Doug Noland writes…

After years of increasingly close cooperation and collaboration, the relationship has turned strained. Both sides are digging in their heels. Credibility is on the line. If one side doesn’t back down, things could really turn problematic. The Fed is asserting that it’s not about to lower the targeted Fed funds rate. Markets are strident: You will cut, and you will cut soon. Bonds are instructing the world to prepare for the Long March.

Market probability for a rate cut by the December 11th FOMC meeting jumped to 80% this week, up from last week’s 75% and the previous week’s 59%.

May 22 – Reuters (Howard Schneider and Jason Lange): “U.S. Federal Reserve officials at their last meeting agreed that their current patient approach to setting monetary policy could remain in place ‘for some time,’ a further sign policymakers see little need to change rates in either direction. ‘Members observed that a patient approach…would likely remain appropriate for some time,’ with no need to raise or lower the target interest rate from its current level of between 2.25 and 2.5%, the Fed… reported in the minutes of the central bank’s April 30-May 1 meeting. Recent weak inflation was viewed by ‘many participants…as likely to be transitory,’ while risks to financial markets and the global economy had appeared to ease – a judgment rendered before the Trump administration imposed higher tariffs on Chinese goods and took other steps that intensified trade tensions.”

Analysts have been quick to point out that additional tariffs along with the breakdown in trade negotiations unfolded post the latest FOMC meeting. True, yet several Fed officials have recently reiterated the message of no urgency to lower rates. This week Atlanta Federal Reserve President Raphael Bostic said he doesn’t see the Fed reducing rates. In a Thursday Bloomberg interview, Federal Reserve Bank of Cleveland President Lorretta Mester went so far as to state that reducing rates (to boost inflation) would be “bad policy.” This followed New York Fed President John Williams’ Wednesday comment: “I don’t see any strong argument today, based on what we have seen in the data or other information, to move interest rates one way or the other.” On Thursday, Dallas Fed President Robert Kaplan stated he was “agnostic at this point about whether the next move is up or down.”

Agnostic the markets are not. Ten-year Treasury yields dropped another seven bps this week to the lows (2.32%) since December 15th, 2017. Two-year yields declined four bps to 2.17%, the low going back to February 2018. Sinking market yields are anything but a U.S. phenomenon. German 10-year bund yields declined another basis point to negative 0.11%, trading this week at low yields going all the way back to the summer of 2016. Swiss yields fell four bps this week to negative 0.45% (low since October 2016). Japanese JGB yields fell two bps to negative 0.07%.

Curiously, yields dropped 15 bps in Italy (2.55%), nine bps in Portugal (0.97%) and six bps in Spain (0.82%). Yields this week were down to 0.04% in Denmark, 0.07% in the Netherlands, 0.11% in Finland, 0.17% in Sweden, 0.19% in Austria, 0.37% in Belgium, 0.38% in Slovakia, 0.45% in Latvia and 0.54% in Slovenia. We have become numb to an incredible market spectacle.

Global “risk off” gathered some momentum this week. The Shanghai Composite declined 1.0%, trading back to around February lows. China’s growth/tech ChiNext index sank 2.4% to the lowest level since February 22nd. Hong Kong’s Hang Seng China Financials index dropped 1.5% to the low going back to January 21st. China’s renminbi mustered a 0.26% gain versus the dollar, a notably unimpressive recovery considering its recent walloping.

“Risk off” was pervasive throughout European equities. Germany’s DAX index fell 1.9%, with France’s CAC40 down 2.2%. Led by a 6.6% drubbing in Italian bank shares, Italy’s MIB index sank 3.5%. Europe’s STOXX 600 Bank index fell 3.0%.

The S&P500 declined 1.2%, with the tech-heavy Nasdaq100 down 2.7%. The Semiconductors were hammered 6.4%. The Dow Transports fell 3.4%.

The unfolding “risk off” backdrop became too much for some key commodities markets. WTI crude was hammered 6.6% this week (biggest decline of the year), trading to a two-month low. Copper declined 1.7%, approaching January lows. Aluminum fell 2.0%, Zinc 1.5%, and Tin 1.0%. The Bloomberg Commodities Index traded Thursday at the lows since “U-turn” January 4th.

May 22 – Reuters (Michael Martina and David Lawder): “China must prepare for difficult times as the international situation is increasingly complex, President Xi Jinping said in comments carried by state media…, as the U.S.-China trade war took a mounting toll on tech giant Huawei… During a three-day trip this week to the southern province of Jiangxi, a cradle of China’s Communist revolution, Xi urged people to learn the lessons of the hardships of the past. ‘Today, on the new Long March, we must overcome various major risks and challenges from home and abroad,’ state news agency Xinhua paraphrased Xi as saying, referring to the 1934-36 trek of Communist Party members fleeing a civil war to a remote rural base, from where they re-grouped and eventually took power in 1949.”

May 19 – Bloomberg (Karen Leigh): “President Donald Trump said he was ‘very happy’ with the trade war and that China wouldn’t become the world’s top superpower under his watch. ‘We’re taking in billions of dollars,’ Trump told Fox News Channel’s Steve Hilton when asked about the end game on the trade war. ‘China is obviously not doing well like us.’ Trump’s comments signal he’s in no rush to get back to negotiating with Beijing… The president also told Hilton he believed China wants to replace America as the world’s leading superpower, and it’s ‘not going to happen with me.’ ‘I think that’s their intention… Why wouldn’t it be? I mean they’re very ambitious people, they’re very smart.’”

If it is negotiation posturing, it’s a rather convincing effort from both sides. Hopes for de-escalation from rapidly deteriorating Chinese/U.S. relations were tempered to start the week. “China is in ‘no rush’ to restart trade talks,” read the headline. President Trump’s comments regarding China not attaining superpower status under his watch played right into Beijing’s narrative.

May 20 – Bloomberg (Ian King, Mark Bergen, and Ben Brody): “The impact of the Trump administration’s threats to choke Huawei Technologies Co. reverberated across the global supply chain on Monday, hitting some of the biggest component-makers. Chipmakers including Intel Corp., Qualcomm Inc., Xilinx Inc. and Broadcom Inc. have told their employees they will not supply Huawei until further notice, according to people familiar with their actions. Alphabet Inc.’s Google cut off the supply of hardware and some software services to the Chinese mobile phone equipment giant, another person familiar said, asking not to be identified discussing private matters. The Trump administration on Friday blacklisted Huawei — which it accuses of aiding Beijing in espionage — and threatened to cut it off from the U.S. software and semiconductors it needs to make its products.”

With technology stocks in the crosshairs, equities were under heavy selling pressure in Monday trading (S&P500 down 2.4%, with the Dow sinking 617 points). In an effort to contain market and supply chain fallout, the administration after Monday’s close moved to grant tech firms a three-month license (with stipulations) to do business with Huawei. Tuesday’s rally suffered a short half-life.

By Tuesday evening, concerns were mounting after reports the Trump administration was considering adding Chinese surveillance firms to the blacklisted companies to be cut off from U.S. technology suppliers. It was the opposite of de-escalation.

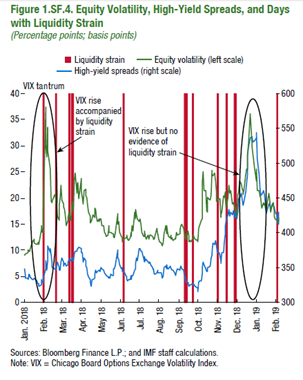

Ten-year Treasury yields fell four bps Wednesday and another six on Thursday (to 2.32%). The Shanghai Composite dropped 1.4% in Thursday trading. In U.S. markets, the VIX popped to 18, as a whiff of vulnerability emerged in U.S. corporate credit. Junk bond spreads increased to near the widest – and investment-grade CDS prices near the highest – level since late-March. U.S. bank stocks dropped 1.8% in Thursday trading, as bank CDS prices widened moderately. For the week, investment-grade corporate bond funds suffered their first outflow ($756 million) in 17 weeks.

May 24 – Bloomberg (Brian Smith): “Like a punch-drunk boxer saved by the bell, the Memorial Day weekend couldn’t have come at a better time for the high-grade credit market. Credit spreads have blown out to the widest levels since March, the new issue market screeched to a halt mid-week… Total high-grade new issue volume (including EM) totaled just shy of $17 billion, well below projections of $20b-$25b, as at least three potential borrowers were said to have punted until next week… Three of this week’s new issue tranches failed to price at the tight end of the guidance range, a rare occurrence and clear signal of investor pushback… Nearly 75% of this week’s deals are trading wide to their new issue pricing levels.”

A Wall Street Journal article (James Mackintosh) headline resonated: “Investors Slowly Wake Up to Fears of a New Cold War – The U.S.-China Trade Conflict Might be a Repeat of a Pattern All-Too Common in Markets When it Comes to Geopolitical Risks: Ignore Them, Then Panic.”

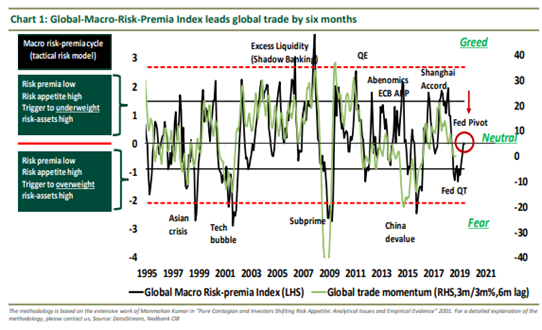

It’s worth generally examining The “Ignore Them, Then Panic” Dynamic. At this point, perpetual monetary stimulus has become deeply imbedded within inflated securities prices across asset classes around the globe. One can disagree on potential catalysts and circumstances, but the most extreme global bond pricing dynamics clearly incorporate prospective rate cuts and additional QE. Meanwhile, risk markets are bolstered by collapsing market yields along with the perception of multiple market backstops (Fed/global central banks, Chinese stimulus, Trump/2020 elections, corporate buybacks, etc.).

Early on in the global government finance Bubble, I advanced the concept of the “Moneyness of Risk Assets.” This was an evolution from the mortgage finance Bubble period’s “Moneyness of Credit” market distortion. The aggressive use of rate policy and central bank balance sheets/Credit to promote stock and bond price inflation nurtured the (central bank backstop-induced) perception of risk assets as safe and liquid stores of value (i.e. money-like). Over time, this had momentous effects throughout the markets, certainly including the booming ETF and derivatives complexes.

When it comes to various risks, over years it became increasingly easy to simply “Ignore Them.” Central banks have repeatedly stepped up to backstop vulnerable risk markets. At the same time, the central bank “put” has ensured readily available inexpensive market insurance (i.e. put options). Why not write flood insurance when the authorities control the weather? And with market protection so cheap, is it not rational to partake in rewarding risk-taking activities? Moreover, with QE having become the principal instrument in the central banking toolkit, prices for Treasury, Bund, JGB and other “safe haven” bonds are essentially guaranteed to rise in the event of heightened systemic risk. Superior to even cheap derivative protection, can’t lose holdings of safe haven bonds offer protection while also inflating in value.

As I’m fond of discussing, crises typically erupt in the money markets. It is when the perception of safety and liquidity is suddenly questioned that all hell breaks loose. And never before have risk markets so harbored the misperception of money-like attributes. This explains the “Then Panic” Dynamic.

I have argued that contemporary finance functions poorly in reverse. The market-based global financial apparatus seemingly performs wondrously so long as securities prices rise, the cost of market protection remains cheap and risk embracement holds sway. And it is almost as if the system has evolved to operate quite splendidly under moderate degrees of apprehension. Such a backdrop provides the Buy the Dip Crowd easy opportunities, while lavishing effortless profits upon the writers/sellers of market protection. To be sure, a hospitable marketplace of mild pullbacks and robust rallies further emboldens the prevailing view that markets always go up (so ignore risk!).

As we witnessed in December, things can start to unwind rather quickly when markets begin questioning the timeliness and scope of the central bank backstop. When the faithful dip buyers reverse course and turn urgent sellers, there’s an immediate market liquidity issue. Worse yet, when the protection sellers (i.e. put writers) suddenly fear they might end up on the hook for substantial market losses, it’s “Then Panic.” They must either buy protection for themselves or start shorting securities to offset their exposure to escalating losses. Any time writers of derivative protection are forced into aggressive selling, markets quickly face a major liquidity problem.

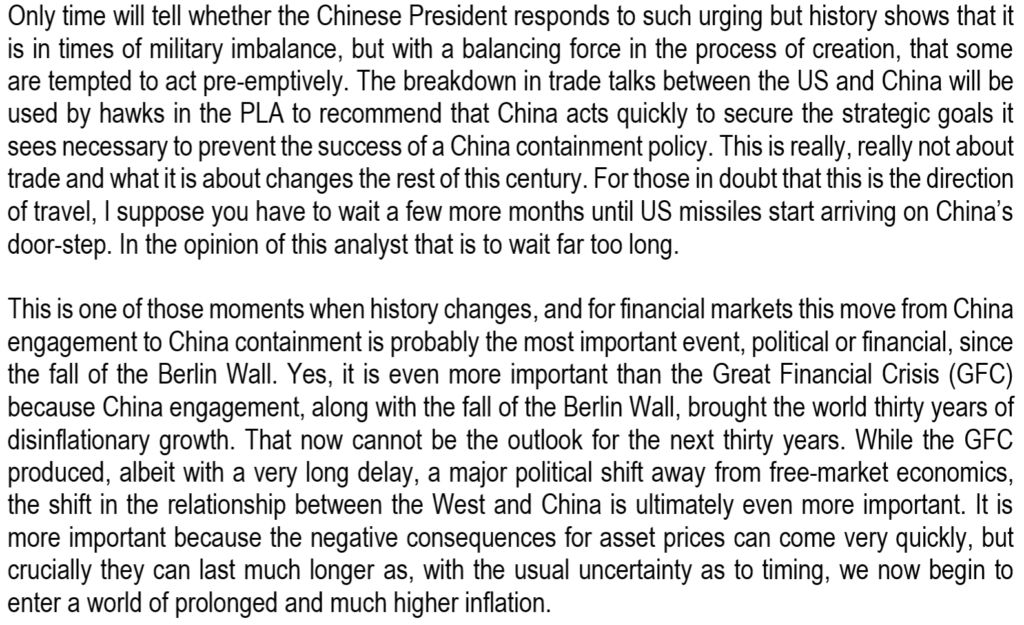

I have argued that the bursting of China’s historic Bubble presents a catalyst for the piercing of the global Bubble. And I posited as recently as last week that the breakdown in U.S. trade negotiations risks pushing China over the edge. I also suggested that acute Chinese fragility likely explains the extraordinary drop in global safe haven bond yields. While this is reasonable analysis, it is surely too simplistic.

Crisis unfolding in China has become a high probability catalyst for bursting the global Bubble. Yet it is structurally-impaired global financial and economic systems that explain virtual panic buying of safe haven bonds in the face of resilient risk markets. For decades now, risk markets have climbed the proverbial “wall of worry” – seemingly scaling new heights after overcoming one potential crisis after another (i.e. deep U.S. recession, European crisis, geopolitical flashpoints, Brexit, multiple China scares, “flash crashes,” the winding down of QE, etc.). It’s rational for risk markets to welcome risk as an opportunity to capitalize on additional central bank and Beijing stimulus measures.

Safe haven bond markets view the backdrop altogether differently. Current market structure is unsustainable. Treasuries, bunds, JGBs, etc. are zeroed in on the risk markets’ proclivity for Ignore Them, Then Panic. The safe havens are now preparing for the Panic Phase, with the presumption that dysfunctional speculative dynamics and deep structural maladjustment ensure the next bout of “risk off” (de-risking/deleveraging) deteriorates into illiquidity and market dislocation.

The assumption is that central bankers will have no alternative than to cut rates and aggressively resort to even greater marketplace liquidity injections (QE). Considering the scope of speculative leverage permeating global markets, along with structural dependency to unending liquidity abundance, I don’t disagree with the safe haven perspective.

Highly speculative risk markets, heartened by extremely low yields and prospects for monetary stimulus, confront a major timing issue. They envisage the Fed and global central banks moving quickly and forcefully to reverse “risk off” before it gains momentum – emboldened by the January U-turn and the belief that the Fed learned from its December blunder.

The Fed, however, is signaling it sees no justification for an itchy trigger finger. There is a contingent within the FOMC surely not overjoyed by the speculative melee incited by their January “pivot”. Believing the markets and economy are fundamentally sound, the Fed back in December was caught unprepared for the intensity of market instability. Many on the FOMC likely view the markets’ rapid recovery as confirming their confidence in underlying system soundness and resiliency. I’ll also assume that Chairman Powell and some committee members are uncomfortable with the view of a “Fed put” not far below current market prices.

The huge 2019 risk market rally has only exacerbated underlying market and economic fragilities. Safe haven bonds concur with this view, while the collapse in global market yields works to support the speculative Bubble raging in the risk markets. Corporate Credit, in particular, has been underpinned by sinking sovereign bond yields. It has made it especially easy to Ignore Them – myriad risks including collapsed trade talks, rising U.S./China tensions, a fragile Chinese Bubble, waning global growth, vulnerable EM, susceptible European finance and economies, and the rapidly deteriorating geopolitical backdrop.

Healthy markets would adjust and correct to reflect heightened uncertainties and deteriorating prospects. Speculative markets instead promote excess and the ongoing accumulation of imbalances, maladjustment and impairment. There’s no operable release valve. Pressure builds and builds – risks accumulate in all the wrong places – Then Panic.

The flaw in contemporary finance – especially within market psychology over recent years – is to believe central bankers have nullified market, economic and Credit cycles. They have certainly averted a number of market crises over recent years, in the process significantly extending cycles. Along the way risk market participants grew greatly overconfident in the capacity of central bankers to permanently forestall crisis. Moreover, they have turned completely blind to the historic crisis festering just below the surface of their delusional view of a “Permanently High Plateau” of global peace and prosperity.

Read Full post below