Doug Noland writes…..

May 31 – Bloomberg (Felice Maranz): “President Trump’s promise to impose tariffs on goods until Mexico halts a flow of undocumented immigrants is being panned by analysts and economists… Here’s a sample of the latest commentary: MUFG, Chris Rupkey: ‘If you are going to turn the world upside down with these America First trade sanctions against imports from China, car imports from Europe, and now immigration from Mexico, you risk turning the economy upside down… Keep your eye trained on stock market valuations as the magnitude of the decline will tell you when investors have had enough and are rushing to the safety of cash in an increasingly dangerous and uncertain world.’ Cowen, Chris Krueger: ‘In the space of a few hours last night, Trump overturned all we thought we understood about the near term direction of the Administration’s trade strategy’… The president ‘unveiled a one-two punch that we believe will make USMCA extremely hard to pass in both Mexico and the U.S.’ ‘When Tariff Man returned on a rainy Sunday (May 4) to announce tariff escalations on China, we detected a consensus that this was merely a negotiating tactic… In the 27 days that have followed, no public talks have been held and the tariff escalation for goods in-transit along with China’s escalation on $60 billion in U.S. exports is hours away.’ AGF Investments, Greg Valliere: ‘These tariffs break new ground’ …because ‘they’re political, a punishment to Mexico for not stopping the surge of immigrants from Central America.’ He listed five ‘enormous implications’: Damage to USMCA ratification process; potential that a ‘slumbering’ Congress may awaken; Trump may not be finished with new tariffs, triggering higher prices for products…; Trump doesn’t seem to be listening to advisers, appears unconcerned by market and economic damage; Federal Reserve may now be forced to cut rates, but that may not be enough to reverse the damage.’”

May 31 – Bloomberg (Michelle Jamrisko and Enda Curra): “Prospects for a U.S.-China trade deal just became even more remote after President Donald Trump whacked tariffs that could rise to 25% on Mexico until that country stops immigrants from entering the U.S. illegally. ‘A U.S.-China trade deal will be even less likely,’ said Khoon Goh, head of research at Australia & New Zealand Banking Group… ‘At the end of the day, what’s the point of doing a deal if the U.S. can just impose tariffs arbitrarily?’ Investors are already bracing for a prolonged economic stand-off between the world’s two biggest economies. One potential beneficiary of the impasse was likely to be Mexico as companies considered shifting supply chains away from China toward lower-cost markets closer to American consumers. The latest escalation of Trump tariffs threatens that process.”

May 31 – Bloomberg (Michael Sin): “‘Trade policy and border security are separate issues. This is a misuse of presidential tariff authority and counter to congressional intent,’ U.S. Senate Finance Committee Chairman Chuck Grassley (R-Iowa) says… ‘Following through on this threat would seriously jeopardize passage of USMCA.’”

May 31 – Bloomberg (Michael R. Bloomberg): “President Donald Trump’s approach to trade policy had set new benchmarks of incoherence and irresponsibility even before his threat to impose escalating tariffs on imports from Mexico — but this latest maneuver takes the cake. The administration plans to harm businesses north and south of the border, and to impose additional new taxes on U.S. consumers, not to remedy a real or imagined trade grievance but to force Mexico to curb migration to the U.S. This is a radical and disturbing development. The administration is invoking a law that allows it to impose emergency economic sanctions. It’s safe to say that Congress never envisaged that those powers would be used in a case like this.”

According to CNBC reporting (Kayla Tausche and Tucker Higgins), the President’s Mexico tariff move was “spearheaded by advisor Stephen Miller.” That the decision was made despite opposition from both Treasury Secretary Mnuchin and Trade Representative Lighthizer is only more troubling to the markets (and the world more generally). Has the President “gone off the rails”? CNBC: “The surprise decision to announce the tariff plan came as Trump was ‘riled up’ by conservative radio commentary about the recent surge in border crossings… As the tariff plan was formulated, top advisors, including Vice President Mike Pence, who was traveling, and Larry Kudlow, who was undergoing surgery, were away.”

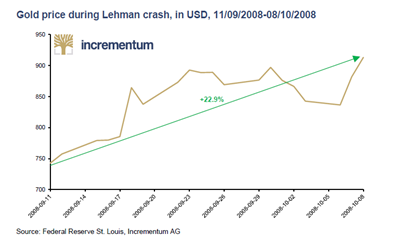

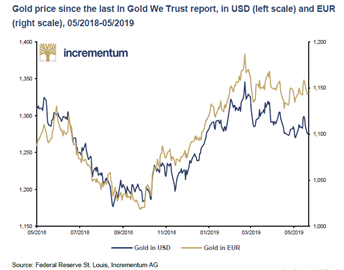

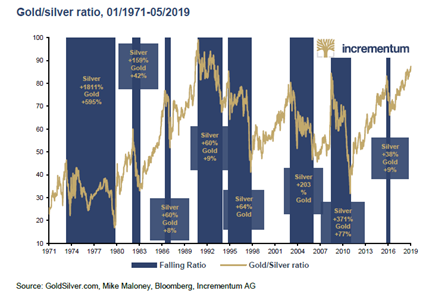

“‘Unreliable’ Trump Throws Markets Into Tizzy as Traders Scramble,” read a Friday afternoon Bloomberg headline. With the S&P500 index wobbling just above the key 200-day moving average, traders had been looking for a supportive tweet. Who would have expected it to be the President to nudge markets toward the cliff’s edge? Meanwhile, increasingly anxious currency traders hit a landmine, as the Mexican peso was slammed 2.4% in Friday trading (2.9% for the week). Mexico’s S&P IPC equities index dropped 1.4%. As if awakening to how incredibly uncertain the backdrop has become, gold surged $21 this week. Seemingly experiencing nightmares of global depression, WTI crude collapsed 8.7% for the week.

For a day, dramatic threats of Mexico tariffs almost took the spotlight off the rapidly escalating China-U.S. trade war. Almost.

May 31 – New York Times (Alexandra Stevenson and Paul Mozur): “The Chinese government said on Friday that it was putting together an ‘unreliable entities list’ of foreign companies and people, an apparent first step toward retaliating against the United States for denying vital American technology to Chinese companies. China’s Ministry of Commerce said the list would contain foreign companies, individuals and organizations that ‘do not follow market rules, violate the spirit of contracts, blockade and stop supplying Chinese companies for noncommercial reasons, and seriously damage the legitimate rights and interests of Chinese companies.’”

This is turning serious. The “Unreliably Entities List” follows reports earlier in the week that China is preparing to restrict the export of rare earth minerals. Friday from the New York Times: “As China Takes Aim, Silicon Valley Braces for Pain.” Another Friday headline, “U.S. is Dependent on China for Almost 80% of Its Medicine,” played into the narrative that the trade war is suddenly appearing much more complex and ominous than previously envisioned. China clearly has the capacity to play hardball; preparations have commenced.

May 29 – Reuters (Ben Blanchard, Michael Martina and Tom Daly): “China is ready to use rare earths to strike back in a trade war with the United States, Chinese newspapers warned… in strongly worded commentaries on a move that would escalate tensions between the world’s two largest economies… In a commentary headlined ‘United States, don’t underestimate China’s ability to strike back’, the official People’s Daily noted the United States’ ‘uncomfortable’ dependence on rare earths from China. ‘Will rare earths become a counter weapon for China to hit back against the pressure the United States has put on for no reason at all? The answer is no mystery,’ it said. ‘Undoubtedly, the U.S. side wants to use the products made by China’s exported rare earths to counter and suppress China’s development. The Chinese people will never accept this!’ the ruling Communist Party newspaper added. ‘We advise the U.S. side not to underestimate the Chinese side’s ability to safeguard its development rights and interests. Don’t say we didn’t warn you!’”

I’ll assume the Mexican tariff issue is resolved relatively soon, while the trade war with China appears poised to be a major and protracted problem. As I’ve highlighted in previous CBBs, this confrontation comes at a tenuous juncture for China’s financial system and economy. The assumption – for the markets and, apparently, within the administration – has been that fragilities would incentivize Beijing to play nice and succumb to a deal.

The Trump administration pushed aggressively, and the deal blew apart. And the longer conciliatory tones go missing from both sides, the more likely it is that the Rubicon has been crossed. This significantly increases the likelihood that China is heading into a crisis backdrop, with Beijing enjoying a larger-than-life “foreigner” “bully” to blame, berate and villainize before a population with expectations perhaps as great as the challenges they now confront.

What could be the most consequential story of the past week received little press attention in the U.S. – and maybe even less in China.

May 28 – Bloomberg: “Is it the start of a new era for China’s $42 trillion financial industry, or a one-time shock that will be quickly forgotten? Five days after the first government seizure of a Chinese bank in 20 years, investors are still grasping for answers. The takeover of Baoshang Bank Co. — announced with scant explanation on Friday night — left China watchers guessing at whether it marks an end to the implicit backstop for banks that has served as a linchpin of the country’s financial stability for decades. Regulators have said they’ll guarantee Baoshang’s smaller depositors, and while they’ve warned some creditors of potential losses, they haven’t said what the final payouts could be or given public guidance on whether the takeover will be a blueprint for other lenders. Complicating matters is the fact that Baoshang has been linked to a conglomerate under investigation by Chinese authorities.”

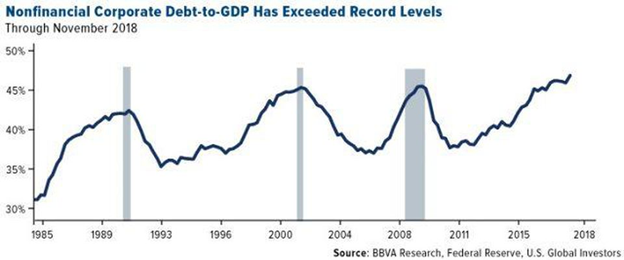

It’s a testament to the incredible growth of China’s banking system (from about $7 TN to $40 TN since the ’08 crisis) that Baoshang, with its mere $80 billion of assets, is one of a very large group of “small banks.” Along with most “small” Chinese banking institutions, Baoshang tapped the “money” markets for much of its gluttonous financing needs. It issued institutional negotiable certificates of deposit (NCD) and aggressively borrowed in the interbank lending market. The first Chinese government bank seizure in 20 years is further notable for Beijing’s decision to impose losses on some Baoshang creditors. While retail depositors are to receive 100% of their funds, corporate and financial creditors face painful haircuts.

May 29 – Reuters (Cheng Leng, Zheng Li and Andrew Galbraith): “Chinese regulators have issued instructions for the repayment of debts owed by China’s beleaguered Baoshang Bank that could see larger debts facing haircuts of as much as 30%, two sources with knowledge of the matter told Reuters. According to oral instructions detailed by the sources, regulators will guarantee the principal but not the interest on interbank debts between 50 million yuan and 100 million yuan. Debts of more than 5 billion yuan ($723.47 million) will have no less than 70% of their principal guaranteed, the sources said. For debts between 100 million and 2 billion yuan, regulators will guarantee no less than 90% of principal, and for debts of 2 billion yuan to 5 billion yuan, no less than 80% of principal will be guaranteed.”

May 31 – Bloomberg: “Holders of bankers’ acceptances worth more than 50m yuan ($7.2m) issued by Baoshang Bank will be repaid at least 80% of the principal, said people familiar with the matter. Investors were told on Friday that while they will be repaid 80% initially, they may still have recourse to the rest of the repayment as regulators progress in resolving Baoshang’s finances…”

Beijing has moved to invalidate the implicit 100% state guarantee of all large bank liabilities – deposits, NCDs, bankers’ acceptances, interbank loans, etc. Such a critical issue should have been decisively addressed years ago – certainly long before China’s Bubble inflated in “Terminal Phase” excess. Now, with the colossal sizes of China’s banking system and money market complex – coupled with rapidly expanding problem loans – a banking crisis would add Trillions (U.S. $) to the central government’s debt load. Bank losses will have to be shared by the marketplace, a prospect few to this point have been willing to contemplate. Going forward, investors will increasingly question the perceived “money-like” attributes of safety and liquidity for Chinese financial instruments.

Baoshang is part of an organization controlled by a Chinese tycoon under criminal investigation. While not a typical bank, its vulnerable financial structure is typical of scores of Chinese financial institutions whose breakneck growth was financed by cheap loans readily available for all from China’s booming (“shadow”) money market. Reminiscent of America’s GSE experience, it was all made possible by implied government guarantees Beijing was for too long content to empower. Beijing has now moved to adjust the rules of the game, with major ramifications for China’s fragile historic Bubble – right along with world markets and the global economy more generally.

May 28 – Bloomberg (Ina Zhou): “Pressure is building in a corner of Chinese lenders’ offshore debt after the nation’s first government seizure of a bank in about two decades. Loss-absorbing bonds, known at Additional Tier 1 instruments or AT1s, plunged across several small lenders on Tuesday after a sell-off on Monday. Huishang Bank Corp.’s 5.5% AT1s sank by a record 3 cents on the dollar Tuesday, while Bank of Jinzhou Co.’s 5.5% note fell most since July and China Zheshang Bank Co.’s 5.45% bond had the steepest drop in a year.”

The Shanghai Composite jumped 1.6% this week, while China’s currency was down only slightly (.07%). Superficially, it was easy to dismiss the Baoshang seizure as “no harm, no foul.” Thank the PBOC.

May 29 – Reuters (John Ruwitch and Simon Cameron-Moore): “China’s central bank made its biggest daily net fund injection into the banking system in more than four months on Wednesday, a move traders saw as an attempt to calm the money market after the rescue of a troubled bank. The government announced its takeover of Baoshang Bank on Friday… Worries that Baoshang’s plight might herald wider problems among China’s regional banks had driven money market rates higher, until the People’s Bank of China (PBOC) delivered a mighty infusion of cash on Wednesday.”

The PBOC’s $36 billion Wednesday injection raises a crucial question: What will be the scope of liquidity needs when a major bank finds itself in trouble – when escalating systemic stress begins fomenting a crisis of confidence? It’s worth noting that Chinese sovereign CDS jumped six bps this week to 59 bps, the high since January. Overnight repo and interbank lending rates rose, along with Chinese corporate bond yields. According to Bloomberg, issuance of negotiable certificates of deposit slowed sharply this week. Chinese finance is tightening, an ominous development for a fragile Bubble.

This is where the analysis turns absolutely fascinating – and becomes as important as it is chilling. The PBOC is at increasing risk of confronting the same predicament that other emerging central banks faced when their Bubbles succumbed: in the event of a mounting crisis of confidence in the stability of the financial system and the local currency, large central bank injections work to fan market fears while generating additional liquidity available to flow out of the system. “Everyone has a plan until they get punched in the mouth.”

Markets ended the week pricing in a 95% probability of a Federal Reserve rate cut by the December 11th meeting. Ten-year Treasury yields sank 20 bps this week to 2.12%, falling all the way back to the lows from September 2017 (2.57% 30-yr yield to pre-2016 election level). German bund yields dropped nine bps to a record low negative 0.20%. Swiss yields fell five bps to negative 0.51%, with Japanese JGB yields down two bps to negative 0.10%. I view the ongoing global yield collapse as powerful confirmation of the acute fragility of Chinese and global Bubbles.

If President Trump is determined to squeeze rate cuts out of the Federal Reserve, he made impressive headway this week. This CBB began with, “So Much for the Trump Put.” As for the “Beijing put,” a $36 billion PBOC liquidity injection was indiscernible beyond Chinese markets. Investors in U.S. securities would be wise to anticipate zero favors from China.

As such, markets are left with the “Fed put.” For the most part, U.S. stocks, equities derivatives and corporate Credit have been comfortable banking on the Federal Reserve backstop. But with things turning dicey in China, risk aversion is gaining a foothold. Investment-grade funds saw outflows surge to $5.1 billion the past week (“most since 2015”). Corporate spreads and CDS prices have begun to indicate liquidity concerns. With the “Fed put” now in play, there are important questions to contemplate: Where’s the “strike price” – what degree of market weakness will it take to compel the Fed to move – and, then, to what effect? Markets, after all, have already priced in aggressive rate cuts. It could very well require some “shock and awe” central banking to reverse markets once panic has begun to set in. And it’s as if global safe haven bond markets are anticipating a bout of panic in the not too distant future.

http://creditbubblebulletin.blogspot.com/2019/06/weekly-commentary-so-much-for-trump-put.html