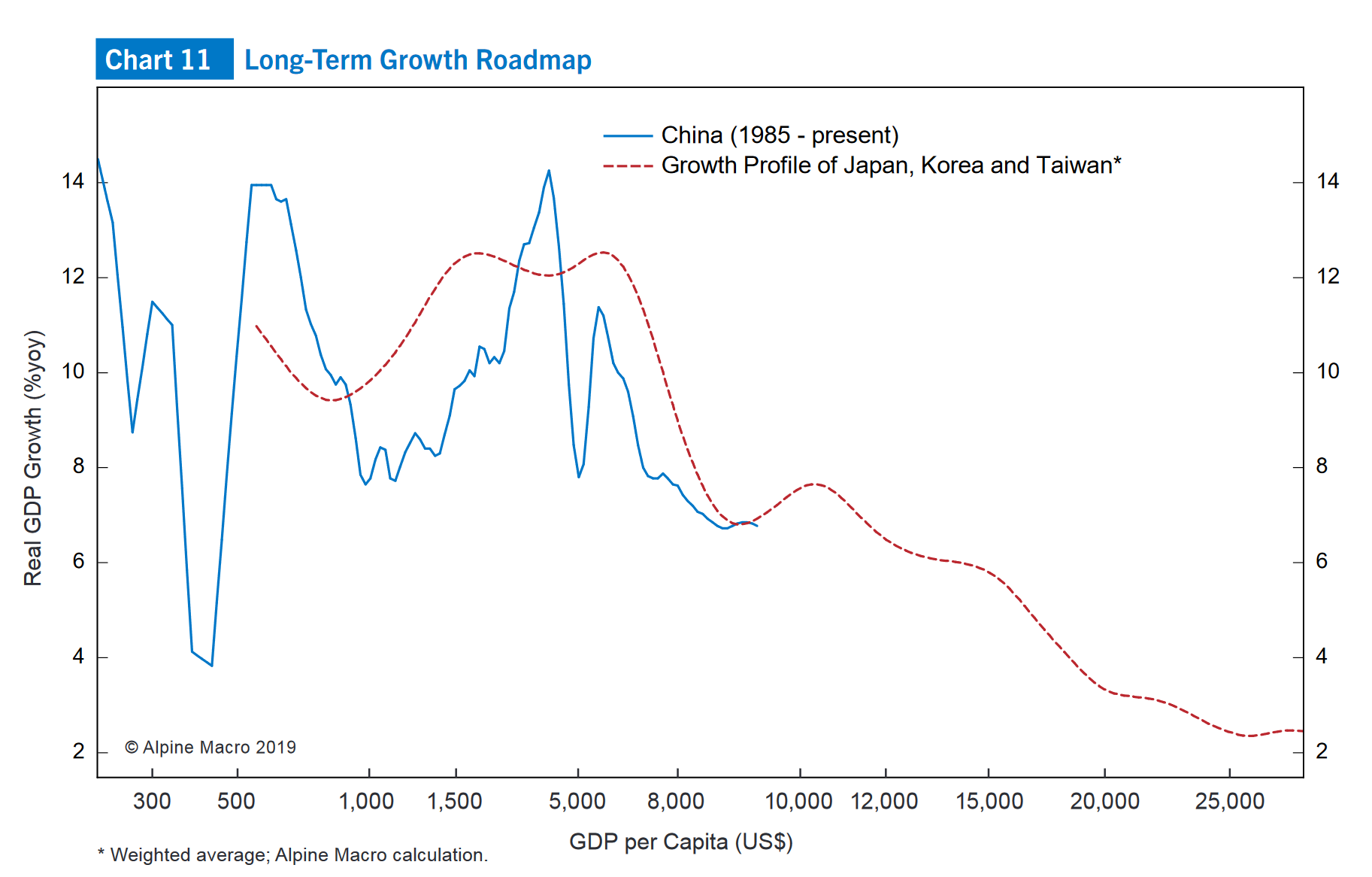

The real crisis which has developed over the past five years, forcing the government to borrow dollars from abroad, is that India’s domestic savings rate has fallen about four percentage points of GDP and almost all of it has been in household savings, which is the main source of incremental borrowing for the government and corporate sector. A decline in annual savings of 4% of GDP means roughly over Rs 7 lakh crore less of household savings available for investment every year.

Therefore, the government wants to tap the sovereign bond market to partially make up for the big fall in domestic savings. The big worry is that there is a structural decline India’s savings rate, and the Budget does not address this problem. Instead, it seeks to rely on the lazy and highly risky solution of dollar denominated borrowings.”

My two cents

I am of the view that till the time India stabilizes its macros and makes its data more credible it should not borrow from international markets. Today,India will have enough demand for its international bond offering with less disclosure because the demand is very strong. The tide will turn when India’s macro fundamentals don’t improve and global liquidity tightens forcing the market to ask tough question which will lead to blowing up of its bond spread. This will make currency more volatile and creates one more headache for Indian central bank which will have to be dealt with by raising rates which in turn will be harmful for economic growth